Maryland Revocable Trust for Estate Planning

Description

How to fill out Revocable Trust For Estate Planning?

Selecting the correct legitimate document template can be quite challenging. It goes without saying, there are numerous templates accessible online, but how do you locate the proper type you require? Utilize the US Legal Forms website.

The service offers thousands of templates, such as the Maryland Revocable Trust for Estate Planning, that you can utilize for business and personal purposes. All of the documents are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and then click the Acquire button to obtain the Maryland Revocable Trust for Estate Planning. Use your account to browse the legitimate documents you may have previously purchased. Navigate to the My documents tab of your account to get another copy of the document you need.

Select the document format and download the legitimate document template for your device. Complete, edit, print, and sign the acquired Maryland Revocable Trust for Estate Planning. US Legal Forms is the largest repository of legitimate documents where you can find various document templates. Utilize the service to obtain properly crafted documents that comply with state regulations.

- First, make sure you have selected the appropriate type for your city/region.

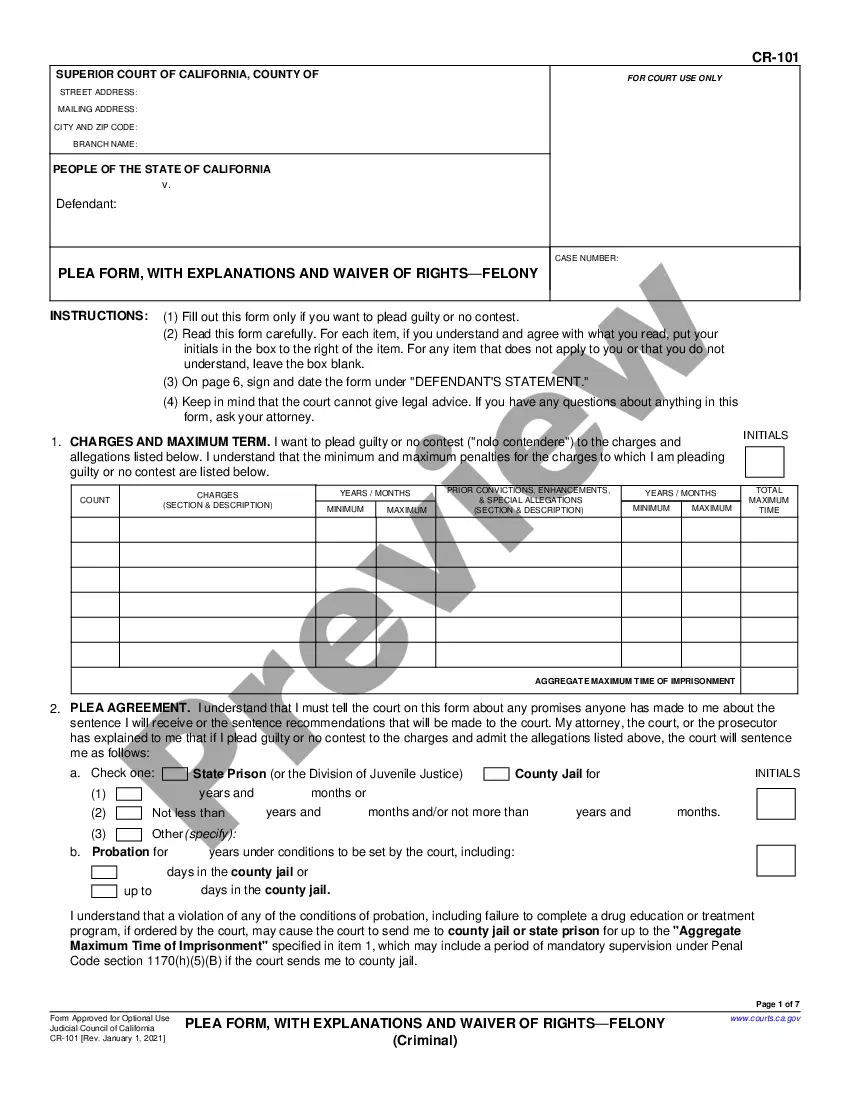

- You can examine the form using the Review button and read the form description to ensure it is indeed suitable for you.

- If the form does not meet your requirements, utilize the Search field to find the correct type.

- Once you are confident the form is appropriate, select the Purchase now button to obtain the form.

- Choose the pricing plan you wish and input the necessary information.

- Create your account and complete the payment with your PayPal account or credit card.

Form popularity

FAQ

A common mistake parents make when setting up a trust fund, even outside Maryland, is failing to clearly define the terms and conditions for the beneficiaries. Without clear guidelines, beneficiaries may struggle with the trust's purpose, leading to confusion or conflict. Additionally, parents may underestimate the ongoing responsibilities required to manage the trust. Learning from these errors can lead to more effective estate planning strategies.

One negative aspect of a Maryland Revocable Trust for Estate Planning is the complexity involved in its setup and maintenance. While these trusts avoid probate, they require regular updating and management to reflect changes in your assets or family situation. Moreover, trusts typically do not protect your assets from creditors, adding a layer of financial risk. Understanding these drawbacks can help you make an informed decision about incorporating a trust.

While a Maryland Revocable Trust for Estate Planning provides many benefits, it is important to be aware of potential pitfalls. One common issue is failing to fund the trust properly; without this step, your assets may still require probate. Additionally, ongoing management of the trust can be daunting for some individuals. Proper planning and regular reviews can help navigate these challenges effectively.

To set up a Maryland Revocable Trust for Estate Planning, start by defining your goals and identifying your assets. Next, you will draft the trust document, which outlines how your assets will be managed during your lifetime and distributed after your death. It’s crucial to sign the document in front of a notary and transfer your assets into the trust. For those seeking guidance, our platform, USLegalForms, offers detailed templates and professional assistance.

In Maryland, a Maryland Revocable Trust for Estate Planning does not require notarization to be valid. However, having your trust document notarized can add an extra layer of security and may help in proving its authenticity in case of any disputes. It's wise to consult with a legal professional to ensure that all requirements for establishing and maintaining your trust are met. Using a platform like US Legal Forms can simplify this process by offering templates and guidance tailored to Maryland laws.

Yes, a Maryland Revocable Trust for Estate Planning typically avoids probate, allowing your assets to transfer directly to your beneficiaries. This can save time and reduce the associated costs with probate. Creating a trust can streamline the process, ensuring your loved ones receive their inheritance without unnecessary delays.

The choice between a will and a trust in Maryland largely depends on your specific needs. A Maryland Revocable Trust for Estate Planning allows you to avoid probate, which can be time-consuming and costly. On the other hand, a will is simpler to create but may require probate, so consider your goals and seek guidance to make the best choice.

A significant mistake parents make when setting up a trust fund is failing to update it regularly. As family structures, financial situations, and laws change, your Maryland Revocable Trust for Estate Planning should reflect these updates. Make it a habit to review your trust periodically to ensure it aligns with your current wishes and circumstances.

Yes, you can write your own Maryland Revocable Trust for Estate Planning if you have a good understanding of the requirements. However, drafting a trust involves legal nuances that can be complex. Therefore, seeking help from a legal professional can ensure your trust is valid and effectively meets your needs.