Maryland Employee Information Form

Description

How to fill out Employee Information Form?

US Legal Forms - one of the most prominent collections of legal templates in the United States - offers a vast selection of legal document formats that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords.

You can find the latest versions of documents like the Maryland Employee Information Form within moments.

Review the form details to ensure you have chosen the appropriate one.

If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you possess a subscription, Log In and download the Maryland Employee Information Form from the US Legal Forms library.

- The Download button will appear on every document you view.

- You can access all previously downloaded documents in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are some simple guidelines to help you get started.

- Make sure you have selected the correct form for your city/region.

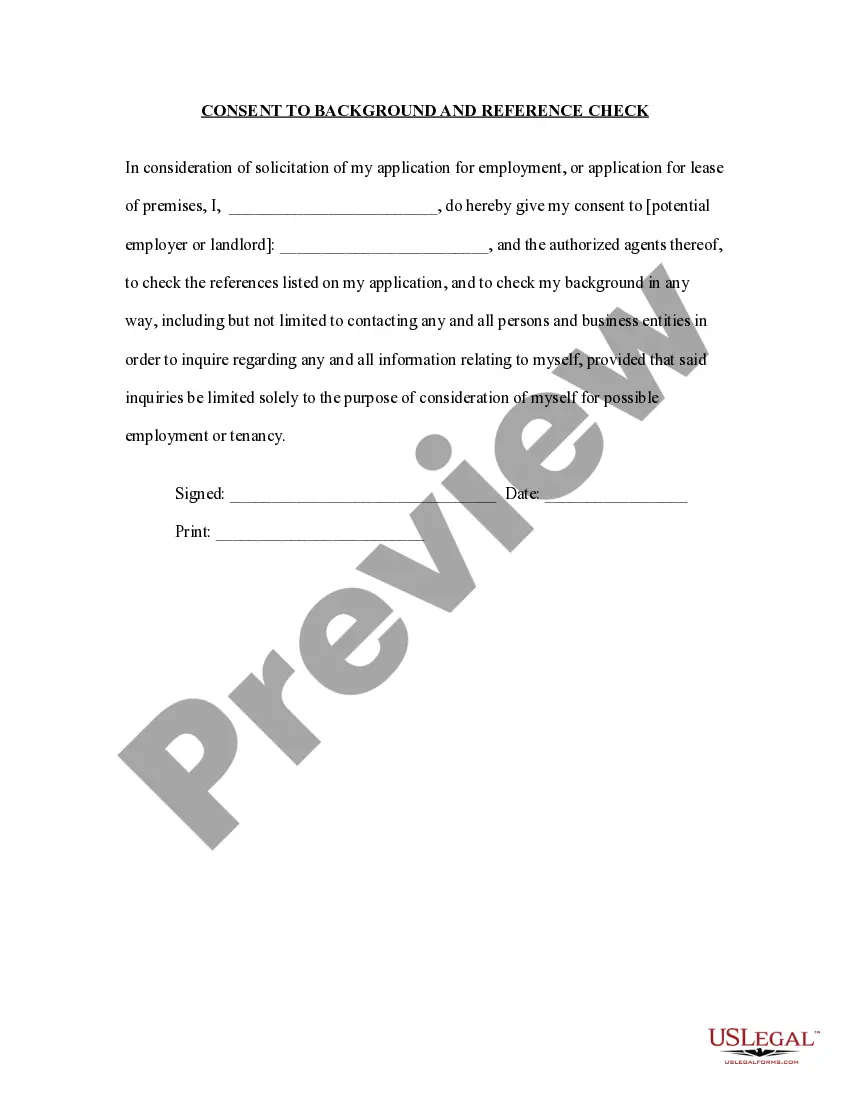

- Click on the Preview button to review the content of the form.

Form popularity

FAQ

Filling out an employee information form is a crucial step for new hires. Begin by accurately entering your personal details, including name, contact information, and social security number. Additionally, include any relevant employment history and emergency contact information. Utilizing resources like the US Legal Forms platform can simplify this process by providing templates and guidance to ensure you complete the Maryland Employee Information Form correctly.

Filling out an employee availability form requires you to specify the days and times you are available to work. Clearly list the hours you can commit and any preferences for shift types. By accurately completing this form, you help your employer plan schedules effectively, making it an essential part of the Maryland Employee Information Form process.

To fill out the MD W4 form, gather your financial information, including dependents and any additional earnings. Clearly state your allowances, considering your situation to avoid under or over withholding. This form, along with the Maryland Employee Information Form, simplifies the tax process by ensuring that your employer can withhold the correct amount of state taxes throughout the year.

Writing employee information involves collecting essential details about the employee's identity and role. Begin with the employee's full name, address, and contact information, followed by job title and department. Providing complete and accurate information is crucial since the Maryland Employee Information Form will be utilized for administrative purposes and payroll processing.

Filling out the Maryland MW507 form is straightforward. Start by entering your personal information such as your name, address, and social security number. Next, indicate your tax exemptions and the total number of allowances you claim. Remember, the Maryland Employee Information Form helps ensure proper tax withholding, so make sure your data is accurate.

To locate your Maryland employer number, you may contact your HR department if you are currently employed. Alternatively, you can reference your Maryland Employee Information Form, where this number may be listed. If you are a business owner, the Maryland Department of Labor provides resources to help you obtain your employer number. For convenience, using tools available on platforms like uslegalforms can streamline this process.

As a new employee, you will typically complete several key documents to facilitate your employment. The Maryland Employee Information Form should be filled out first, as it gathers critical personal details. Moreover, you will likely need to submit a federal W-4 and an I-9 form. Completing this paperwork promptly helps your employer onboard you effectively.

Employees in Maryland primarily use the Maryland Employee Information Form for tax purposes. This form allows employers to obtain your tax withholding information, which facilitates accurate payroll processing. Additionally, new hires might also fill out the federal W-4 form. Using these forms correctly ensures that your taxes are withheld appropriately from your paycheck.

In Maryland, new hires must submit several forms to comply with hiring regulations. The Maryland Employee Information Form tops the list, as it gathers necessary employee details. Besides this form, employers often require the federal W-4 and I-9 forms. Completing this paperwork promptly helps ensure a smooth transition into your new workplace.

When starting a new job, employees generally need to fill out a few important documents. The Maryland Employee Information Form is key as it collects essential personal and tax information. Additionally, new hires must complete a federal W-4 form and may also need to sign an I-9 form to verify their eligibility to work. Staying organized with these forms simplifies the onboarding process for everyone involved.