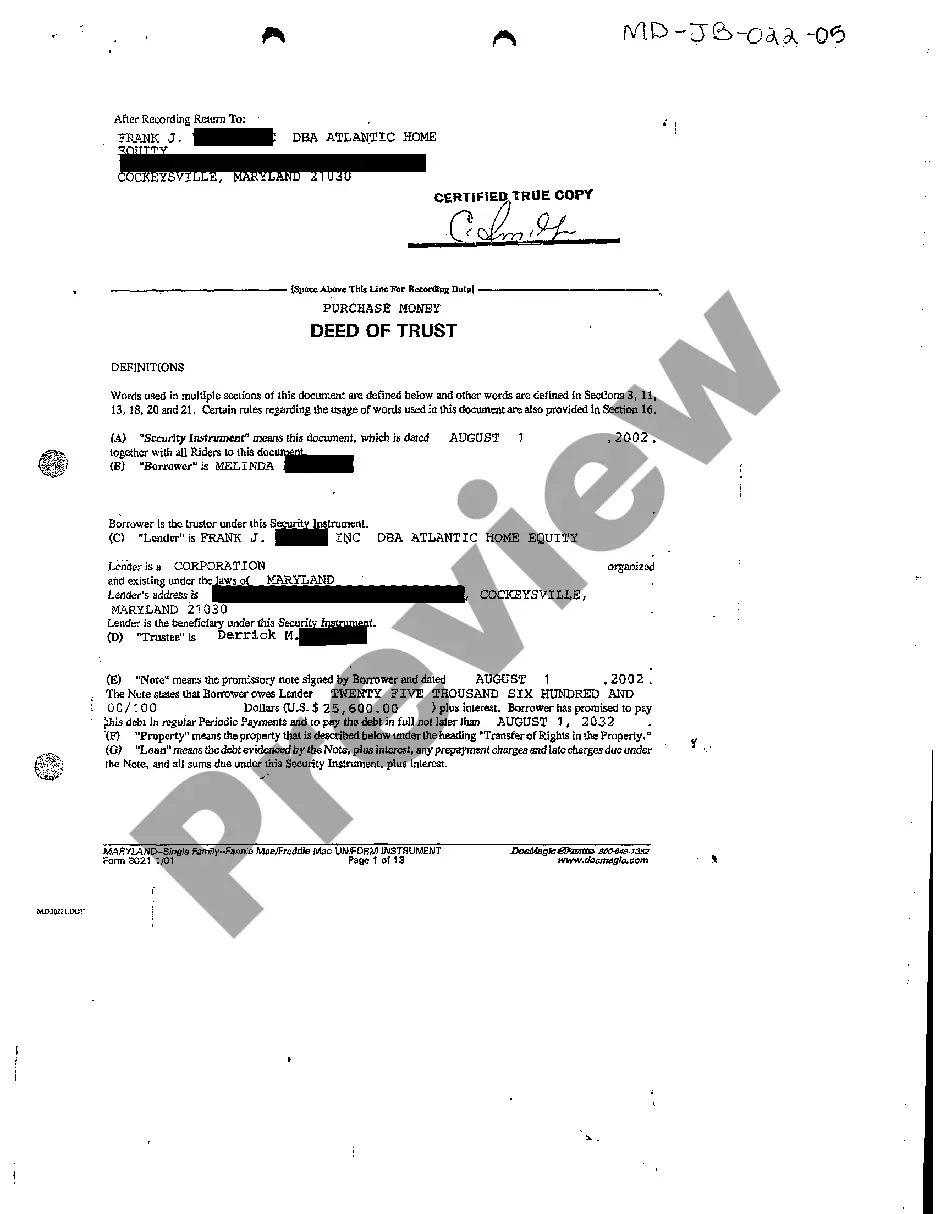

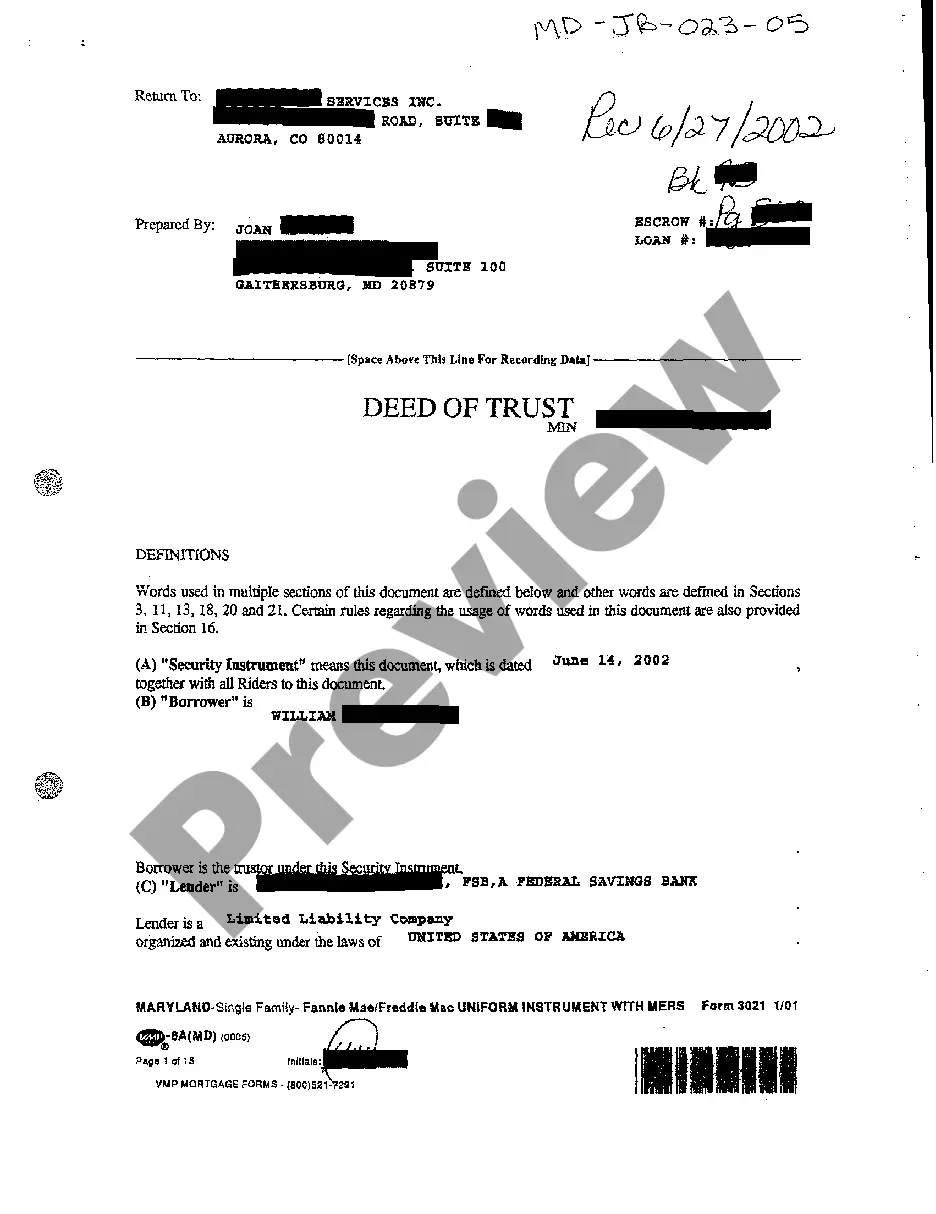

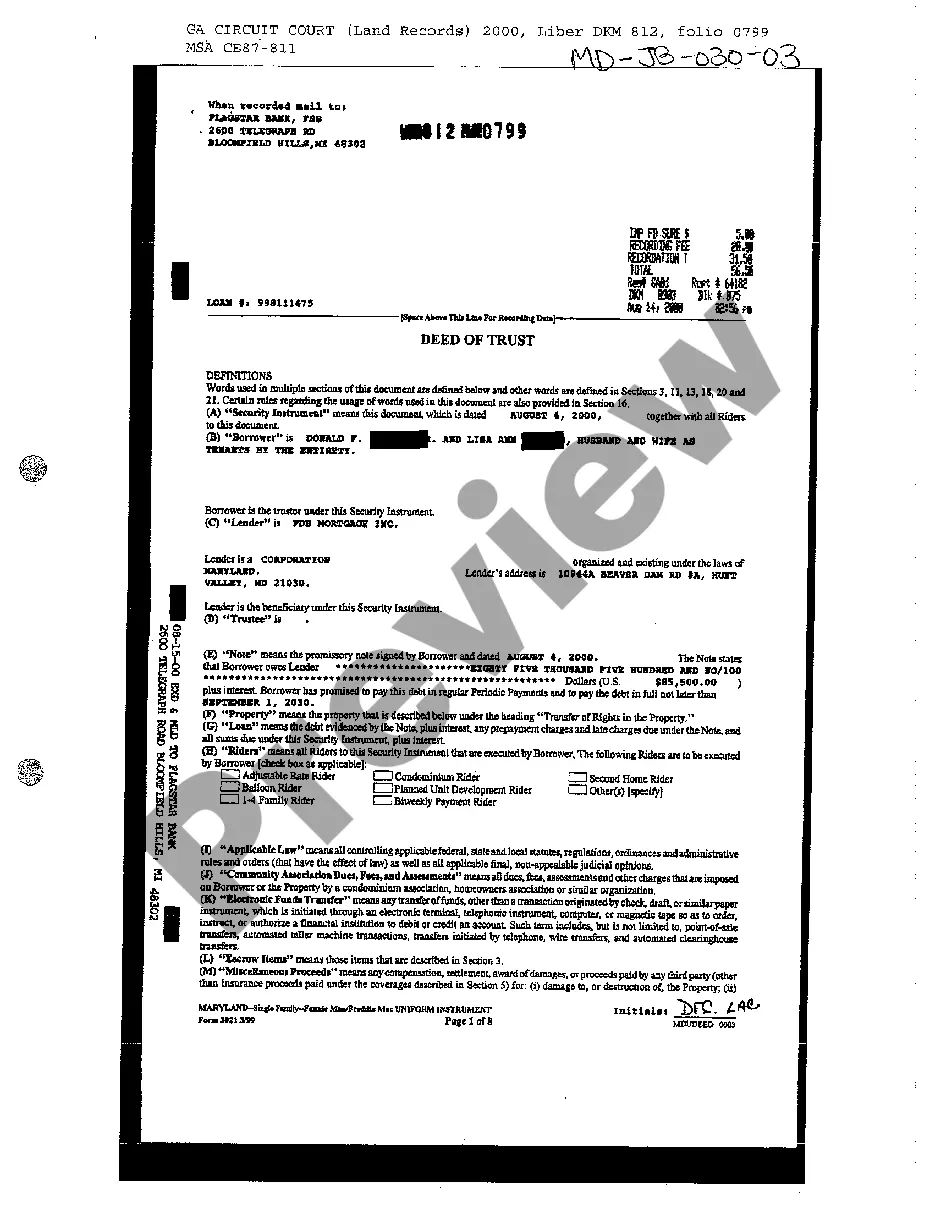

Maryland Deed of Trust

Description

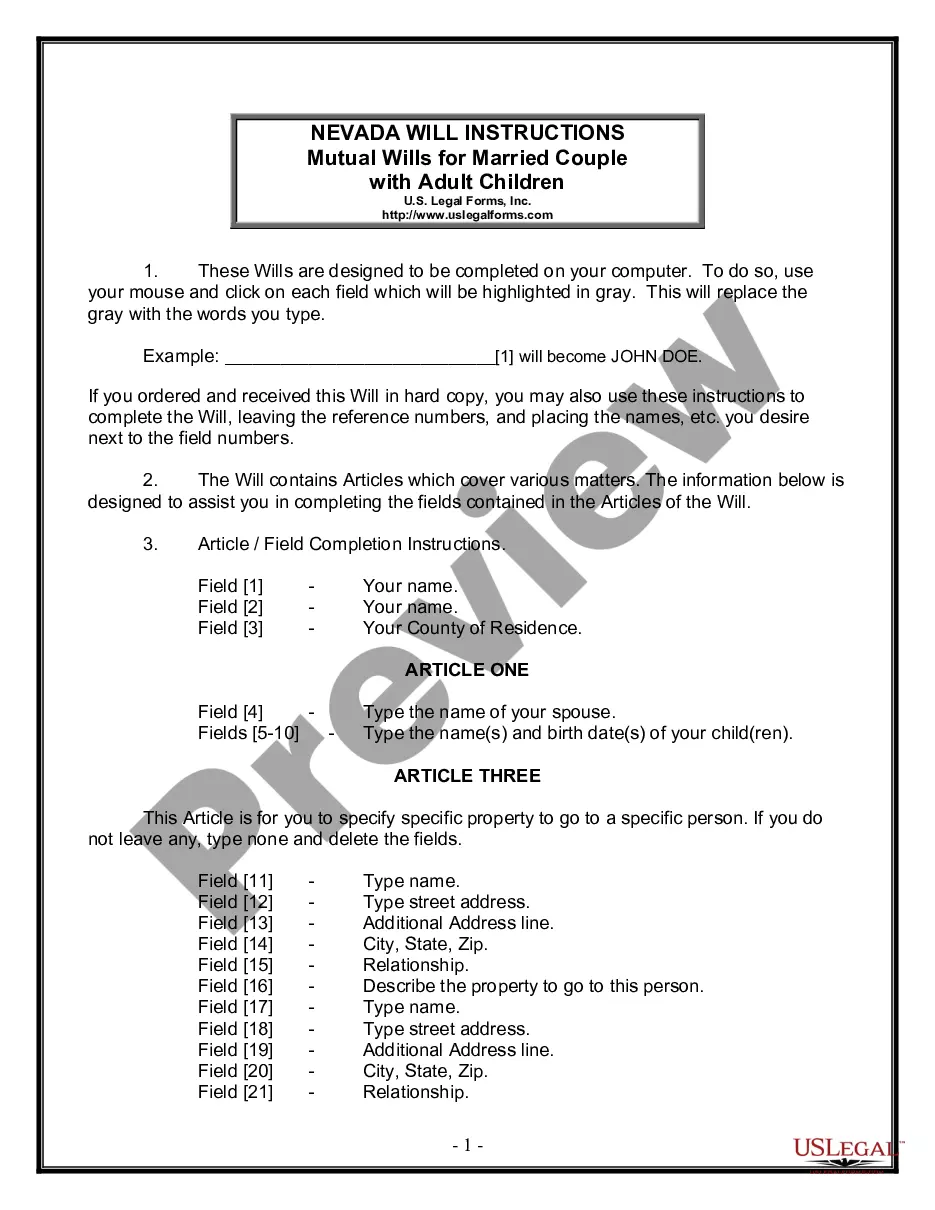

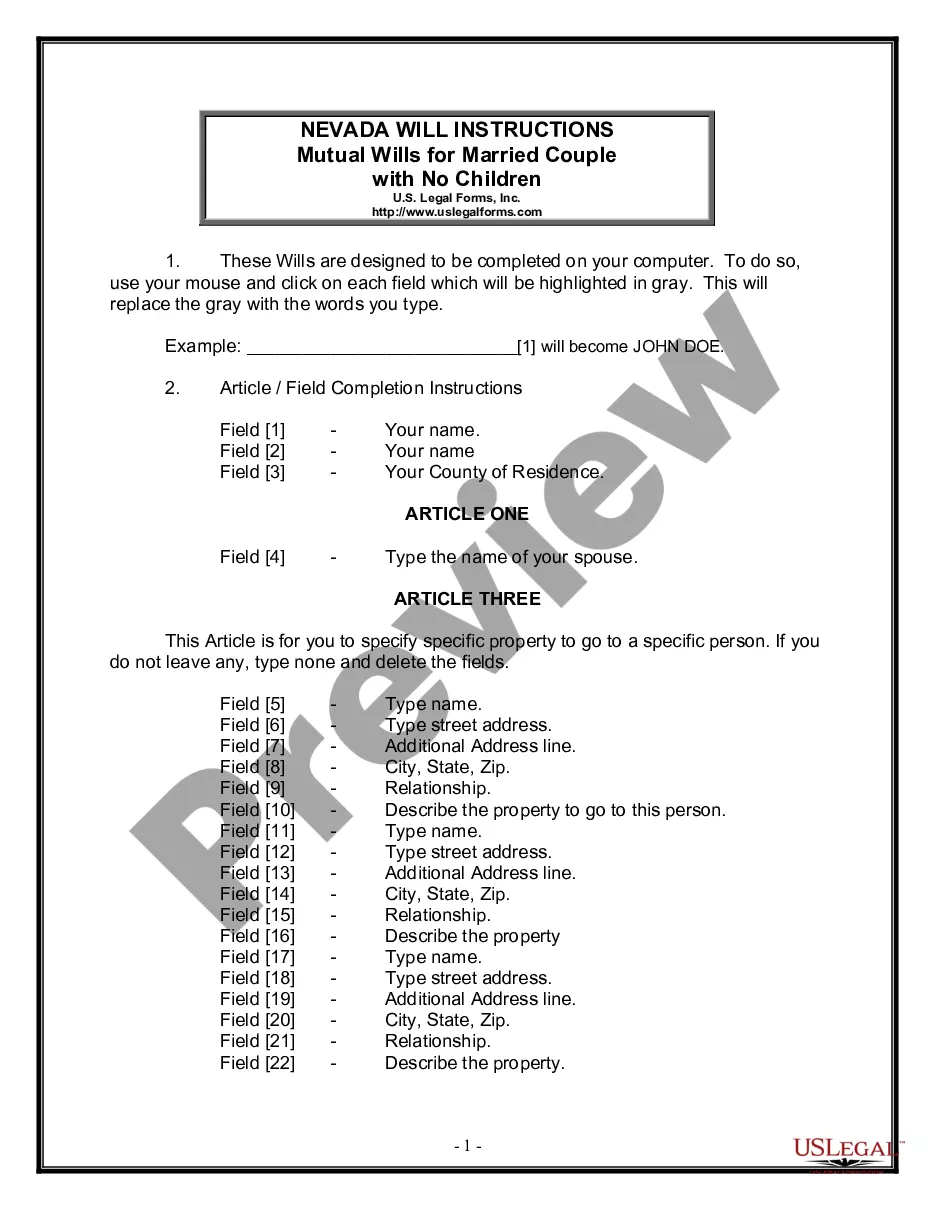

How to fill out Maryland Deed Of Trust?

You are invited to the finest legal documents repository, US Legal Forms.

Here, you can locate any template including Maryland Deed of Trust forms and download them (as numerous as you desire).

Prepare formal documents within a few hours, instead of days or even weeks, without incurring substantial costs with an attorney.

If the template meets all of your requirements, simply click Buy Now. To create an account, choose a subscription plan. Use a credit card or PayPal account to register. Save the template in your preferred format (Word or PDF). Print the document and fill it with your or your company’s information. Once you’ve completed the Maryland Deed of Trust, send it to your attorney for validation. It’s an additional step but a crucial one to ensure you’re fully protected. Join US Legal Forms today and gain access to countless reusable templates.

- Obtain the state-specific form in just a few clicks and feel confident knowing that it was prepared by our experienced legal experts.

- If you’re already a registered user, simply Log In to your account and click Download next to the Maryland Deed of Trust you require.

- Because US Legal Forms is cloud-based, you’ll always have access to your downloaded forms, regardless of the device you’re using.

- Find them in the My documents section.

- If you do not have an account yet, what are you waiting for? Follow our guidelines below to begin.

- If this is a state-specific template, verify its validity in the state where you reside.

