Maryland Business Deductibility Checklist

Description

How to fill out Business Deductibility Checklist?

Are you presently in the location where you require documents for either business or personal purposes almost every day.

There are many authorized document templates available online, but finding ones you can trust is challenging.

US Legal Forms provides a vast selection of template forms, such as the Maryland Business Deductibility Checklist, designed to comply with state and federal regulations.

When you find the right form, click on Buy now.

Choose the pricing plan you want, fill in the necessary information to create your account, and purchase the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Next, you can download the Maryland Business Deductibility Checklist template.

- If you do not have an account and want to start using US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it is for the correct city/region.

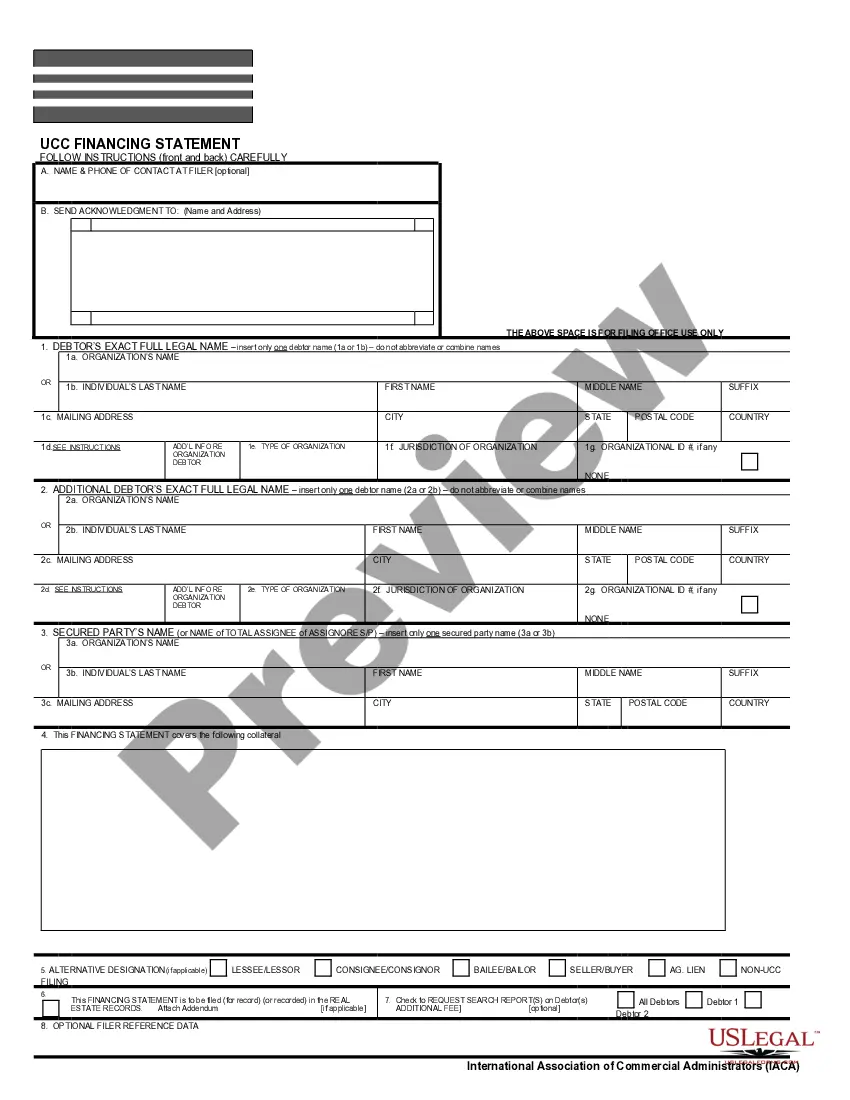

- Use the Preview button to review the form.

- Check the summary to confirm that you have selected the correct form.

- If the form isn't what you're looking for, use the Lookup area to find the form that meets your needs and criteria.

Form popularity

FAQ

Yes, Maryland is often seen as a business-friendly state. The state offers a variety of resources and support for entrepreneurs, including tax incentives and access to funding. By leveraging tools like the Maryland Business Deductibility Checklist, you can maximize your benefits and ensure smooth operations.

A business not in good standing in Maryland has failed to meet one or more legal requirements, such as not filing reports or paying fees. This status can restrict your ability to conduct business legally and may lead to penalties. It's crucial to refer to the Maryland Business Deductibility Checklist to ensure your business meets all necessary standards.