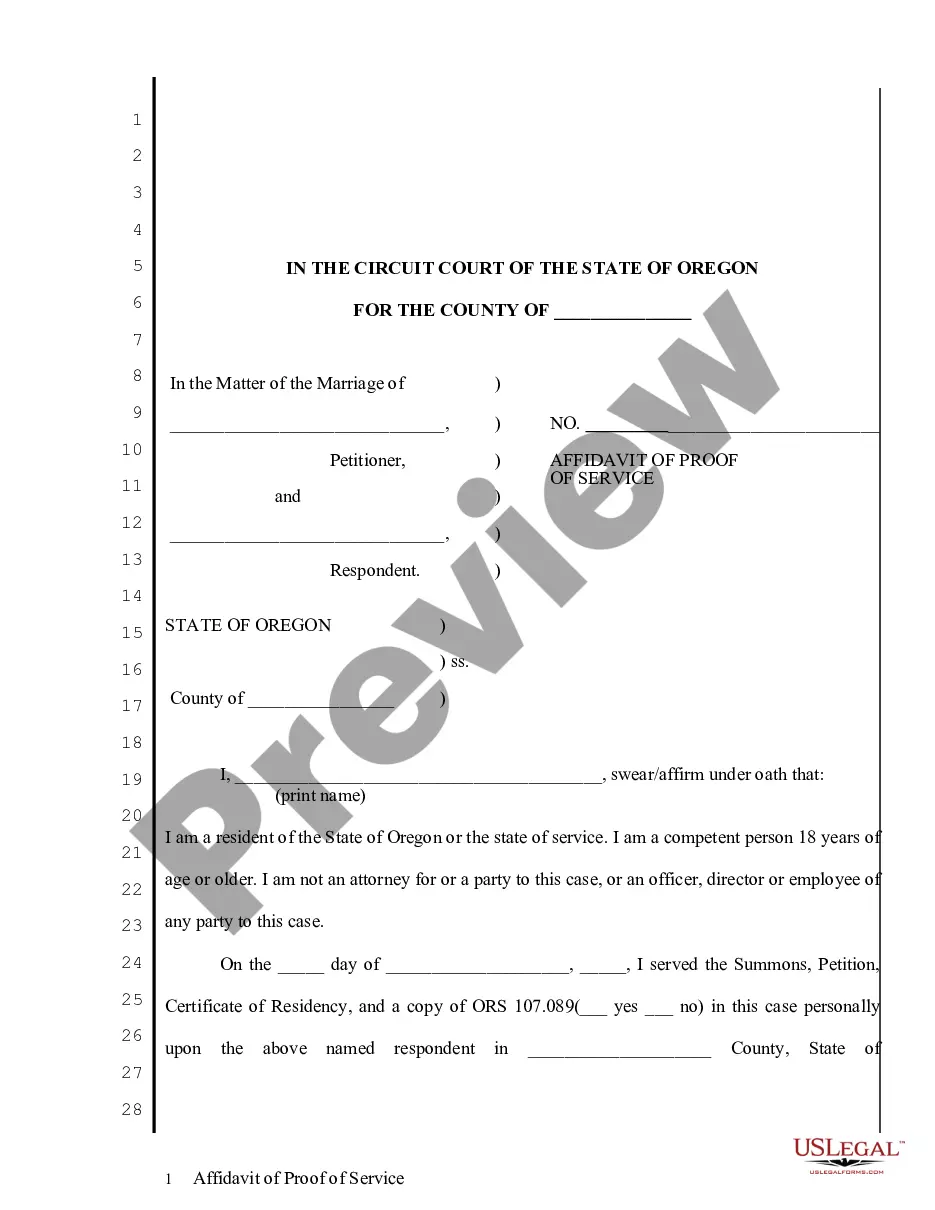

Maryland Application By Foreign Personal Representative To Set Inheritance Tax is a form used by a foreign personal representative (FPR) to set the inheritance tax due on the estate of a non-resident decedent. The application must be completed and filed with the Comptroller of Maryland within nine months of the decedent’s death. The FPR must provide information about the estate, including its assets, liabilities, and beneficiaries. The application must also include a copy of the decedent’s will or other document that names the FPR as the representative. There are two types of Maryland Application By Foreign Personal Representative To Set Inheritance Tax: the Form 504 and the Form 504A. Form 504 is used when the estate is valued at more than $50,000 and the decedent died after October 1, 2017. Form 504A is used when the estate is valued at $50,000 or less and the decedent died after October 1, 2017.

