Maryland Agreement for Sale of Business by Sole Proprietorship with Leased Premises

Description

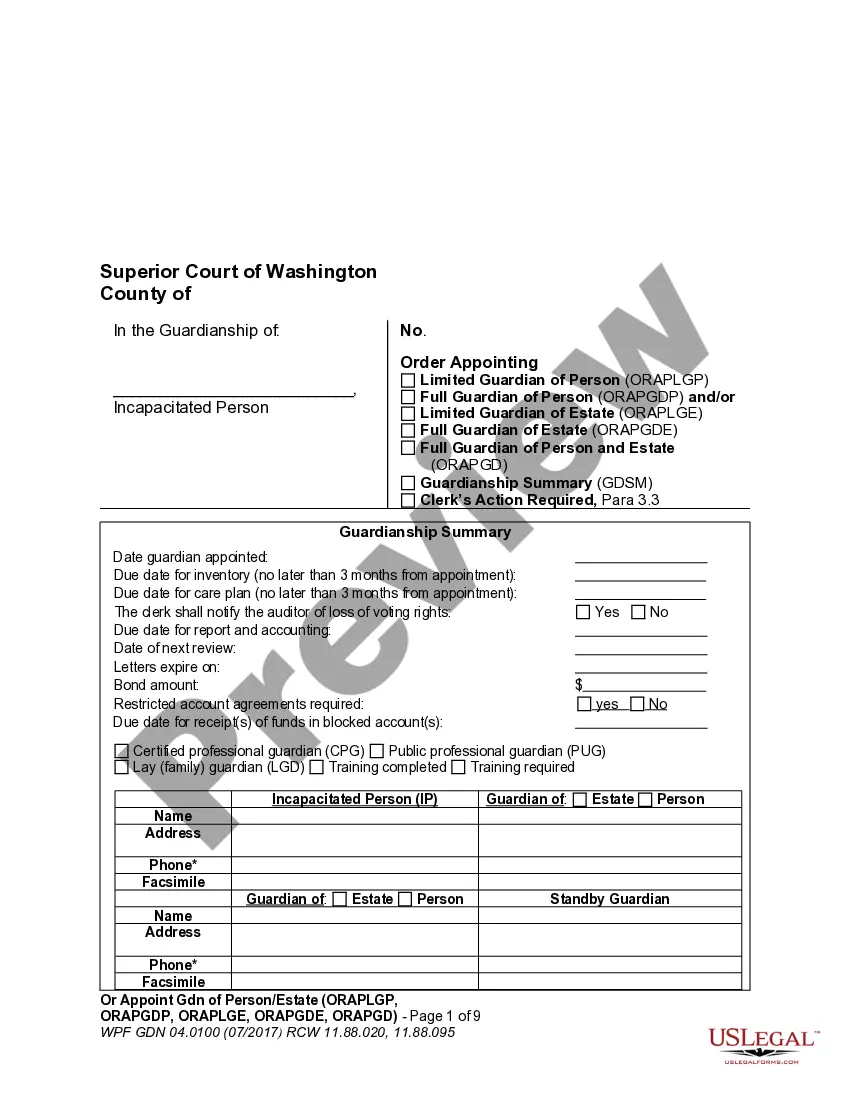

How to fill out Agreement For Sale Of Business By Sole Proprietorship With Leased Premises?

Selecting the ideal legal document template can be a struggle. Of course, there are countless templates accessible online, but how do you locate the specific legal document you require.

Take advantage of the US Legal Forms website. This service offers a multitude of templates, including the Maryland Agreement for Sale of Business by Sole Proprietorship with Leased Premises, which can be utilized for both business and personal purposes.

All of the forms are reviewed by experts and comply with federal and state regulations.

