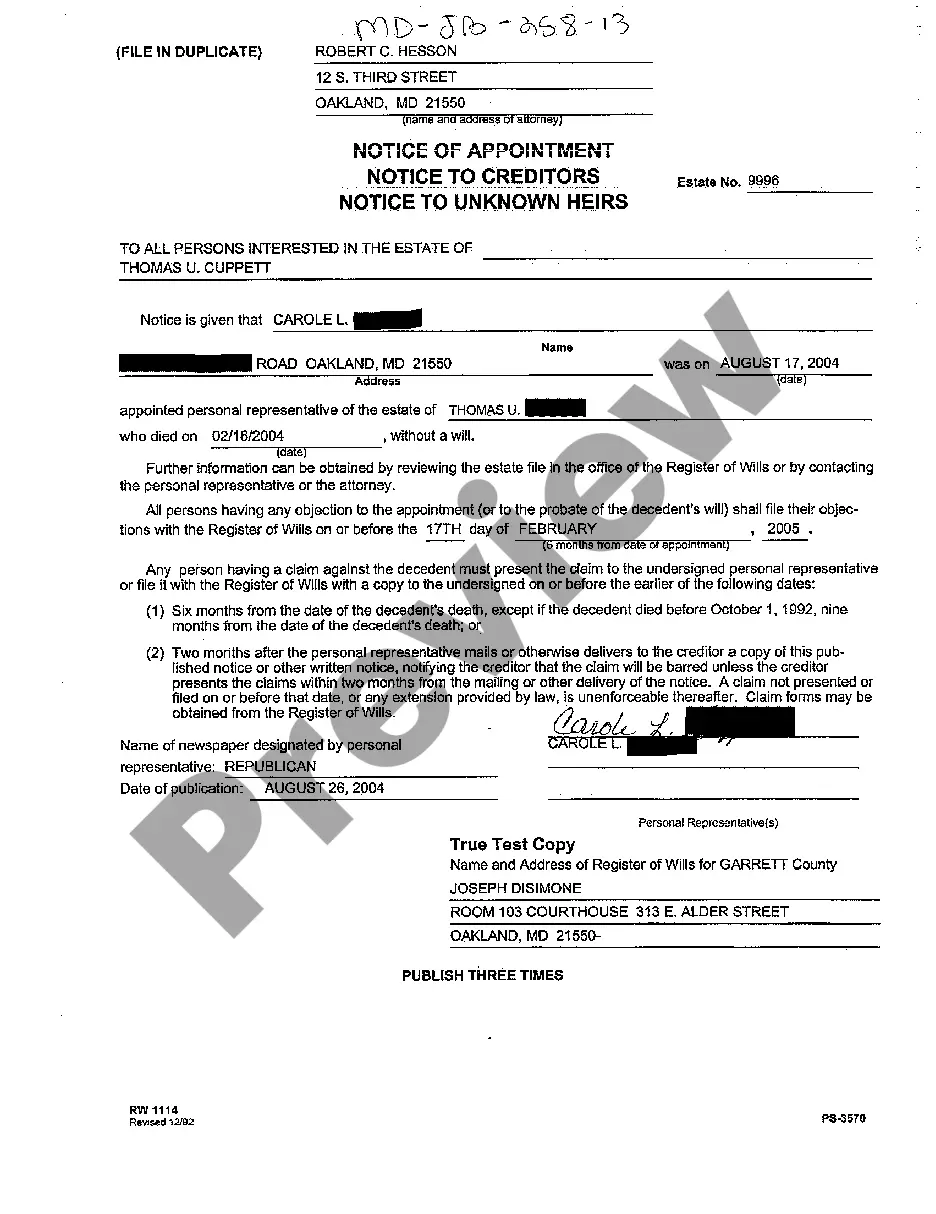

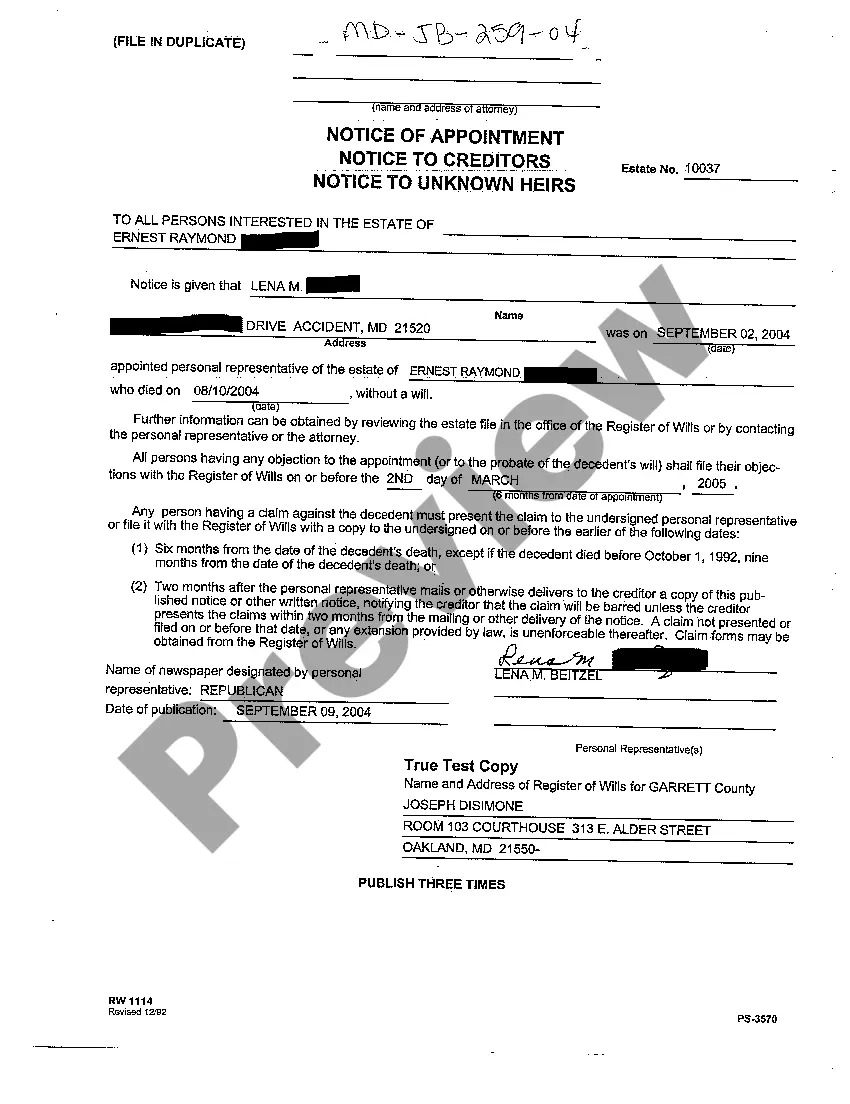

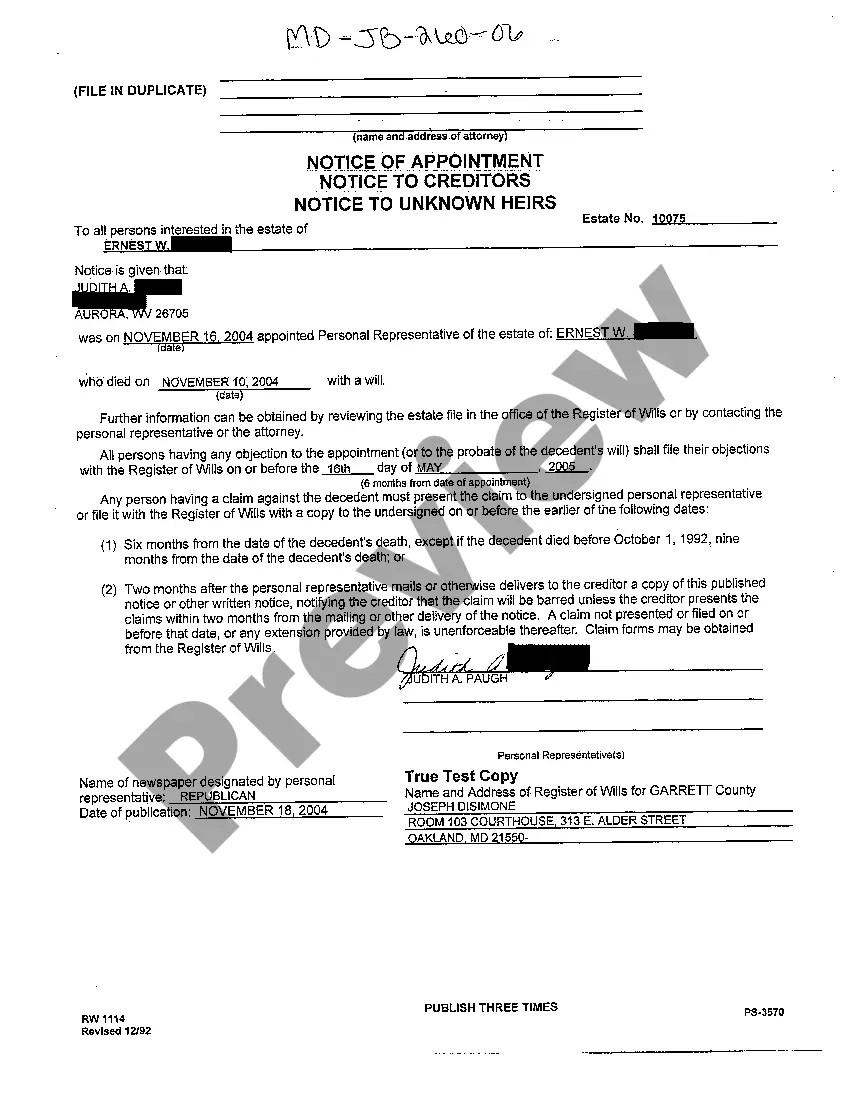

