Maryland Indemnification Agreement for a Trust

Description

How to fill out Indemnification Agreement For A Trust?

Selecting the correct legal documents web template can be a challenge.

Of course, there are numerous designs available online, but how can you acquire the legal form you require.

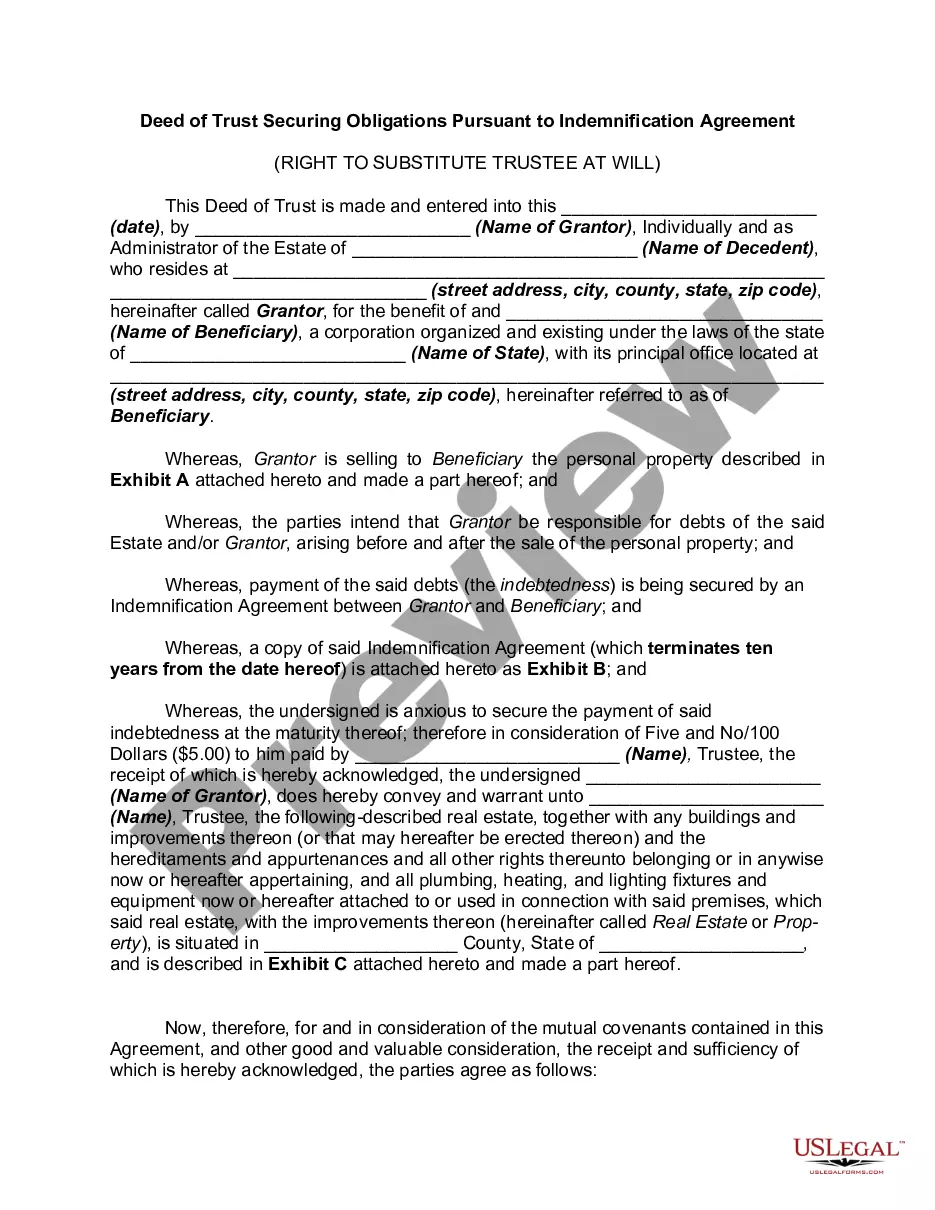

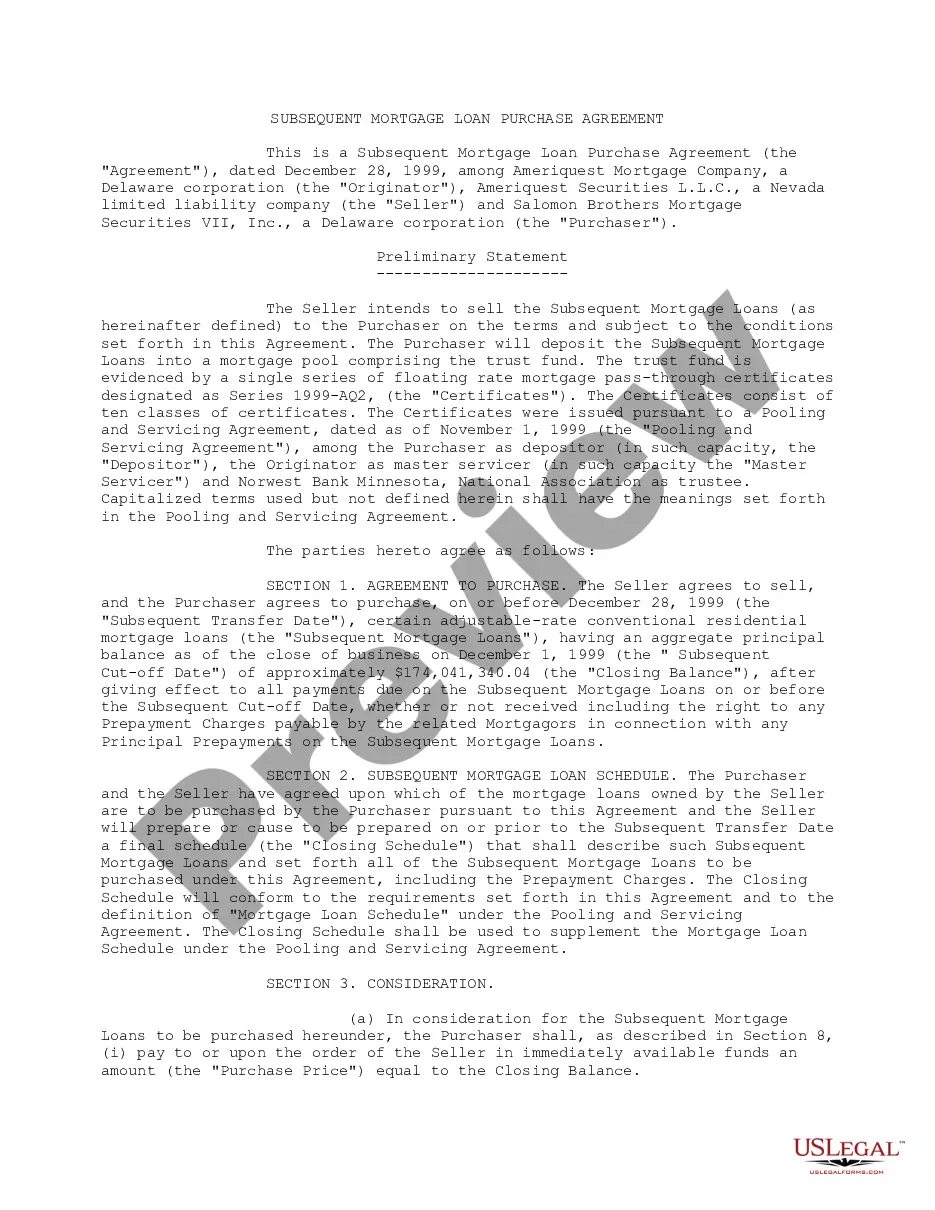

