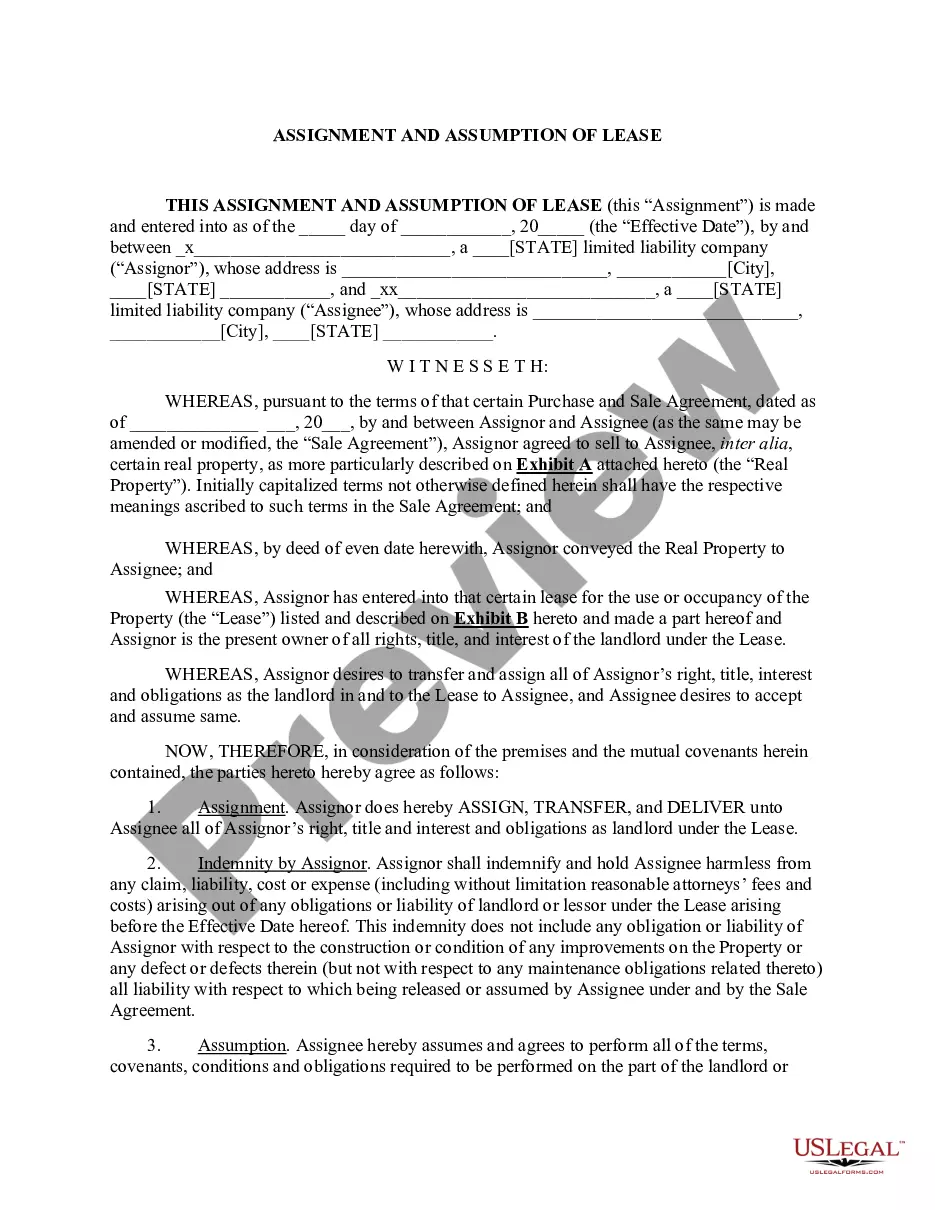

An assignment by a beneficiary of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Maryland Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary

Description

How to fill out Assignment By Beneficiary Of An Interest In The Trust Formed For The Benefit Of Beneficiary?

