Maryland Commitment for Title Insurance

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maryland Commitment For Title Insurance?

You are invited to the most extensive legal documents repository, US Legal Forms. Here, you will discover any example including Maryland Commitment for Title Insurance formats and download them (as many of them as you desire/require). Prepare formal documents within a few hours, instead of days or weeks, without spending a fortune on a lawyer.

Obtain the state-specific form in a few clicks and feel confident knowing it was created by our accredited attorneys.

If you’re already a subscribed client, just Log In to your account and click Download next to the Maryland Commitment for Title Insurance you need. Because US Legal Forms operates online, you’ll always have access to your saved templates, irrespective of the device you’re using. Find them under the My documents section.

Print the document and fill it with your/your business’s information. Once you’ve completed the Maryland Commitment for Title Insurance, forward it to your attorney for verification. It’s an additional step but a vital one to ensure you’re completely protected. Register for US Legal Forms now and gain access to thousands of reusable samples.

- If you do not have an account yet, what are you waiting for.

- Review our steps below to get started.

- If this is a state-specific template, verify its relevance in your state.

- Examine the description (if available) to determine if it’s the correct format.

- View more content using the Preview feature.

- If the example meets all your criteria, simply click Buy Now.

- To create your account, select a pricing option.

- Utilize a credit card or PayPal account to register.

- Download the document in the format you need (Word or PDF).

Form popularity

FAQ

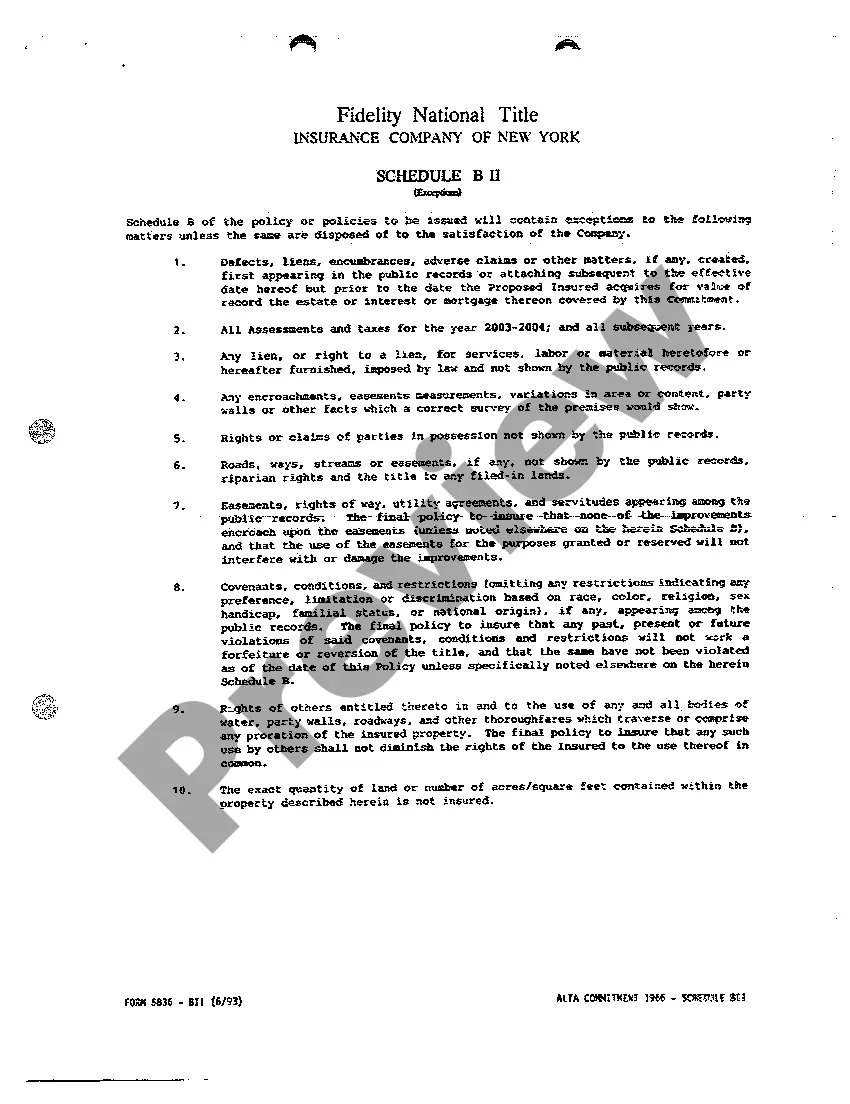

Title commitments are most often presented on a standard form distributed by the American Land Title Association or ALTA. The ALTA form contains a section generally known as the Schedule B Section II. This is a list of exceptions to coverage offered by the title insurance policy.