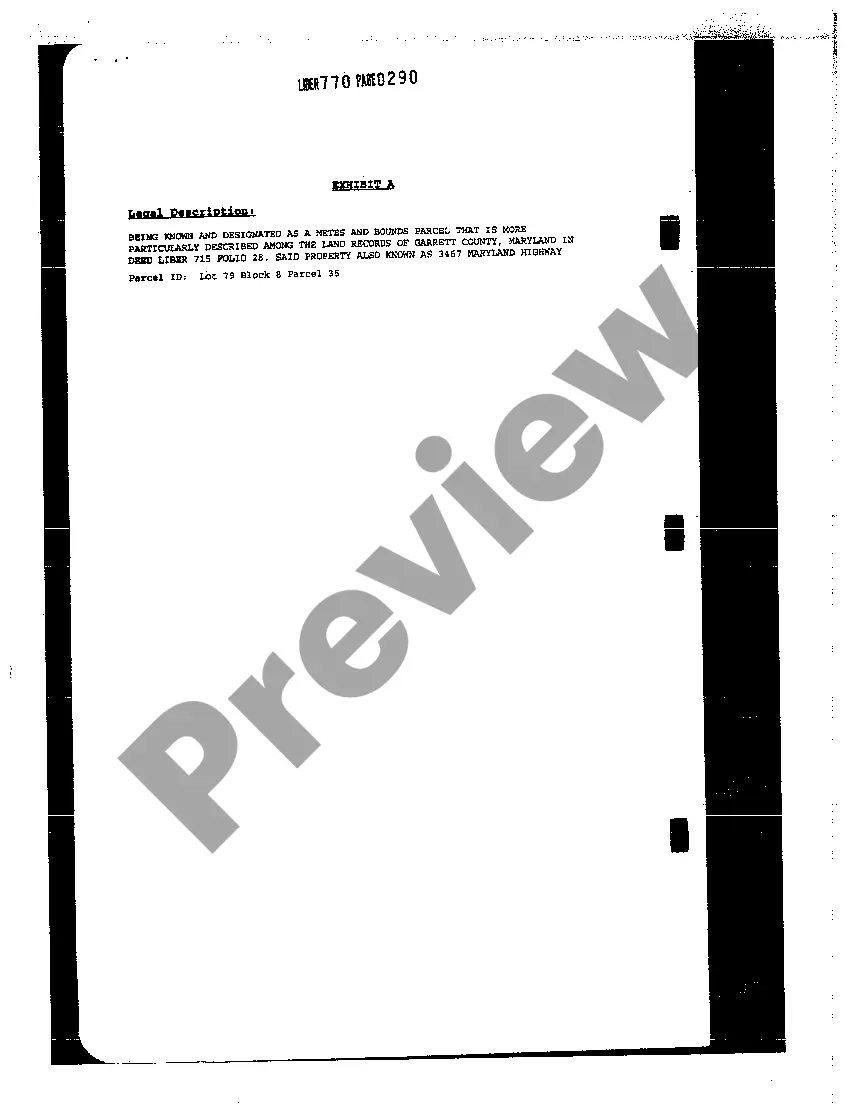

- Review the description (if available) to determine if it’s the correct sample.

- View more details with the Preview feature.

Form popularity

FAQ

Under Maryland Real Property §7-105 and Maryland Rule 14-214(b)(2), corporate trustees may not exercise the power of sale. An individual (i.e., a natural person) appointed as trustee in a deed of trust or as a substitute trustee shall conduct the sale of property subject to a deed of trust.

A deed of trust acts as an agreement between youthe homebuyerand your lender. It states not just that you'll repay the loan, but that a third party called the trustee will hold legal title to the property until you do. A deed of trust is the security for your loan, and it's recorded in the public records.

The following states may use either Mortgage Agreements or Deed of Trusts: Colorado, Idaho, Illinois, Iowa, Maryland, Montana, Nebraska, Oklahoma, Oregon, Tennessee, Texas, Utah, Wyoming, Washington, and West Virginia.

As you stated in your question, it is recorded among the land records, and your lender keeps the original. When you pay off the loan, the lender will return the deed of trust with the promissory note. This document is rather lengthy and quite legalistic.