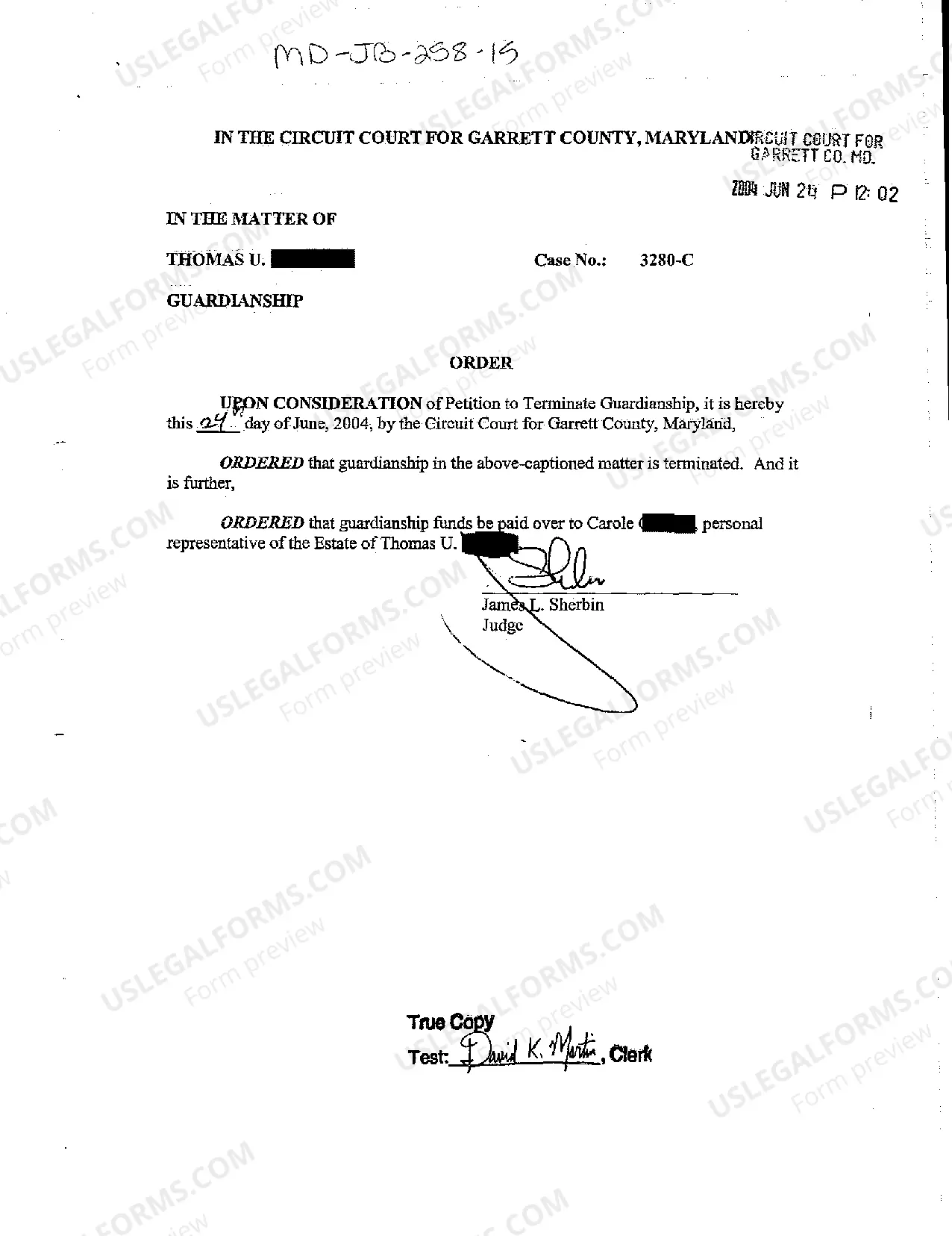

Maryland Order Terminating Guardianship and Funds to be Paid Over to Personal Representative of Estate

Description

How to fill out Maryland Order Terminating Guardianship And Funds To Be Paid Over To Personal Representative Of Estate?

You are invited to the most important legal documentation library, US Legal Forms.

Here you will discover various examples such as Maryland Order Terminating Guardianship and Funds to be Paid Over to Personal Representative of Estate templates and download them (as many as you desire/require). Prepare official paperwork in just a few hours, rather than days or even weeks, without spending excessively on an attorney.

Obtain the state-specific sample in a few clicks and feel assured with the understanding that it was prepared by our qualified legal specialists.

