Maryland Amend Articles - Resolution Form - Corporate Resolutions

Description

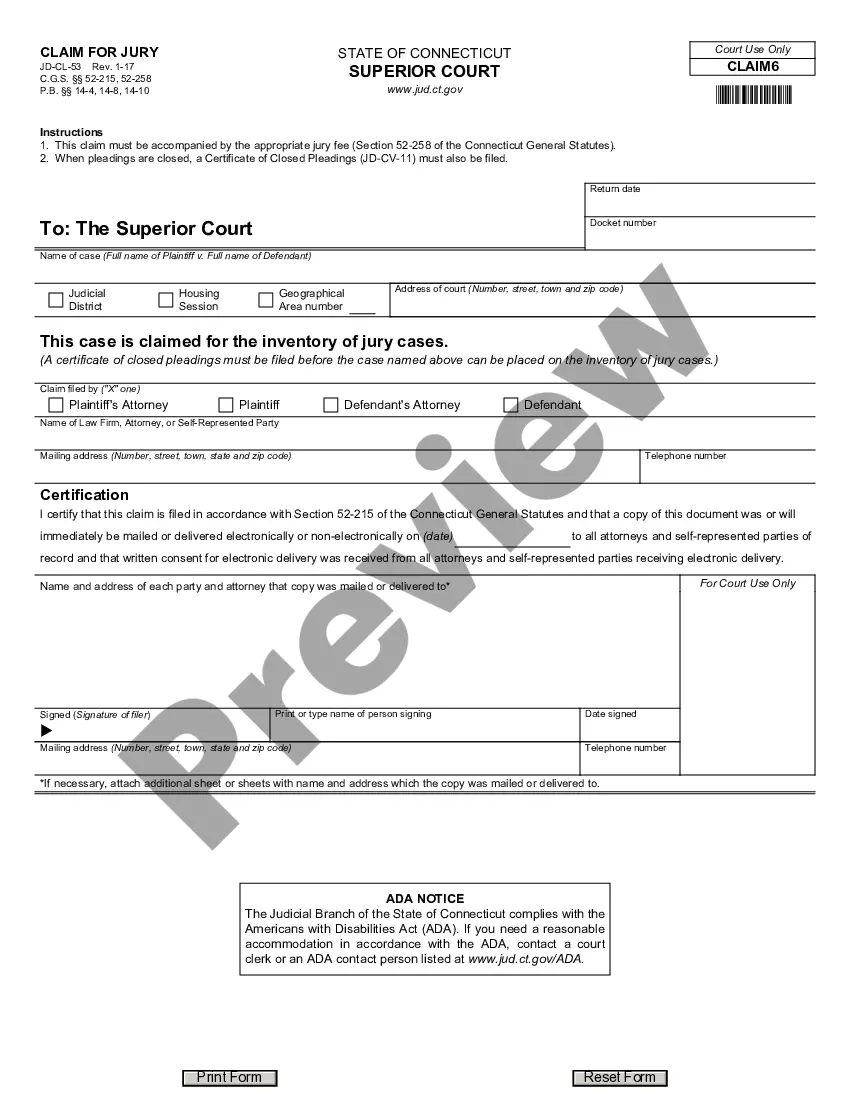

How to fill out Amend Articles - Resolution Form - Corporate Resolutions?

US Legal Forms - one of the largest compilations of legal documents in the United States - offers a range of legal form templates that you can download or print.

Through the website, you can access thousands of forms for business and personal purposes, categorized by type, state, or keywords.

You can obtain the latest versions of forms such as the Maryland Amend Articles - Resolution Form - Corporate Resolutions within moments.

Read the form summary to confirm that you have selected the appropriate form.

If the form does not meet your requirements, use the Search field at the top of the page to find the one that does.

- If you already possess a subscription, sign in to download the Maryland Amend Articles - Resolution Form - Corporate Resolutions from your US Legal Forms library.

- The Download feature will appear on every form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- To utilize US Legal Forms for the first time, here are easy steps to get started.

- Ensure you have chosen the correct form for your specific city/state.

- Click on the Preview button to review the content of the form.

Form popularity

FAQ

To write a company resolution, begin by clearly stating the purpose of the resolution, indicating what the company intends to decide. Follow with a resolved clause that details the decision and any necessary action steps. Be sure to include the date and the names of those approving the resolution. For an easy and effective solution, refer to the Maryland Amend Articles - Resolution Form - Corporate Resolutions to create an accurate document that meets your needs.

Writing a resolution report involves summarizing the discussions and decisions made during a meeting. Start with the date and attendees of the meeting, followed by a record of the specific resolutions passed. Clearly present any voting results and key points raised during discussions. Make your report clearer and more effective by using the Maryland Amend Articles - Resolution Form - Corporate Resolutions to maintain consistency.

To write a corporate resolution example, start by identifying the action the corporation is taking. Clearly state the intention, then follow with the resolved clause that outlines the agreement or decision made. Remember to include relevant details like the date and those who participated in the decision-making process. Using the Maryland Amend Articles - Resolution Form - Corporate Resolutions can help streamline this process and ensure all necessary elements are included.

The format of a resolution typically includes a title, a statement of purpose, a resolved clause, and a date. You begin with a clear title indicating the subject of the resolution, followed by a brief statement that outlines the issue or decision. Next, the resolved clause specifies the actions approved by the board or shareholders. Consider using the Maryland Amend Articles - Resolution Form - Corporate Resolutions for a professional template that simplifies this process.

A corporate resolution is a formal document that records decisions made by a corporation’s board or its shareholders. For example, if a company decides to open a new bank account, a resolution authorizing this action would be drafted. This document serves as a legal record and demonstrates compliance with laws regarding corporate governance. Utilize the Maryland Amend Articles - Resolution Form - Corporate Resolutions for creating such essential documents.

Maryland Form 1 must be filed by all businesses that own personal property as of January 1st, which includes corporations, limited liability companies, and partnerships. Even if a business operates at a loss, filing is still a requirement. Properly completing and submitting this form ensures compliance with state tax laws. As you organize your company’s affairs, consider the Maryland Amend Articles - Resolution Form - Corporate Resolutions to assist with any necessary adjustments.

Generally, any Maryland resident with a gross income exceeding the state's thresholds must file a Maryland tax return. This requirement also includes non-residents earning income from Maryland sources. Accurate and timely filing helps taxpayers avoid potential penalties and interest. If your business structure changes, remember to update information using the Maryland Amend Articles - Resolution Form - Corporate Resolutions.

Maryland Form 1 is the state's personal property tax return. This form captures details about the personal property owned by a business as of January 1st each year. Filing this form is vital for all businesses operating in Maryland to properly assess personal property taxes. To keep your filings and resolutions orderly and compliant, the Maryland Amend Articles - Resolution Form - Corporate Resolutions may be beneficial.

A Maryland estate tax return must be filed for any estate with a value exceeding the state's exemption limit upon the person's passing. This requirement applies regardless of whether the deceased lived in Maryland. It is crucial to file the return within nine months of the date of death to avoid penalties. If you're looking to manage corporate ownership changes associated with an estate, consider using the Maryland Amend Articles - Resolution Form - Corporate Resolutions.

SDAT stands for the State Department of Assessments and Taxation. This agency is responsible for managing real property assessments, business charters, and the registration of corporate entities in Maryland. By ensuring accurate filings, businesses can avoid legal issues and maintain good standing. Utilizing the Maryland Amend Articles - Resolution Form - Corporate Resolutions can assist in keeping your corporate records up to date with SDAT.