Maryland Community Property Disclaimer

Description

How to fill out Community Property Disclaimer?

Have you found yourself in a scenario where you require documents for either business or personal reasons almost every time.

There are numerous legal document templates accessible online, but locating ones you can trust isn't easy.

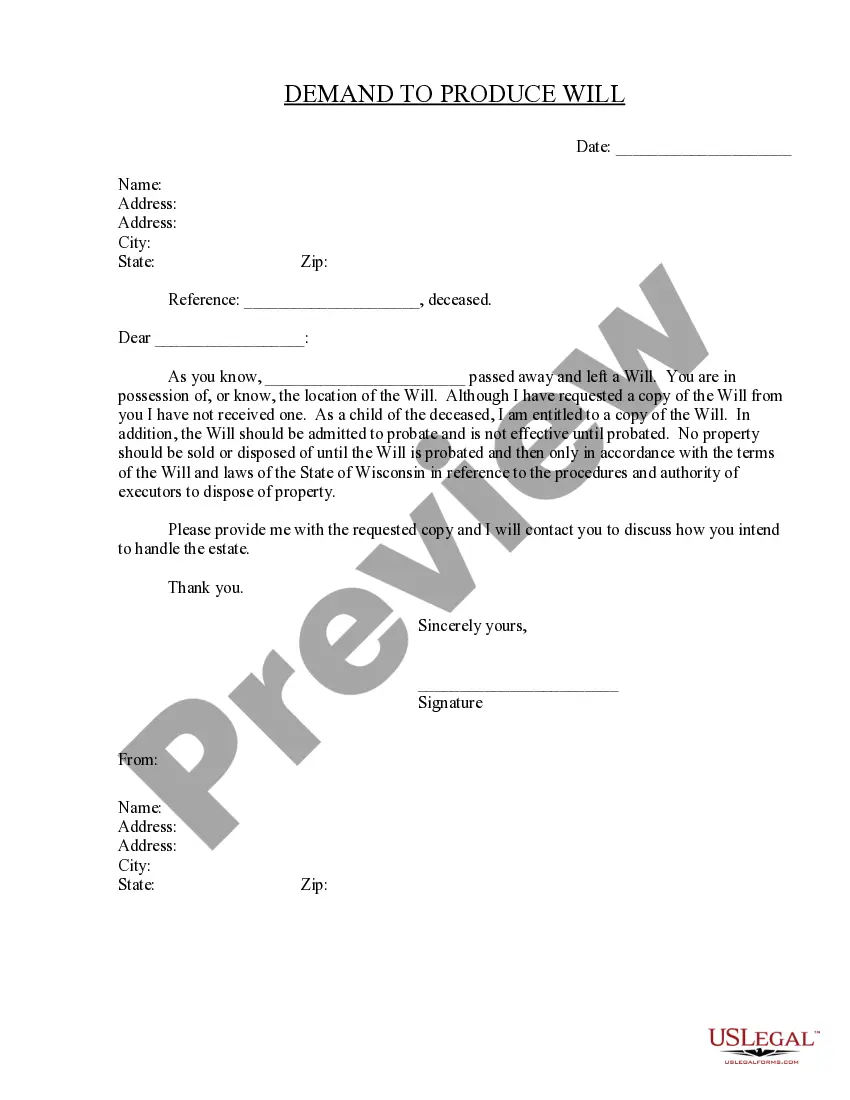

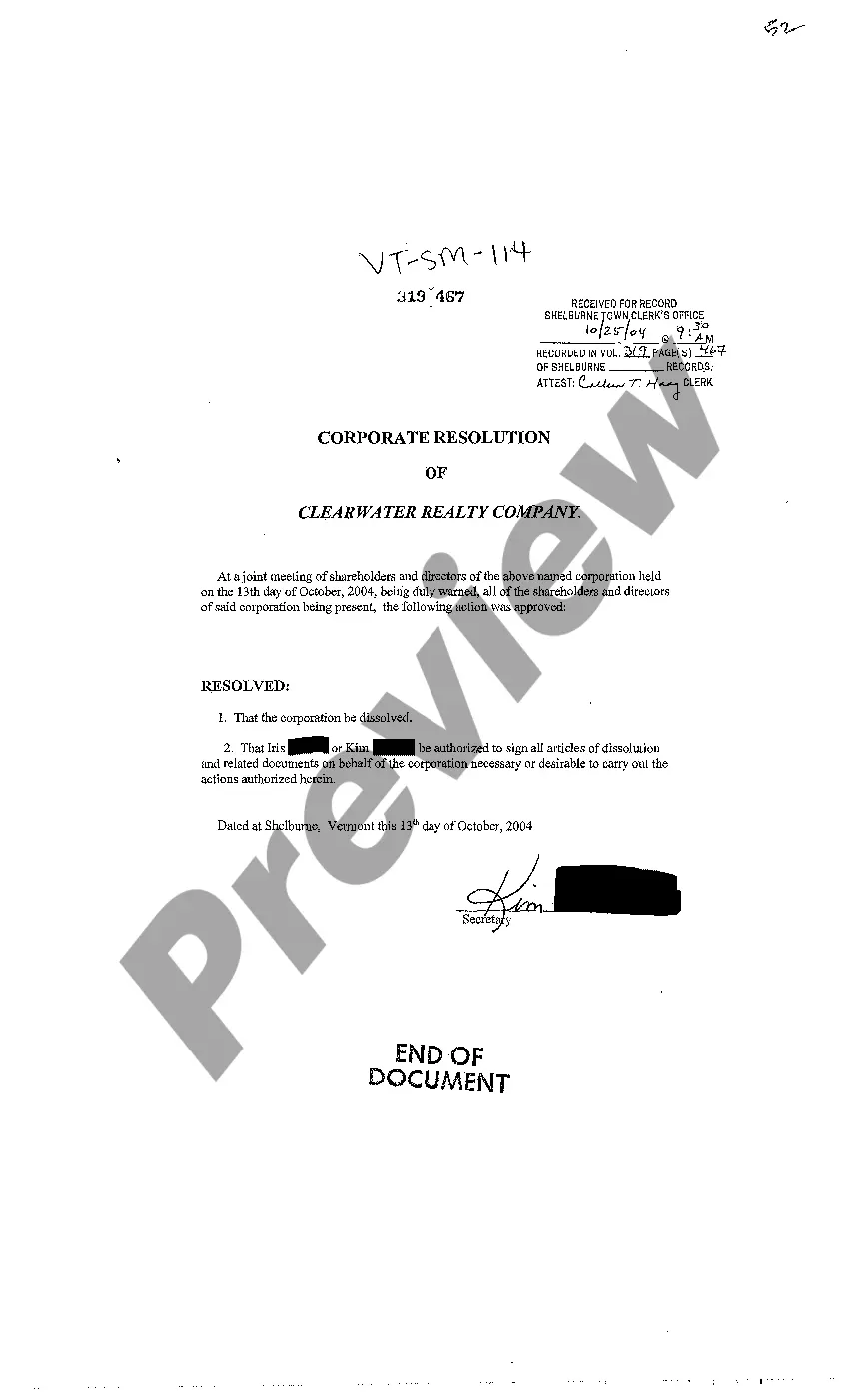

US Legal Forms provides thousands of form templates, including the Maryland Community Property Disclaimer, which can be customized to fulfill federal and state regulations.

If you acquire the right form, simply click Purchase now.

Select the pricing plan you wish, enter the required information to create your account, and pay for your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Maryland Community Property Disclaimer template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you require and ensure it is for the correct state/region.

- Use the Review button to examine the form.

- Check the details to confirm that you have selected the correct form.

- If the form isn't what you're looking for, use the Search field to find the form that fits your needs and preferences.

Form popularity

FAQ

The Maryland Uniform Disclaimer of Property Interests Act outlines the legal framework for disclaiming property in the state. This act enables individuals to refuse property that they might otherwise inherit or receive, which can be particularly useful when dealing with community property matters. Understanding the Maryland Community Property Disclaimer can help clarify the implications of accepting or declining property. If you need guidance, US Legal Forms offers resources to help you navigate this process smoothly.

The condition of the property disclosure form can be filled out by the seller of the property, often with assistance from real estate professionals. It is essential for sellers to provide accurate details about their property to ensure compliance and transparency. Misrepresentation can lead to legal consequences, so it is vital to be thorough. If you're unsure about the process, USLegalForms offers templates that guide you in completing this form correctly.

A residential property condition disclaimer statement is a document that a seller may use to limit their liability by stating the condition of the property. This statement informs potential buyers about any known issues and indicates the seller's intent to sell the property as-is. It plays a significant role in transactions, ensuring that all parties are aware of the property's status. Utilizing resources like USLegalForms can help you create a comprehensive disclaimer that meets legal standards.

