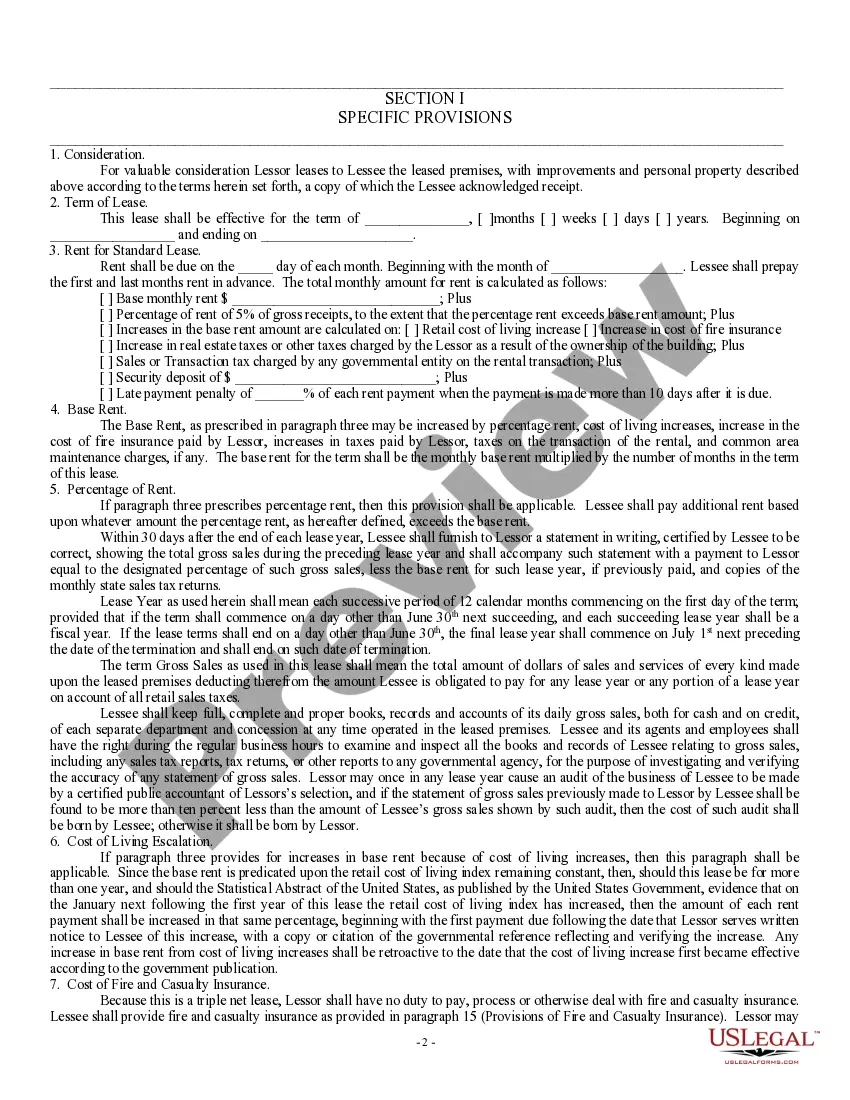

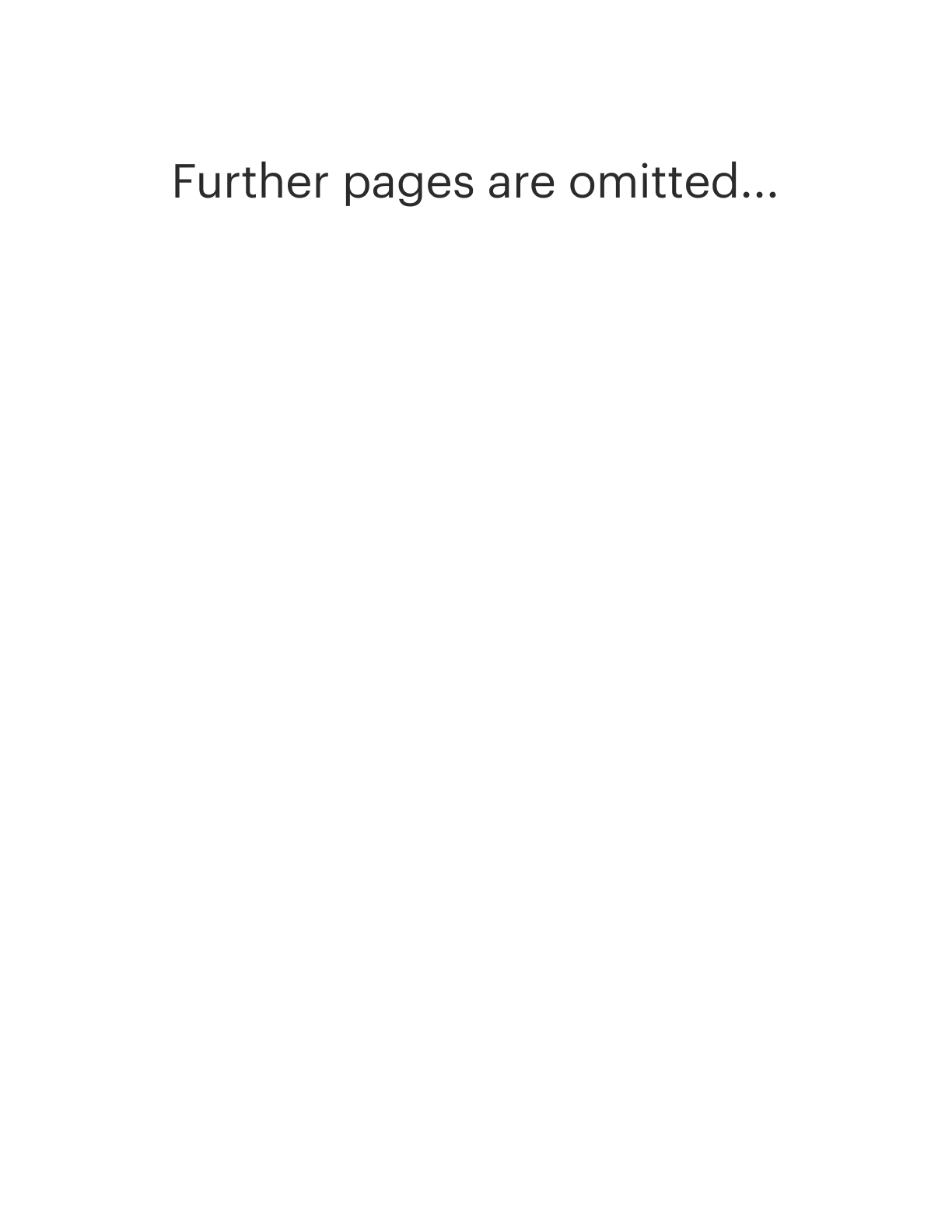

Maryland Triple Net Lease for Commercial Real Estate

Description

How to fill out Triple Net Lease For Commercial Real Estate?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a range of legal document formats that you can download or print. By using the website, you can access a multitude of forms for business and personal use, categorized by types, states, or keywords.

You can find the latest versions of forms such as the Maryland Triple Net Lease for Commercial Real Estate in just a few moments.

If you already have a subscription, Log In and download the Maryland Triple Net Lease for Commercial Real Estate from the US Legal Forms library. The Download button will appear on every document you view. You can access all previously acquired forms from the My documents tab in your account.

Process the payment. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Make modifications. Complete, edit, print, and sign the downloaded Maryland Triple Net Lease for Commercial Real Estate. Every template you added to your account has no expiration date and is yours indefinitely. So, if you wish to download or print another copy, simply navigate to the My documents area and click on the document you need. Access the Maryland Triple Net Lease for Commercial Real Estate with US Legal Forms, the most extensive library of legal document formats. Utilize a vast array of professional and state-specific templates that meet your business or personal requirements.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your city/region. Click the Review button to examine the form's content.

- Check the form details to confirm that you have selected the right document.

- If the form does not suit your needs, utilize the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, pick the payment plan you prefer and provide your details to sign up for an account.