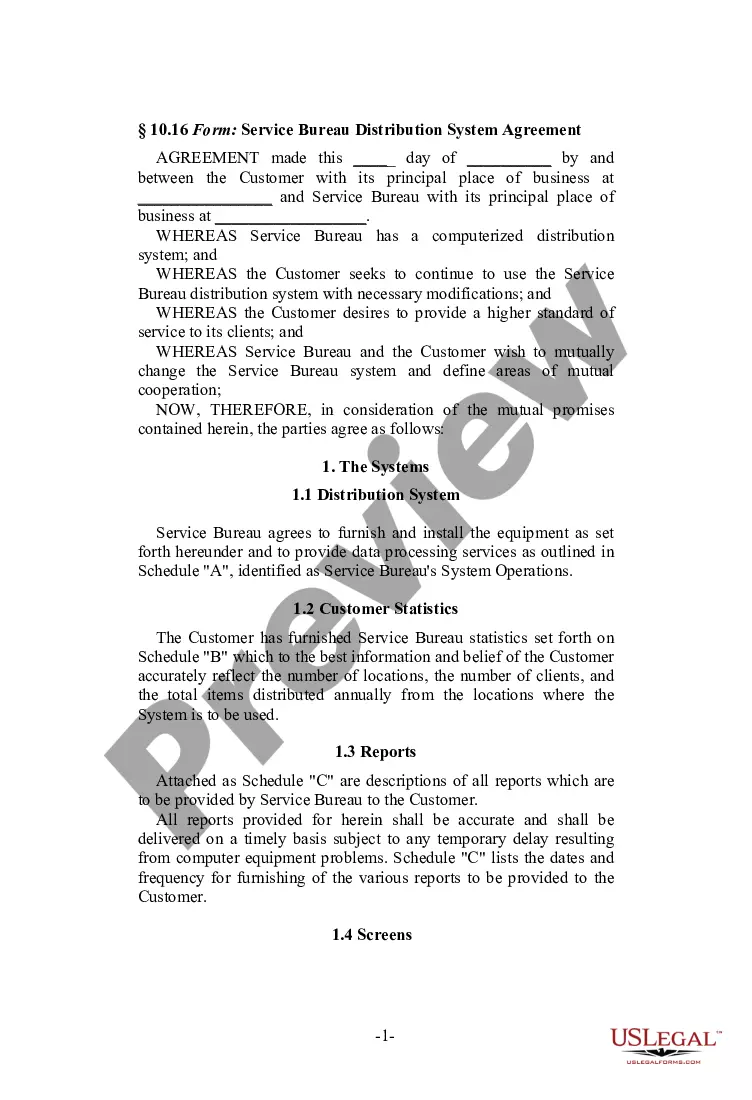

Utilize the US Legal Forms website. The service provides thousands of templates, including the Maryland Indemnification Agreement for a Trust, that you can utilize for business and personal needs.

You can preview the form using the Preview button and review the form description to confirm it is suitable for your needs.

- All templates are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, sign in to your account and click the Download button to obtain the Maryland Indemnification Agreement for a Trust.

- Use your account to browse through the legal forms you have purchased previously.

- Visit the My documents tab in your account and retrieve another copy of the document you require.

