Maryland FMLA Tracker Form - Year Measured from Date of Request - Employees with Set Schedule

Description

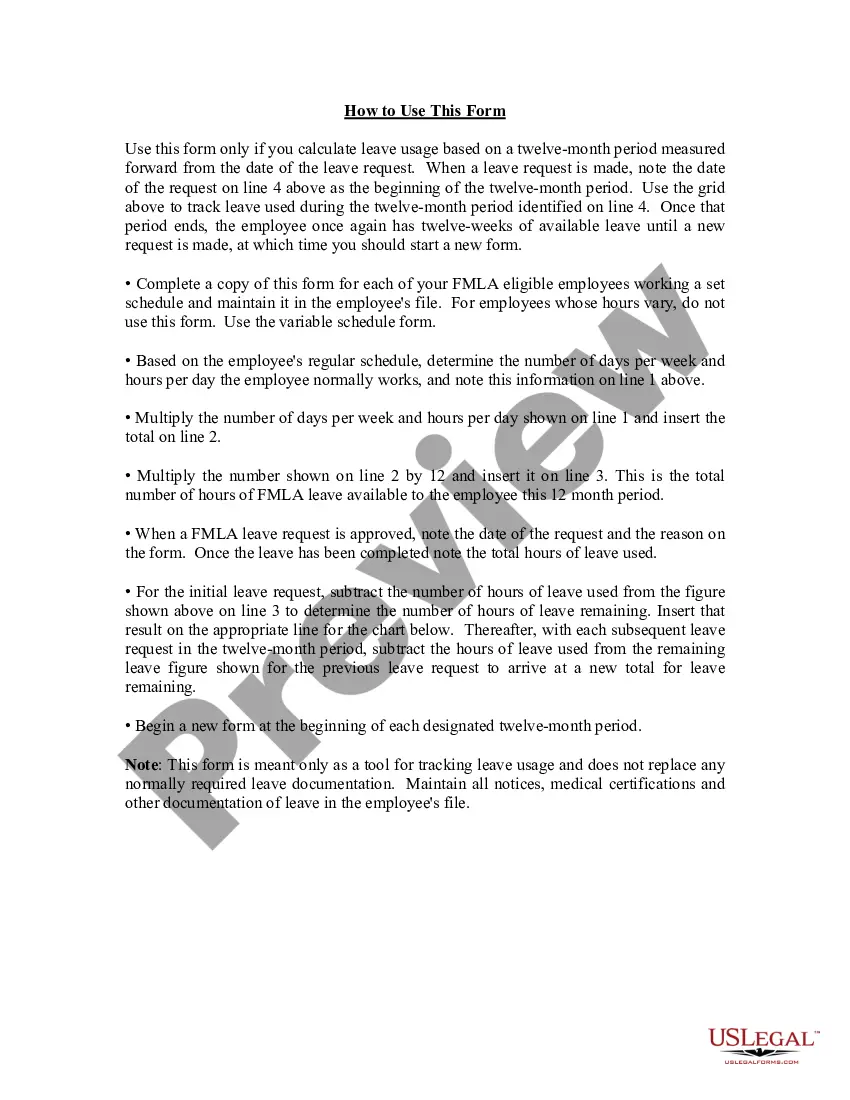

How to fill out FMLA Tracker Form - Year Measured From Date Of Request - Employees With Set Schedule?

You can utilize time online trying to locate the sanctioned document template that fulfills the state and federal requirements you need.

US Legal Forms offers countless legal forms that are reviewed by professionals.

You can directly acquire or create the Maryland FMLA Tracker Form - Year Measured from Date of Request - Employees with Set Schedule from my service.

Refer to the form description to confirm you have chosen the appropriate template. If available, utilize the Review button to examine the document template as well.

- If you possess a US Legal Forms account, you may Log In and click the Acquire button.

- Subsequently, you can complete, amend, create, or sign the Maryland FMLA Tracker Form - Year Measured from Date of Request - Employees with Set Schedule.

- Each legal document template you obtain is yours indefinitely.

- To obtain another copy of a purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, adhere to the straightforward instructions listed below.

- First, ensure that you have selected the correct document template for your state/city of choice.

