Maryland Demand for Payment of an Open Account by Creditor

Description

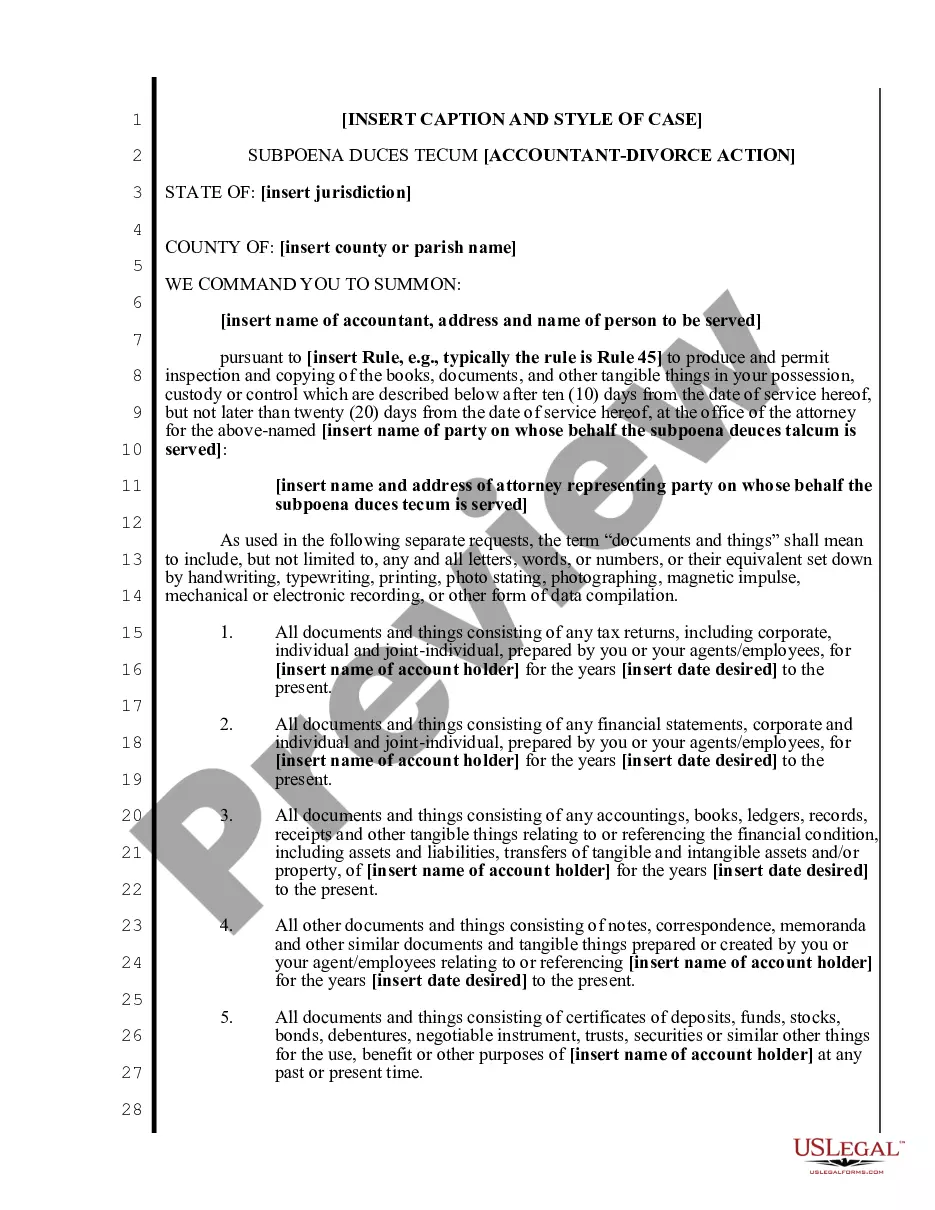

How to fill out Demand For Payment Of An Open Account By Creditor?

Are you presently within a situation that you will need files for either enterprise or individual uses nearly every day time? There are a lot of legal document themes available online, but discovering kinds you can rely isn`t straightforward. US Legal Forms gives a large number of develop themes, just like the Maryland Demand for Payment of an Open Account by Creditor, which are created to meet federal and state specifications.

In case you are previously informed about US Legal Forms web site and also have a merchant account, basically log in. Following that, it is possible to down load the Maryland Demand for Payment of an Open Account by Creditor format.

If you do not have an profile and need to start using US Legal Forms, abide by these steps:

- Find the develop you want and make sure it is for that correct metropolis/region.

- Make use of the Preview switch to analyze the form.

- See the information to ensure that you have chosen the proper develop.

- In case the develop isn`t what you`re seeking, utilize the Look for field to obtain the develop that meets your requirements and specifications.

- Whenever you discover the correct develop, simply click Buy now.

- Pick the costs program you want, fill out the specified info to generate your money, and pay for an order making use of your PayPal or bank card.

- Decide on a hassle-free file file format and down load your version.

Find all of the document themes you have bought in the My Forms menu. You can aquire a further version of Maryland Demand for Payment of an Open Account by Creditor any time, if necessary. Just select the needed develop to down load or printing the document format.

Use US Legal Forms, probably the most extensive collection of legal varieties, to conserve time as well as prevent mistakes. The support gives skillfully made legal document themes which you can use for an array of uses. Create a merchant account on US Legal Forms and start generating your lifestyle easier.

Form popularity

FAQ

If the garnishee fails to file a timely answer, the judgment creditor may proceed for a judgment by default against the garnishee (Md. Rule 3-509.) reply is not filed, the court may enter the judgment upon request of the judgment creditor, the judgment debtor, or the garnishee.

The Maryland Fair Debt Collection Act prohibits debt collectors and creditors from engaging in deceptive, threatening, or other abusive collection behavior. In Maryland, the federal Fair Debt Collection Practices Act (FDCPA) and state law regulate debt collectors.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

Under Maryland law debt collectors may not... Use or threaten force or violence. Threaten criminal prosecution, unless a violation of criminal law is involved. Disclose or threaten to disclose information affecting your reputation for credit worthiness if they know the information is false.

The creditor must file a lawsuit against you in court to enforce the debt within 3 years, or they will lose the legal right to enforce that debt against you in court. For credit cards, the 3-year period begins to run on the date the debt is ?incurred.? Md. Code Ann., Cts. & Jud.

The Fair Debt Collection Practices Act (FDCPA) is the main federal law that governs debt collection practices. The FDCPA prohibits debt collection companies from using abusive, unfair, or deceptive practices to collect debts from you.

Time Limits on Collection The statute of limitations gives creditors 3 years to file a lawsuit against you for the debt you owe. If the case is brought to court and the judge rules in favor of the creditor, they then have only 12 years to collect the settlement.

Protected (exempt) Property Up to $1,000 in household furnishings, goods, clothing, appliances, books, pets and other personal items. Money payable to you as the result of court judgments, insurance benefits, child support, and compensation because of sickness, accident, injury or death.