Maryland Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions

Description

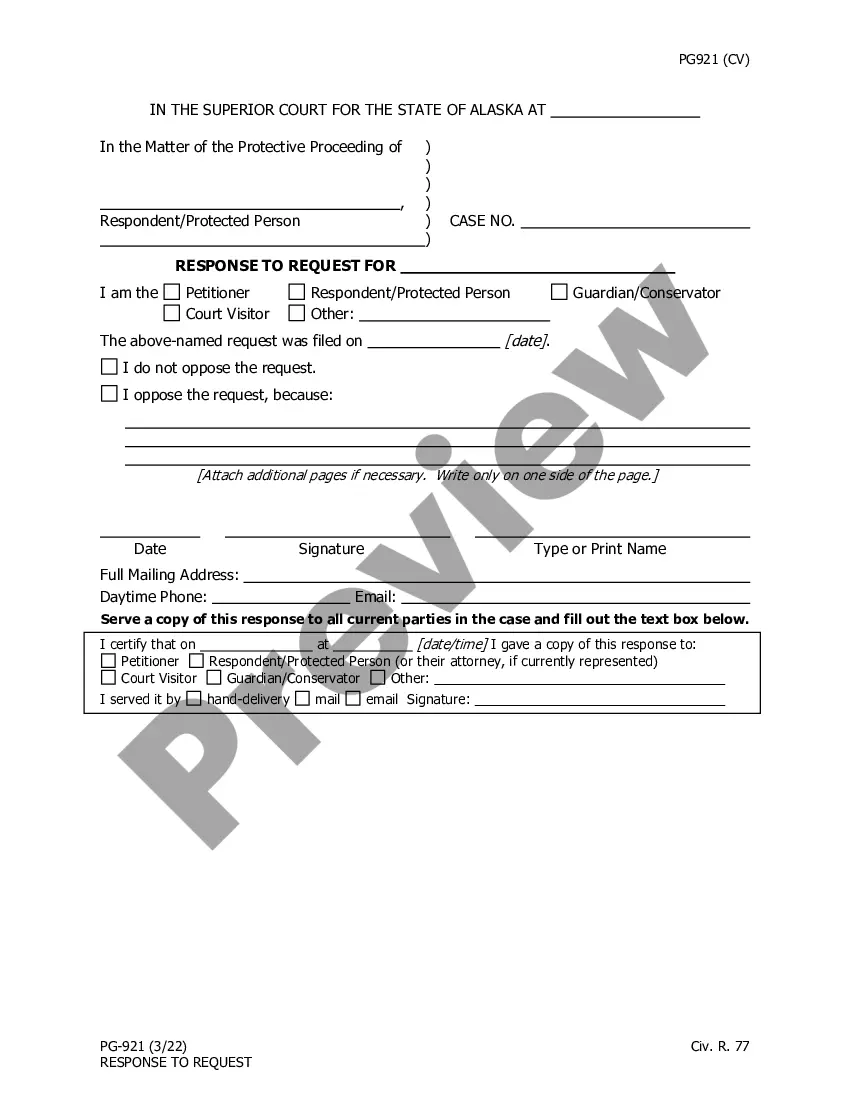

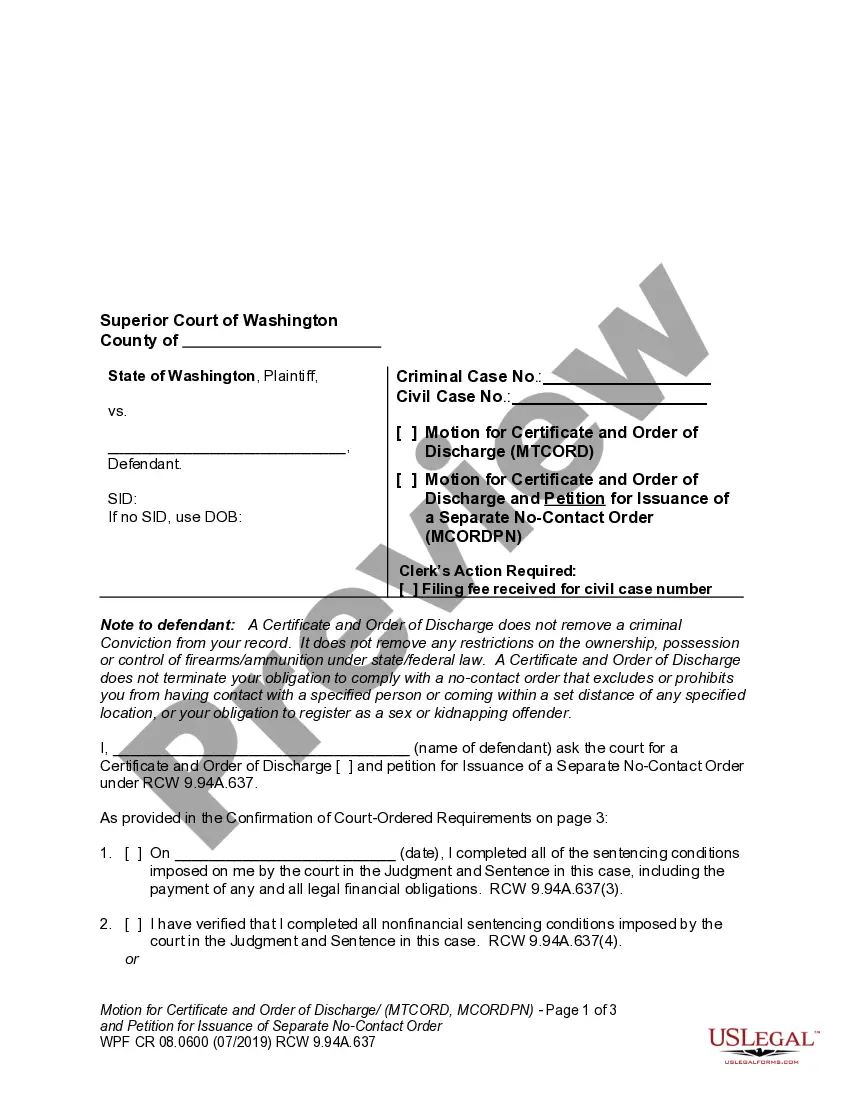

How to fill out Borrow Money On Promissory Note - Resolution Form - Corporate Resolutions?

US Legal Forms - one of the biggest collections of lawful templates in the United States - offers a variety of lawful document templates that you can obtain or print.

By utilizing the website, you can find thousands of forms for business and personal needs, organized by types, regions, or keywords.

You can quickly access the latest forms like the Maryland Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions in moments.

If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

If you are satisfied with the form, confirm your choice by clicking the Download now button. Then, select the pricing plan you prefer and provide your details to create an account.

- If you have a subscription, Log In and obtain the Maryland Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions from the US Legal Forms library.

- The Download button will appear on each template you view.

- You can find all previously acquired forms in the My documents section of your account.

- To start using US Legal Forms for the first time, here are some simple instructions to guide you.

- Ensure you have selected the correct form for your city/state.

- Click the Review button to examine the content of the form.

Form popularity

FAQ

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

A corporate resolution is the legal document that provides the rules and framework as to how the board can act under various circumstances. Corporate resolutions provide a paper trail of the decisions made by the board and the executive management team.

RESOLVED THAT the company do hereby obtain and avail financial assistance/Credit facility of an amount not exceeding (Loan or Credit/Overdraft amount) from (Name, Branch and Address of the bank) in order to meet the (requirements of the company), and such loan shall be obtained on such terms and conditions as specified

