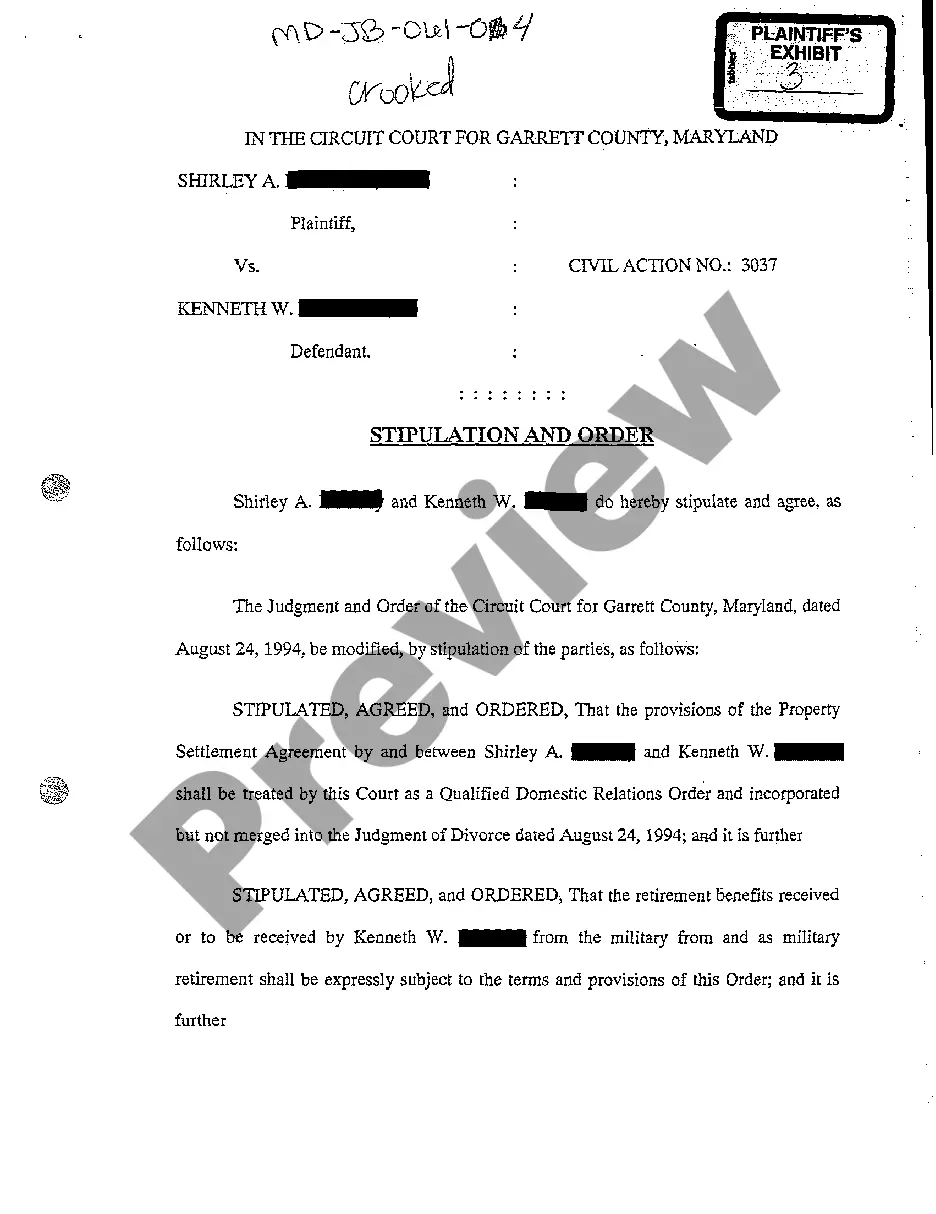

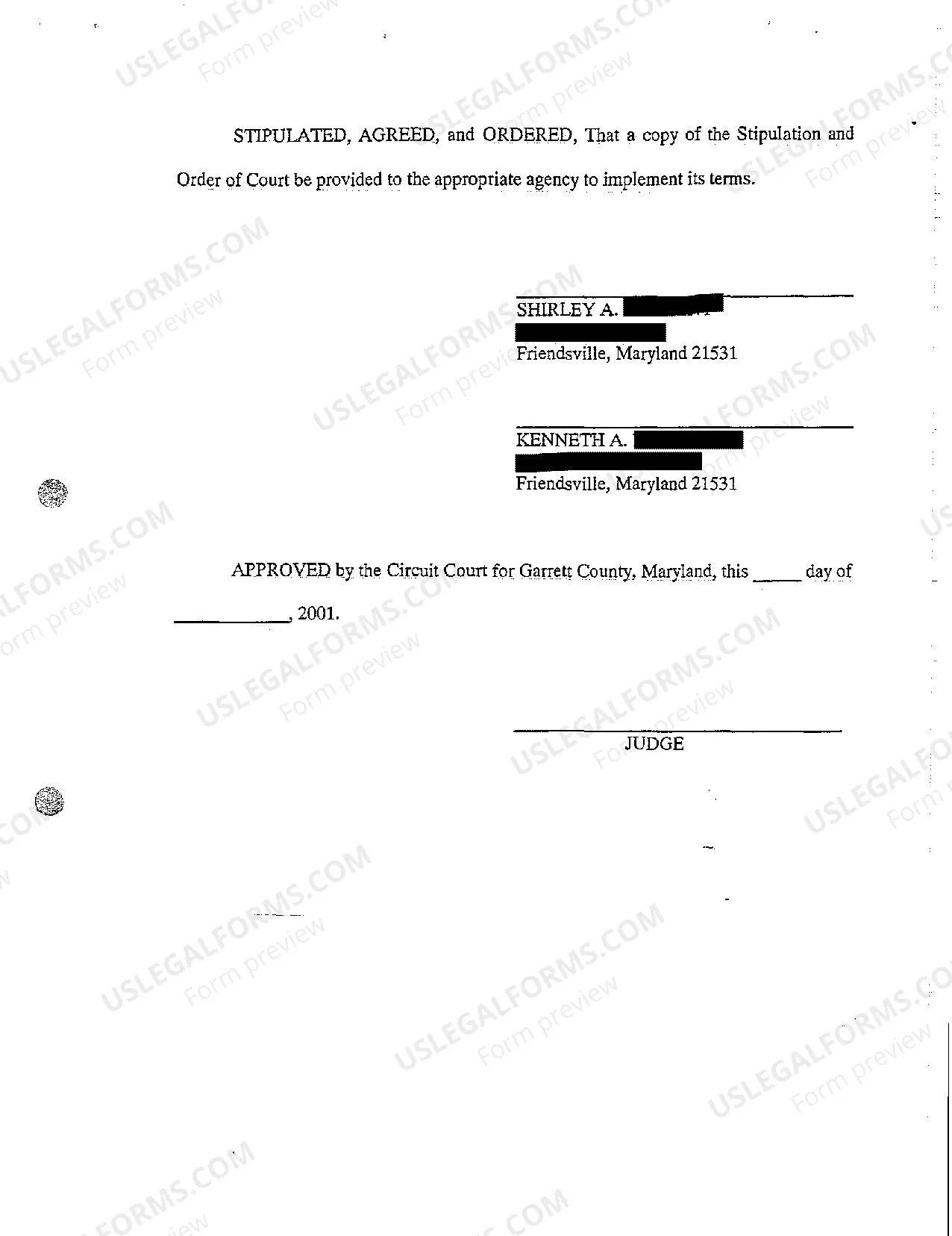

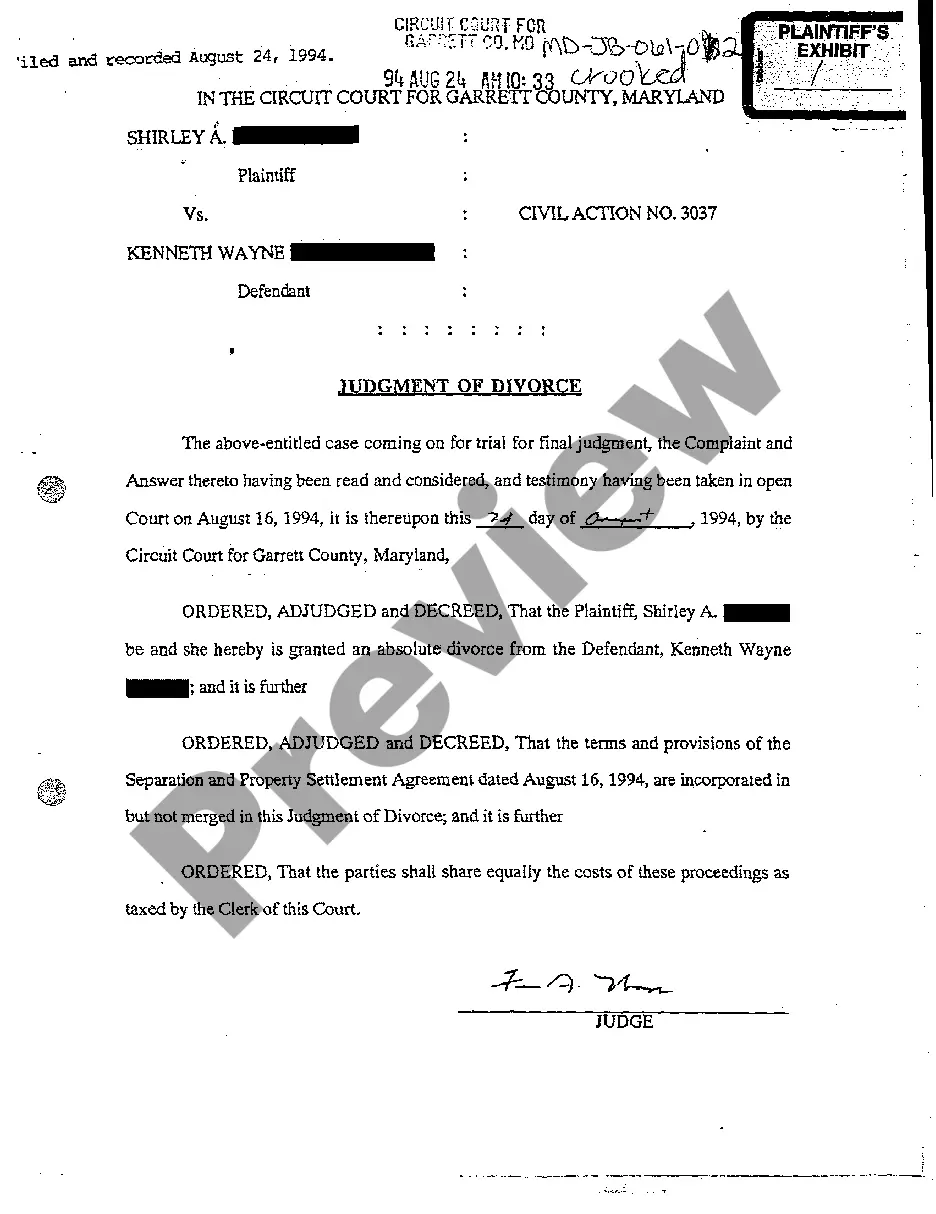

Maryland Stipulation and Order that Retirement Benefits be Paid Out in Accordance with Divorce Decree

Description

How to fill out Maryland Stipulation And Order That Retirement Benefits Be Paid Out In Accordance With Divorce Decree?

You are invited to the largest legal forms repository, US Legal Forms. Here you can locate any example including Maryland Stipulation and Order for Retirement Benefits to be Disbursed per Divorce Decree forms and retain them (as many as you desire/require). Craft official paperwork in hours, instead of days or weeks, without overpaying for a lawyer or attorney.

Obtain the state-specific example in just a few clicks and feel assured that it has been prepared by our credentialed legal experts.

If you’re already a subscribed member, simply Log In to your profile and then click Download next to the Maryland Stipulation and Order for Retirement Benefits to be Disbursed per Divorce Decree you wish to procure. Since US Legal Forms operates online, you’ll typically have access to your saved templates, regardless of the device you’re accessing them from. View them in the My documents section.

