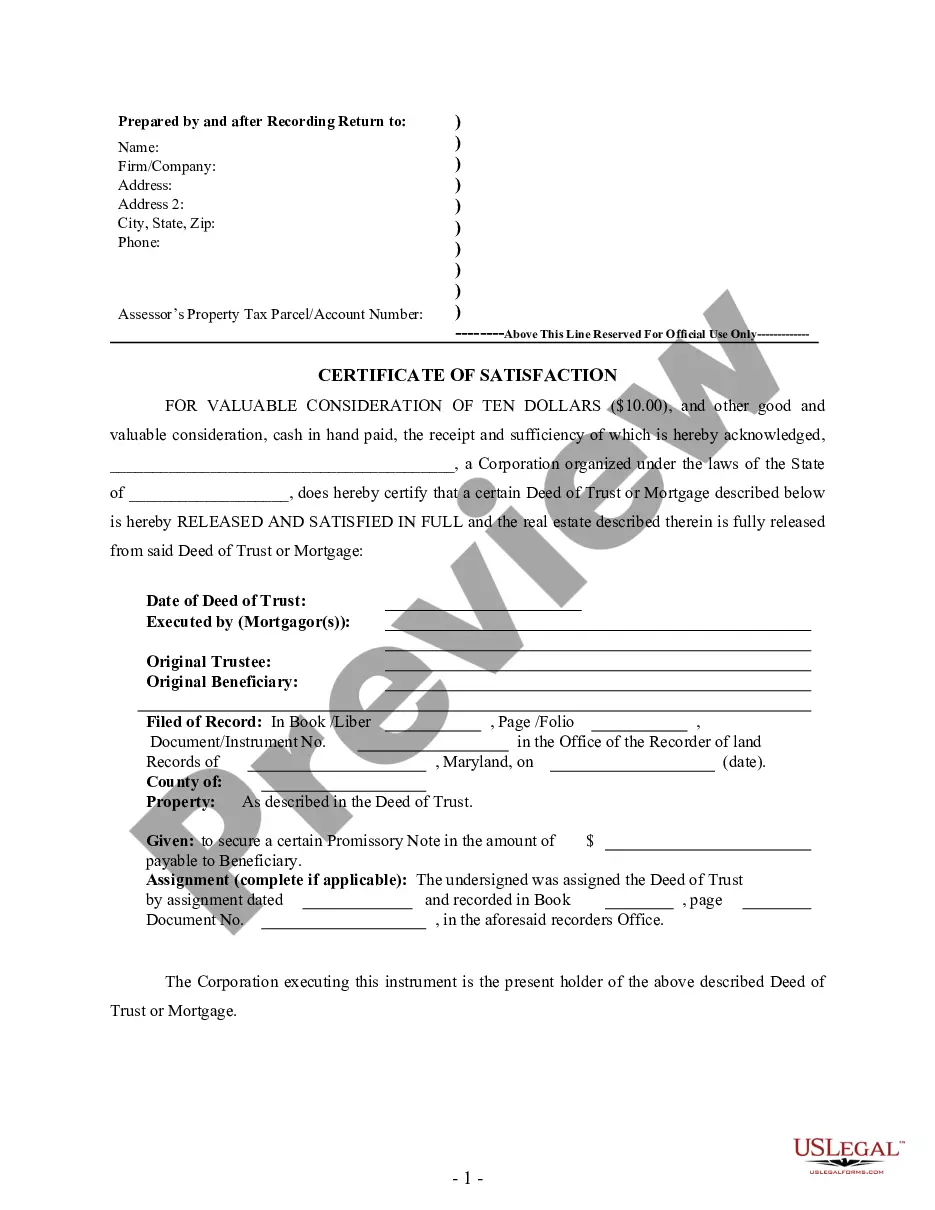

Satisfaction, Release or Cancellation of Deed of Trust by Corporation

Assignments Generally: Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rules is that the assignment must be in proper written format and recorded to provide notice of the assignment.

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

Maryland Law

Assignment: An assignment must be in writing and recorded.

Demand to Satisfy: Mortgagee must record satisfaction and provide written evidence of same to mortgagor within 30 days of written demand.

Recording Satisfaction: A release may be endorsed on the original mortgage or deed of trust by the mortgagee or his assignee, the trustee or his successor under a deed of trust, or by the holder of the debt or obligation secured by the deed of trust. The mortgage or the deed of trust, with the endorsed release, then shall be filed in the office in which the mortgage or deed of trust is recorded.