Under Section 76-2120 of the Nebraska Revised Statutes, the seller of a residential property must complete the seller property condition disclosure statement. This requirement helps protect both parties by outlining the property's current state and any defects. Being transparent about property conditions can facilitate smoother transactions. Tools like USLegalForms can help you fulfill these legal requirements effortlessly.

The transfer disclosure statement is typically completed by the seller of the property. This form provides essential information about the property's condition and any known issues. It is crucial for buyers to receive this disclosure for an informed decision. To ensure compliance, consider using tools like USLegalForms, which simplifies the process of completing these legal documents.

A joint statement in court serves as a formal declaration of shared understanding between both parties regarding specific matters in a legal case. In Maryland divorce court, this often includes details of asset division. Implementing a Maryland Community Property Disclaimer can reinforce the clarity of these joint statements, protecting the interests of both spouses.

Sellers of residential property in Maryland are required to complete the Maryland Residential Property Disclosure Disclaimer Statement. This statement informs buyers about the property's condition and any known issues regarding it. Including a Maryland Community Property Disclaimer can enhance buyer confidence and ensure a smoother transaction.

In Maryland, separate bank accounts can be considered marital property if funds are commingled or if there is evidence that they were used for marital purposes. If you maintained complete separation without any contributions from marital ties, those accounts may remain separate. A Maryland Community Property Disclaimer could help clarify these distinctions during any disputes.

Maryland Rule 9 207 governs the requirement of joint statements of marital property during divorce proceedings. This rule aims to promote transparency between parties, helping courts achieve a fair division of assets. Incorporating a Maryland Community Property Disclaimer can further clarify each spouse's contributions and rights.

The disclaimer statute in Maryland allows an individual to refuse or disclaim any interest in property they inherit or receive. When this statute applies, it can effectively exclude that property from the person's estate. A Maryland Community Property Disclaimer can complement this statute by addressing specific marital property concerns.