Maryland Assignment of Accounts Receivable

Description

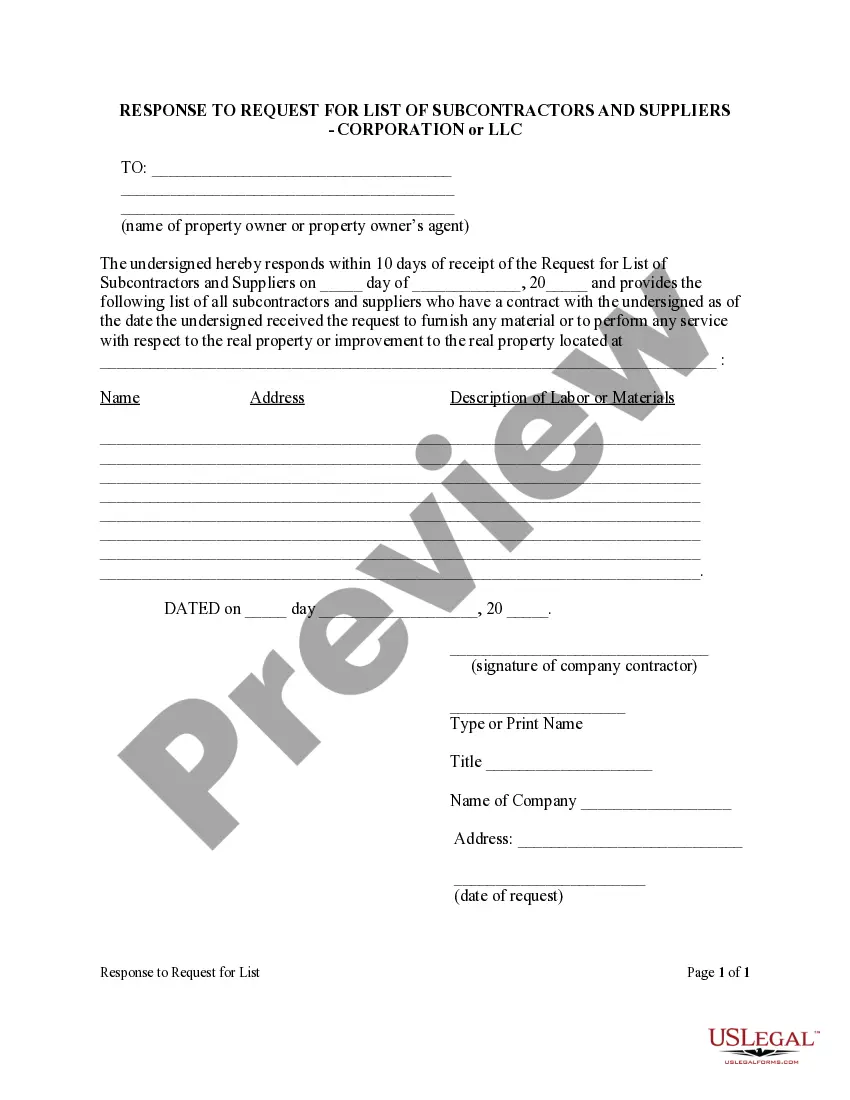

How to fill out Assignment Of Accounts Receivable?

If you wish to finalize, obtain, or generate legal document formats, utilize US Legal Forms, the premier compilation of legal forms, accessible online.

Employ the site's straightforward and user-friendly search to find the documents you need.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you find the form you need, click the Acquire now button. Choose the payment plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Use US Legal Forms to access the Maryland Assignment of Accounts Receivable with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Acquire button to access the Maryland Assignment of Accounts Receivable.

- You can also reach forms you have previously saved in the My documents section of your account.

- If this is your first time using US Legal Forms, follow these steps.

- Step 1. Make sure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the content of the form. Don't forget to read the summary.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative types of the legal form template.

Form popularity

FAQ

Filing accounts receivable involves documenting and recording the amounts owed by customers for products or services rendered. To streamline this process, consider using efficient accounting software or platforms that specialize in accounts receivable management. At uslegalforms, we provide resources and templates that make navigating the Maryland Assignment of Accounts Receivable easier and more efficient for your business.

A notice of assignment of receivables is a communication that informs debtors about the transfer of their outstanding invoices to a new collector. This notice ensures that all payment instructions are correctly followed moving forward. Clarity is crucial in this process to prevent payment delays and maintain accurate accounting.

Assigning accounts receivable typically involves drafting a formal agreement between the original creditor and the new party. It is essential to notify the debtors of this arrangement to ensure proper payment channels. Using platforms like USLegalForms can streamline the documentation process and provide necessary legal resources.

The notice of assignment of accounts is a document that notifies a debtor that their accounts receivable have been assigned to another party. This notice serves to formalize the transition and directs payment to the new creditor. It plays a critical role in maintaining transparency during the transfer process.

A notice of assignment is a formal communication to a debtor that informs them of the transfer of their payment obligations to another entity. This document provides clarity on where payments should be sent in the future. Receiving this notice is vital for ensuring that all parties remain informed about their financial responsibilities.

The assignment of receivables is an arrangement in which a business transfers its rights to collect outstanding invoices to another entity. This transfer can help the original creditor access funds quickly. Ultimately, this strategy is crucial for businesses seeking to improve their financial positioning.

In the Uniform Commercial Code (UCC), accounts receivable refers to the amounts owed to a business by its customers for goods or services delivered. This definition encompasses all forms of payment due, which companies can utilize as assets. By understanding the framework of accounts receivable under the UCC, you can better leverage Maryland Assignment of Accounts Receivable for potential funding solutions.

To perfect a lien on accounts receivable, you must file a UCC-1 financing statement with the appropriate state office. This filing establishes your legal claim to the receivables if the borrower defaults. When approaching Maryland Assignment of Accounts Receivable, perfecting liens is essential to protect your interests and ensure your financial security.

The adjusting journal entry for accounts receivable often involves recognizing accrued interest or updating estimates for bad debts. You may debit bad debt expense while crediting accounts receivable. If your business utilizes Maryland Assignment of Accounts Receivable, maintaining accurate adjustments ensures proper alignment between your records and financial health.