Maryland Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits

Description

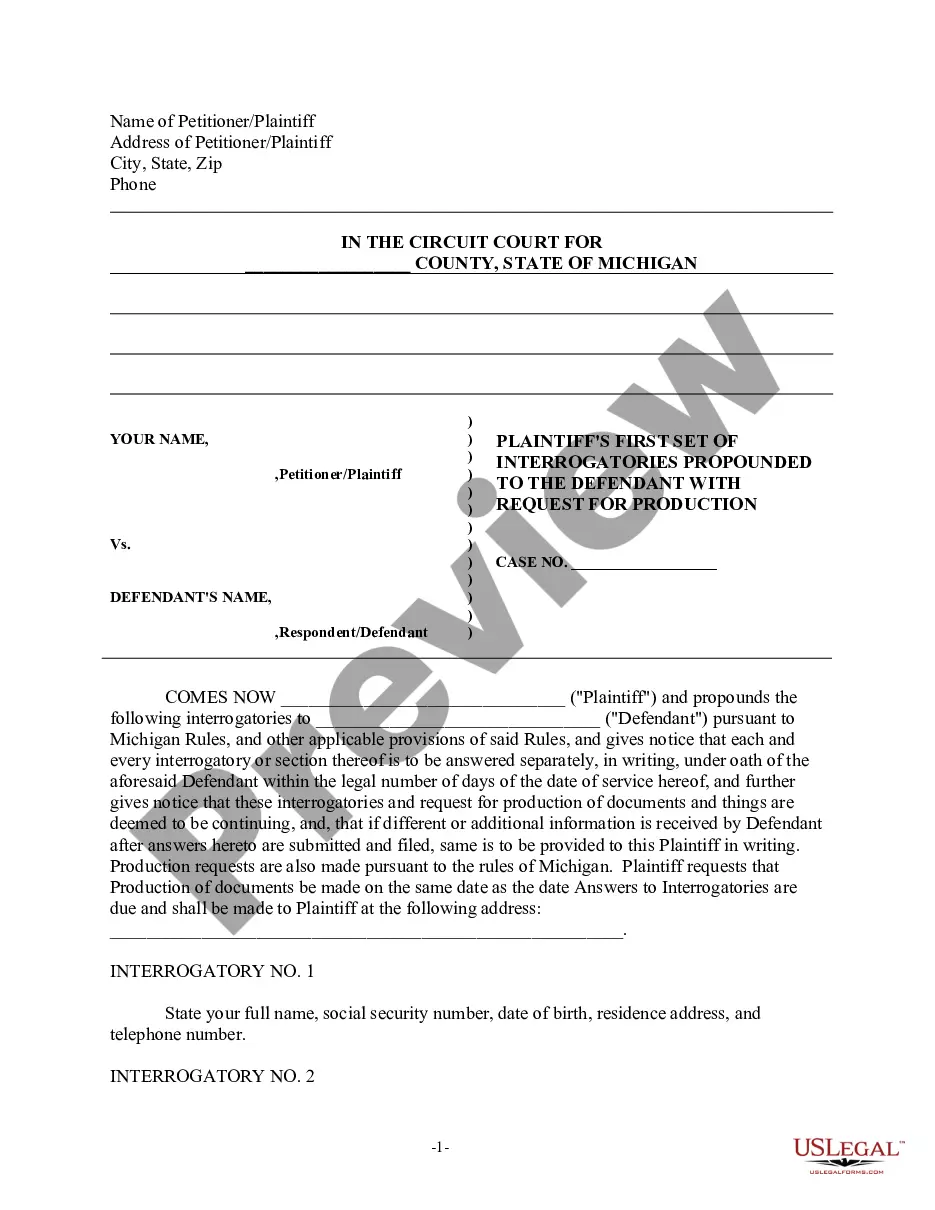

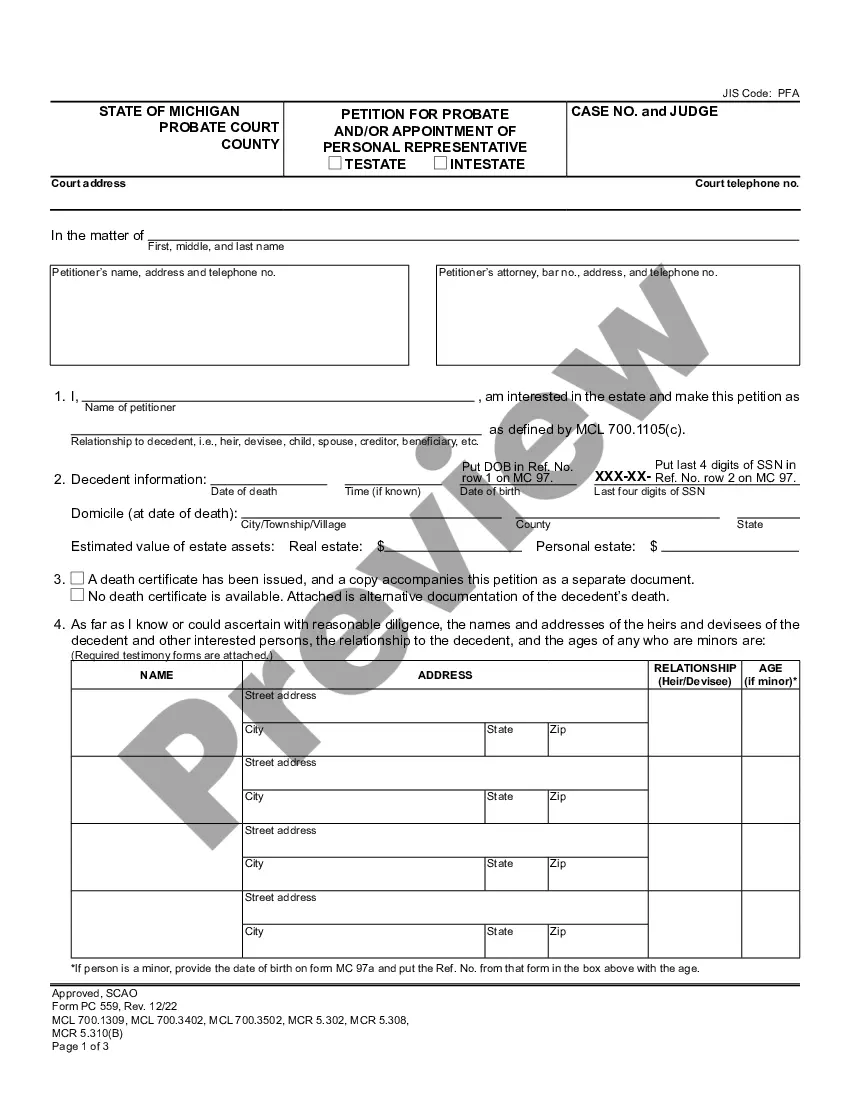

How to fill out Letter From Known Imposter To Creditor Accepting Responsibility For Accounts, Charges Or Debits?

US Legal Forms - among the largest libraries of lawful types in America - provides a wide array of lawful record layouts you may obtain or print out. Using the web site, you can find a large number of types for enterprise and person purposes, sorted by classes, says, or search phrases.You will discover the latest variations of types just like the Maryland Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits within minutes.

If you have a subscription, log in and obtain Maryland Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits from the US Legal Forms library. The Acquire switch will appear on each type you see. You have accessibility to all previously delivered electronically types in the My Forms tab of the bank account.

In order to use US Legal Forms for the first time, here are basic guidelines to help you started out:

- Ensure you have selected the right type for your city/region. Click the Review switch to check the form`s information. See the type description to ensure that you have chosen the proper type.

- When the type does not match your specifications, take advantage of the Search industry towards the top of the display to obtain the one who does.

- Should you be content with the form, confirm your decision by simply clicking the Purchase now switch. Then, select the pricing program you prefer and provide your qualifications to sign up on an bank account.

- Process the deal. Make use of your charge card or PayPal bank account to finish the deal.

- Find the format and obtain the form on the system.

- Make changes. Load, edit and print out and sign the delivered electronically Maryland Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits.