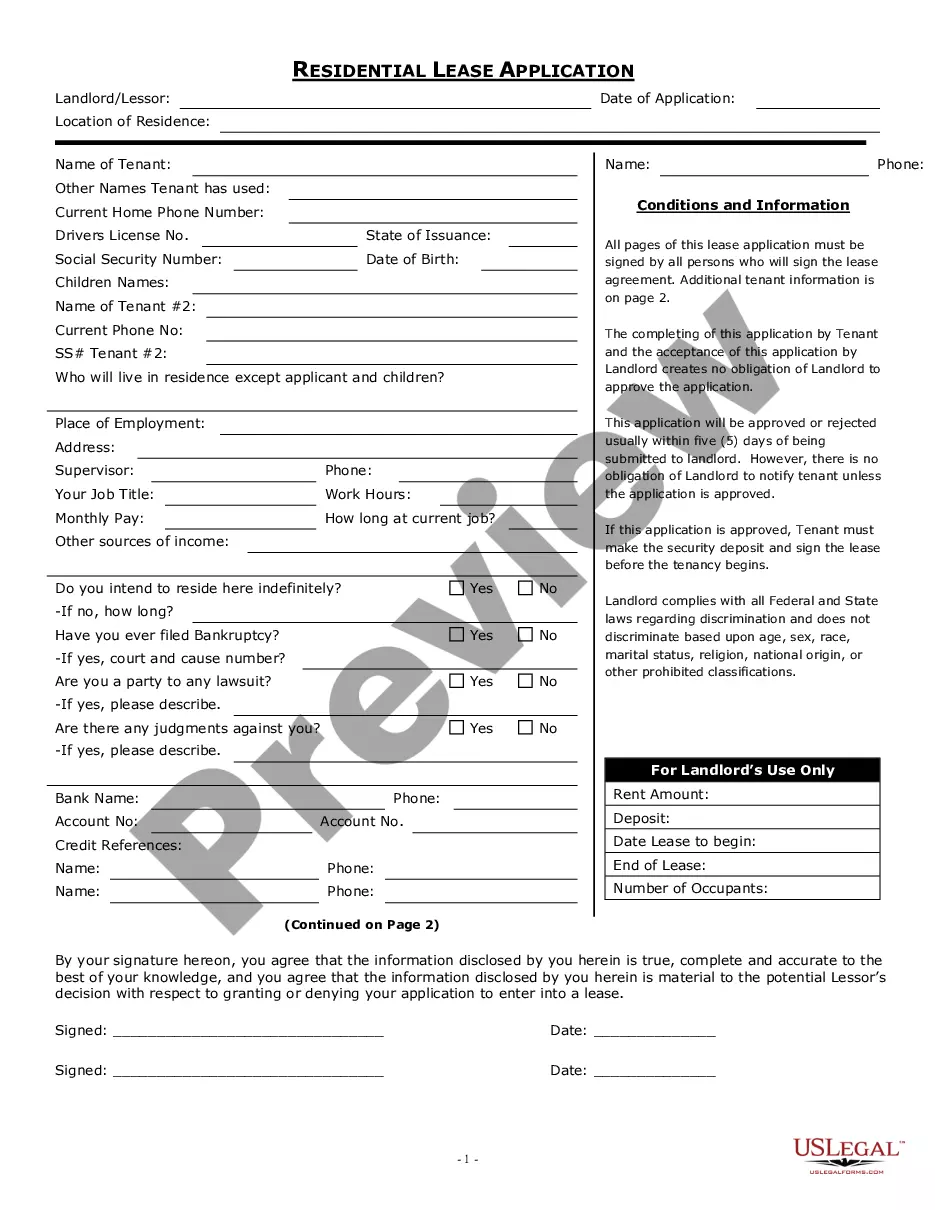

- If you are a new user of US Legal Forms, here are some basic steps you should take.

- First, ensure you have chosen the correct form for your city/state.

Form popularity

FAQ

A statutory trust is formed by filing a certificate of trust with the State Department of Assessments and Taxation of Maryland (the SDAT) and is a separate legal entity.

Recently, Maryland joined more than 25 other states and the District of Columbia in enacting its version of the Uniform Trust Code (UTC).

A trust instrument is not required to be notarized in Maryland. However, it is common practice to notarize the settlor's signature and the witnesses' signatures of the trust agreement to express that the settlor: 220e Intentionally created the trust.

2 Fortunately for our neighboring Delmarva attorneys, Delaware and Virginia are in the majority. 3 Maryland practitioners, however, do not have a decanting statute available.

A trust protector is an individual, or group of individuals, who are given the power to ensure that the purposes and goals of the creator of an irrevocable trust are ultimately fulfilled.