Marginal Satisfaction: Allowed, either on the original mortgage document, or on the record of same at the recording office.

Penalty: If mortgagee fails to satisfy mortgage of record and provide mortgagee written evidence thereof within 30 days of written demand, mortgagee is liable for the delivery of the release and for all costs and expenses in connection with the bringing of the action, including reasonable attorney fees.

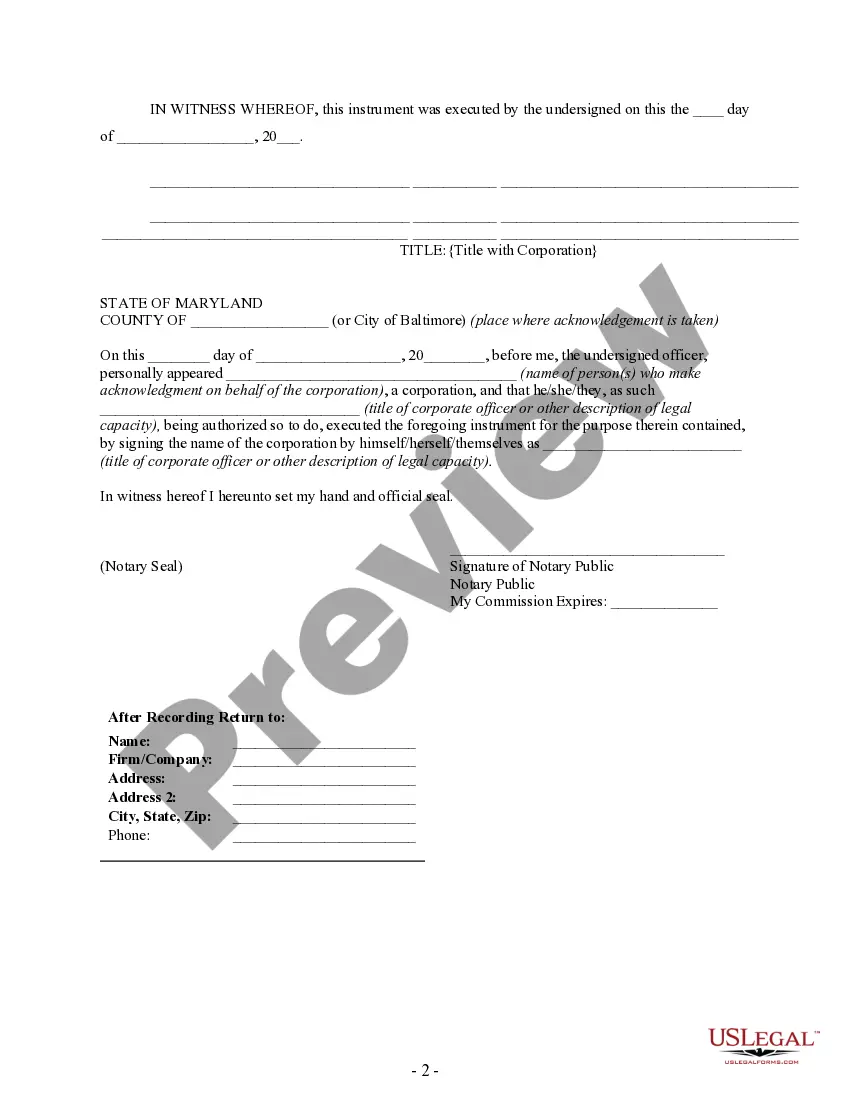

Acknowledgment: An assignment or satisfaction must contain a proper Maryland acknowledgment, or other acknowledgment approved by Statute.

Maryland Statutes

Article - Real Property 3-105.

(a) A mortgage or deed of trust may be released validly by any procedure enumerated in this section.

(b) A release may be endorsed on the original mortgage or deed of trust by the mortgagee or his assignee, the trustee or his successor under a deed of trust, or by the holder of the debt or obligation secured by the deed of trust. The mortgage or the deed of trust, with the endorsed release, then shall be filed in the office in which the mortgage or deed of trust is recorded. The clerk shall record the release photographically, with an attachment or rider affixed to it containing the names of the parties as they appear on the original mortgage or deed of trust, together with a reference to the book and page number where the mortgage or deed of trust is recorded.