Locating the appropriate legal document template can be challenging. It’s important to note that there are numerous web templates accessible online, but how do you discover the legal form you desire? Utilize the US Legal Forms website.

The service offers a vast array of web templates, such as the Maryland Assignment by Beneficiary of an Interest in the Trust Created for the Benefit of the Beneficiary, which you can utilize for both professional and personal purposes. Each of the forms is reviewed by specialists and complies with state and federal regulations.

If you are already registered, Log In to your account and click on the Acquire button to obtain the Maryland Assignment by Beneficiary of an Interest in the Trust Created for the Benefit of the Beneficiary. Use your account to browse through the legal forms you have previously obtained. Visit the My documents section of your account to obtain another copy of the document you require.

Finally, fill out, modify, print, and sign the acquired Maryland Assignment by Beneficiary of an Interest in the Trust Created for the Benefit of the Beneficiary. US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Take advantage of this service to acquire professionally-crafted documents that meet state requirements.

- If you are a new user of US Legal Forms, follow these simple steps.

- First, ensure you have selected the correct form for your city/state. You can view the form using the Preview button and read the form description to confirm it is suitable for you.

- If the form does not fulfill your requirements, use the Search field to find the correct form.

- Once you are certain that the form is accurate, click on the Buy now button to obtain the form.

- Select the payment plan you wish to use and enter the required information. Create your account and complete the purchase using your PayPal account or credit card.

- Choose the document format and download the legal document template to your device.

Form popularity

FAQ

The interest of a beneficiary under a trust encompasses their claim to the assets held within the trust. This includes both income generated and the principal amount, which is subject to the terms set forth in the trust agreement. The Maryland Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary provides a formal mechanism for beneficiaries to manage or transfer their interests efficiently. Grasping the nature of your interest is vital for effective trust management.

A beneficiary's interest in a trust consists of their entitlement to receive distributions from the trust according to the terms established by the trust document. This can involve either immediate benefits or future distributions contingent on specific events. Utilizing the Maryland Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary can aid in transferring these interests to another party when needed. Thus, understanding this concept can help you manage your or your beneficiary's expectations effectively.

A qualified beneficiary under the Maryland Trust Act includes individuals who are current beneficiaries and those who would become beneficiaries if the trust were to terminate. This designation ensures that they have certain rights to information and notification about trust activities. By acknowledging who qualifies, you can better comprehend how the Maryland Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary applies to your situation. Such knowledge empowers you to make informed decisions regarding your interests.

The beneficiaries' interests in a trust refer to their rights to receive benefits from the trust property. These interests can include income generated by the trust or a share of the trust principal upon distribution. Under the Maryland Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, beneficiaries can formally assign their interests to others if they choose. Understanding these rights is crucial to ensuring that you navigate your interests effectively.

The assignment of beneficial interest involves a beneficiary transferring their rights to receive benefits from a trust to another party. This can be achieved through a legal process, such as the Maryland Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary. Understanding this concept is crucial for beneficiaries looking to manage their interests strategically.

The right to assign interest allows a beneficiary to transfer their entitlement in the trust to another individual or entity. This right is typically documented in the trust agreement or relevant Maryland laws. Clarifying this right can empower beneficiaries to make informed decisions regarding their interests.

Yes, a beneficiary can transfer their interest in the trust, often through a formal process known as the Maryland Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary. It is important to adhere to the requirements of the trust document and any applicable state laws. Consulting with a professional can help facilitate this transfer.

Yes, a beneficiary generally has the right to review the trust document in Maryland. This access helps ensure transparency and allows the beneficiary to understand their rights and interests. Engaging with an attorney can provide additional clarity on how to formally request this information.

To assign your inheritance effectively, you may consider executing a Maryland Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary. This legal document outlines the transfer of your interest to another party. It is advisable to consult a legal expert to navigate the assignment process smoothly.

In Maryland, a beneficiary typically has the right to receive distributions from the trust as specified. Additionally, they may have the option to inspect certain trust documents. Understanding your rights as a beneficiary can significantly enhance your experience and engagement with the trust.