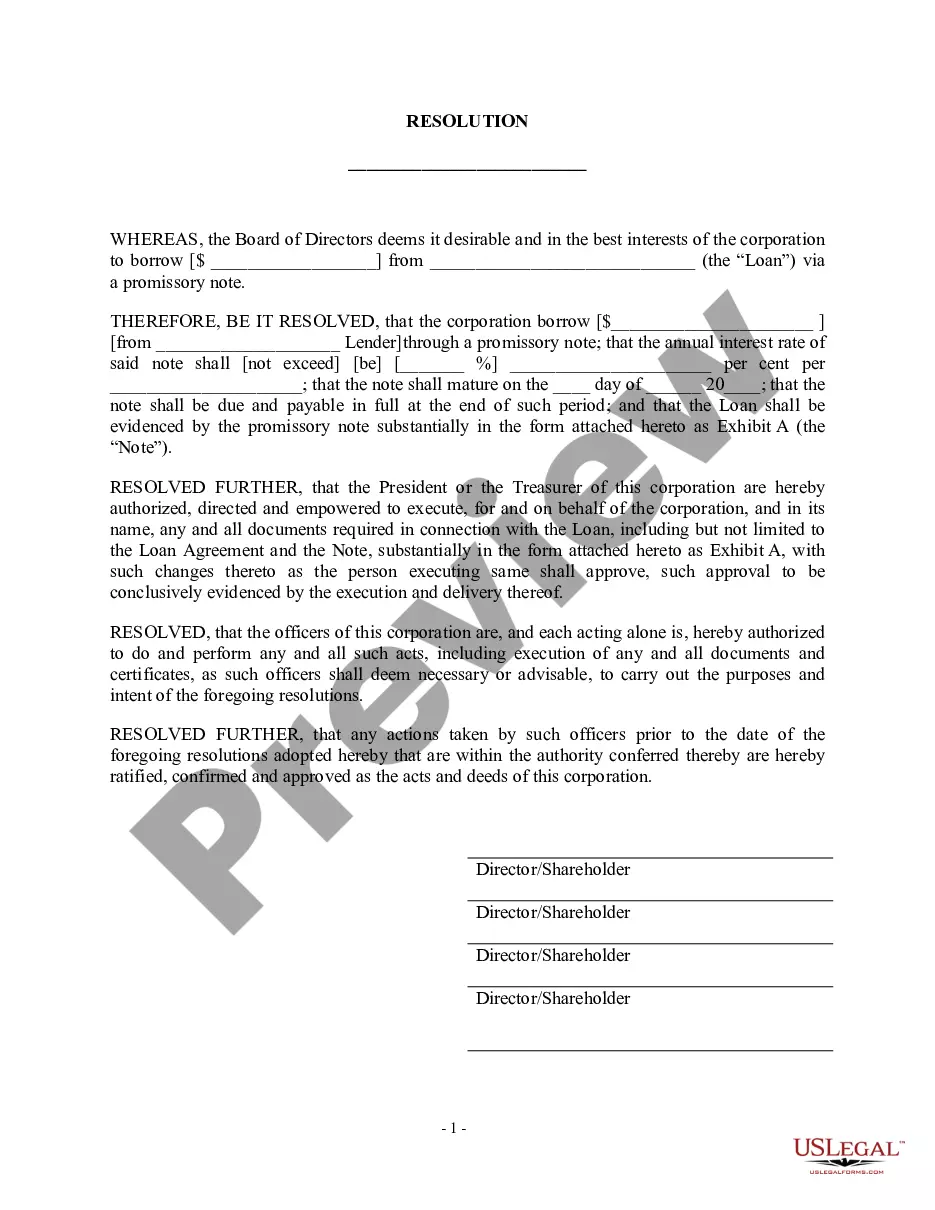

A trustee may ask a beneficiary to sign a piece of paper indemnifying the trustee prior to making a distribution of trust assets. First, let's talk about what indemnification means? Indemnification is a legal term. It literally means that one person is going to pay for any loss or harm suffered by another person.

A: Yes. Md. Code Ann., Corporations and Associations Article §12-902 requires such trusts to register with the Department of Assessments and Taxation before doing any business in Maryland.

Indemnity/indemnification:A trustee is entitled to reasonable compensation for her services. The amount payable can either come from the trust agreement itself or be fixed by the court (taking into account the trustee's skill level and actual duties performed) or state statute.

Some of the most common reasons trusts are invalid include: Legal formalities were not followed when executing the trust instrument. The trust was created or modified through forgery or another type of fraud. The trust maker was not mentally competent when they created or modified the trust.

It helps to remember that a Trust is a separate legal entity. The Trustees and beneficiaries are not personally liable for debts owed by the Trust. The Trustee is acting in a fiduciary capacity.