Maryland Revocable Trust for House is a legal arrangement established by a Maryland resident to hold assets, specifically a house or real estate property, during their lifetime and after their death. This type of trust is designed to offer flexible control over the assets and provide efficient estate planning solutions for homeowners in Maryland. A Revocable Trust for House in Maryland allows the trustee to maintain control over the property while alive and also ensures a smooth transition of ownership upon the granter's death, avoiding the need for probate. It provides the granter with the ability to modify or terminate the trust as per their wish. There are several types of Maryland Revocable Trusts for House based on specific purposes or conditions: 1. Living Revocable Trust: This is the most common type of revocable trust, where the granter transfers ownership of their house or property into the trust while being the primary beneficiary during their lifetime. They have the power to manage, sell, or mortgage the property as per their requirements and can revoke the trust at any time. 2. Joint Revocable Trust: A joint revocable trust is created by a married couple to hold joint property such as a shared house. This trust allows both spouses to have control over the trust assets, and upon the death of one spouse, the surviving spouse becomes the sole trustee with full control. 3. Testamentary Revocable Trust: This type of trust is established through a will and becomes effective upon the granter's death. It allows them to direct how their house or property should be managed, distributed, or sold after their demise. 4. Irrevocable Life Insurance Trust: Although not specific to houses, this type of trust is worth mentioning as it can be used in Maryland for estate planning purposes. It involves the creation of an irrevocable trust that owns a life insurance policy, providing funds to pay estate taxes or potentially fund the purchase of a house after the granter's death. In summary, Maryland Revocable Trust for House offers flexibility, asset protection, and efficient estate planning solutions for homeowners. Whether it is a living revocable trust, joint revocable trust, testamentary revocable trust, or an irrevocable life insurance trust, Maryland residents have various trust options to safeguard their house or property, ensure a seamless transfer of ownership, and minimize probate complications.

Maryland Revocable Trust for House

Description

How to fill out Maryland Revocable Trust For House?

If you want to complete, obtain, or print sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's user-friendly and convenient search to find the documents you require.

Various templates for business and personal use are categorized by types and states, or keywords.

Every legal document template you purchase is yours permanently. You have access to every form you have downloaded in your account. Click on the My documents section and select a form to print or download again.

Stay competitive, and obtain and print the Maryland Revocable Trust for House with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Step 1. Ensure you have selected the template for the correct city/state.