Each format you included in your bank account does not have an expiry day which is the one you have for a long time. So, in order to obtain or print out yet another copy, just check out the My Forms area and then click on the type you will need.

Get access to the Maryland Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits with US Legal Forms, probably the most considerable library of lawful record layouts. Use a large number of skilled and express-distinct layouts that satisfy your business or person requires and specifications.

Form popularity

FAQ

If you feel you've been contacted in error, send a letter disputing a debt in writing. Ask the agency to stop contacting you. If the agency can't provide proof, you owe the money, by law, they must stop collection efforts.

Send the agency a letter by mail asking them to confirm their debt in writing. Search for the company name on the internet, review their website, call their number, etc. Do your homework. If they refuse to answer all of your questions, there's a good chance you're in the middle of a scam.

While debt validation requests can be a useful tool, they are not effective at resolving the issue. In most cases, creditors and collection agencies are able to provide the necessary documentation to prove the validity of the debt.

Because my income has dropped considerably I can no longer afford the terms of the original loan. As a loyal customer of your financial institution, I'd like to ask for the following: ? A lower interest rate amount of NO MORE THAN 6% ? Accept lower payments of $ _________ per month.

Here's the important part: You have just 30 days to respond to a debt validation letter with your debt verification letter. If you don't dispute the debt within 30 days, the debt is assumed valid. That means the debt collector can continue to contact you. You can still send a dispute after 30 days.

It's generally easier for first-party creditors to prove you owe a debt. They simply produce the original credit agreement that shows your name and identifying information, like your address and Social Security number.

Debt Validation Letter Example I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.