Form popularity

FAQ

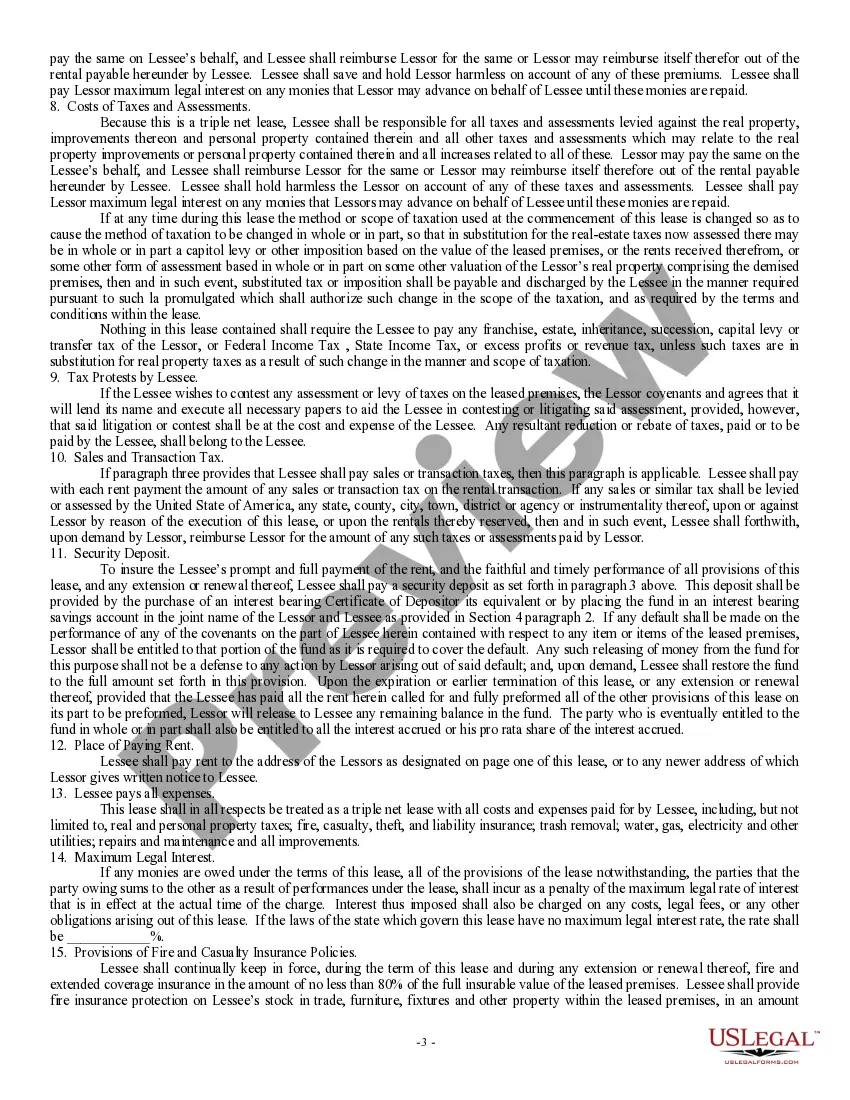

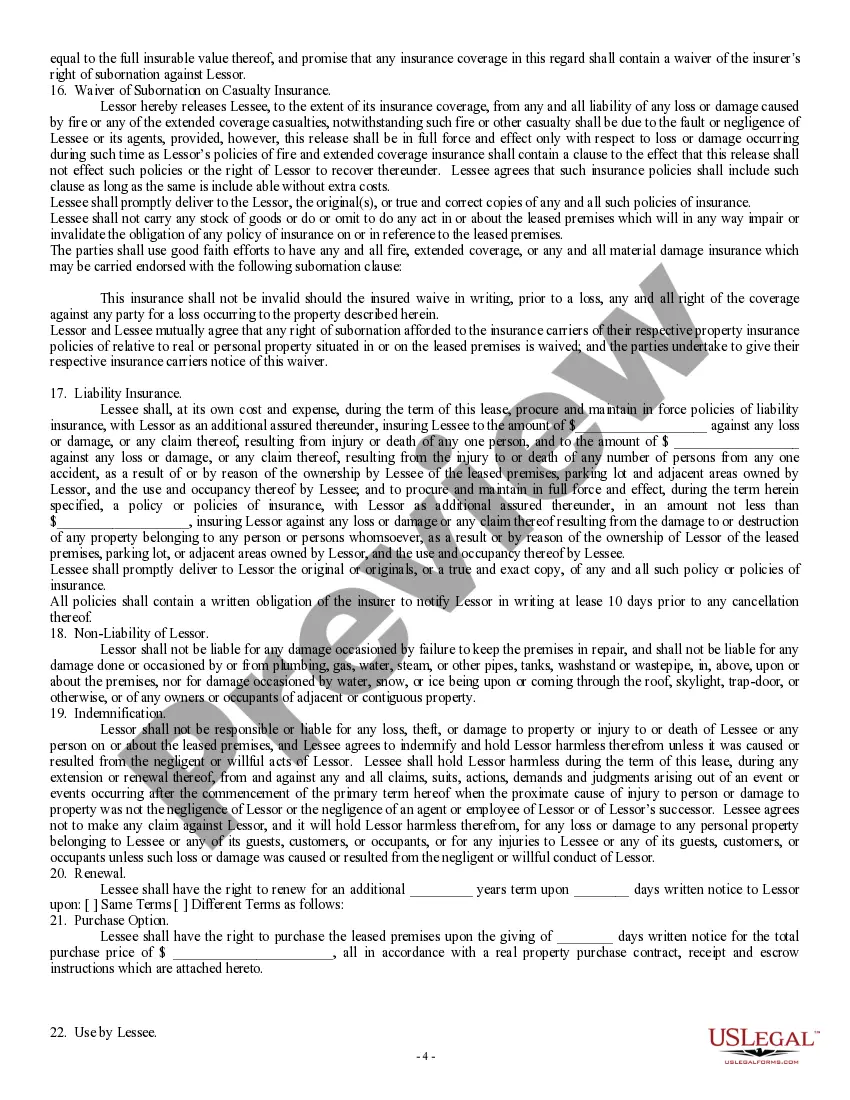

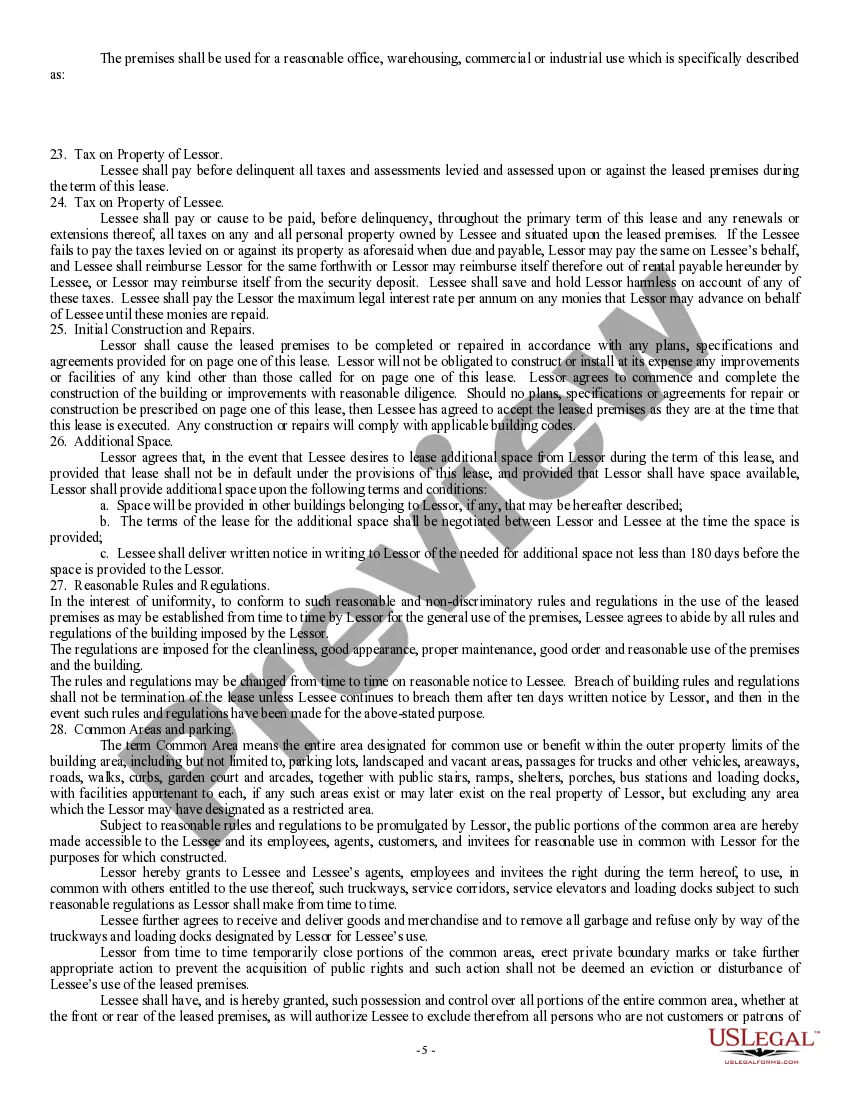

Structuring a triple net lease involves clearly defining the responsibilities of both the landlord and the tenant. Typically, the lease outlines that the tenant will cover property taxes, insurance, and all maintenance costs in addition to the base rent. It is crucial to have explicit terms regarding each party's obligations to avoid disputes. If you are exploring options, consider using US Legal Forms as a practical solution to create structured agreements for a Maryland Triple Net Lease for Commercial Real Estate.

A common example of a NNN lease includes a retail store leasing space in a shopping center. In this scenario, the tenant is responsible for paying not only the rent but also the property taxes, insurance, and maintenance costs associated with the space. This type of lease provides landlords with a steady income stream while transferring operational responsibilities to the tenant. Understanding concepts like this is essential when considering a Maryland Triple Net Lease for Commercial Real Estate.

While a Maryland Triple Net Lease for Commercial Real Estate can offer reduced base rent, it also has drawbacks. Tenants bear the financial responsibility for operating expenses, which can fluctuate. Additionally, if a property has unexpected maintenance issues, the costs fall solely on the tenant. It is wise to thoroughly assess the lease terms, as this helps you make an informed decision.

