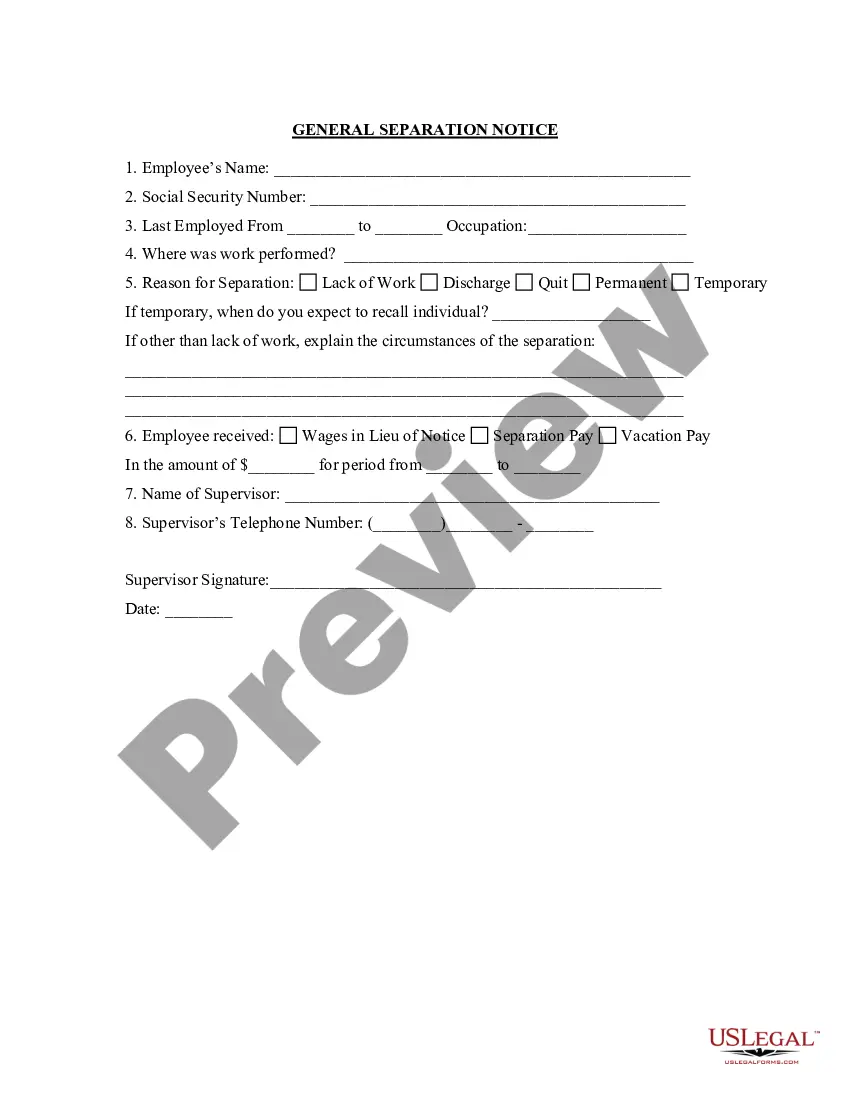

Maryland Separation Notice for 1099 Employee

Description

How to fill out Separation Notice For 1099 Employee?

You are capable of spending numerous hours online looking for the valid document format that complies with the federal and state requirements you need.

US Legal Forms provides an extensive collection of legal forms that are evaluated by experts.

It is easy to download or print the Maryland Separation Notice for 1099 Employee from my service.

Read the form details to ensure you have selected the correct form. If available, utilize the Preview button to view the document format as well.

- If you already possess a US Legal Forms account, you can Log In and click the Obtain button.

- After that, you can complete, edit, print, or sign the Maryland Separation Notice for 1099 Employee.

- Each legal document format you purchase is yours permanently.

- To acquire another copy of any purchased form, go to the My documents tab and click on the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions provided below.

- First, ensure that you have chosen the correct document format for the county/town of your choice.

Form popularity

FAQ

The self-employment assistance program in Maryland supports individuals who wish to start their own businesses. This program offers training and resources while allowing participants to collect unemployment benefits. If you are a 1099 employee seeking advice on transitioning, a Maryland Separation Notice for 1099 Employee can help document your employment history as you prepare for self-employment.

