Maryland Balloon Secured Note

Description

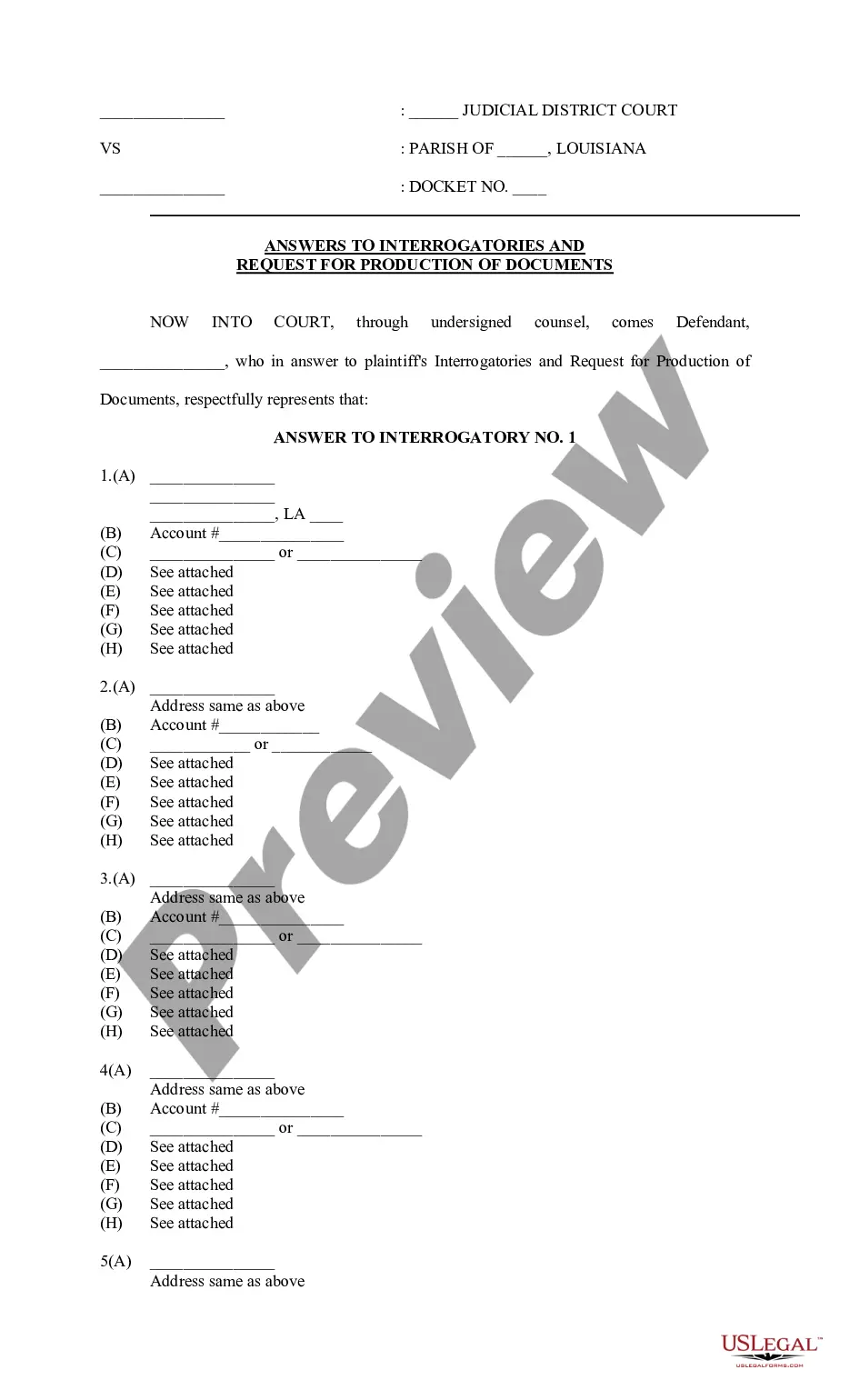

How to fill out Balloon Secured Note?

You have the ability to spend hours on the internet looking for the appropriate legal document template that meets the federal and state requirements you need.

US Legal Forms offers a vast selection of legal documents that are reviewed by experts.

You can easily download or print the Maryland Balloon Secured Note through our service.

- If you already have a US Legal Forms account, you may Log In and click on the Download button.

- Subsequently, you can complete, modify, print, or sign the Maryland Balloon Secured Note.

- Every legal document template you obtain is yours permanently.

- To obtain another copy of the purchased form, navigate to the My documents section and select the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the easy steps below.

- First, make sure you have selected the correct template for the region/area of your choice. Refer to the form description to confirm you have chosen the right one.

- If available, utilize the Preview option to review the document template as well.

- If you wish to find an additional version of the form, use the Search area to locate the template that fits your needs and requirements.

- Once you have found the template you desire, click on Get now to continue.

Form popularity

FAQ

A balloon payment is a larger-than-usual one-time payment at the end of the loan term. If you have a mortgage with a balloon payment, your payments may be lower in the years before the balloon payment comes due, but you could owe a big amount at the end of the loan.

Often, when a borrower has paid as agreed, but is unable to make the balloon payment, the bank will convert the loan to full amortization. This means it will become a full 25-year loan as opposed to coming due in five years.

The loan is written for a much shorter period, usually between five and seven years. The last payment is the balloon payment. The remaining balance of the loan must be paid off in one large payment and with cash or a refinance.

A balloon payment provision in a loan is not illegal per se. Federal and state legislatures have enacted various laws designed to protect consumers from being victimized by such a loan.

The balloon payment is equal to unpaid principal and interest due when a balloon mortgage becomes due and payable. If the balloon payment isn't paid when due, the mortgage lender notifies the borrower of the default and may start foreclosure.

A balloon payment is a larger-than-usual one-time payment at the end of the loan term. If you have a mortgage with a balloon payment, your payments may be lower in the years before the balloon payment comes due, but you could owe a big amount at the end of the loan.

Legal Bulletins The Maryland Secondary Mortgage Loan Law permits lenders to schedule balloon payments only if the balloon payment is expressly disclosed to the borrower, agreed to by the borrower and lender in writing, and required to be postponed one time for 6 months at the borrower's request.

A balloon payment isn't allowed in a type of loan called a Qualified Mortgage, with some limited exceptions. Tip: A mortgage with a balloon payment can be risky because you owe a larger payment at the end of the loan.

You can handle a balloon payment in several different ways.Refinance: When the balloon payment is due, one option is to pay it off by obtaining another loan.Sell the asset: Another option for dealing with a balloon payment is to sell whatever you bought with the loan.More items...

A balloon loan is a type of loan that does not fully amortize over its term. Since it is not fully amortized, a balloon payment is required at the end of the term to repay the remaining principal balance of the loan.