Maryland Application By Foreign Personal Representative To Set Inheritance Tax

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maryland Application By Foreign Personal Representative To Set Inheritance Tax?

Drafting legal documents can be quite overwhelming unless you have pre-prepared fillable templates ready at hand. With the US Legal Forms online database of official paperwork, you can trust the templates you receive, as they all align with federal and state regulations and are validated by our experts.

So if you require to create the Maryland Application By Foreign Personal Representative To Set Inheritance Tax, our platform is the optimal choice to access it.

Here’s a brief guide for you: Document compliance review. You should thoroughly check the details of the form you wish to utilize and ensure it meets your requirements and adheres to your state regulations. Previewing your document and examining its overall description will assist you in doing that. Alternative search (optional). Should there be any discrepancies, search the library using the Search tab at the top of the page until you discover a suitable template, and click Buy Now once you identify the one you are looking for. Account creation and form acquisition. Sign up for an account on US Legal Forms. After account confirmation, Log In and select your preferred subscription option. Proceed with the payment (PayPal and credit card options are provided). Template retrieval and additional use. Select the file type for your Maryland Application By Foreign Personal Representative To Set Inheritance Tax and click Download to save it to your device. You can print it to fill out your documents manually or use a multi-functional online editor for quicker and more effective preparation of an electronic version. Haven’t you tried US Legal Forms yet? Register for our service today to obtain any formal document swiftly and easily whenever needed, and keep your paperwork organized!

- Getting your Maryland Application By Foreign Personal Representative To Set Inheritance Tax from our repository is as simple as 1-2-3.

- Existing users with an active subscription just need to sign in and click the Download button after finding the right template.

- If needed, users can utilize the same document from the My documents section of their account.

- However, if you are new to our service, registering with a valid subscription is a quick process.

Form popularity

FAQ

The Maryland Inheritance Tax applies to all beneficiaries unless they have a specific exemption from the tax. A decedent's spouse, child, stepchild, grandchild, step-grandchild, parent, grandparent or sibling are exempt from paying Maryland Inheritance Tax.

Ing to the Internal Revenue Service (IRS), federal estate tax returns are only required for estates with values exceeding $12.06 million in 2022 (rising to $12.92 million in 2023). If the estate passes to the spouse of the deceased person, no estate tax is assessed.318 Taxes for 2022 are paid in 2023.

Children in Maryland Inheritance Law If you have children who are minors, your spouse will inherit half of the intestate property and your children will inherit the other half. If you have no minor children, your spouse will inherit $15,000 of the intestate property and then half of the remaining property.

An executor in the state of Maryland is actually called a personal representative. A decedent's last will and testament often nominates the individual that the decedent would like to serve as the personal representative.

Maryland is one of a few states with an inheritance tax. The tax focuses on the privilege of receiving property from a decedent. The Maryland inheritance tax rate is 10% of the value of the gift.

The requirements of a personal representative in Maryland are that a personal representative is over the age of 18, is detail-oriented, has not committed any serious crimes, is a U.S. citizen or legal resident, is able to qualify for a bond, and someone who has not been subject to bankruptcy.

Maryland Estate Tax Exemption The estate tax threshold for Maryland is $5 million as of 2023. This means that if you die and your total estate is worth less than $5 million, the estate owes nothing at all to the state of Maryland.

Finally, if the estate qualifies for simplified probate as a small estate under Maryland law (meaning the total value of all probate property is less than $50,000), there is no inheritance tax due.