US Legal Forms - one of several largest libraries of authorized types in the States - delivers a wide array of authorized record layouts you are able to acquire or printing. Utilizing the site, you will get 1000s of types for enterprise and personal reasons, sorted by types, claims, or keywords.You can find the latest variations of types like the Maryland Motion to Discharge or Quash Writ of Garnishment within minutes.

If you currently have a membership, log in and acquire Maryland Motion to Discharge or Quash Writ of Garnishment in the US Legal Forms library. The Obtain key can look on every develop you see. You get access to all formerly delivered electronically types in the My Forms tab of the account.

In order to use US Legal Forms the very first time, allow me to share basic guidelines to obtain started off:

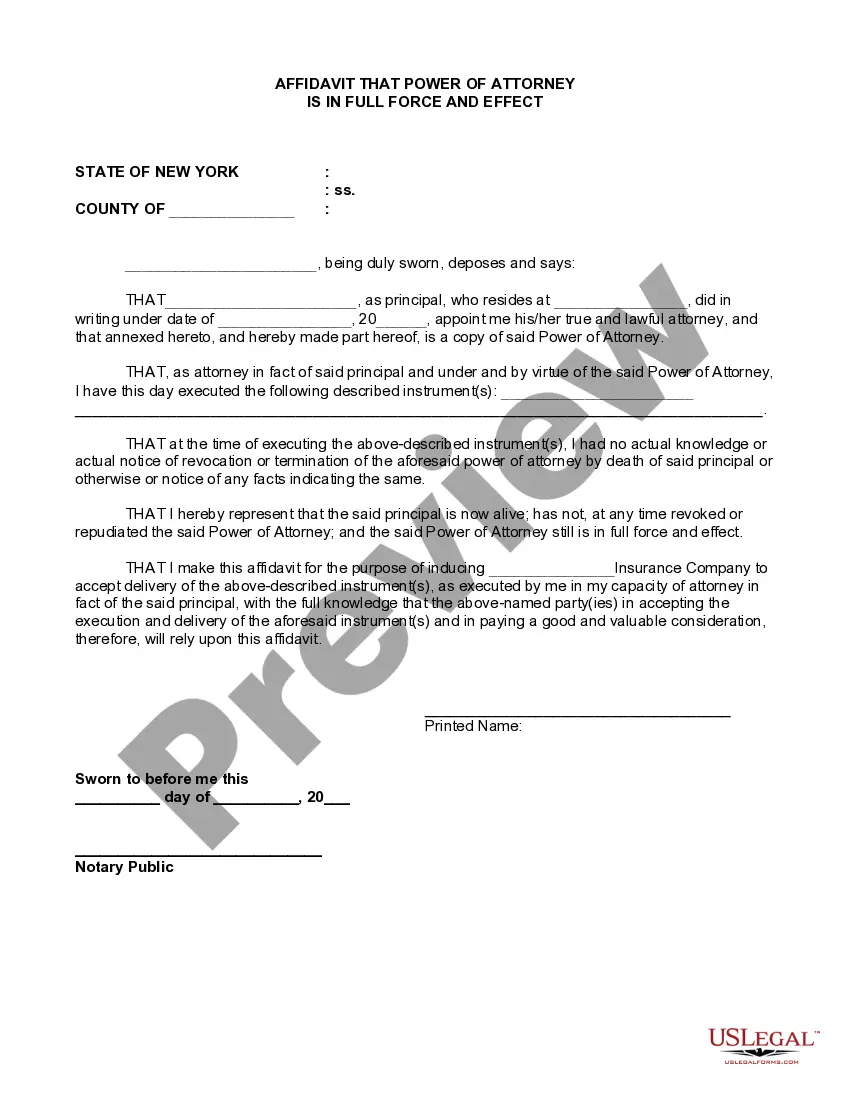

- Make sure you have selected the proper develop for the area/state. Click on the Review key to examine the form`s articles. Look at the develop explanation to ensure that you have selected the proper develop.

- In case the develop does not satisfy your demands, make use of the Look for area at the top of the display to discover the one that does.

- When you are content with the shape, validate your option by clicking the Acquire now key. Then, choose the prices plan you prefer and offer your qualifications to register to have an account.

- Method the transaction. Make use of your credit card or PayPal account to finish the transaction.

- Pick the file format and acquire the shape on the product.

- Make alterations. Fill up, modify and printing and indication the delivered electronically Maryland Motion to Discharge or Quash Writ of Garnishment.

Each and every design you included with your account lacks an expiry particular date and it is your own property forever. So, if you wish to acquire or printing an additional backup, just go to the My Forms segment and then click around the develop you will need.

Gain access to the Maryland Motion to Discharge or Quash Writ of Garnishment with US Legal Forms, the most extensive library of authorized record layouts. Use 1000s of skilled and express-certain layouts that satisfy your organization or personal needs and demands.