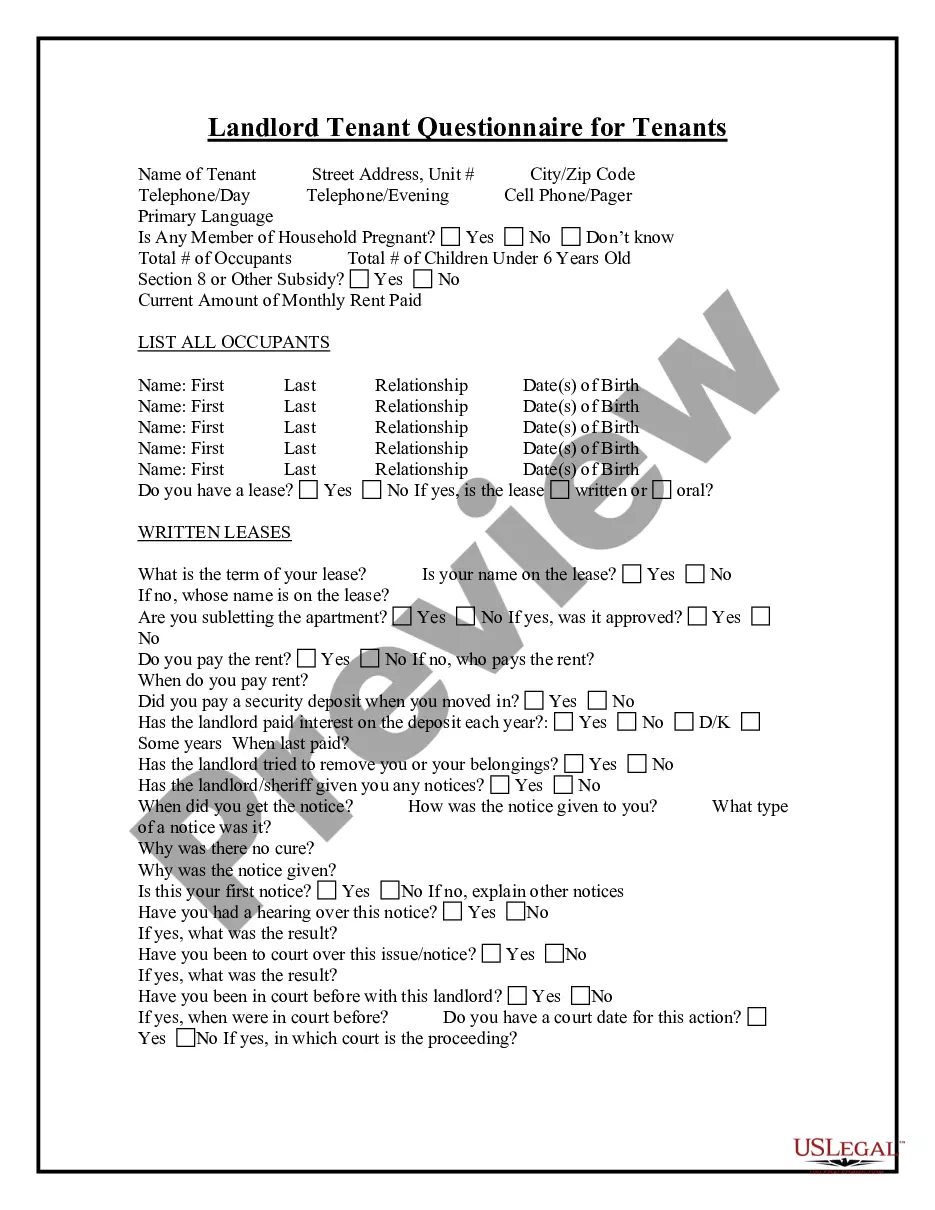

Maryland Resident Information Sheet

Description

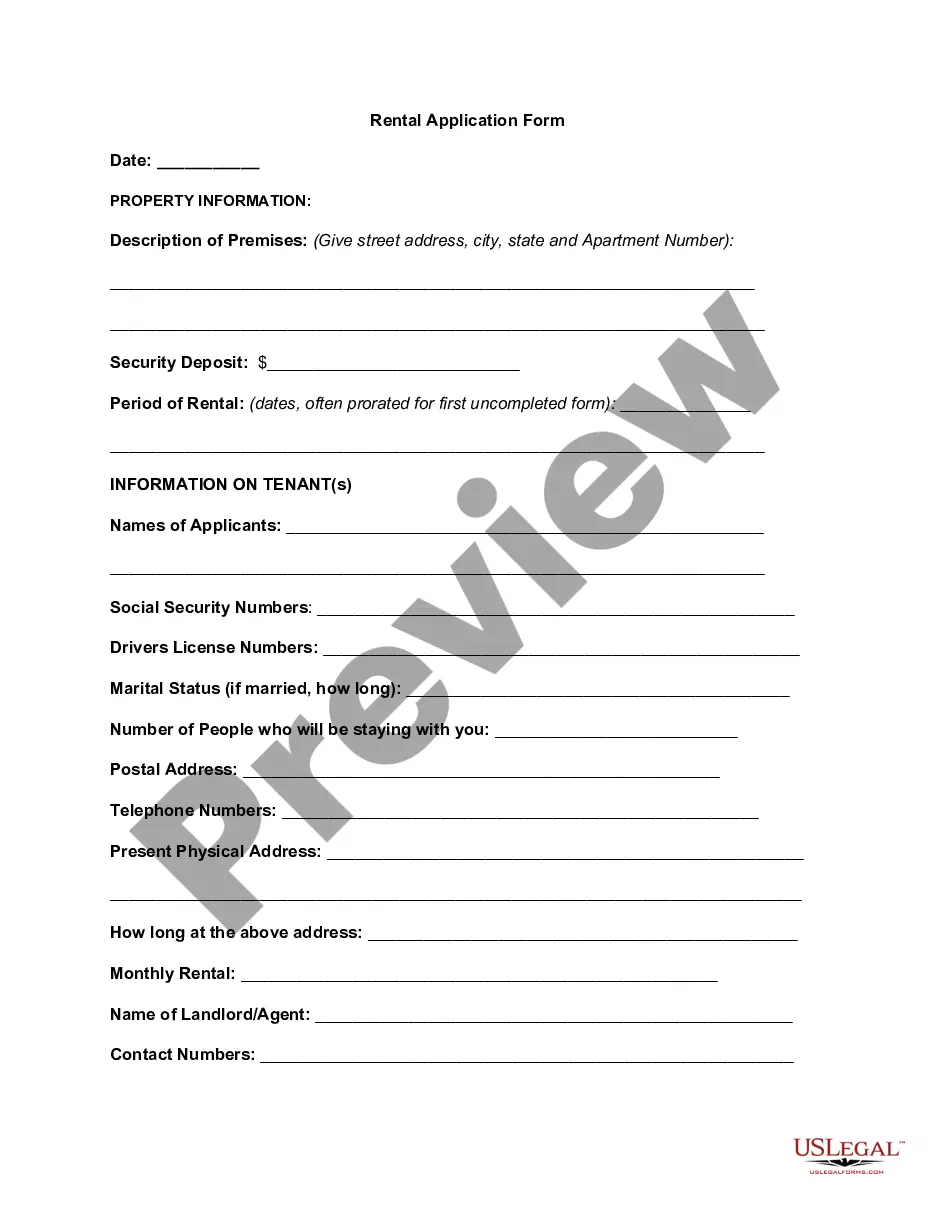

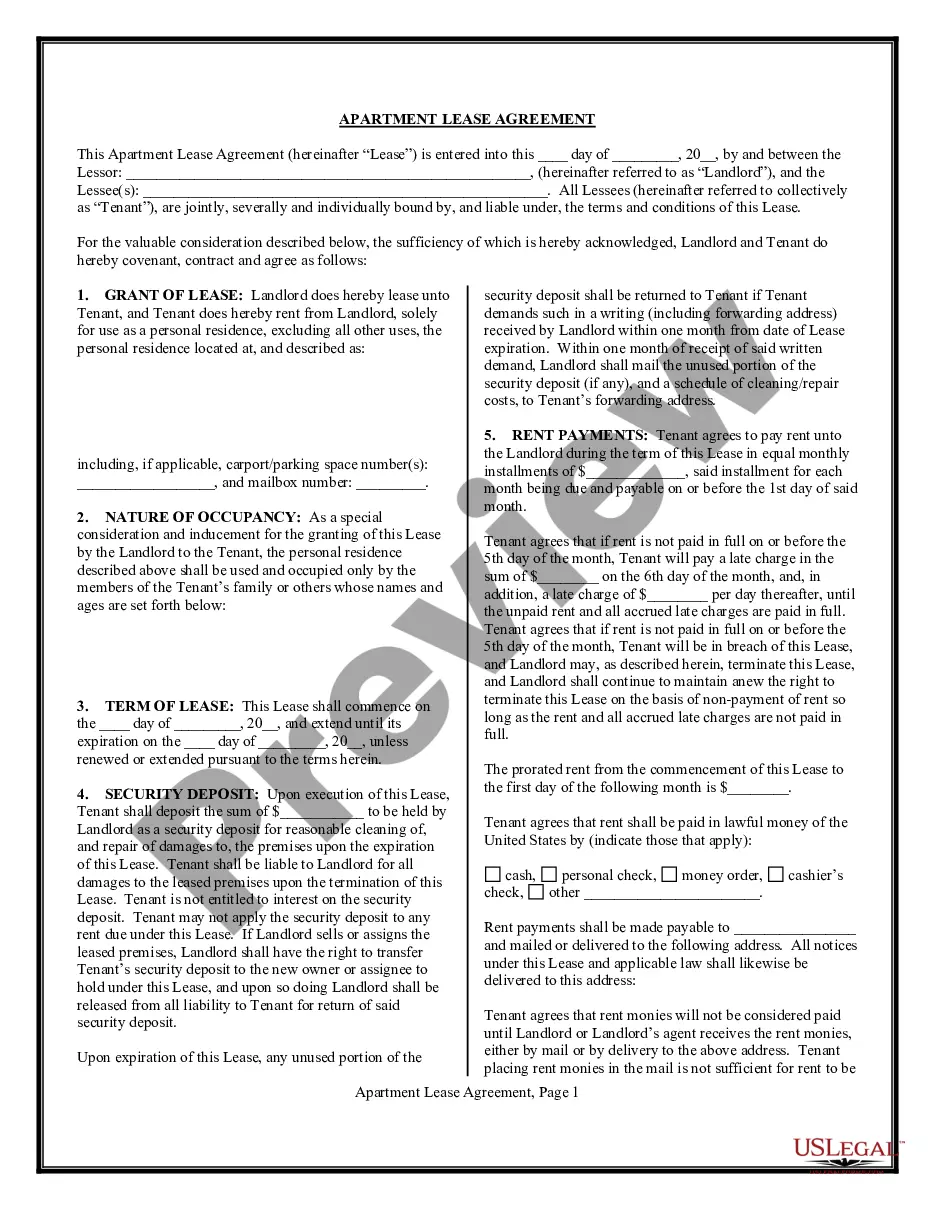

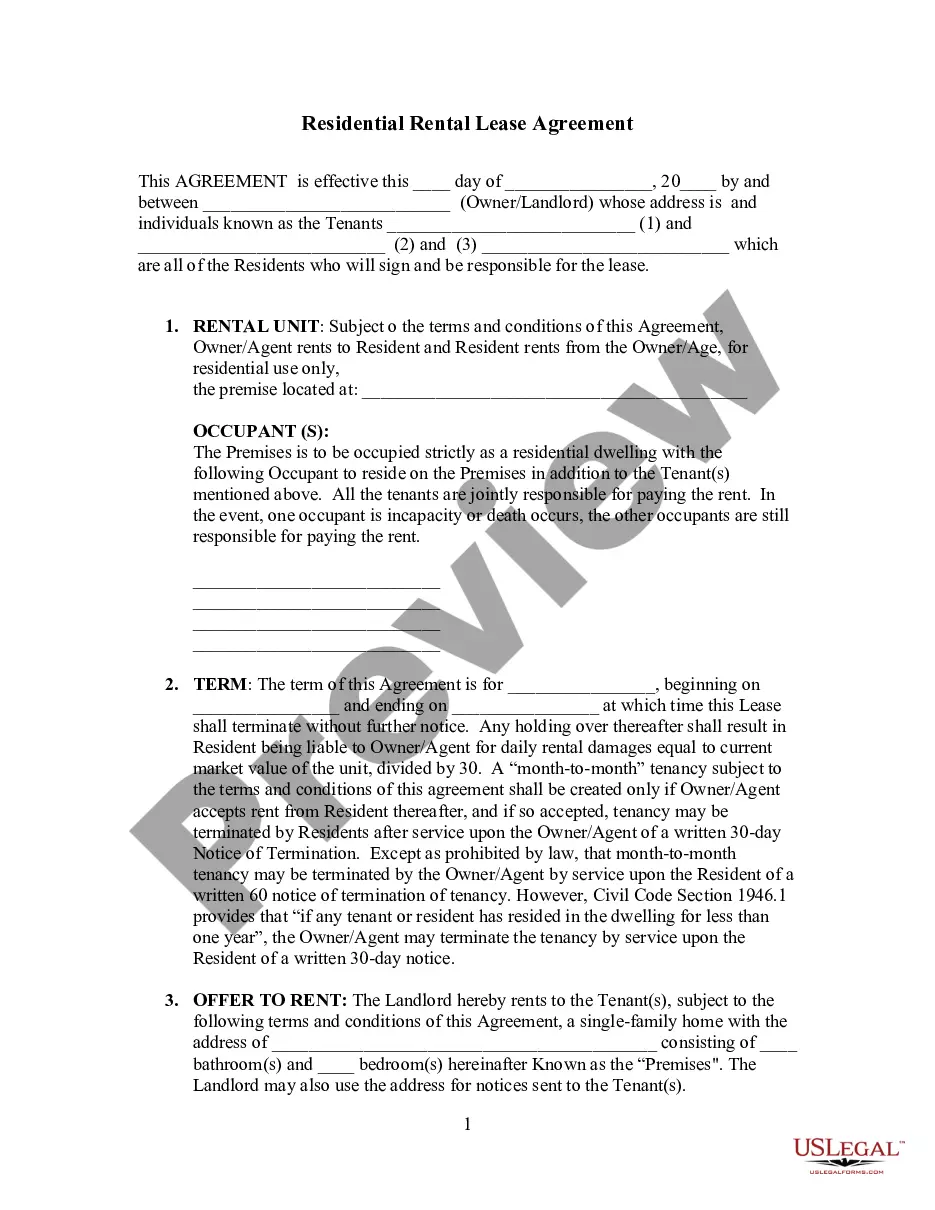

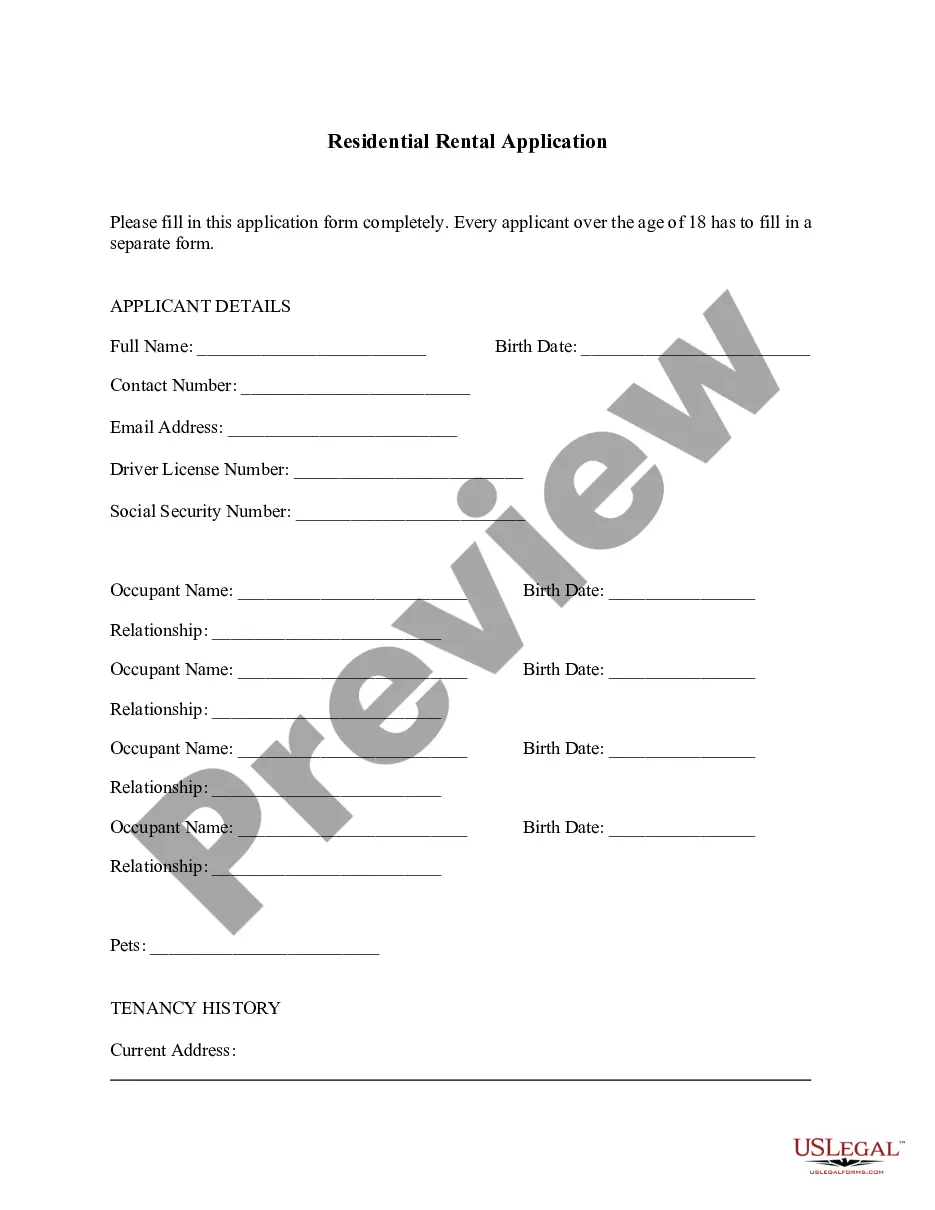

How to fill out Resident Information Sheet?

Selecting the appropriate legal document template can be challenging. Naturally, there are numerous designs available online, but how do you find the legal form you require? Utilize the US Legal Forms website. The service provides thousands of templates, including the Maryland Resident Information Sheet, which can be utilized for business and personal purposes. All forms are reviewed by experts and comply with federal and state requirements.

If you are already a registered user, sign in to your account and click the Download button to obtain the Maryland Resident Information Sheet. Use your account to browse the legal forms you have previously acquired. Navigate to the My documents section of your account to retrieve another copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps for you to follow: First, ensure you have selected the correct form for your city/area. You can preview the form using the Review option and read the form description to confirm it is the right one for you. If the form does not meet your needs, use the Search bar to find the appropriate form. When you are confident that the form is suitable, click the Acquire now button to obtain the form.