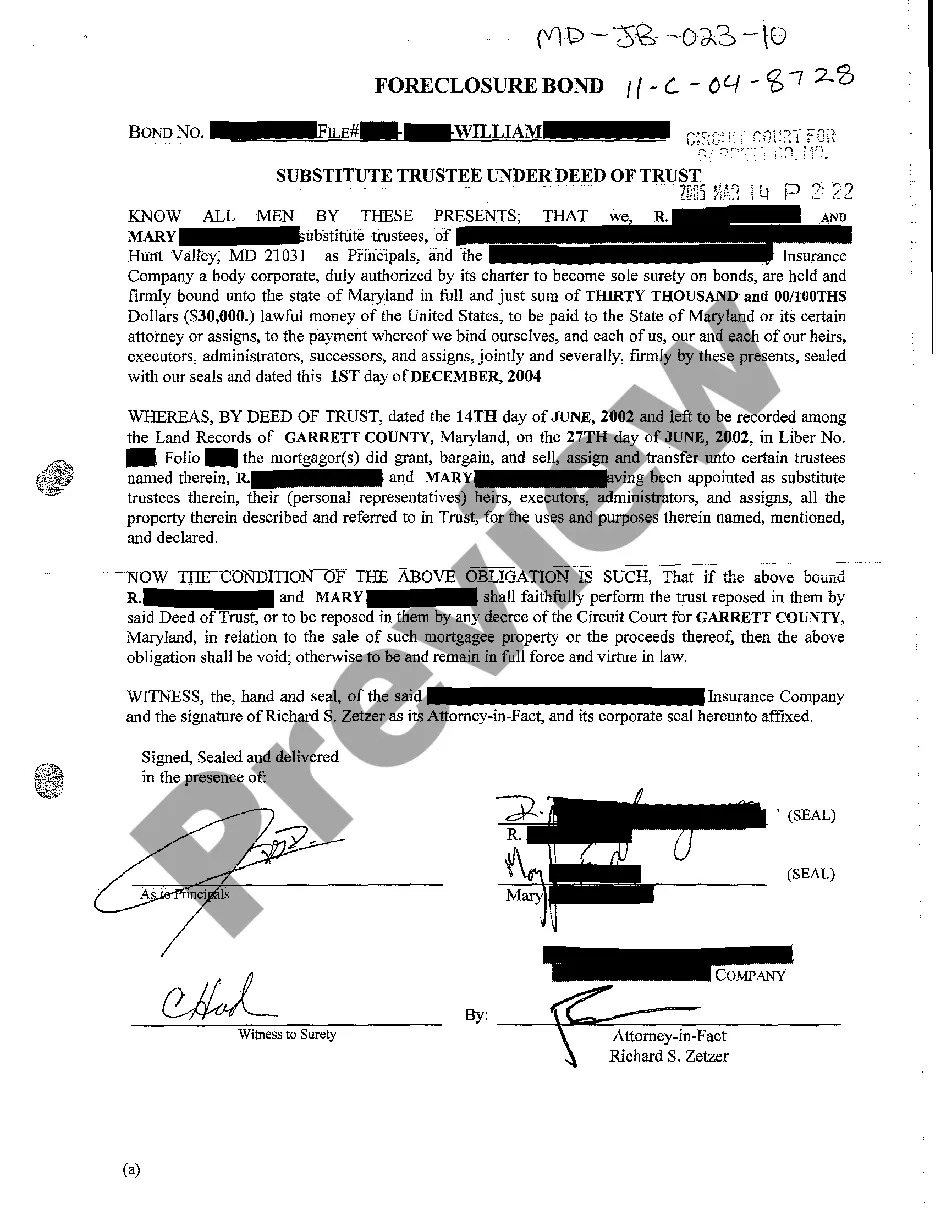

Once all requirements and conditions are met, then the Title Insurance policy is issued. A Title Commitment Review is generally conducted by the professional surveyor conducting the ALTA/ACSM Land Title Survey, an attorney or a third party due diligence firm.

The title commitment is essentially our promise (i.e., commitment) to issue the title insurance policy after closing, and contains the same terms, conditions and exclusions that will be in the actual title insurance policy.