In a Maryland Triple Net Lease for Commercial Real Estate, operating expenses typically include property taxes, insurance, and maintenance costs. These expenses are the responsibility of the tenant and can vary significantly based on the property type and location. By understanding these expenses, tenants can better budget for their monthly costs. This transparency can create a smoother landlord-tenant relationship.

Getting approved for a Maryland Triple Net Lease for Commercial Real Estate requires demonstrating financial reliability and a comprehensive understanding of lease responsibilities. You should prepare to show your business’s financial documents and possibly a lease guarantee. Using a platform like UsLegalForms can help you navigate these requirements and ensure you meet all necessary criteria.

While a Maryland Triple Net Lease for Commercial Real Estate offers benefits such as lower base rent, it does come with drawbacks. Tenants bear the responsibilities of property taxes, insurance, and maintenance costs, which can add financial pressure. It’s essential to carefully consider these obligations to avoid unexpected expenses.

Qualifying for a Maryland Triple Net Lease for Commercial Real Estate involves showcasing your business's financial strength and operational history. Landlords often look for established businesses with a proven track record. A solid business plan and adequate insurance coverage also play crucial roles in satisfying landlord requirements.

To get approved for a Maryland Triple Net Lease for Commercial Real Estate, you typically need to demonstrate sound financial stability and responsible business practices. Landlords assess your credit history, income, and business reputation. Providing thorough documentation, such as tax returns and financial statements, can significantly enhance your chances of approval.

To get started in a triple net lease, first, research properties that fit your business needs and budget. Next, consult with a real estate professional who understands the Maryland Triple Net Lease for Commercial Real Estate. They can help you navigate the process, negotiate terms, and ensure you understand all aspects of the lease before making a commitment.

$24.00 sf yr means that the rent for the commercial space is $24 per square foot per year. This figure usually includes the base rent along with estimated triple net expenses, which cover property taxes, insurance, and maintenance. Understanding this calculation is vital when entering into a Maryland Triple Net Lease for Commercial Real Estate, as it directly affects your overall lease agreement costs.