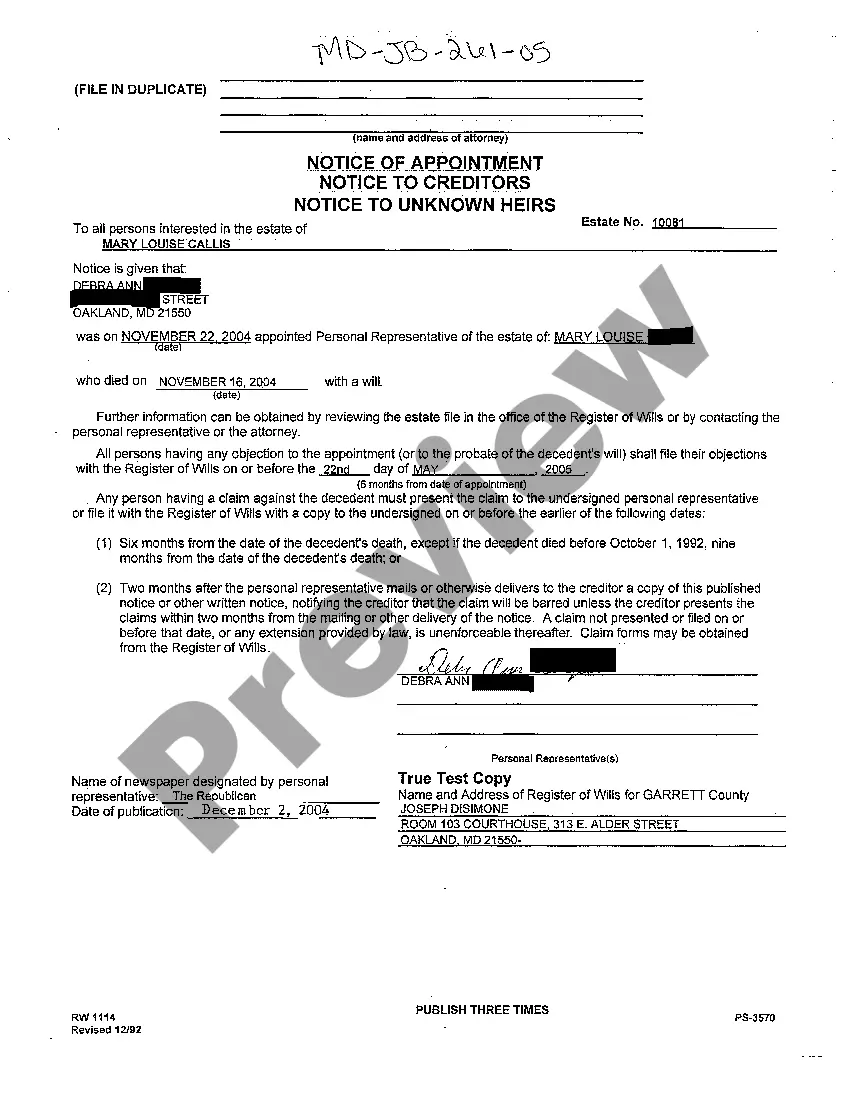

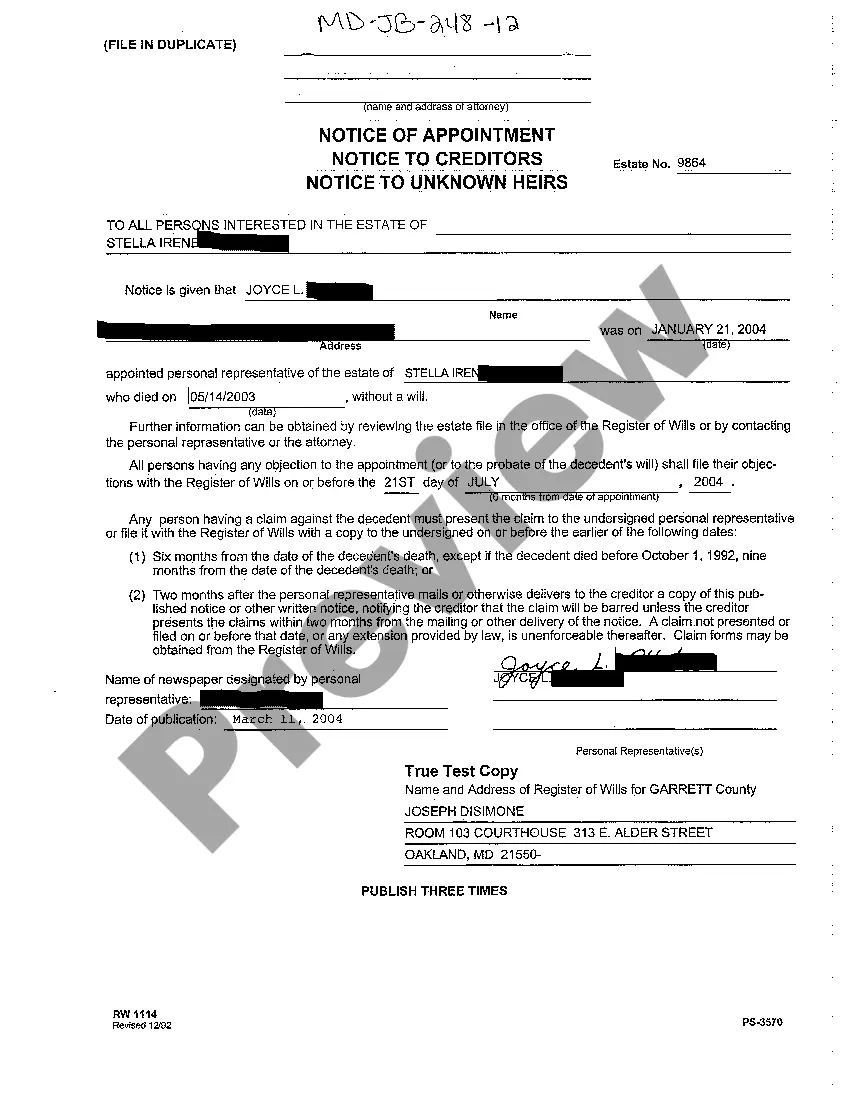

Maryland Notice of Appointment of Personal Representative to Creditors and Unknown Heirs

Description

How to fill out Maryland Notice Of Appointment Of Personal Representative To Creditors And Unknown Heirs?