If the form does not meet your expectations, utilize the Search section to find the correct form. Once you are confident that the form is suitable, click the Acquire Now button to obtain the document. Select the pricing plan you prefer and enter the required information. Create your account and complete the purchase using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Finally, complete, modify, print, and sign the obtained Maryland Agreement for Sale of Business by Sole Proprietorship with Leased Premises. US Legal Forms is the largest library of legal documents where you can find numerous document templates. Utilize the service to obtain professionally crafted documents that comply with state regulations.

- If you're already registered, Log In to your account and click the Acquire button to find the Maryland Agreement for Sale of Business by Sole Proprietorship with Leased Premises.

- Use your account to browse through the legal forms you've previously purchased.

- Navigate to the My documents tab in your account and obtain another copy of the document you need.

- If you're a new user of US Legal Forms, follow these straightforward guidelines.

- First, ensure you have selected the correct form for your location/state.

- You can review the document using the Review button and read the description to confirm it's the right one for your needs.

Form popularity

FAQ

One significant disadvantage of a sole proprietorship is the unlimited personal liability you assume for business debts and obligations. This means your personal assets may be at risk if your business faces financial challenges. Additionally, raising capital can be more difficult compared to other business structures. Nonetheless, tools like the Maryland Agreement for Sale of Business by Sole Proprietorship with Leased Premises can help you navigate these challenges when planning your business exit strategy.

In Maryland, you typically need a business license to operate as a sole proprietor. Depending on your business type and location, specific licenses may be required to comply with local regulations. Obtaining the necessary licenses is crucial when you plan to engage in activities outlined in documents such as the Maryland Agreement for Sale of Business by Sole Proprietorship with Leased Premises. This step legitimizes your operations and safeguards against potential legal issues.

Yes, registering as a sole proprietor in Maryland is essential for operating your business legally. You need to register your business name, especially if it differs from your own. This registration ensures that you can legally enter into agreements, like the Maryland Agreement for Sale of Business by Sole Proprietorship with Leased Premises. Additionally, it protects your business's identity and enhances credibility.

A sole proprietor agreement is a document outlining the terms under which a sole proprietorship operates. It covers aspects such as business operations, rights, responsibilities, and any agreements with third parties. Leveraging a Maryland Agreement for Sale of Business by Sole Proprietorship with Leased Premises can help you define these terms clearly and protect your interests.

An operating agreement is typically not required for a sole proprietorship, as this business structure is often less formal than others. However, creating one can help clarify your business operations and financial arrangements. Even though it's not mandatory, using a Maryland Agreement for Sale of Business by Sole Proprietorship with Leased Premises can aid in formalizing agreements as your business grows.

A simple business contract should include essential details like the names of the parties involved, what is being exchanged, and the payment terms. Keep your language clear and straightforward, avoiding unnecessary complexity. The Maryland Agreement for Sale of Business by Sole Proprietorship with Leased Premises serves as an effective template to create a clear and simple agreement.

To write a contract for sale, begin with the names and addresses of the parties, followed by a description of the item or service being sold. Clearly outline the terms of payment, delivery, and any potential penalties for breach of contract. Using a Maryland Agreement for Sale of Business by Sole Proprietorship with Leased Premises can provide a solid foundation for ensuring all aspects are covered.

To formulate a sale contract, start by clearly defining the parties involved, the subject matter of the sale, and the terms of sale. Include details like payment terms, delivery conditions, and any warranties. By utilizing a Maryland Agreement for Sale of Business by Sole Proprietorship with Leased Premises, you can create a legally binding document that outlines these critical elements.

Yes, a sole proprietor must register their business with the state of Maryland, especially if they're operating under a name different from their legal name. This registration helps establish legitimacy and is necessary for conducting business legally. If you are engaging in a Maryland Agreement for Sale of Business by Sole Proprietorship with Leased Premises, ensuring that your business is properly registered is a crucial step.

Under a sole proprietorship, the business is not a separate legal entity from its owner. The owner and the business are considered one and the same legally, which affects liability and ownership rights. When drafting a Maryland Agreement for Sale of Business by Sole Proprietorship with Leased Premises, keep this critical factor in mind.