Print the document and fill it out with your or your business’s details. Once you’ve completed the Maryland Stipulation and Order for Retirement Benefits to be Disbursed per Divorce Decree, forward it to your attorney for validation. It’s an additional step, but a necessary one to ensure that you’re fully protected. Join US Legal Forms today and gain access to thousands of reusable templates.

- If you have yet to create an account, what are you waiting for.

- Verify its validity in your residing state if this is a state-specific document.

- Examine the description (if available) to determine if it’s the correct template.

- Check out additional content with the Preview feature.

- If the document satisfies all your needs, simply click Buy Now.

- To create an account, choose a subscription plan.

- Utilize a credit card or PayPal account to register.

- Store the document in your preferred format (Word or PDF).

Form popularity

FAQ

In Maryland, the statute of limitations for filing a QDRO after a divorce is generally three years. It is crucial to act quickly to secure your rights to the retirement benefits specified. Referencing the Maryland Stipulation and Order that Retirement Benefits be Paid Out in Accordance with Divorce Decree can guide your actions in this matter.

To protect your pension after divorce, consider obtaining a QDRO, which stipulates how pension benefits will be divided. You might also want to discuss your specific situation with a legal professional to ensure compliance with the Maryland Stipulation and Order that Retirement Benefits be Paid Out in Accordance with Divorce Decree.

Yes, pensions are classified as marital property in Maryland. Therefore, they can be subject to division during divorce. It is important to negotiate the terms of the Maryland Stipulation and Order that Retirement Benefits be Paid Out in Accordance with Divorce Decree to protect your financial interests.

In many cases, you may be entitled to a portion of your husband's pension in a divorce. Maryland law permits courts to divide pension benefits accumulated during the marriage. Utilizing the Maryland Stipulation and Order that Retirement Benefits be Paid Out in Accordance with Divorce Decree can help ensure that your rights are upheld.

Yes, a 401k is considered marital property in Maryland. This means that it can be divided during divorce proceedings. The Maryland Stipulation and Order that Retirement Benefits be Paid Out in Accordance with Divorce Decree can facilitate the fair allocation of these assets.

Pensions in Maryland are often split through a Qualified Domestic Relations Order (QDRO). This legal order allows the court to direct the pension plan administrator to distribute retirement benefits. The Maryland Stipulation and Order that Retirement Benefits be Paid Out in Accordance with Divorce Decree may include provisions for this division, ensuring a smooth transition.

In Maryland, a pension may be considered marital property during a divorce. This means that it could be subject to division based on the Maryland Stipulation and Order that Retirement Benefits be Paid Out in Accordance with Divorce Decree. To protect your pension, it is crucial to understand how it will be handled in the settlement process.

Yes, under certain conditions, your ex-wife can claim a portion of your retirement benefits even years after your divorce. This situation often arises if a Maryland Stipulation and Order that Retirement Benefits be Paid Out in Accordance with Divorce Decree was not properly established or executed. It's critical to review your divorce decree and any related documents to ensure compliance. For a clear understanding of your rights and obligations, consider consulting with professionals or utilizing platforms like US Legal Forms to access necessary legal documents and resources.

In Maryland, pensions are typically divided using a method that considers the duration of the marriage and the employee’s years of service. The division occurs through a Qualified Domestic Relations Order (QDRO), as outlined in the Maryland Stipulation and Order that Retirement Benefits be Paid Out in Accordance with Divorce Decree. This approach helps ensure an equitable distribution of retirement assets. For those seeking assistance, USLegalForms provides resources and templates that support this process.

A Qualified Domestic Relations Order (QDRO) is a legal order that divides retirement benefits between spouses during a divorce. It allows one spouse to receive a portion of the other’s retirement plan, guided by the Maryland Stipulation and Order that Retirement Benefits be Paid Out in Accordance with Divorce Decree. This process ensures a fair division of assets while adhering to legal standards. Using platforms like USLegalForms can simplify the QDRO preparation and submission process.