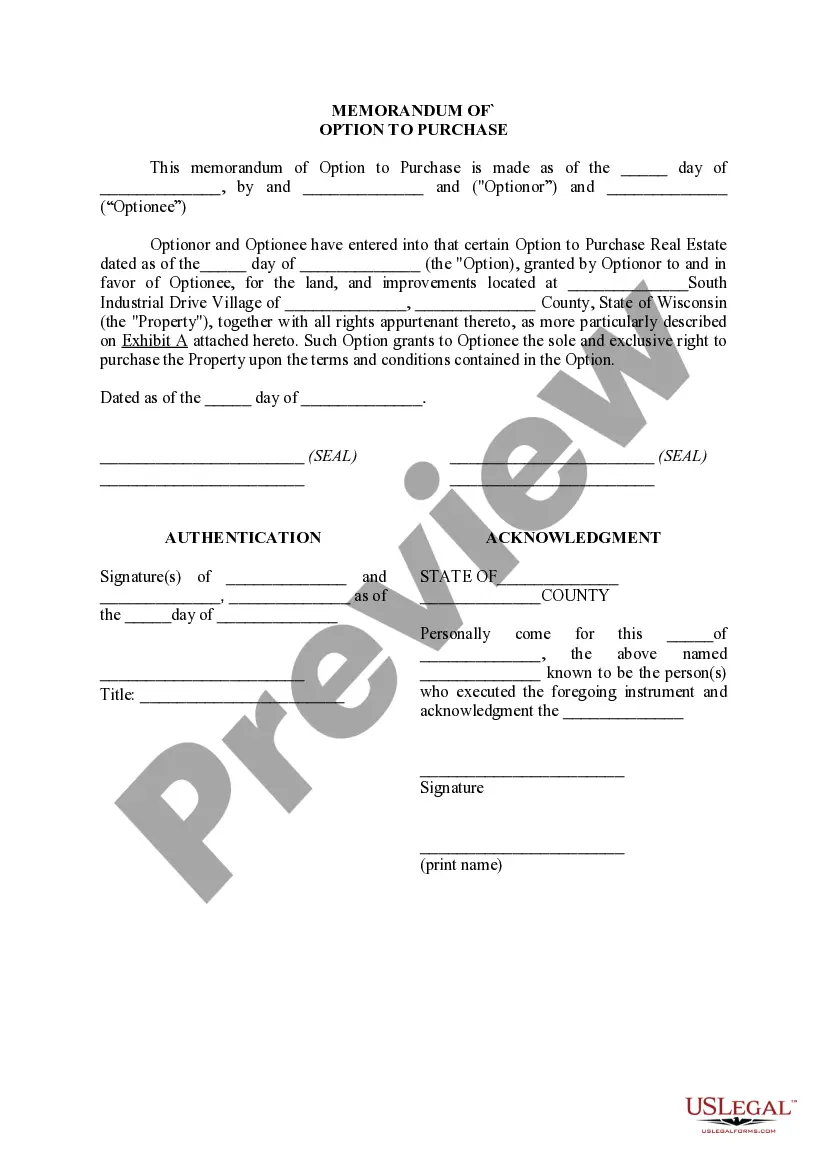

- Step 2. Use the Review feature to inspect the document's content. Remember to read the description.

- Step 3. If you are not satisfied with the document, use the Search field at the top of the screen to find other versions of the legal template.

- Step 4. Once you have found the form you need, click the Buy Now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the purchase.

- Step 6. Select the format of your legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the Maryland Revocable Trust for House.

Form popularity

FAQ

Placing your home in a Maryland Revocable Trust for House ensures a smooth transfer of property to your heirs without the hassles of probate. This proactive step helps you retain control over your estate while providing peace of mind knowing your wishes will be honored. Furthermore, it allows for privacy, keeping your financial affairs out of the public eye.

In addition to the costs of setting up a Maryland Revocable Trust for House, another disadvantage is the potential for mismanagement if not properly maintained. If you don’t update your trust with new assets, you may inadvertently leave them outside the trust, making them subject to probate. Additionally, the assets could still be subject to creditors' claims.

Placing your home in a Maryland Revocable Trust for House allows you to avoid probate upon your death, streamlining the transfer of assets to your heirs. This setup also provides flexibility, as you can modify or revoke the trust at any time while you are still alive. Trusts can offer benefits like enhanced privacy and effective asset management.

While a Maryland Revocable Trust for House offers many benefits, there are some disadvantages to consider. For example, setting up a trust may involve legal fees and paperwork that can be cumbersome. Additionally, if you do not manage the trust properly, it can lead to complications in the future, which is why using a reliable resource like uslegalforms is highly recommended.

The Maryland Revocable Trust for House is often considered the best option for homeowners looking to manage their property effectively. This type of trust allows you to retain control over the property while providing flexibility and ease of transfer upon your passing. It is essential to consult with an estate planning expert to determine if this trust aligns with your unique situation.

Transferring your property to a Maryland Revocable Trust for House involves executing a new deed that names the trust as the property owner. You also need to record this deed with the local land records office to make the transfer official. Seeking assistance from professionals or using platforms like uslegalforms can make this process smoother.

To place your house in a Maryland Revocable Trust for House, start by drafting the trust document, which outlines the terms of the trust and names the beneficiaries. Next, you will need to execute a deed that transfers ownership from you to the trust. It is advisable to work with an attorney or utilize a trusted online platform, like uslegalforms, to ensure the process is completed accurately.

One common mistake parents make when establishing a Maryland Revocable Trust for House is not clearly defining their wishes and instructions. Without precise terms, family disputes may arise, potentially undermining the trust’s purpose. It is crucial to communicate openly with family members to avoid misunderstandings down the road.

Yes, Medicaid can potentially take your house even if you have a Maryland Revocable Trust for House. Since the trust is revocable, you still have control over the assets within it, which means Medicaid considers it available for claims. To protect your home from Medicaid recovery, it’s crucial to seek professional guidance and explore options that align with your estate planning goals.

While a Maryland Revocable Trust for House offers significant advantages, it does have some downsides. One potential drawback is that assets in a revocable trust are still considered part of your estate for tax purposes. Therefore, they may be subject to estate taxes upon your death. Additionally, you may incur costs for setting up and maintaining the trust, which can add up over time.

Interesting Questions

More info

We are FDIC insurance providers. If you have any queries about deposit and savings account services provided by the FDIC, call for more information.