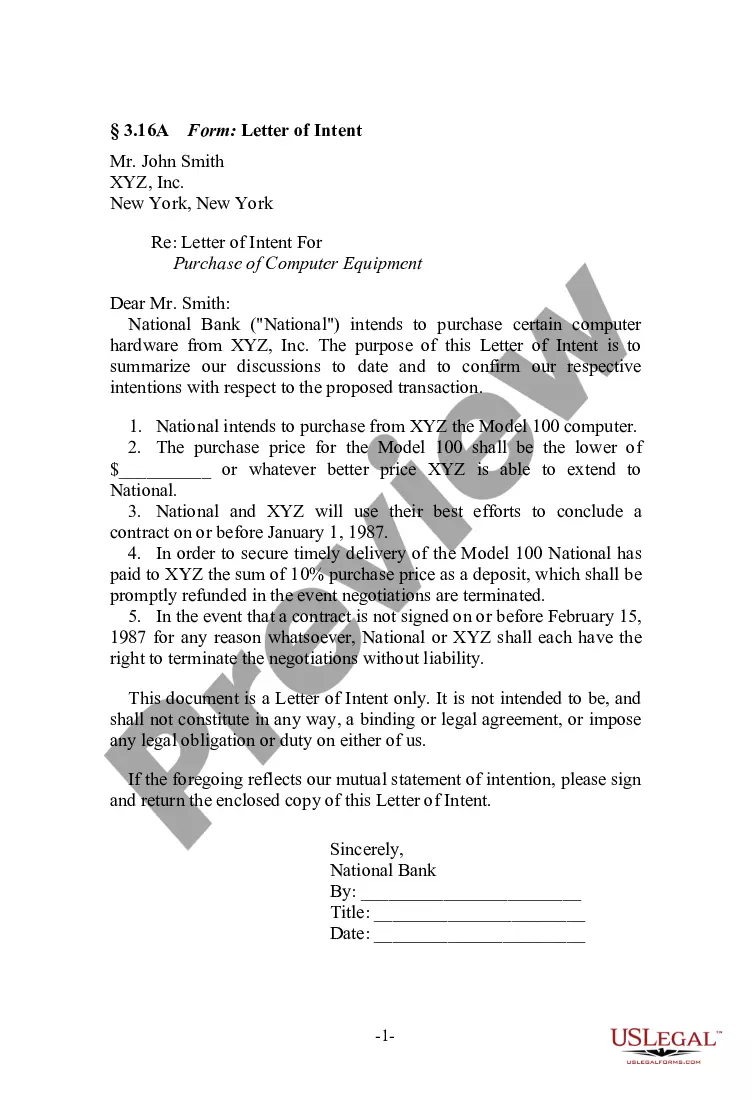

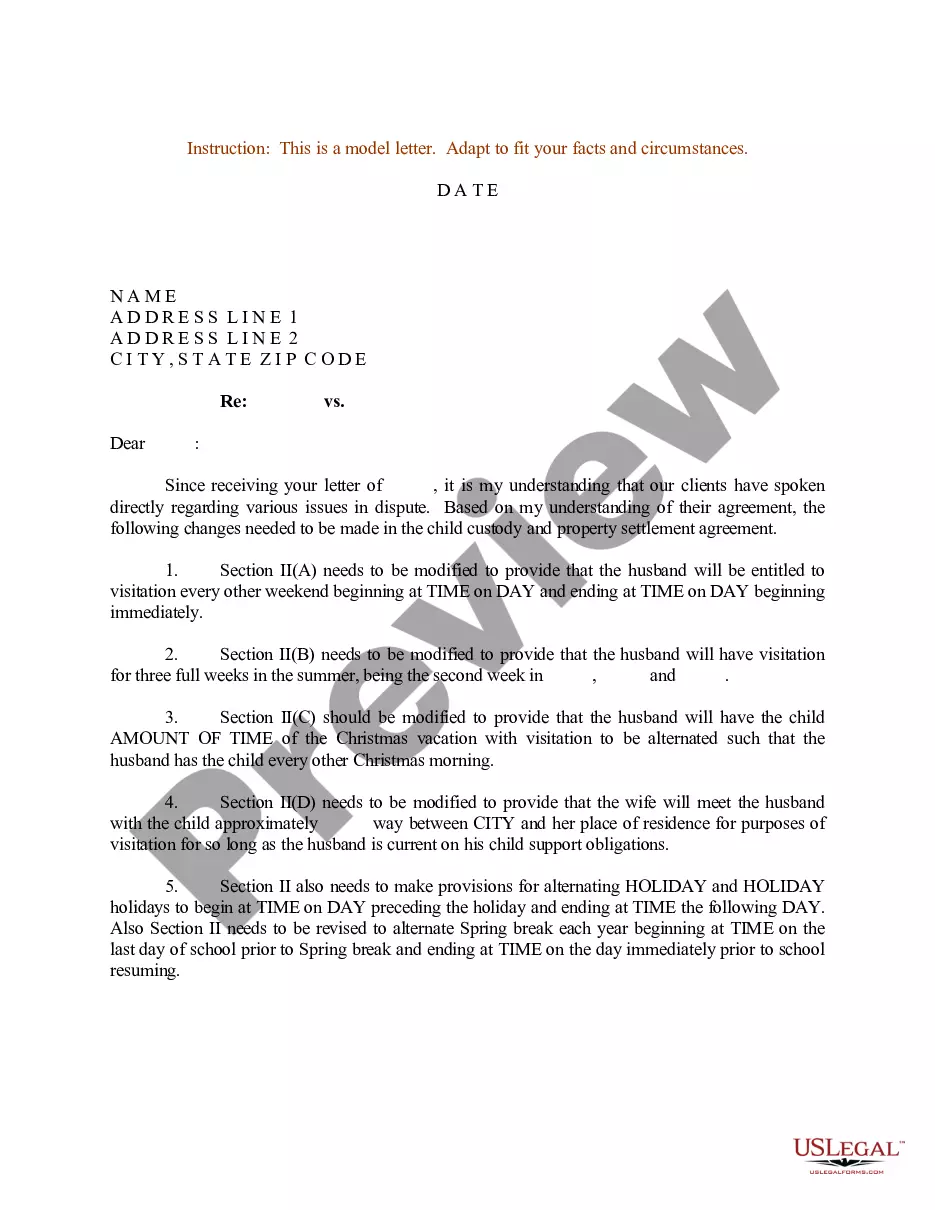

US Legal Forms offers a broad selection of legal documents to assist your needs.

- Choose the pricing plan you prefer and input the required information.

- Create your account and pay for your order using your PayPal account or credit card.

- Select the document format and download the legal document template to your device.

- Complete, edit, print, and sign the downloaded Maryland Resident Information Sheet.

- US Legal Forms is the largest collection of legal documents where you can find a variety of document templates.

- Utilize the service to download professionally crafted documents that adhere to state requirements.

Form popularity

FAQ

Statutory resident - You maintain and occupy a place of abode (that is a place to live) for more than 6 months of the tax year in Maryland. Part-Year Residents - If you either established or abandoned Maryland residency during the calendar year, you are considered a part-year resident.

Briefly stated, an individual is a resident of Maryland if the individual is domiciled in Maryland on the last day of the taxable year or if the individual maintains a place of abode in Maryland for more than six months of the taxable year and is physically present in the State for 183 days or more during the taxable

Were you a resident of Maryland for part of the year? If you either established or abandoned Maryland residency during the calendar year, you must file as a part-year resident, using Form 502. You may also be required to file a return with your other state of residence.