(c) At the option of the clerk of the court in whose office the book form of recording is used, the release may be written by the mortgagee, or his assignee, or the trustee, or his successor under a deed of trust, on the record in the office where the mortgage or deed of trust is recorded and attested by the clerk of the court. At the time of recording any mortgage or deed of trust, the clerk of the court in whose office the book form of recording is used shall leave a blank space at the foot of the mortgage or deed of trust for the purpose of entering such release.

(d) (1) When the debt secured by a deed of trust is paid fully or satisfied, and any bond, note, or other evidence of the total indebtedness is marked paid or canceled by the holder or his agent, it may be received by the clerk and indexed and recorded as any other instrument in the nature of a release. The marked note has the same effect as a release of the property for which it is the security, as if a release were executed by the named trustees, if there is attached to or endorsed on the note an affidavit of the holder, the party making satisfaction, or an agent of either of them, that it has been paid or satisfied, and specifically setting forth the land record reference where the original deed of trust is recorded.

(2) When the debt secured by a mortgage is paid fully or satisfied, and the original mortgage is marked paid or canceled by the mortgagee or his agent, it may be received by the clerk and indexed and recorded as any other instrument in the nature of a release. The marked mortgage has the same effect as a release of the property for which it is the security, as if a release were executed by the mortgagee, if there is attached to or endorsed on the mortgage an affidavit of the mortgagee, the mortgagor, the party making satisfaction, or the agent of any of them, that it has been paid or satisfied, and specifically setting forth the land record reference where the mortgage is recorded.

(3) When the debt secured by a mortgage or deed of trust is paid fully or satisfied, and the canceled check evidencing final payment or, if the canceled check is unavailable, a copy of the canceled check accompanied by a certificate from the institution on which the check was drawn stating that the copy is a true and genuine image of the original check is presented, it may be received by the clerk and indexed and recorded as any other instrument in the nature of a release. The canceled check or copy accompanied by the certificate has the same effect as a release of the property for which the mortgage or deed of trust is the security, as if a release were executed by the mortgagee or named trustees, if:

(i) The party making satisfaction of the mortgage or deed of trust has:

1. Allowed at least a 60-day waiting period, from the date the mortgage or deed of trust is paid fully or is satisfied, for the party satisfied to provide a release suitable for recording;

2. Sent the party satisfied a copy of this section and a notice that, unless a release is provided within 30 days, the party making satisfaction will obtain a release by utilizing the provisions of this paragraph; and

3. Following the mailing of the notice required under sub-subparagraph 2 of this subparagraph, allowed an additional waiting period of at least 30 days for the party satisfied to provide a release suitable for recording; and

(ii) The canceled check or copy accompanied by the certificate contains the name of the party whose debt is being satisfied, the debt account number, if any, and words indicating that the check is intended as payment in full of the debt being satisfied; and

(iii) There is attached to the canceled check or copy accompanied by the certificate an affidavit made by a member of the Maryland Bar that the mortgage or deed of trust has been satisfied, that the notice required under subparagraph (i) of this paragraph has been sent, and specifically setting forth the land record reference where the original mortgage or deed of trust is recorded.

(4) When the debt secured by a mortgage or deed of trust is fully paid or satisfied and the holder or the agent of the holder of the mortgage or deed of trust note or other obligation secured by the deed of trust, or the trustee or successor trustee under the deed of trust, executes and acknowledges a certificate of satisfaction substantially in the form specified under 4-203(d) of this article, containing the name of the debtor, holder, the authorized agent of the holder, or the trustee or successor trustee under the deed of trust, the date, and the land record recording reference of the instrument to be released, it may be received by the clerk and indexed and recorded as any other instrument in the nature of a release. The certificate of satisfaction shall have the same effect as a release executed by the holder of a mortgage or the named trustee under a deed of trust.

(5) When the holder of a mortgage or deed of trust note or other obligation secured by the deed of trust has agreed to release certain property from the lien of the mortgage or deed of trust and the holder or the agent of the holder of the mortgage or deed of trust note or other obligation secured by the deed of trust, or the trustee or successor trustee under the deed of trust executes and acknowledges a certificate of partial satisfaction or partial release substantially in the form specified under 4-203(e) of this article, containing the name of the debtor, holder, the authorized agent of the holder, or the trustee or successor trustee under the deed of trust, the date, the land record recording reference of the instrument to be partially released, and a description of the real property being released, it may be received by the clerk and indexed and recorded as any other instrument in the nature of a partial release. The certificate of partial satisfaction or partial release shall have the same effect as a partial release executed by the holder of a mortgage, the holder of the debt secured by a deed of trust, or the named trustee under a deed of trust.

