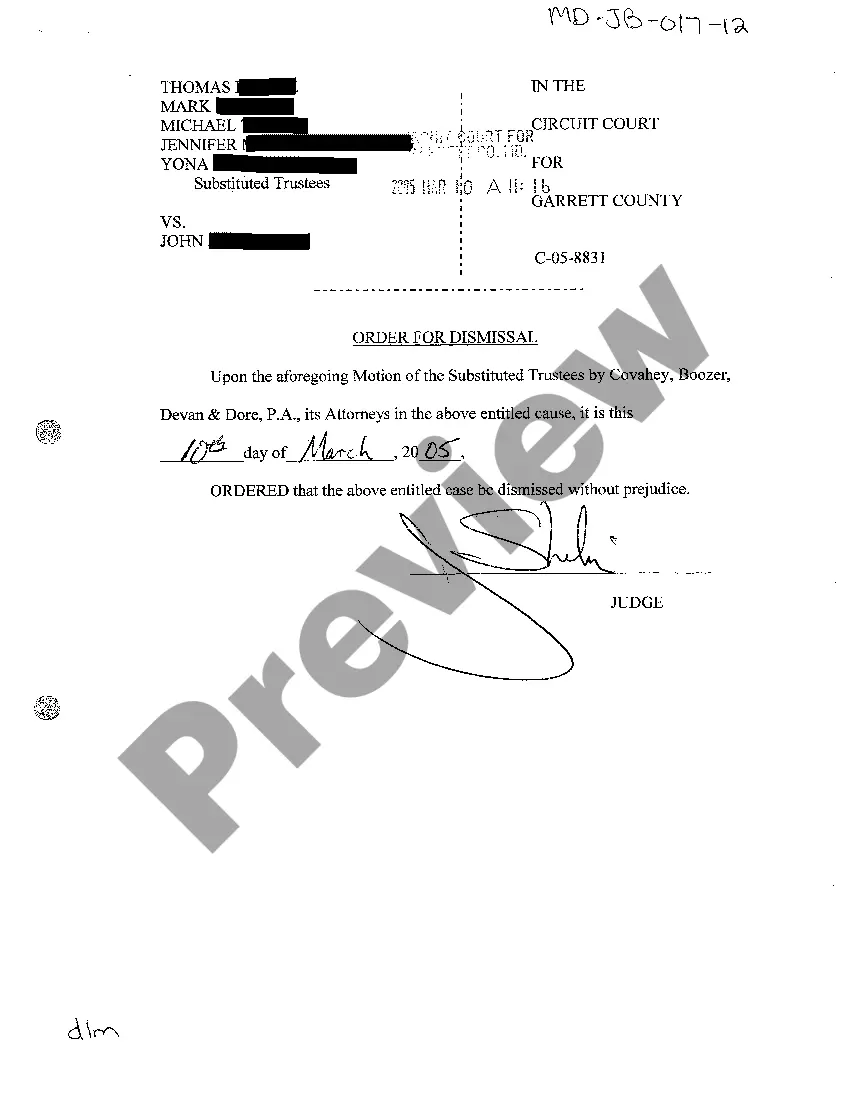

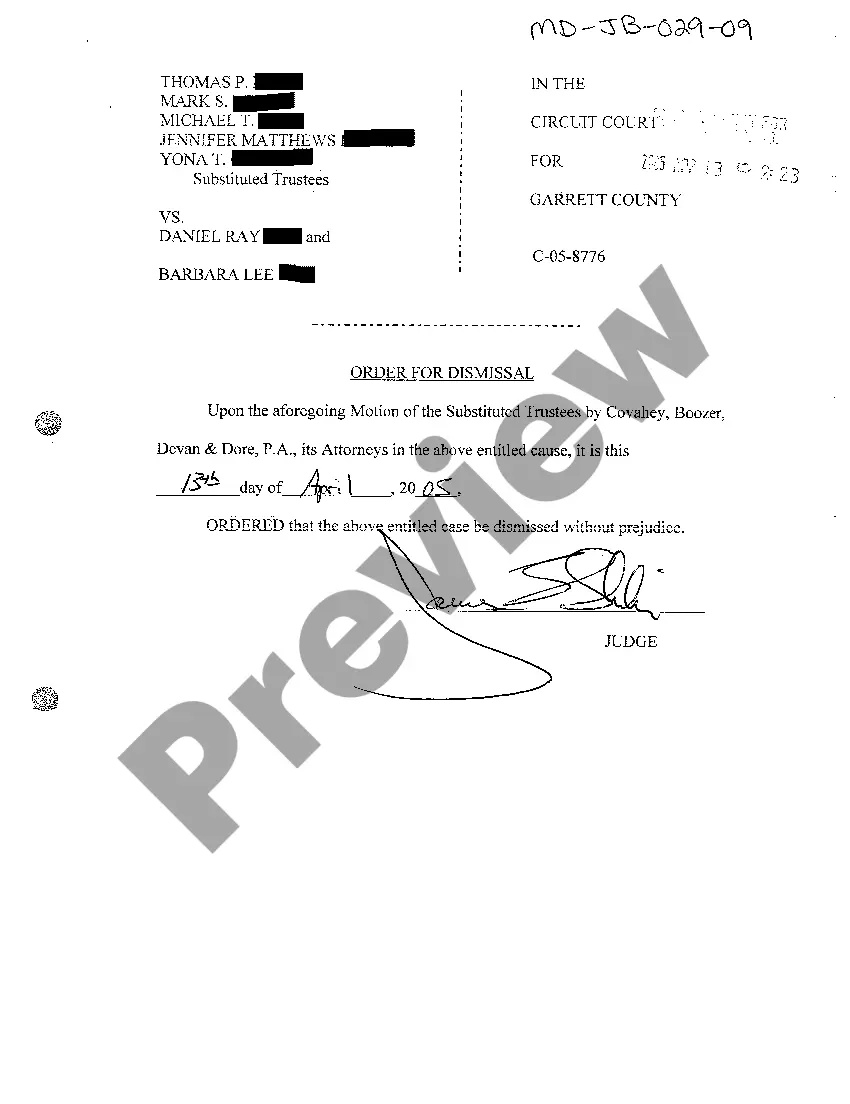

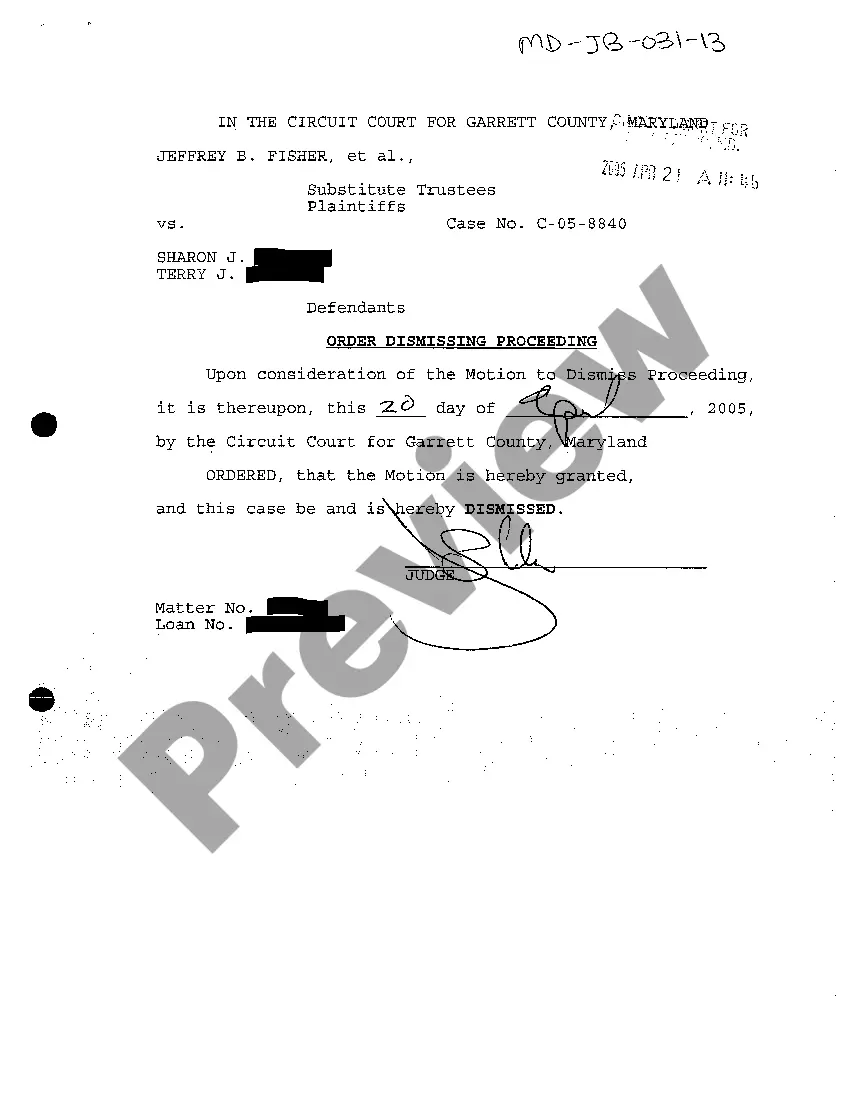

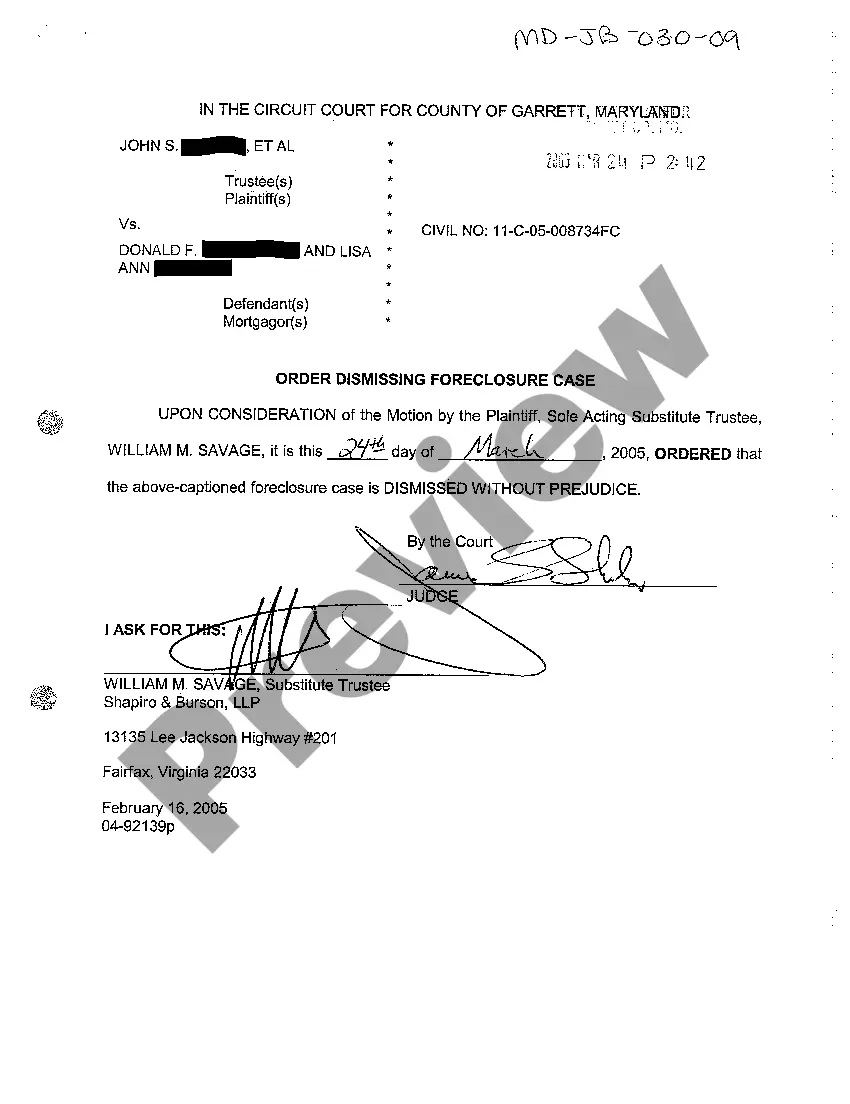

Maryland Order Dismissing Foreclosure Case

Description

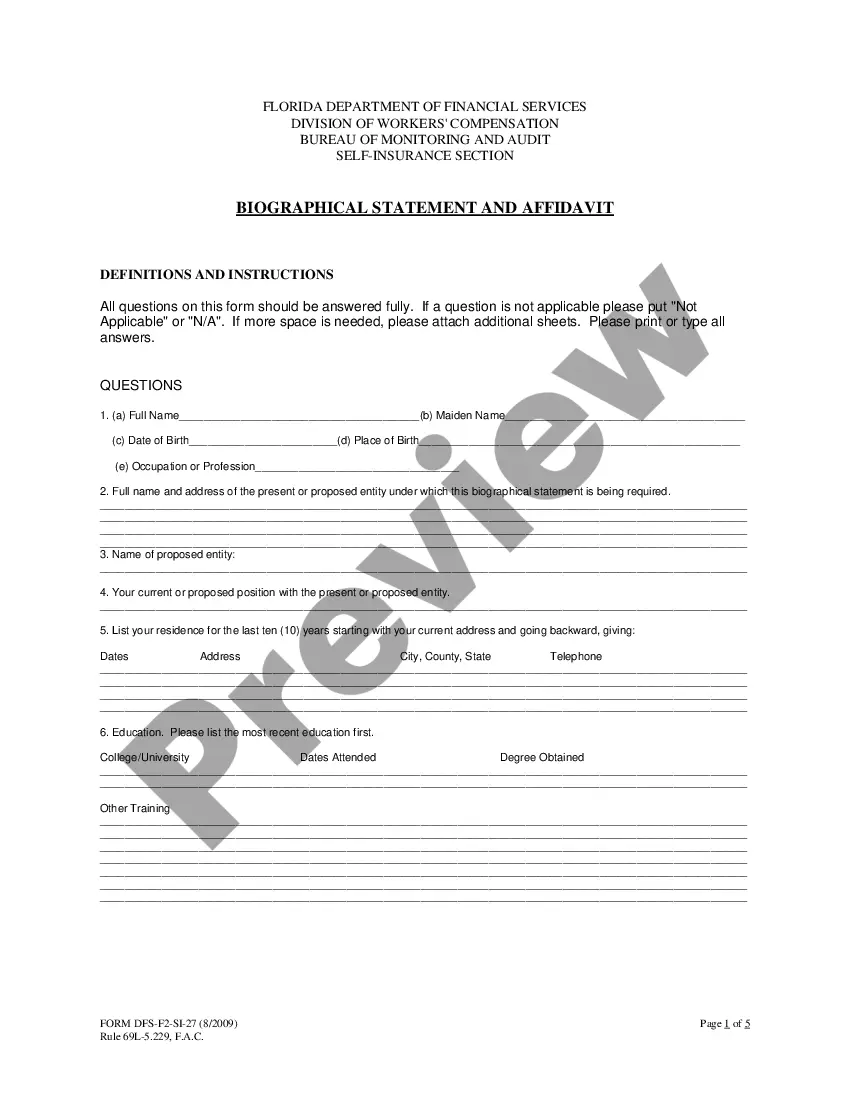

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maryland Order Dismissing Foreclosure Case?

Greetings to the most extensive collection of legal documents, US Legal Forms. Here, you can discover any sample including Maryland Order Dismissing Foreclosure Case paperwork and keep them (as many as you desire). Prepare official documents in just a few hours, not days or weeks, without incurring high expenses with a lawyer. Obtain your state-specific template in just a few clicks and feel assured knowing it was created by our certified attorneys.

If you're already a subscribed user, simply sign in to your account and then click Download next to the Maryland Order Dismissing Foreclosure Case you require. Since US Legal Forms is online-based, you’ll always have access to your downloaded templates, regardless of the device you’re using. Locate them in the My documents section.