The resident PSD code for an out of state employee is 880000. Employers must withhold and report the appropriate non-resident tax, with the exception of Maryland employees. The York Adams Tax Bureau will not require local earned income tax to be withheld from Maryland residents.

Your business received a tax notice from the Comptroller of Maryland. Notices are sent from our offices to business taxpayers for a variety of reasons. It could be a missing return, an error on a return. It could be that your IRS return doesn't match your Maryland return.

Purpose of Form. Form 502CR is used to claim personal income tax credits for individuals (including resident fiduciaries).

If you are sending a Form 502 or Form 505 (with a payment) through the US Postal Service, send it to: Comptroller of Maryland, Payment Processing, PO Box 8888, Annapolis, MD 21401-8888.

Resident Status: You are considered a Maryland resident if your permanent home (domicile) is in the state or if you spent more than half of the year here. For income tax purposes, this means that you were physically present in the state for more at least 183 days.

If you are a Maryland resident, you can file long Form 502 and 502B if your federal adjusted gross income is less than $100,000. If you lived in Maryland only part of the year, you must file Form 502. If you are a nonresident, you must file Form 505 and Form 505NR.

Use Form 510 (Schedule K-1) to report the distributive or pro rata share of the member's income, additions, subtractions, nonresident tax and credits apportioned to Maryland.