(e) A release of a mortgage or deed of trust may be made on a separate instrument if it states that the mortgagee, holder of the debt or obligation secured by the deed of trust, trustee, or assignee releases the mortgage or deed of trust and states the names of the parties to the mortgage or deed of trust and the date and recording reference of the mortgage or deed of trust to be released. In addition, any form of release that satisfies the requirements of a deed and is recorded as required by this article is sufficient.

(f) (1) A holder of a debt secured by a mortgage or deed of trust, or a successor of a holder, may release part of the collateral securing the mortgage or deed of trust by executing and acknowledging a partial release on an instrument separate from the mortgage or deed of trust.

(2) A partial release shall:

(i) Be executed and acknowledged;

(ii) Contain the names of the parties to the mortgage or deed of trust, the date, and the land record recording reference of the instrument subject to the partial release; and

(iii) Otherwise satisfy the requirements of a valid deed.

(3) The clerk of the court shall accept, index, and record, as a partial release, an instrument that complies with and is filed under this section.

(4) Unless otherwise stated in an instrument recorded among the land records, a trustee under a deed of trust may execute, acknowledge, and deliver partial releases.

(g) If a full or partial release of a mortgage or deed of trust is recorded other than at the foot of the recorded mortgage or deed of trust, the clerk shall place a reference to the book and page number or other place where the release is recorded on the recorded mortgage or deed of trust.

(h) Unless otherwise expressly provided in the release, a full or partial release that is recorded for a mortgage or deed of trust that is re-recorded, amended, modified, or otherwise altered or affected by a supplemental instrument and which cites the released mortgage or deed of trust by reference to only the original recorded mortgage, deed of trust, or supplemental instrument to the original mortgage or deed of trust, shall be effective as a full or partial release of the original mortgage or deed of trust and all supplemental instruments to the original mortgage or deed of trust.

(i) Unless otherwise expressly provided in the release, a full or partial release that is recorded for a mortgage or deed of trust, or for any re-recording, amendment, modification, or supplemental instrument to the mortgage or deed of trust shall terminate or partially release any related financial statements, but only to the extent that the financing statements describe fixtures that are part of the collateral described in the full or partial release.

7-106 REAL PROP. Provisions for releases;

(a) Prohibition against release fee not specified in instrument. No trustee of a deed of trust may charge, demand, or receive any money or any other item of value exceeding $ 15 for the partial or complete release of the deed of trust unless the fee is specified in the instrument. Any person who violates this section is guilty of a misdemeanor and on conviction is subject to a fine not exceeding $ 100.

(b) Mailing or delivering evidence of recorded release of mortgage or deed of trust.

(1) Subject to the provisions of paragraph (5) of this subsection a person who has undertaken responsibility for the disbursement of funds in connection with the grant of title to property, shall mail or deliver to the vendor and purchaser in the transaction, the original or a photographic, photostatic, or similarly reproduced copy of the recorded release of any mortgage or deed of trust which the person was obliged to obtain and record with all or part of the funds to be disbursed. If the original or copy of a recorded release is not readily obtainable at the time of recording, the person may mail or deliver to the purchaser or vendor the original or a copy of the court's recordation receipt for the release, or any other certified court document clearly evidencing the recordation of the release.

(2) The required evidence of a recorded release shall be mailed or delivered to the vendor and purchaser within 30 days from the delivery of the deed granting title to the property. However, if the recording of the release is delayed beyond the 30-day period for causes not attributable to the neglect, omission, or malfeasance of the person responsible for the disbursement of funds, a letter explaining the delay shall be mailed or delivered to the vendor and purchaser within the 30-day period, and the person shall mail or deliver to the vendor and purchaser the required evidence of the recorded release at the earliest opportunity. The person shall follow the procedure of mailing or delivering a letter of explanation every 30 days until the required evidence of a recorded release is mailed or delivered to the purchaser and vendor.