If you don't possess an account yet, what exactly are you waiting for? Review our guidelines listed below to get started.

Once you've finalized the Maryland Order Dismissing Foreclosure Case, submit it to your attorney for approval. It’s an additional step but an essential one for ensuring you’re completely covered. Register for US Legal Forms today and gain access to thousands of reusable templates.

- If this is a state-specific document, verify its validity in the state where you reside.

- Examine the description (if available) to determine if it’s the correct template.

- View additional content using the Preview option.

- If the sample fulfills all of your needs, click Buy Now.

- To create an account, select a pricing option.

- Use a credit card or PayPal account to register.

- Store the template in the desired format (Word or PDF).

- Print the document and fill it in with your or your business’s information.

Form popularity

FAQ

You can stop the foreclosure process by informing your lender that you will pay off the default amount and extra fees. Your lender would prefer to have the money much more than they would have your home, so unless there are extenuating circumstances, this should work.

Call the Maryland HOPE hotline at 1-877-462-7555 to find a state-approved nonprofit agency that can provide individual guidance to homeowners facing foreclosure.

Foreclosure Case Dismissals A foreclosure case dismissed with prejudice can't be brought again for the same default or reasons already alleged by a lender and then dismissed by a court. When foreclosure cases are dismissed without prejudice, lenders can refile later, though, that can be expensive for them.

If you have recently lost your home to a foreclosure and the sale has already occurred, you might be able to reverse the sale or get the property back through the right of redemption.

A home foreclosure dismissed 'without prejudice' gives the lender an opportunity to get their case together. However, while the homeowner is waiting for the lender to re-file, the homeowner has time to pursue an alternative outcome, like a short sale or mortgage modification.

Foreclosure auctions are usually held at the courthouse in the county where the property is located. After a sale has taken place, it usually takes approximately 30-45 days for the sale to be ratified, however the ratification time can vary significantly from county to county.

You can stop the foreclosure process by informing your lender that you will pay off the default amount and extra fees. Your lender would prefer to have the money much more than they would have your home, so unless there are extenuating circumstances, this should work.

Dismissal. When a judge dismisses a foreclosure case, the matter closes and the foreclosure can't proceed. Judges may dismiss foreclosure cases if the lender can't prove it owns your mortgage or if the lender didn't follow the state's foreclosure procedure correctly.

Thus, just as a summary judgment is not a dismissal meaning a summary judgment should not be sought through a motion to dismiss a dismissal is not a summary judgment, and should not be sought thereby.