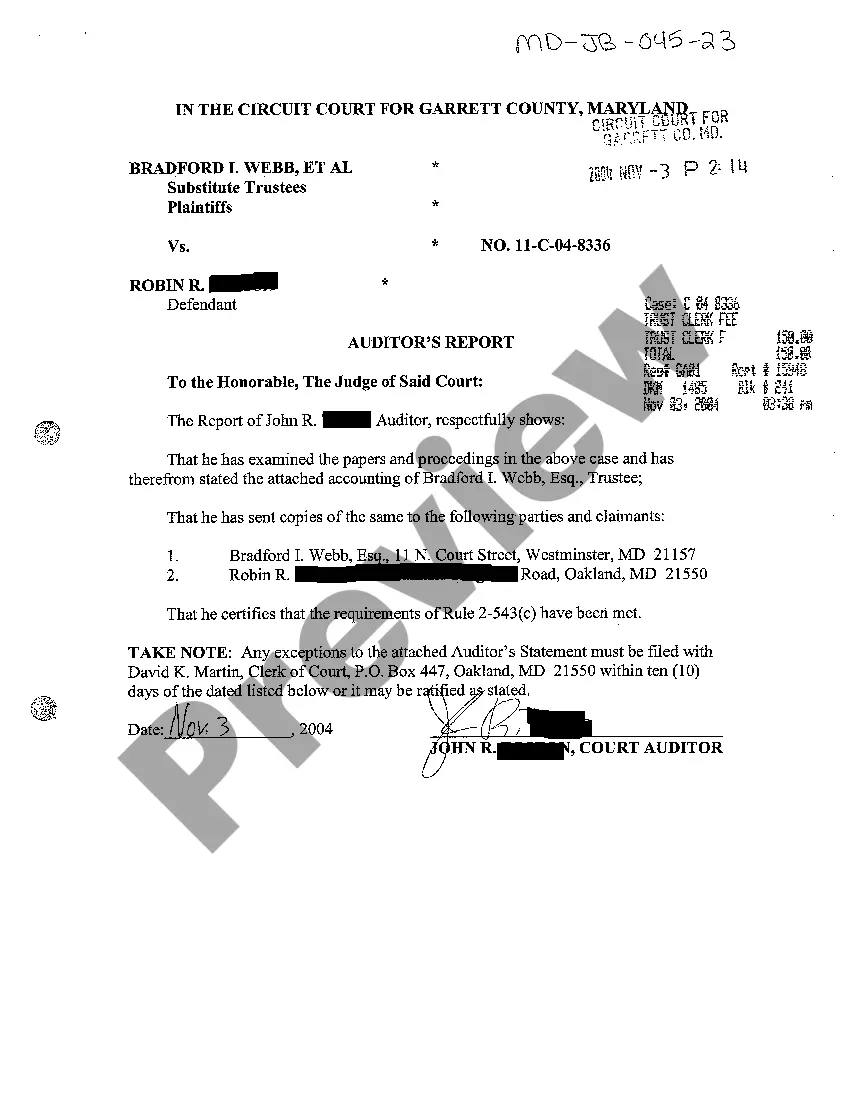

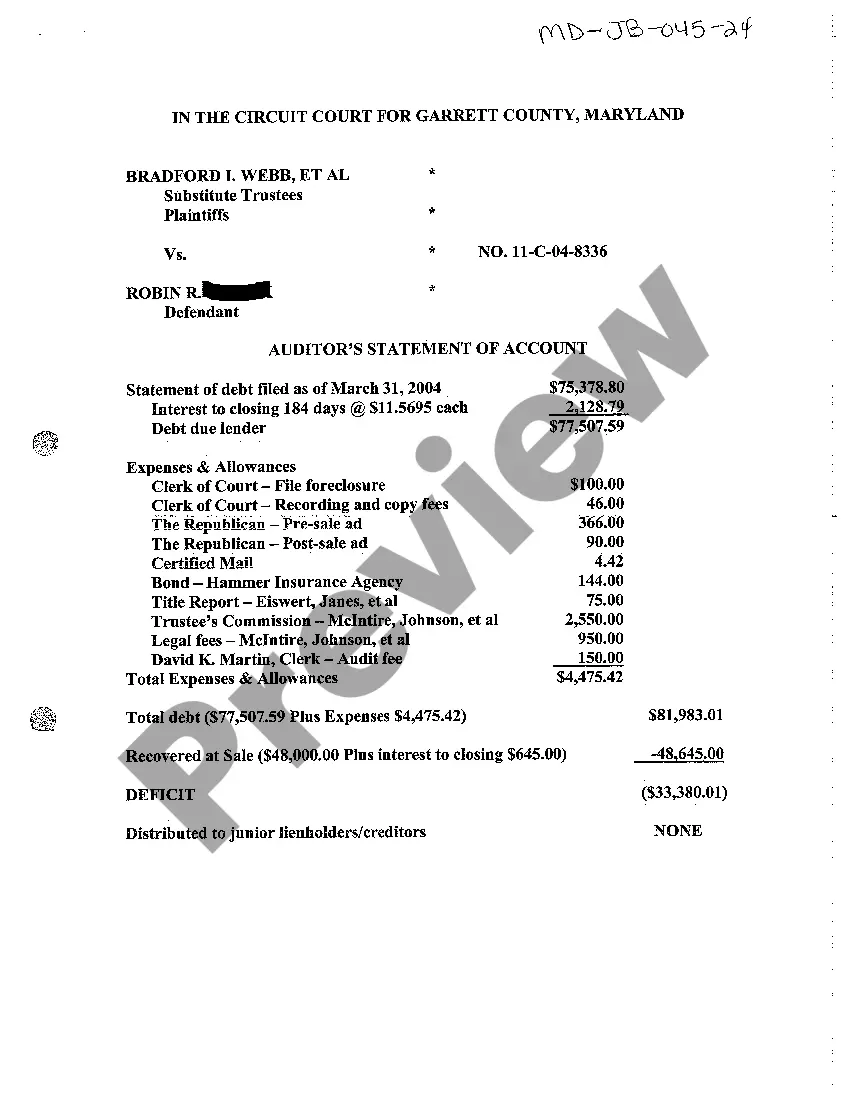

Maryland Auditor's Statement of Account

Description

How to fill out Maryland Auditor's Statement Of Account?

You are invited to the most important legal documents collection, US Legal Forms.

Here you can discover any template including Maryland Auditor's Statement of Account templates and acquire them (as many as you desire/require).

Prepare official documents in a few hours, rather than days or weeks, without spending a fortune on a legal advisor.

If the template meets all your needs, click Buy Now. To create your account, choose a pricing plan. Use a credit card or PayPal account to subscribe. Save the document in your preferred format (Word or PDF). Print the file and complete it with your or your business’s information. After finishing the Maryland Auditor's Statement of Account, send it to your attorney for validation. It’s an extra step but a crucial one to ensure you’re completely protected. Register for US Legal Forms today and access thousands of reusable templates.

- Obtain your state-specific template with just a few clicks and feel confident knowing it was crafted by our state-certified legal experts.

- If you’re already a subscribed user, just Log In to your account and then click Download next to the Maryland Auditor's Statement of Account you wish.

- Since US Legal Forms is an online service, you will always have access to your downloaded forms, regardless of the device you’re using.

- You can find them within the My documents section.

- If you haven't yet created an account, what are you waiting for? Review our guidelines below to get started.

- If this is a state-specific form, confirm its validity in the state where you reside.

- Review the description (if available) to understand if it’s the appropriate example.

- View additional content with the Preview feature.

Form popularity

FAQ

The best way to identify the auditor of a publicly traded company is to check the company's most recent filings using our EDGAR database of corporate filings. You'll find the identity of the company's auditor in its annual report on Form 10-K. Look for the "Accountant's Report" under Item 8 of the Form 10-K.

