Maryland Sample Letter for Letter Requesting Extension to File Business Tax Forms

Description

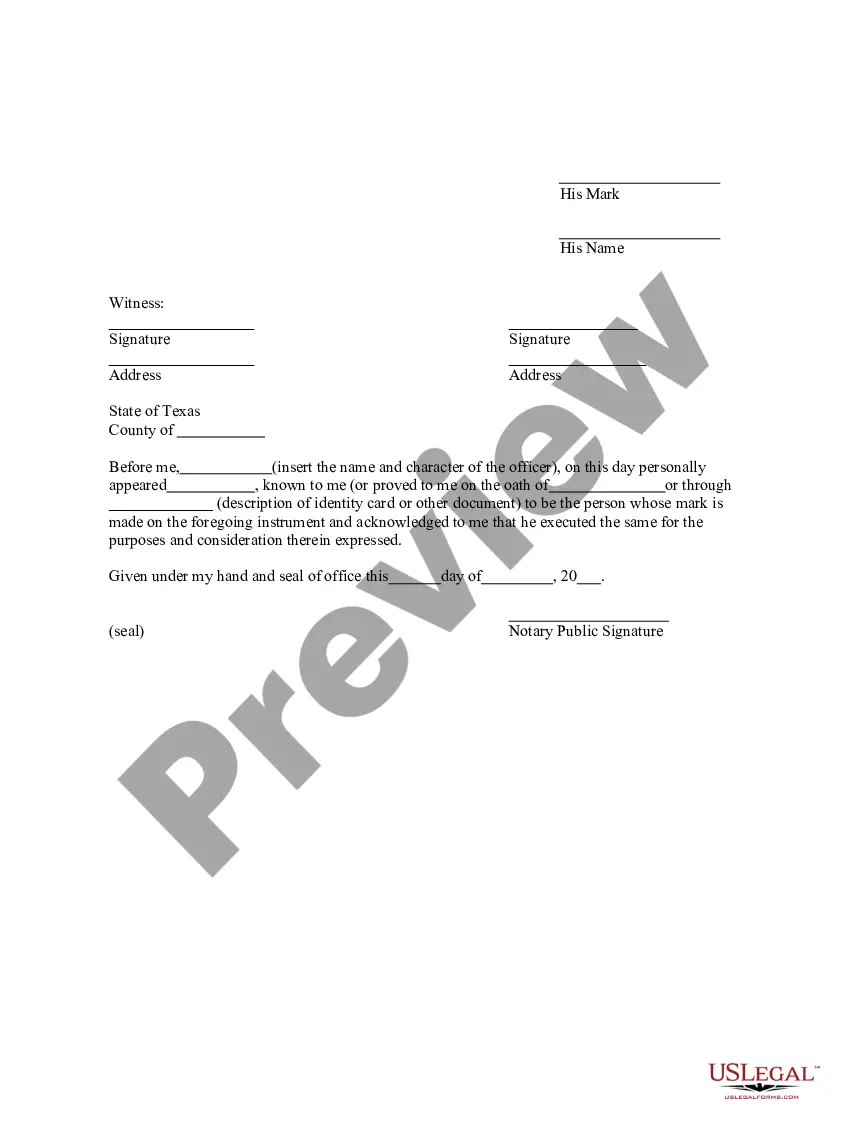

How to fill out Sample Letter For Letter Requesting Extension To File Business Tax Forms?

If you wish to finalize, obtain, or print legal document templates, utilize US Legal Forms, the largest assortment of legal documents available online.

Employ the site’s simple and user-friendly search function to locate the files you need.

Various templates for business and personal purposes are organized by categories and claims, or keywords and phrases.

Step 3. If you are not satisfied with the form, utilize the Search bar at the top of the screen to find alternative versions of the legal form template.

Step 4. Once you have located the form you desire, click the Purchase now button. Choose your preferred pricing plan and enter your information to register for an account.

- Utilize US Legal Forms to locate the Maryland Sample Letter for Letter Requesting Extension to File Business Tax Forms in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download option to access the Maryland Sample Letter for Letter Requesting Extension to File Business Tax Forms.

- You can also view forms you have previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Verify that you have selected the form for the correct city/state.

- Step 2. Use the Review option to inspect the form’s content. Be sure to check the outline.

Form popularity

FAQ

Maryland does grant an automatic extension for corporations, aligning with federal guidelines. This allows you an additional six months to file your business tax forms without submitting a separate request. Nevertheless, it's crucial to meet your tax obligations during this period. For a smooth experience, utilize the Maryland Sample Letter for Letter Requesting Extension to File Business Tax Forms from US Legal Forms to ensure your correspondence is appropriate.

Yes, Maryland honors the federal extension for corporations, simplifying your filing obligations. By accepting the federal extension, Maryland provides you with the flexibility to manage your tax deadlines more efficiently. Just ensure that you submit the necessary tax payments during this time. You can refer to the Maryland Sample Letter for Letter Requesting Extension to File Business Tax Forms for clear guidance on drafting your request.

Yes, the IRS extension can apply to corporations that need more time to file their business tax forms. Corporations can request an automatic six-month extension using Form 7004. This means you can delay submitting your tax forms, provided you file the request correctly. For assistance with this process, consider using the Maryland Sample Letter for Letter Requesting Extension to File Business Tax Forms available on US Legal Forms.

Yes, you can request a tax extension online through the IRS website. This method is often quicker and more efficient compared to mailing a paper form. You simply need to fill out the extension form and submit it electronically. To enhance your submission's clarity, you may want to refer to a Maryland Sample Letter for Letter Requesting Extension to File Business Tax Forms.

Asking for a tax extension involves completing and submitting the required extension form to the IRS or your state tax authority. Be sure to include any necessary identification or tax information as requested. After submission, wait for confirmation of your extension. A Maryland Sample Letter for Letter Requesting Extension to File Business Tax Forms can serve as an effective way to compose your request professionally.

To obtain a tax extension approval letter, you must file the appropriate extension form with the IRS and wait for confirmation. Usually, this approval is sent electronically if you file online. Retain a copy of your submitted request as it serves as proof of your request for an extension. Consider utilizing a Maryland Sample Letter for Letter Requesting Extension to File Business Tax Forms to make your application clear and concise.

Yes, you can request an extension on your business taxes. This extension provides you with additional time to prepare your tax forms without facing penalties for late submission. It's important to submit your extension request before the due date of your business tax forms. Using a Maryland Sample Letter for Letter Requesting Extension to File Business Tax Forms can help streamline your process.

To file a business tax extension for your LLC, you must complete IRS Form 7004. This form allows you to request additional time to file your business tax forms. It's advisable to submit it electronically through the IRS website for quicker processing. Additionally, having a Maryland Sample Letter for Letter Requesting Extension to File Business Tax Forms can help you formally communicate your extension request.

To request an extension for your taxes in Maryland, complete the Maryland state extension form, which can be found on the state's tax website. Submit this form before your tax due date to avoid penalties. Using a Maryland Sample Letter for Letter Requesting Extension to File Business Tax Forms can streamline your request.

To receive a tax extension letter, you need to submit the relevant extension form to the IRS or your state tax authority before the due date. After they process your request, they will send you a confirmation letter. A Maryland Sample Letter for Letter Requesting Extension to File Business Tax Forms can guide you through the process.