If the example meets your needs, just click Buy Now. To create an account, select a pricing plan. Use a credit card or PayPal account to register. Download the document in the format you require (Word or PDF). Print the document and complete it with your/your business’s details. Once you’ve filled out the Maryland Order Terminating Guardianship and Funds to be Paid Over to Personal Representative of Estate, send it to your lawyer for confirmation. It’s an additional step but a vital one to ensure you’re fully protected. Join US Legal Forms today and gain access to numerous reusable templates.

- If you’re already a subscribed user, just Log In to your account and click Download next to the Maryland Order Terminating Guardianship and Funds to be Paid Over to Personal Representative of Estate you desire.

- Since US Legal Forms is an online service, you’ll always have access to your stored templates, regardless of the device you’re using.

- Find them within the My documents tab.

- If you don't possess an account yet, what exactly are you waiting for.

- Review our guidelines below to get started.

- If this is a state-specific sample, check its validity in your residing state.

- Examine the description (if available) to determine if it’s the correct example.

- See additional content with the Preview option.

Form popularity

FAQ

Rule 6 421 in Maryland pertains to the procedures involved in terminating guardianship. Specifically, this rule outlines the legal framework for an order terminating guardianship, ensuring that it aligns with the Maryland Order Terminating Guardianship and Funds to be Paid Over to Personal Representative of Estate. This process includes clarifying the roles of the personal representative and the distribution of funds. Understanding this rule is crucial for anyone navigating the complexities of guardianship and estate matters in Maryland.

Guardianship law in Maryland provides a framework for protecting individuals who are unable to care for themselves due to incapacity. The law outlines the roles and responsibilities of guardians and the rights of those under guardianship. For those looking to understand their options, access to a Maryland Order Terminating Guardianship and Funds to be Paid Over to Personal Representative of Estate can clarify the legal processes involved and protect their interests.

To remove a guardian in Maryland, you must file a formal petition with the court that established the guardianship. This petition should include substantial evidence that supports your claim for why the guardianship should be ended. The court will consider factors such as the well-being of the person under guardianship, making it essential to present a strong case, possibly guided by a Maryland Order Terminating Guardianship and Funds to be Paid Over to Personal Representative of Estate.

Terminating parental rights in Maryland is a legal procedure that requires a compelling reason, such as neglect or abuse. The process often involves filing a petition and attending a court hearing where evidence must be presented. Given the gravity of this action, using resources such as USLegalForms can be incredibly beneficial to navigate the complexities involved in obtaining a Maryland Order Terminating Guardianship and Funds to be Paid Over to Personal Representative of Estate.

Terminating guardianship in Maryland involves filing a petition with the local court that granted the guardianship. You must show the court that the reasons for guardianship are no longer valid. It's advisable to gather necessary documentation and possibly seek legal advice to streamline the process, especially when dealing with a Maryland Order Terminating Guardianship and Funds to be Paid Over to Personal Representative of Estate.

To exit financial guardianship, it is essential to demonstrate that you no longer require a guardian for financial matters. You must file a petition in the appropriate Maryland court, providing evidence for your capacity to manage your finances. Seeking professional assistance, such as resources from USLegalForms, can facilitate the process of obtaining a Maryland Order Terminating Guardianship and Funds to be Paid Over to Personal Representative of Estate.

In Maryland, custody refers to the legal arrangement concerning where a child resides and who makes significant decisions for the child. Guardianship, on the other hand, pertains to an adult or entity appointed to care for an individual who cannot care for themselves due to incapacity. Both terms can be complex, and a Maryland Order Terminating Guardianship and Funds to be Paid Over to Personal Representative of Estate may clarify the financial aspects involved.

Rule 10 103 in Maryland addresses the process for terminating a guardianship. This rule specifies the conditions under which a guardianship may be dissolved, particularly when it is no longer necessary for the welfare of the individual. Understanding this rule is crucial if you are considering a Maryland Order Terminating Guardianship and Funds to be Paid Over to Personal Representative of Estate.

In Maryland, the compensation of a personal representative is generally calculated based on the estate's total value. This compensation is typically a percentage, which varies depending on the complexity of the estate's management and the time involved. Following a Maryland Order Terminating Guardianship, the personal representative’s role becomes crucial in ensuring the appropriate funds are paid over from the estate. Familiarizing yourself with compensation can help you in discussions with personal representatives about their services.

Rule 6-414 in Maryland outlines the procedures surrounding the appointment and duties of a personal representative, especially in financial matters. This rule ensures that all actions taken, such as a Maryland Order Terminating Guardianship and the funds being paid over to the personal representative of the estate, are performed in compliance with the law. Understanding this rule can help you navigate any legal requirements smoothly. Using platforms like uslegalforms can simplify this process significantly.