You are invited to the most crucial legal documents repository, US Legal Forms. Here you can discover any template including Maryland Notice of Appointment of Personal Representative to Creditors and Unknown Heirs forms and save them (as many as you want/require). Create official documents in just a few hours, instead of days or weeks, without having to spend a fortune on a legal advisor.

Obtain the state-specific template in just a few clicks and be assured knowing that it was prepared by our state-certified legal experts.

If you’re already a registered user, simply Log Into your account and click Download next to the Maryland Notice of Appointment of Personal Representative to Creditors and Unknown Heirs you need.

- Since US Legal Forms is internet-based, you’ll always have access to your stored templates, regardless of the device you’re using.

- Find them in the My documents section.

- If you don't have an account yet, what are you waiting for.

- Follow the instructions below to get started.

- If this is a state-specific document, verify its applicability in the state where you reside.

- Check the description (if available) to determine if it’s the right template.

- Explore more content using the Preview feature.

- If the document meets all of your requirements, simply click Buy Now.

- To create an account, select a pricing plan.

- Use a credit card or PayPal account to subscribe.

- Download the document in the format you need (Word or PDF).

- Print the document and fill it out with your/your business’s details.

- After you’ve completed the Maryland Notice of Appointment of Personal Representative to Creditors and Unknown Heirs, send it to your attorney for verification. This extra step is crucial for ensuring you’re fully protected.

- Join US Legal Forms today and gain access to a large number of reusable examples.

Form popularity

FAQ

After a loved one dies, his or her estate must be settled. While most people want the settlement process to be done ASAP, probate in Maryland, including Howard County, can take between 9 to 18 months, presuming there is no challenges to a Will or any litigation.

Maryland is a reasonable compensation state for executor fees. Maryland executor compensation has a restriction, though. Maryland executor fees, by law, should not exceed certain amounts. Reasonable compensation is not to exceed 9% if less than $20,000; and $1,800 plus 3.6% of the excess over $20,000.

You can administer an estate even if the deceased died without a will or failed to specify an executor. If your relationship to the deceased doesn't make you the probate court's default choice for administrator, you'll need to get permission from the relatives ahead of you in the priority order.

A personal representative usually is named in a will. However, courts sometimes appoint a personal representative. Usually, whether or not the deceased left a will, the probate court will issue a finding of fact that a will has or has not been filed and a personal representative or administrator has been appointed.

Locate Documents. Record the preferences of the testator. Check status of property and accounts. Confirm beneficiaries are correct. Make a list of personal possessions. Create a schedule of assets. Make a list of credit cards and debts. Electronic access to information.

Step 1, Determine whether You are the Personal Representative. Step 2, Petition to Probate the Estate. Step 3, Make an Inventory of the Estate. Step 4, Assess any projected Inheritance Taxes. Step 5, Consolidate the Estate and Manage Expenses.

The Maryland statutes say that the maximum personal representative fee is 9 percent of the estate's value if the estate is worth $20,000 or less. That would equal $900 on a $10,000 estate. The fee is $1,800 for estates greater than $20,000, plus 3.6 percent of the estate's value over $20,000.

Determine Your Priority for Appointment. Receive Written Waivers From Other Candidates. Contact Court in the County Where Deceased Resided. File the Petition for Administration. Attend the Probate Hearing. Secure a Probate Bond.

An executor is someone named in your will, or appointed by the court, who is given the legal responsibility to take care of any remaining financial obligations. Typical duties include: Distributing assets according to the will. Maintaining property until the estate is settled (e.g., upkeep of a house)