Maryland Shipping and Order Form for Software Purchase

Description

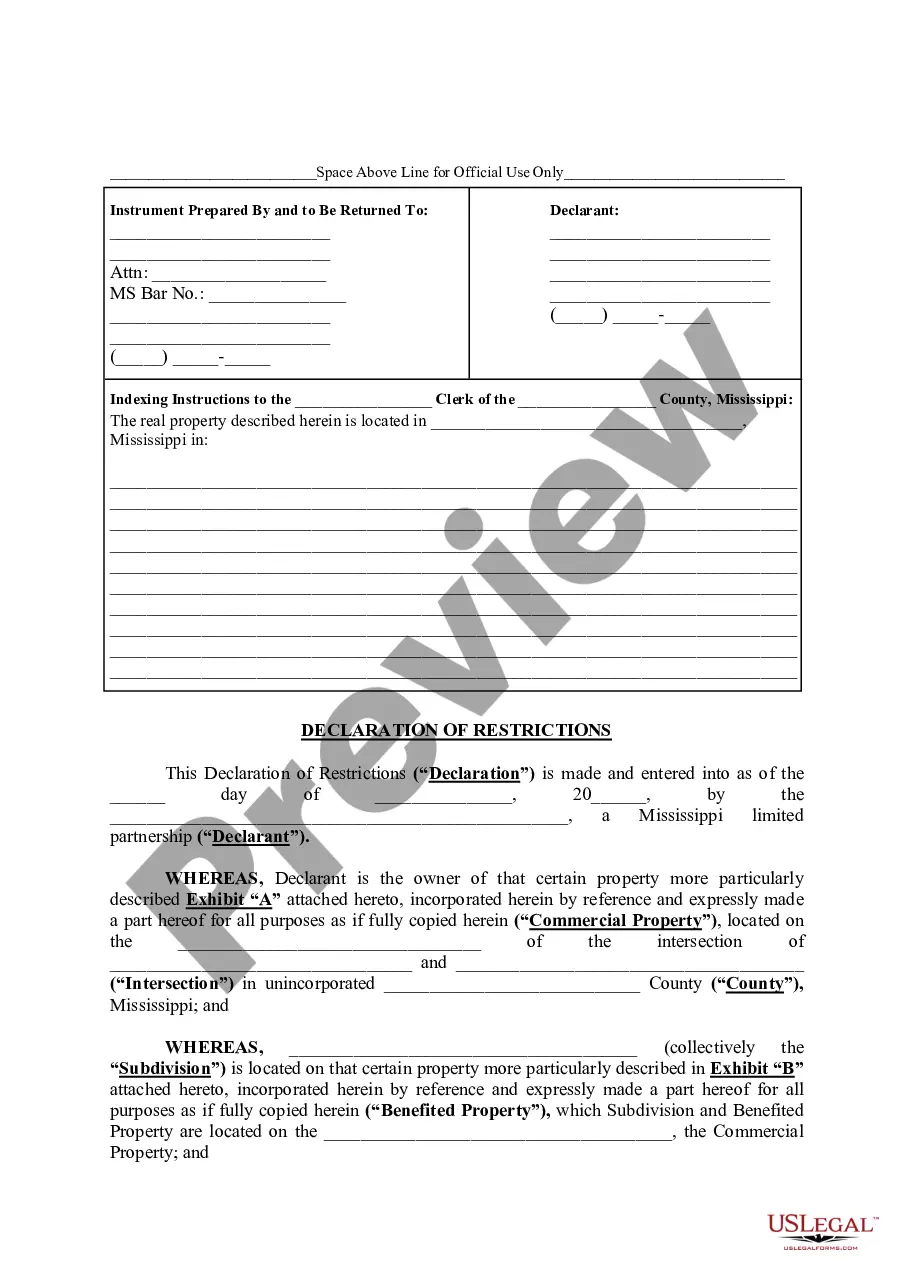

How to fill out Shipping And Order Form For Software Purchase?

It is feasible to spend several hours online searching for the legal document template that meets the state and federal criteria you require.

US Legal Forms offers a multitude of legal forms that can be reviewed by professionals.

You can easily download or print the Maryland Shipping and Order Form for Software Purchase from our platform.

If available, utilize the Review option to browse through the document template as well. To find another version of the form, use the Search field to locate the template that fits your needs and preferences.

- If you possess a US Legal Forms account, you can sign in and select the Download option.

- After that, you can complete, modify, print, or sign the Maryland Shipping and Order Form for Software Purchase.

- Each legal document template you acquire is yours indefinitely.

- To obtain another copy of the purchased form, visit the My documents tab and click on the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/region of your choice.

- Check the form description to confirm that you have selected the right form.

Form popularity

FAQ

To contact the comptroller of Maryland, you should visit their official website where you will find a list of contact options. This includes phone numbers and email addresses for different departments. Additionally, if you are managing software purchases, consider how the Maryland Shipping and Order Form can simplify your transactions when dealing with state agencies.

The hottest topic in the State & Local Tax community has been the emergence of tax laws surrounding the taxability of Software as a Service or more commonly known as SaaS. In March 2021, Maryland's Office of the Comptroller issued guidance on digital products and streaming tax, declaring that SaaS is taxable.

This includes food, clothing, jewelry, vehicles, furniture, and art. However, there are exceptions, including: Agricultural Products Items sold/bought are not taxed if they are bought by a farmer and are being used for an agricultural purpose. Read the Law: Md.

A 6% tax rate applies to most goods and services....These services include, but are not limited to:Manufacturing or producing personal property;Transportation of electricity or natural gas;Commercial cleaning and janitorial services;Certain telecommunications services;Credit reporting;Security services; and.More items...

Although there is no specifically required form for a resale certificate, it must include the buyer's name, address, Maryland sales and use tax registration number, and a signed statement indicating that the purchase of tangible property or taxable service is intended for resale or will be incorporated into a product

As noted above, as of March 14, 2021, Maryland's sales and use tax applies to the sale of a digital product, regardless of whether the digital product is sold to the customer with rights of permanent use or less than permanent use (i.e., a rental) as well as sold as a subscription to access or stream the product.

Yes. Every time you purchase taxable tangible goods, whether in person, over the phone, or on the Internet, the purchase is subject to Maryland's 6 percent sales and use tax if you use the merchandise in Maryland.

Digital products and Software as a Service (SaaS) are subject to Maryland sales and use tax as of March 14, 2021.

Maryland sales tax may apply to charges for shipping, handling, delivery, freight, and postage. Generally, delivery charges included in the price of a taxable sale are taxable as well. Separately stated shipping charges are not taxable. Handling charges cannot be separately stated and are taxed on taxable sales.

A contract to receive electronically delivered digital products, entered on December 1, 2020, is not subject to sales and use tax.