Maryland Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate

Description

How to fill out Lease Of Retail Store With Additional Rent Based On Percentage Of Gross Receipts - Real Estate?

In the event that you need to acquire, download, or create authentic document templates, utilize US Legal Forms, the most extensive assortment of valid forms that can be accessible online.

Leverage the website's straightforward and user-friendly search function to locate the documents you require. Many templates for business and personal purposes are categorized by types and titles, or keywords.

Utilize US Legal Forms to locate the Maryland Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate in just a few clicks.

Every valid document format you purchase is yours indefinitely. You will have access to every form you downloaded within your account. Click on the My documents section and select a form to print or download again.

Compete and download, and print the Maryland Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate with US Legal Forms. There are countless professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Obtain button to acquire the Maryland Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate.

- You can also access forms you previously downloaded within the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the directions below.

- Step 1. Ensure you have selected the form for the correct city/state.

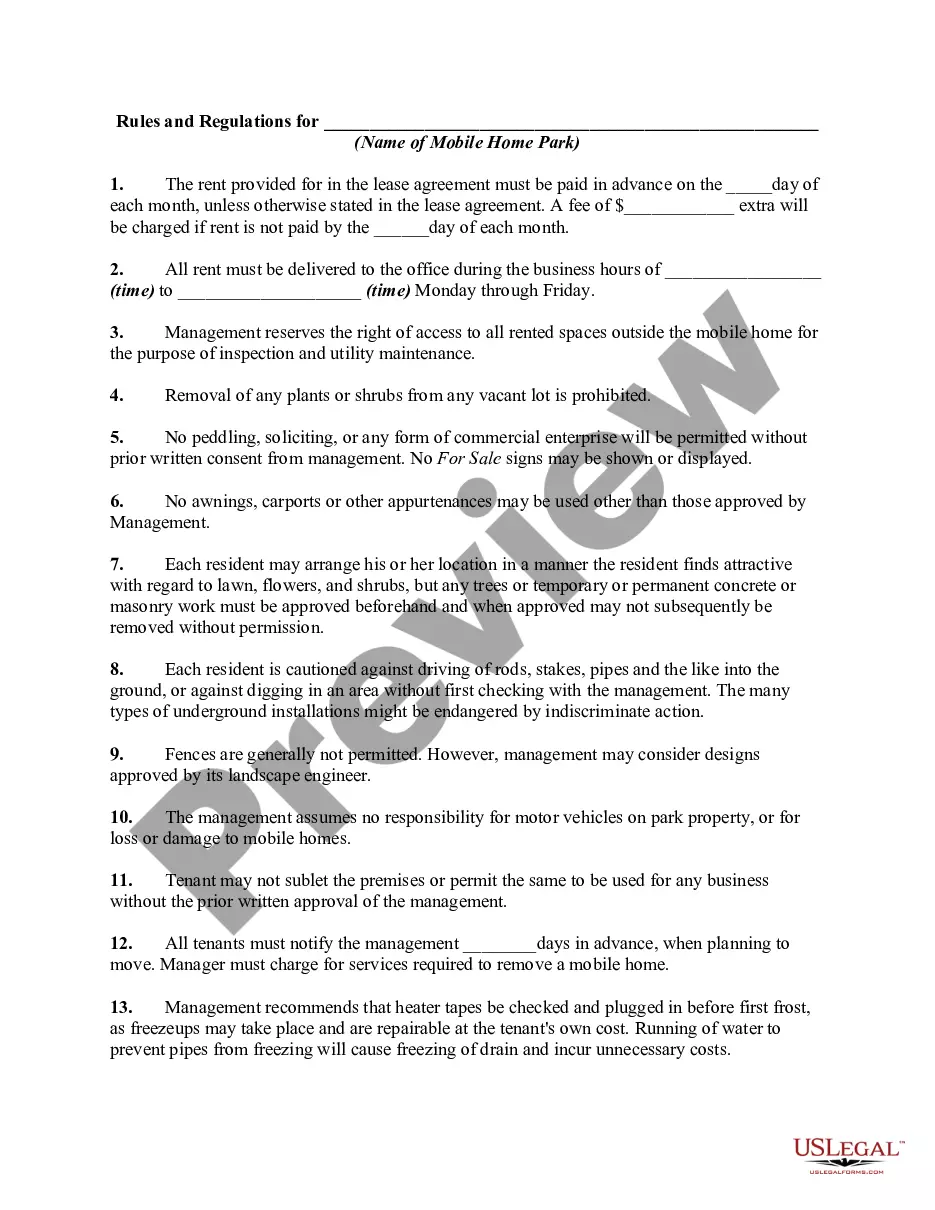

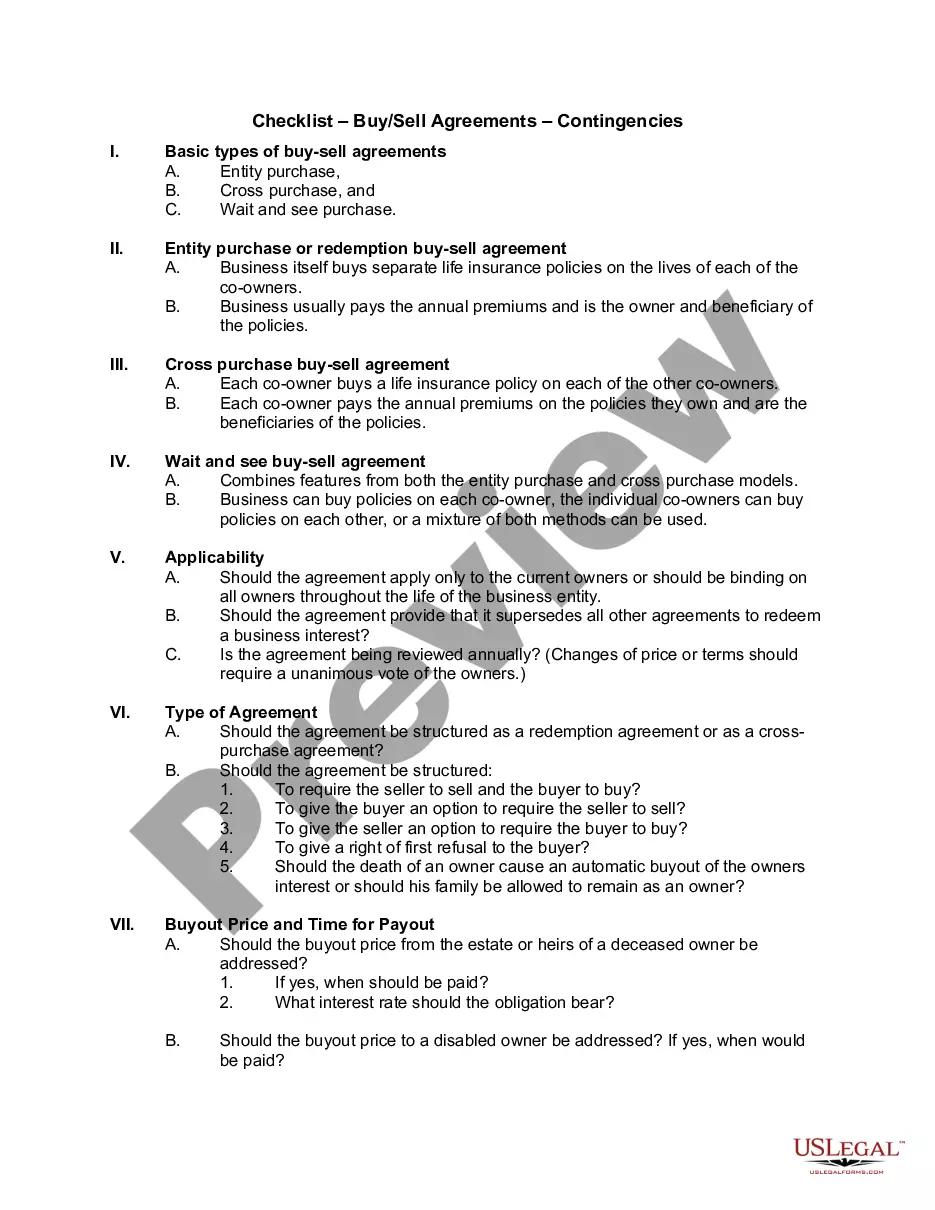

- Step 2. Use the Review option to assess the form’s content. Be sure to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative forms in the valid document format.

- Step 4. Once you have found the form you need, select the Get now option. Choose your preferred payment plan and enter your information to sign up for an account.

- Step 5. Complete the transaction. You can utilize your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the valid document and download it onto your device.

- Step 7. Complete, review, and print or sign the Maryland Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate.

Form popularity

FAQ

To calculate the percentage rent breakpoint in a Maryland Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, first determine your total annual sales. Next, identify the agreed-upon percentage that triggers additional rent. Divide the annual sales by the percentage rate to find your breakpoint. This method helps landlords and tenants understand how additional rents can affect financial outcomes.

The formula for the percentage of agreement typically involves calculating the percentage of total rent that is contingent upon gross receipts. In relation to a Maryland Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, this formula helps both landlords and tenants clarify their financial responsibilities. It's essential to review this formula regularly to ensure compliance and optimize revenue potential.