Internal auditors go beyond traditional financial reporting.Internal auditors also evaluate whether the company's activities comply with its strategy, and they may consult on a variety of financial issues as they arise within the company. In contrast, external auditors focus solely on the financial statements.

What types of evidence does an auditor examine to verify the accuracy of your financial statements? Typically, auditors obtain evidence through inspection (of documents or tangible assets, for example), inquiries, observation, third-party confirmations, testing of selected transactions and other procedures.

Every business keeps records of its operations and transactions, and accountants take this information to produce four basic financial statements: a profit and loss statement, balance sheet, statement of cash flows and statement of changes in owners' equity.

The purpose of a financial statement audit is to add credibility to the reported financial position and performance of a business. The Securities and Exchange Commission requires that all entities that are publicly held must file annual reports with it that are audited.

Fully audited statements are subjected to the most intense scrutiny to verify accuracy and correctness. The following procedures are usually found in a fully audited income statement, balance sheet, cash flow statement and statement of changes in owners' equity: Cash: Send confirmations to banks to confirm balances.

An audited financial statement is any financial statement that a certified public accountant (CPA) has audited. When a CPA audits a financial statement, they will ensure that the statement adheres to general accounting principles and auditing standards.

The auditor's report must accompany the financial statements when they are issued to the intended recipients. The purpose of a financial statement audit is to add credibility to the reported financial position and performance of a business.

Fully audited statements are subjected to the most intense scrutiny to verify accuracy and correctness. The following procedures are usually found in a fully audited income statement, balance sheet, cash flow statement and statement of changes in owners' equity: Cash: Send confirmations to banks to confirm balances.