Form popularity

FAQ

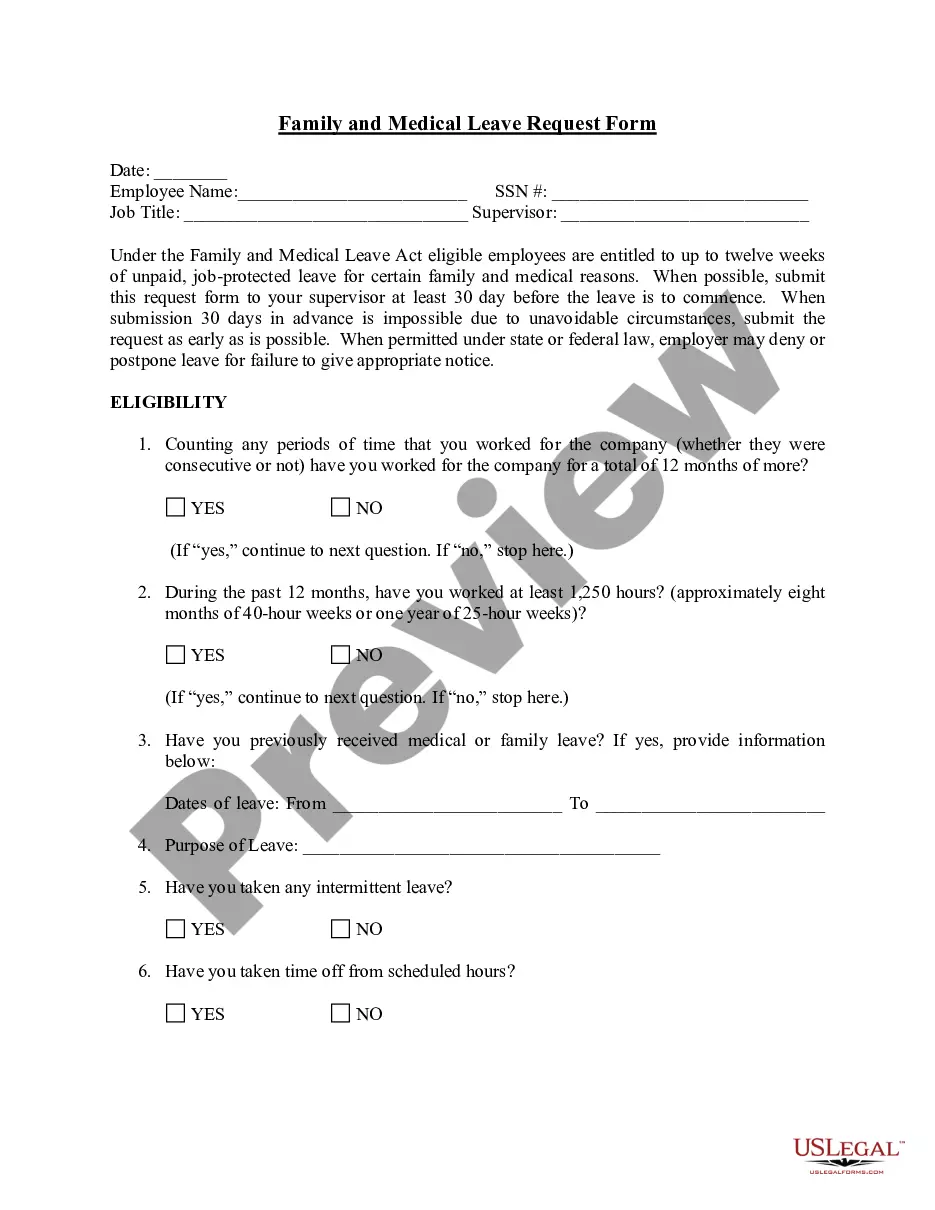

Under the ''rolling'' 12-month period, each time an employee takes FMLA leave, the remaining leave entitlement would be the balance of the 12 weeks which has not been used during the immediately preceding 12 months. 2022