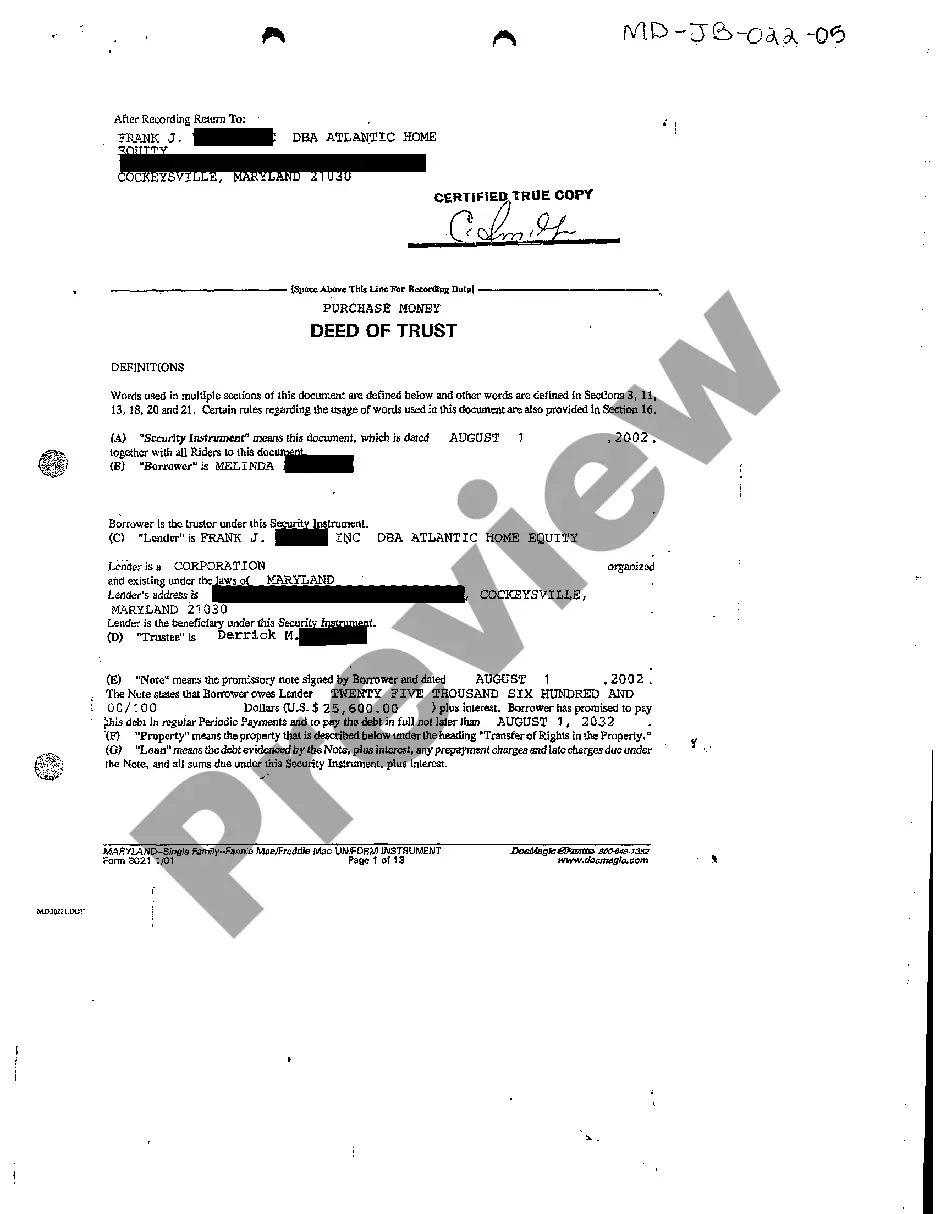

A title commitment is a document that iterates the details surrounding the property. It lists the various requirements, exclusions, and exceptions behind issuing title insurance on the property. It's also a promise to issue title insurance as long as all stipulations in Section B are met.

A title commitment (or whatever name yours goes by) is basically the title company's promise to issue a title insurance policy for the property after closing. The title commitment contains the same terms, conditions, and exclusions that will be in the actual insurance policy.

Two basic types of title insurance policies are available to owners of real property in California: (1) a standard coverage policy and (2) an extended coverage policy. A standard policy insures primarily against defects in title which are discoverable through an examination of the public record.

Although the average time it takes for a lender to completely close a mortgage is 53 days, it could be as little as 15 days. The actual timing of the mortgage commitment letter arriving in escrow depends on many factors and must arrive before the house can close.

The title company will mail you your own copy when the title commitment is complete. It is normally the title company's responsibility to send a copy to the buyer and/or lender prior to closing. In the closing process, there is nothing the lender should provide the buyer in the title insurance aspect, Tacher says.