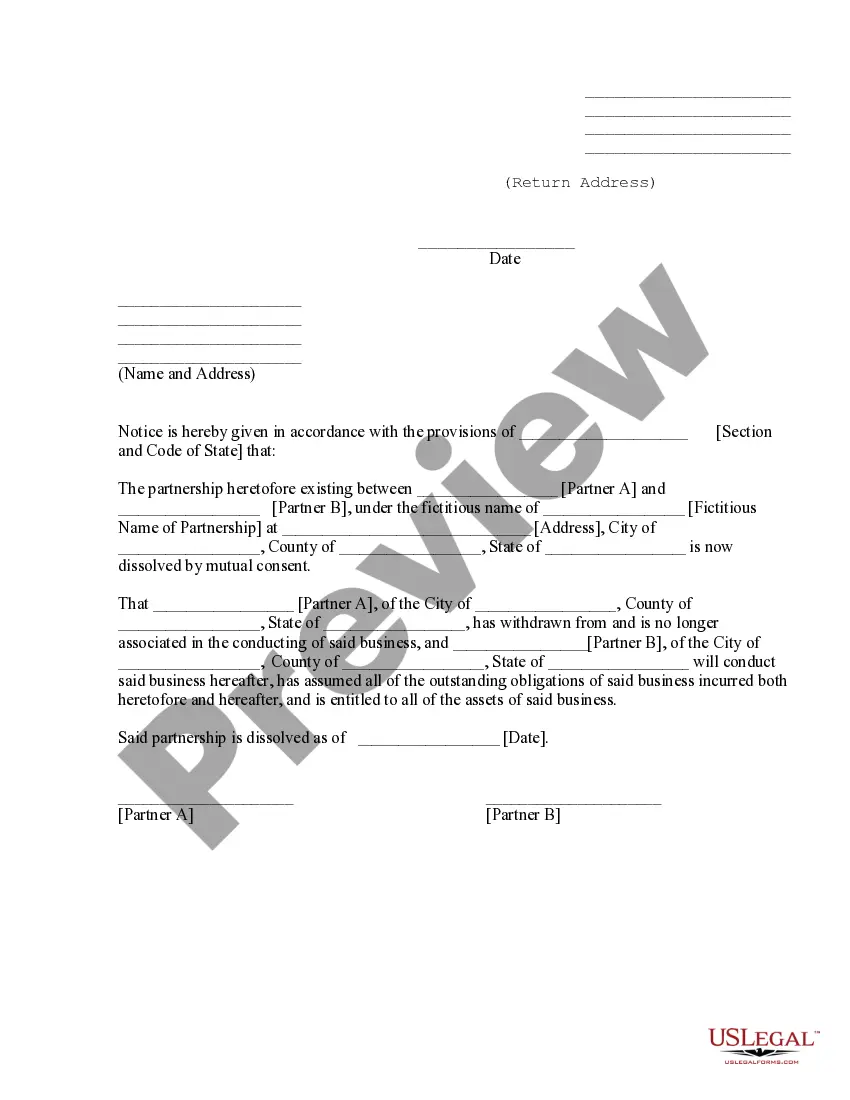

Maryland is an employment-at-will state. This means that either the employer or the employee may end the employment relationship without giving either notice or a reason.

Do independent contractors qualify for unemployment insurance? Yes, with the passing of the CARES Act, independent contractors, gig workers, and self-employed individuals are eligible for unemployment insurance if they are unable to work due to COVID-19.

How To Resign From a Contract Position With GraceCommunicate with your recruiting partner. There are a lot of reasons why you might want to move on, most of which are perfectly understandable.Give proper notice.Keep the stakes in mind.Leave the job better than you found it.

A) Yes. There is a special program which provides benefits to those who are not traditionally eligible for unemployment insurance, which includes gig workers (Uber, Lyft, AirBnB hosts, etc.), freelancers, and independent contractors.

Working as an independent contractor gives you a number of freedoms that include allowing you to end a working relationship if you don't like your client.

If your independent contractor agreement contains a provision that allows the parties to terminate the relationship at any time, revise the agreement to include a notice provision with at least some kind of a notice period required for termination of the contract.

Although independent contractors do not have the right to workers' compensation benefits in Maryland, there are some cases in which employers have misclassified a worker as an independent contractor when the worker is actually an employee.

