Maryland Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company

Description

How to fill out Resolution Of Meeting Of LLC Members To Specify Amount Of Annual Disbursements To Members Of The Company?

You can spend several hours online looking for the legal document format that meets the state and federal standards you need.

US Legal Forms offers an extensive collection of legal forms that are assessed by experts.

It is easy to download or print the Maryland Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company with the help provided.

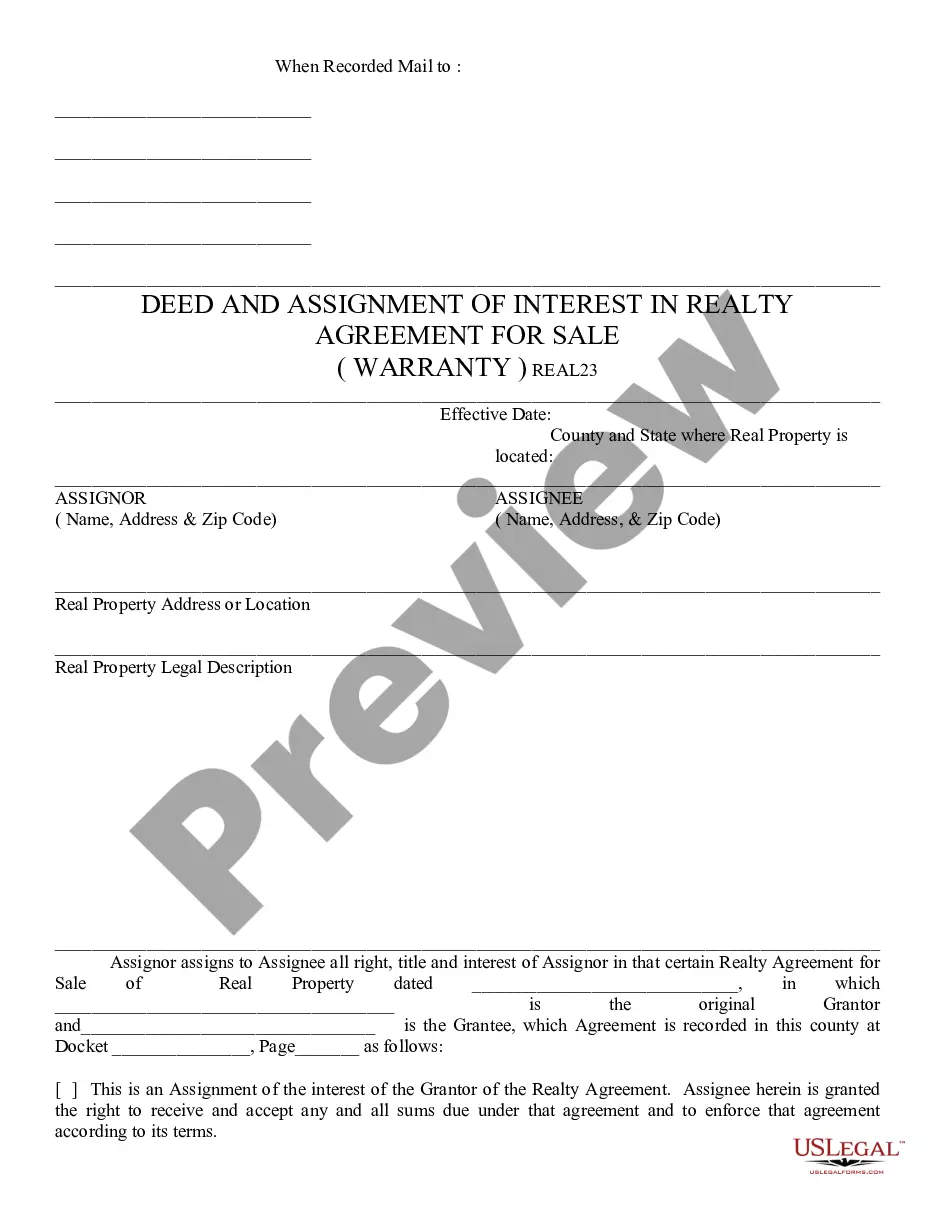

If available, utilize the Preview button to view the document format as well.

- If you already possess a US Legal Forms account, you may Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Maryland Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company.

- Each legal document format you acquire is yours for a long time.

- To obtain another copy of a purchased document, visit the My documents tab and click the designated button.

- If you are using the US Legal Forms website for the first time, follow the simple steps below.

- First, ensure you have selected the correct document format for your area/city of interest.

- Read the document details to confirm you have picked the correct form.

Form popularity

FAQ

An operating agreement is a foundational document that outlines the management and operational procedures of an LLC. In contrast, a resolution is a specific decision made by the members that reflects a consensus on a particular issue. For example, a Maryland Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company serves as a decision point governed by the terms established in the operating agreement.

Section 2-106 details the statutory requirements for LLCs in Maryland, including governance and the establishment of resolutions. This section provides a legal framework that guides member meetings and decision-making processes. Understanding this section is vital for creating a Maryland Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company.

An LLC member resolution is the written record of a member vote authorizing a specific business action. Formal resolutions aren't necessary for small, everyday decisions. However, they're useful for granting authority to members to transact significant business actions, such as taking out a loan on behalf of the LLC.

A member of the LLC should have an ethical responsibility to meet the obligations of the firm. They should have duty of care.

An LLC resolution is a written record of important decisions made by members that describes an action taken by the company and confirms that members were informed about it and agreed to it.

Any LLC member can propose a resolution, but all members must vote on it. Typically a majority of the members is needed to pass the resolution, but each LLC may have different voting rights. Some LLCs give a different value to each member's vote based on their percentage of interest in the company.

An LLC resolution is a document describing an action taken by the managers or owners of a company, with a statement regarding the issue that needs to be voted on. This does not need to be a complicated document, and need only include necessary information.

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

A corporation is an incorporated entity designed to limit the liability of its owners (called shareholders). Generally, shareholders are not personally liable for the debts of the corporation. Creditors can only collect on their debts by going after the assets of the corporation.

Those LLC members who operate the business owe the fiduciary duties of loyalty and reasonable care to the non-managing LLC owners. Depending upon your state, LLC members may be able to revise, broaden, or eliminate these fiduciary duties by contract or under the conditions of their LLC operating agreement.