Maryland Notice of Default on Promissory Note Installment

Description

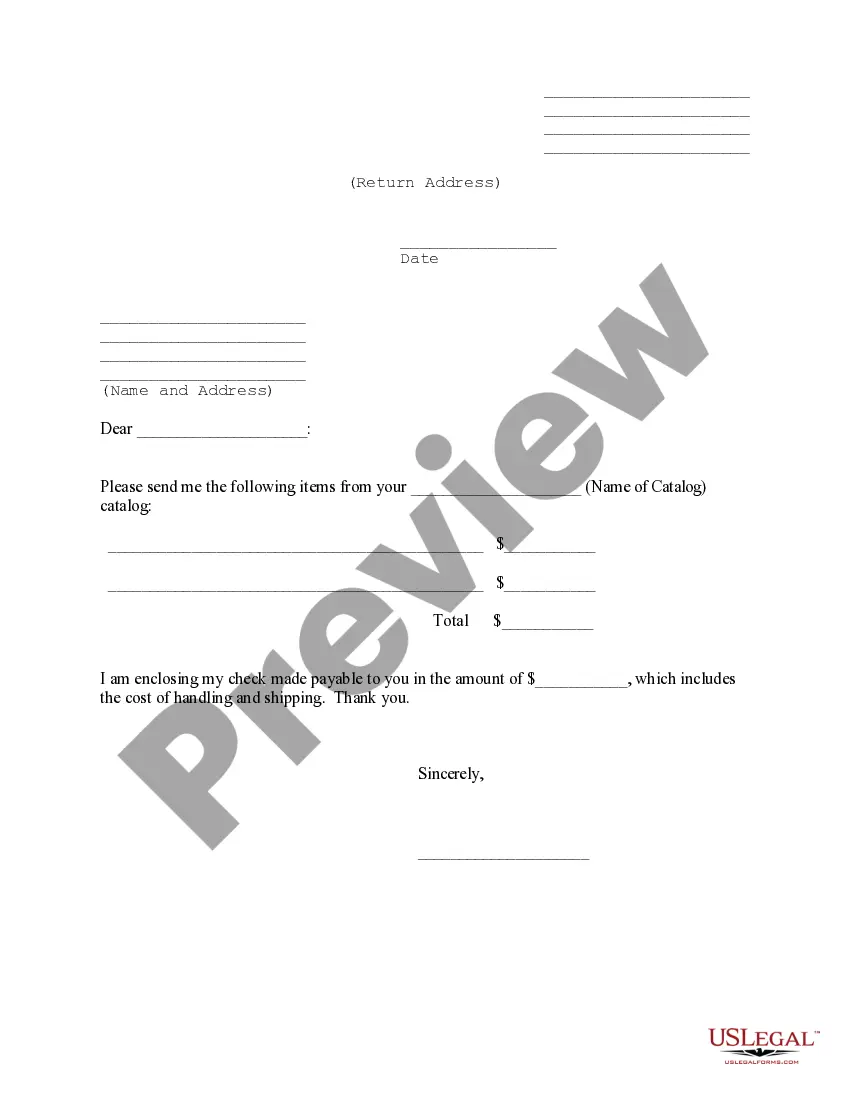

How to fill out Notice Of Default On Promissory Note Installment?

You can dedicate numerous hours online attempting to locate the legal document template that satisfies the state and federal requirements you need.

US Legal Forms offers thousands of legal forms that are reviewed by professionals.

You can download or print the Maryland Notice of Default on Promissory Note Installment from the service.

If available, use the Preview button to review the document template as well.

- If you already possess a US Legal Forms account, you may Log In and click the Download button.

- Then, you may complete, modify, print, or sign the Maryland Notice of Default on Promissory Note Installment.

- Every legal document template you purchase is yours forever.

- To obtain another copy of the acquired form, visit the My documents tab and click the corresponding button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/region of your choice.

- Read the form description to confirm you have chosen the right form.

Form popularity

FAQ

A notice of default on a promissory note is a formal communication to the borrower indicating that they have failed to meet their repayment obligations. This notice serves as a warning and outlines the steps that will follow if the borrower does not rectify the default. It is an important legal document that protects the lender's rights. To create a compliant Maryland Notice of Default on Promissory Note Installment, you can leverage tools available on the US Legal Forms platform.

When someone defaults on a promissory note, the first step is to review the terms of the agreement and the notice of default requirements. Communicating with the borrower often helps in understanding their situation and may lead to a resolution. If needed, you can prepare to take legal action to enforce the note. Utilizing the Maryland Notice of Default on Promissory Note Installment is an essential part of this process.

Writing a notice of default involves clearly stating the details of the promissory note, including the borrower’s name, account number, and the amount due. You should specify the nature of the default, such as missed payments, and include a request for immediate action. Using a template can simplify this process. The US Legal Forms platform offers resources to help you craft a Maryland Notice of Default on Promissory Note Installment that meets legal standards.

To legally enforce a promissory note, you generally need to validate its terms, including the amount due and payment schedules. You can initiate legal action if the borrower fails to comply. This usually involves filing a lawsuit in the relevant jurisdiction. In such cases, the Maryland Notice of Default on Promissory Note Installment can serve as an important document, notifying the borrower of their default.

To write a default notice, start by stating the name of the borrower and the details of the promissory note, including the amount owed and the payment terms. Clearly outline the default details, specifying how and when the borrower has defaulted. Include a statement that identifies this communication as a Maryland Notice of Default on Promissory Note Installment, and set a deadline for the borrower to respond or take corrective action. For an effective template, consider using US Legal Forms, which provides tailored documents to streamline this process.

If someone defaults on a promissory note, the first step is to review the terms outlined in the agreement to understand your rights. Next, consider reaching out to the borrower to discuss the situation and explore possible repayment options. If this does not resolve the issue, you may need to issue a Maryland Notice of Default on Promissory Note Installment, which serves as a formal alert of the default. Engaging a legal professional, or utilizing platforms like US Legal Forms, can simplify this process and ensure you follow the proper legal channels.

Receiving a notice of default indicates that you are behind on your payments. This document serves as a formal alert from the lender, outlining the amount you owe and the need to resolve the issue. Addressing the Maryland Notice of Default on Promissory Note Installment quickly is crucial to avoid further penalties or foreclosure.

If you default on a promissory note, the lender may initiate collection actions to recover the owed amount. This can lead to legal proceedings, and you may receive a Maryland Notice of Default on Promissory Note Installment as a formal warning. It's essential to consult with a legal professional to understand your rights and options.

The default rate on a promissory note varies but typically increases significantly from the original interest rate. When you default, lenders usually apply a higher rate to compensate for the additional risk. Understanding the Maryland Notice of Default on Promissory Note Installment can help you navigate these financial penalties more effectively.