A corporate resolution that authorizes borrowing on a line of credit is often referred to a borrowing resolution. This resolution indicates that the members (LLC) or Board of Directors (Corporation) have held a meeting and conducted a vote allowing the company to borrow a specific loan amount.

A corporate resolution that authorizes borrowing on a line of credit is often referred to a borrowing resolution. This resolution indicates that the members (LLC) or Board of Directors (Corporation) have held a meeting and conducted a vote allowing the company to borrow a specific loan amount.

Loan Resolution means that certain Resolution, adopted by the Board of the City on March 8, 2021, authorizing a loan under a loan agreement between the Borrower and the Issuer to finance the Project.

A corporate resolution is a written document created by the board of directors of a company detailing a binding corporate action. A corporate resolution is the legal document that provides the rules and framework as to how the board can act under various circumstances.

A corporate resolution to open a business bank account is a document that clearly shows the bank who has the authority to start an account on behalf of your corporation. If this information isn't specifically covered in your Articles of Incorporation or bylaws, your bank may require a resolution.

What to Include in a Corporate Resolution FormThe date of the resolution.The state in which the corporation is formed and under whose laws it is acting.Signatures of officers designated to sign corporate resolutionsusually the board chairperson or the corporate secretary.Title the document with its purpose.More items...?

Name of the lender from whom they will borrow sums of money. Signature of authorized member/director that will execute and endorse all such documents required by said bank as well as agreement to perform all acts and sign all agreements and obligations required by said bank. The state where the business is formed.