Maryland Withheld Delivery Notice

Description

How to fill out Withheld Delivery Notice?

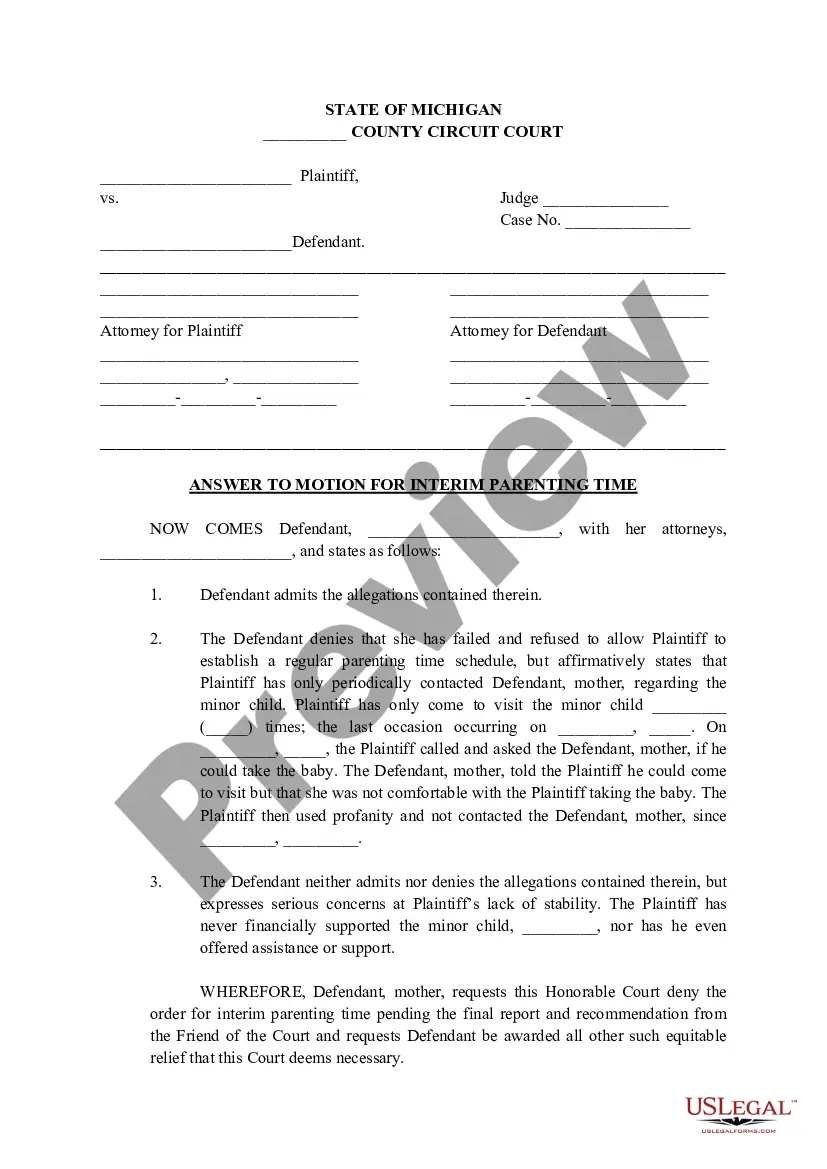

You might spend hours online searching for the legal document template that matches the state and federal criteria you require.

US Legal Forms offers thousands of legal forms that have been evaluated by professionals.

You can easily download or print the Maryland Withheld Delivery Notice from the service.

If available, take advantage of the Preview option to review the document template as well.

- If you already possess a US Legal Forms account, you can Log In and select the Download option.

- Subsequently, you can fill out, modify, print, or sign the Maryland Withheld Delivery Notice.

- Every legal document template you obtain is yours permanently.

- To acquire another copy of a purchased form, visit the My documents tab and click the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your county or area of interest.

- Check the form description to confirm that you have chosen the correct type.

Form popularity

FAQ

Maryland withholding refers to the process where employers deduct state income tax from employee wages before payment. This deduction helps ensure that employees prepay their state income tax obligations. Understanding Maryland withholding is crucial for managing your finances effectively. For further clarification, the Maryland Withheld Delivery Notice can serve as an informational tool, along with resources from uslegalforms.

The law requires that you complete an Employee's Withholding Allowance Certificate so that your employer, the state of Maryland, can withhold federal and state income tax from your pay. The State of Maryland has a form that includes both the federal and state withholdings on the same form.

You are not required by law to withhold Maryland income taxes from the wages paid to a domestic employee in a private residence. However, you may do so as a courtesy to the employee. If you wish, you can register your withholding account online and use bFile to file your withholding returns electronically for free.

You may claim exemption from Maryland income taxes if your federal income will not exceed $10,400, whether or not you are claimed as a dependent. For more information and forms, visit the university Tax Office website.

Yes. The state of Maryland requires additional forms to be submitted with 1099s. If you file 1099s by paper, you must submit Form MW508 (Annual Employer Withholding Reconciliation Return) and 1096. If you e-file, only Form MW508 needs to be submitted with 1099s.

Form MW-506 is Maryland's reporting form for Return of Income Tax Withheld. In other words, it documents that you withheld your employees' estimated income tax liability and remitted these funds to the state.

You are not required by law to withhold Maryland income taxes from the wages paid to a domestic employee in a private residence. However, you may do so as a courtesy to the employee. If you wish, you can register your withholding account online and use bFile to file your withholding returns electronically for free.

Your business received a tax notice from the Comptroller of Maryland. Notices are sent from our offices to business taxpayers for a variety of reasons. It could be a missing return, an error on a return. It could be that your IRS return doesn't match your Maryland return.

Does Maryland mandate W-2 filing for 2021? Yes! The State of Maryland mandates the filing of Form W-2 only if there is a state tax withholding.

You can close your withholding account by calling Taxpayer Service at 410-260-7980 or 1-800-638-2937 from elsewhere in Maryland, Monday - Friday, a.m. - p.m.