(3) If the person responsible for the disbursement of funds does not comply with the provisions of paragraphs (1) and (2), the vendor, purchaser, or a duly organized bar association of the State may petition a court of equity to order an audit of the accounts maintained by the person for funds received in connection with closing transactions in the State. The petition shall state concisely the facts showing noncompliance and shall be verified. On receipt of the petition, the court shall issue an order to the person to show cause within ten days why the audit should not be conducted. If cause is not shown, the court may order the audit to be conducted. The court may order other relief as it deems appropriate under the circumstances of the case.

(4) Prior to delivery of the deed granting title to the property, the person responsible for the disbursement of funds shall inform the vendor and purchaser in writing of the provisions of this section.

(5) Unless specifically requested to do so by either the purchaser or the vendor, a person responsible for the disbursement of funds in a closing transaction is not required to provide the purchaser or vendor with the required evidence of a recorded release if the person properly disburses all funds entrusted to him in the course of the closing transaction within five days from the date of the delivery of any deed granting title to the property.

(6) The vendor shall bear the cost of reproducing and mailing a recorded release under this section unless the parties otherwise agree.

(c) Presumption of payment; termination of lien; continuation statements.

(1) If a mortgage or deed of trust remains unreleased of record, the mortgagor or grantor or any interested party is entitled to a presumption that it has been paid if:

(i) 12 years have elapsed since the last payment date called for in the instrument or the maturity date as set forth in the instrument or any amendment or modification to the instrument and no continuation statement has been filed;

(ii) The last payment date or maturity date cannot be ascertained from the record, 40 years have elapsed since the date of record of the instrument, and no continuation statement has been filed; or

(iii) One or more continuation statements relating to the instrument have been recorded and 12 years have elapsed since the recordation of the last continuation statement.

(2) Except as otherwise provided by law, if an action has not been brought to enforce the lien of a mortgage or deed of trust within the time provided in paragraph (1) of this subsection and, notwithstanding any other right or remedy available either at law or equity, the lien created by the mortgage or deed of trust shall terminate, no longer be enforceable against the property, and shall be extinguished as a lien against the property.

(3) (i) A continuation statement may be filed within 1 year before the expiration of the applicable time period under paragraph (1) of this subsection.

(ii) A continuation statement shall:

1. Be signed by:

A. The current mortgagee, if the instrument is a mortgage; or

B. The current beneficiary or any one or more of the current trustees if the instrument is a deed of trust;

2. Identify the original instrument by:

A. The office, docket or book, and first page where the instrument is recorded; and

B. The name of the parties to the instrument; and

3. State that the purpose of the continuation statement is to continue the effectiveness of the original instrument.

(iii) Upon timely recordation in the land records where the original instrument was recorded of a continuation statement under this subparagraph, the effectiveness of the original instrument shall be continued for 12 years after the day on which the continuation statement is recorded.

(iv) A continuation statement is effective if it substantially complies with the requirements of subparagraph (ii) of this paragraph.

(d) Furnishing original copy of executed release. Any person who has a lien on real property in this State, or the agent of the lienholder, on payment in satisfaction of the lien, on written request, shall furnish to the person responsible for the disbursement of funds in connection with the grant of title to that property the original copy of the executed release of that lien. If the lien instrument is a deed of trust the original promissory note marked paid or canceled in accordance with 3-105(d)(1) of this article constitutes an executed release. If the lien instrument is a mortgage, the original mortgage marked paid or canceled in accordance with 3-105(d)(2) of this article constitutes an executed release. This release shall be mailed or otherwise delivered to the person responsible for the disbursement of funds:

(1) Within seven days of the receipt, by the holder of the lien, of currency, a certified or cashier's check, or money order in satisfaction of the debt, including all amounts due under the lien instruments and under instruments secured by the lien; or

(2) Within seven days after the clearance of normal commercial channels of any type of commercial paper, other than those specified in paragraph (1), received by the holder of the lien in satisfaction of the outstanding debt, including all amounts due under the lien instruments and under the instruments secured by the lien.

(e) Enforcement. If the holder of a lien on real property or his agent fails to provide the release within 30 days, the person responsible for the disbursement of funds in connection with the grant of title to the property, after having made demand therefor, may bring an action to enforce the provisions of this section in the circuit court for the county in which the property is located. In the action the lienholder, or his agent, or both, shall be liable for the delivery of the release and for all costs and expenses in connection with the bringing of the action, including reasonable attorney's fees.