To calculate the leased percentage, divide the area of the leased space by the total area of the property. In the context of the Maryland Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, this calculation is vital for understanding how much space you occupy relative to the total. Knowing your leased percentage helps in making informed decisions regarding business operations and financial planning.

The formula for calculating a lease typically includes rent, additional charges, and lease term. For Maryland Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, the formula takes into account both the base rent and the additional percentage rent based on gross sales. This comprehensive approach allows parties to gauge total costs and project future earnings accurately.

A natural breakpoint refers to the sales threshold at which the tenant begins paying percentage rent. In a Maryland Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, this figure is important for landlords and tenants alike. Knowing the natural breakpoint helps tenants budget effectively and provides landlords with a clearer understanding of revenue projections.

The lease factor percentage represents the ratio used to determine the amount of rent owed based on gross sales. In the context of a Maryland Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, this percentage is typically outlined in the lease agreement. It is crucial for tenants to understand this percentage, as it directly impacts their rental expenses.

To calculate a percentage lease under the Maryland Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, first determine the total gross receipts for the business. Next, multiply these receipts by the agreed percentage specified in the lease agreement. This calculation helps both landlords and tenants understand their financial obligations and ensures transparency in the leasing process.

In Maryland, private property refers to land or assets owned by individuals or businesses rather than the government. This includes residential homes, commercial properties, and personal belongings. The distinction between private and public property is essential when discussing a Maryland Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate.

A property that a business owns typically refers to any real estate, including buildings and land, used for business operations. This may also include leased properties under agreements like a Maryland Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. Understanding ownership implications can be crucial for business strategy.

In Maryland, rental income is generally taxed as ordinary income, which means it will be subject to personal or corporate income tax rates. Landlords should deduct allowable expenses, such as maintenance and management fees, when calculating taxable income. If you are entering a Maryland Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, you should be aware of these tax implications.