Pandemic Unemployment Assistance (PUA)Provides benefits for claimants who are ineligible for regular UI and unemployed due to a COVID-19 related reason. This includes gig workers, independent contractors, the self-employed, and those with insufficient work history.

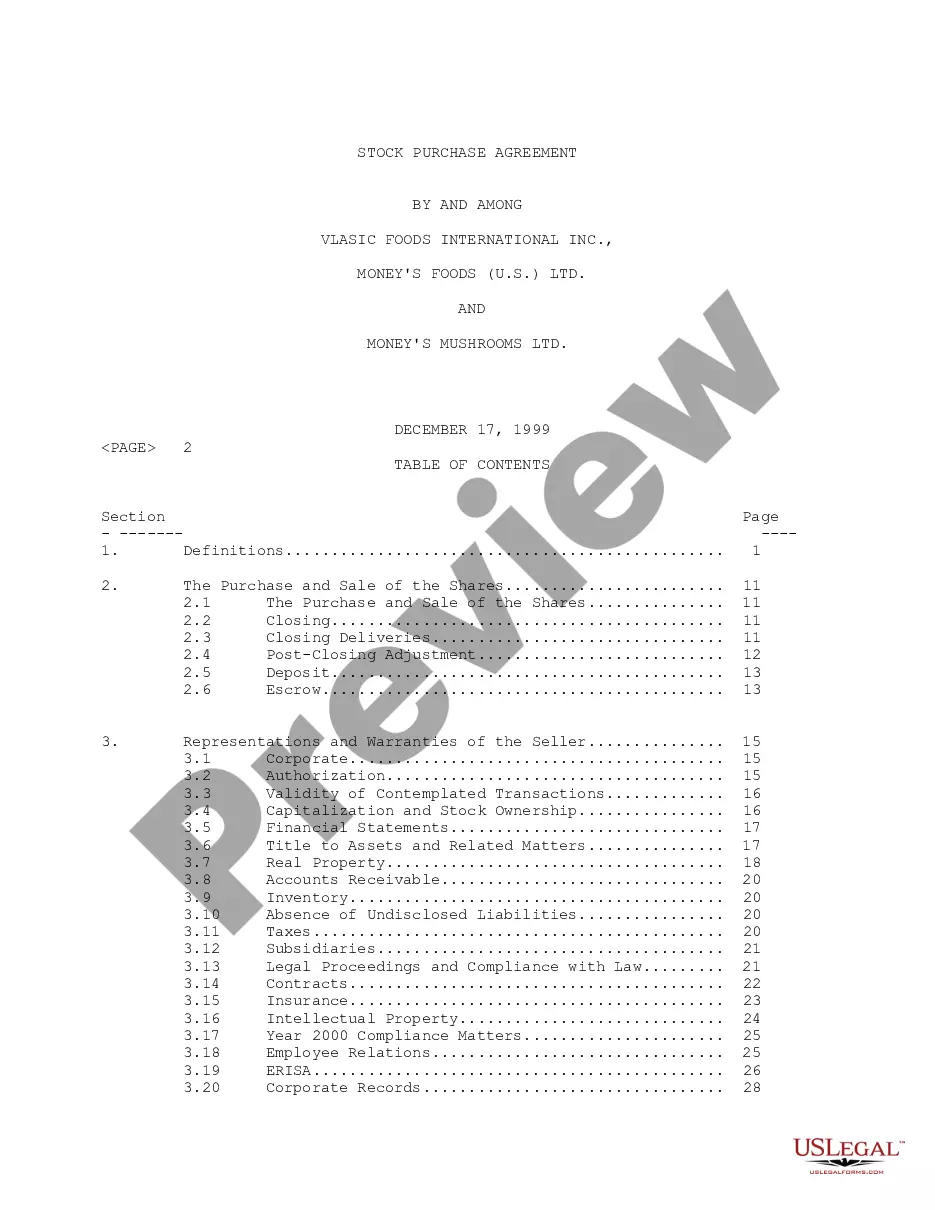

The only problem is that it is often illegal. There is no such thing as a 1099 employee. The 1099 part of the name refers to the fact that independent contractors receive a form 1099 at the end of the year, which reports to the IRS how much money was paid to the contractor.