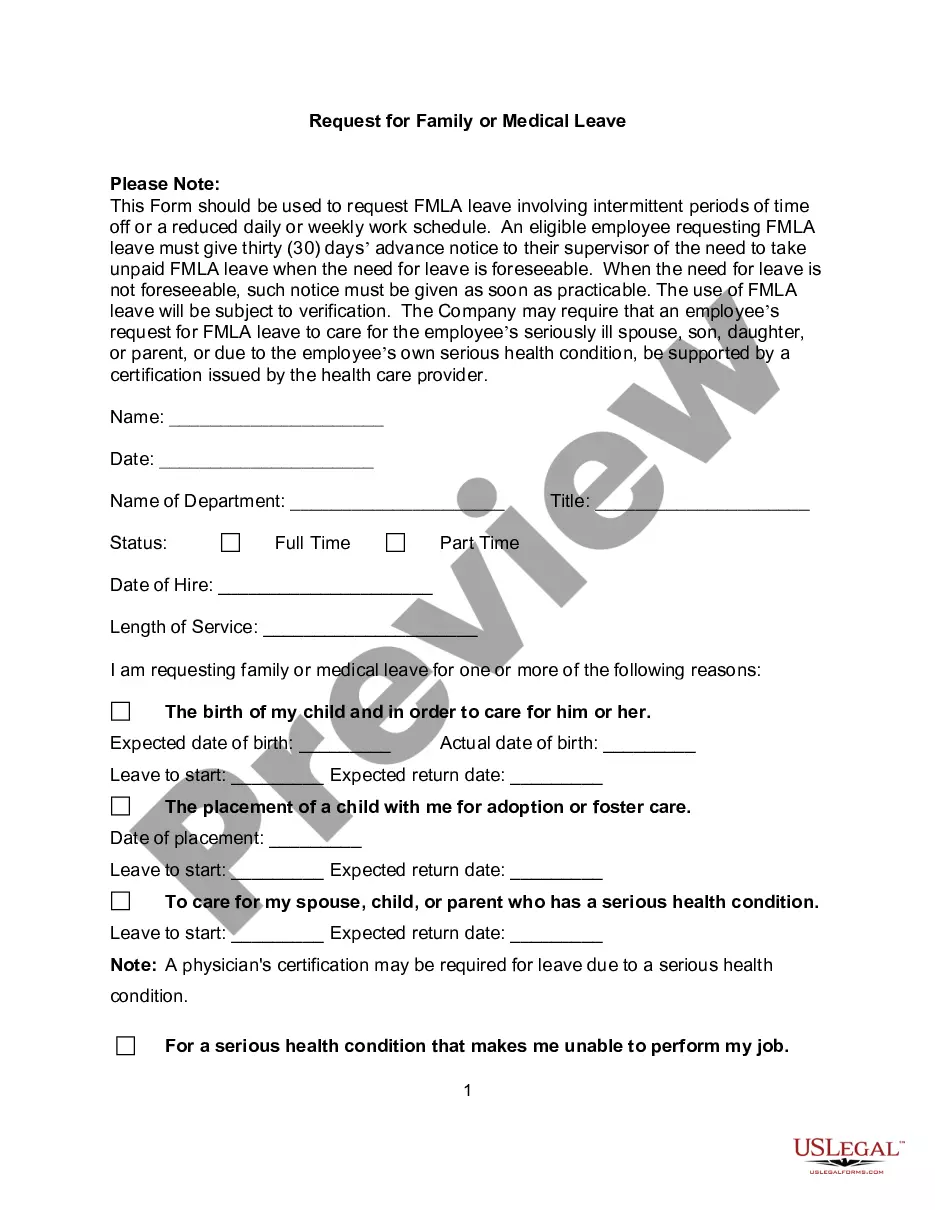

An employee's 12-week FMLA leave can be calculated using the calendar year, any fixed 12-month year, the first day of FMLA leave or a rolling period.

This is a problem because FMLA leave cannot be backdated. That means that employees will get more than 12 weeks of leave. Employees who take FMLA leave must be provide an eligibility notice of FMLA rights within 5 days of the first day of FMLA.

One of the easiest methods by which an employer can track FMLA leave is to place all employees on a calendar year track. This means that each employee can take 12 weeks of FMLA leave anytime between January and December, and the calculations reset on January 1 of each year.

The amount of FMLA leave taken is divided by the number of hours the employee would have worked if the employee had not taken leave of any kind (including FMLA leave) to determine the proportion of the FMLA workweek used.

Under the ''rolling'' 12-month period, each time an employee takes FMLA leave, the remaining leave entitlement would be the balance of the 12 weeks which has not been used during the immediately preceding 12 months. 2022 Example 1: Michael requests three weeks of FMLA leave to begin on July 31st.

The 12-month rolling sum is the total amount from the past 12 months. As the 12-month period rolls forward each month, the amount from the latest month is added and the one-year-old amount is subtracted. The result is a 12-month sum that has rolled forward to the new month.

For example, an employer considers Thanksgiving a holiday and is closed on that day, and none of its employees work. One of its employees is taking 12 weeks of unpaid FMLA leave the last 12 weeks of the calendar year. The employer would count Thanksgiving Day as FMLA leave for that employee.