Maryland Partial Release Of Judgment Lien

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maryland Partial Release Of Judgment Lien?

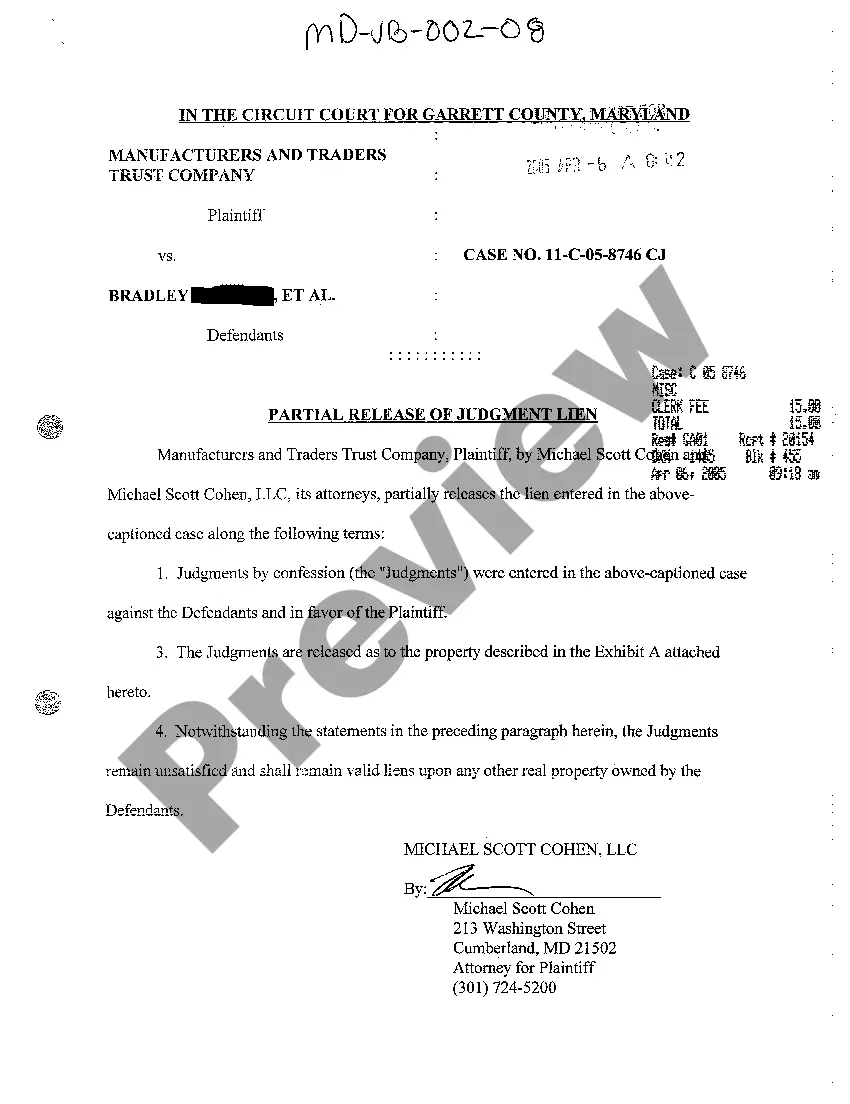

Greetings to the premier legal document repository, US Legal Forms. Here you can acquire any template, such as Maryland Partial Release Of Judgment Lien documents, and store them (as numerous as you desire). Create formal paperwork in mere hours instead of days or weeks, without shelling out a fortune on an attorney. Obtain your state-specific template in just a few clicks and rest assured knowing it was prepared by our state-certified legal professionals.

If you’re already a subscribed user, simply Log In to your profile and select Download next to the Maryland Partial Release Of Judgment Lien you need. Since US Legal Forms is internet-based, you’ll typically retain access to your downloaded documents, regardless of the device you’re using. View them in the My documents section.

If you haven’t created an account yet, what are you holding out for? Review our guidelines listed below to get started.

Once you’ve filled out the Maryland Partial Release Of Judgment Lien, forward it to your lawyer for verification. It’s an additional step but a vital one to ensure you’re fully protected. Join US Legal Forms now and gain access to a vast collection of reusable templates.

- If this is a state-specific form, verify its legitimacy in your residing state.

- Inspect the description (if available) to confirm it’s the right template.

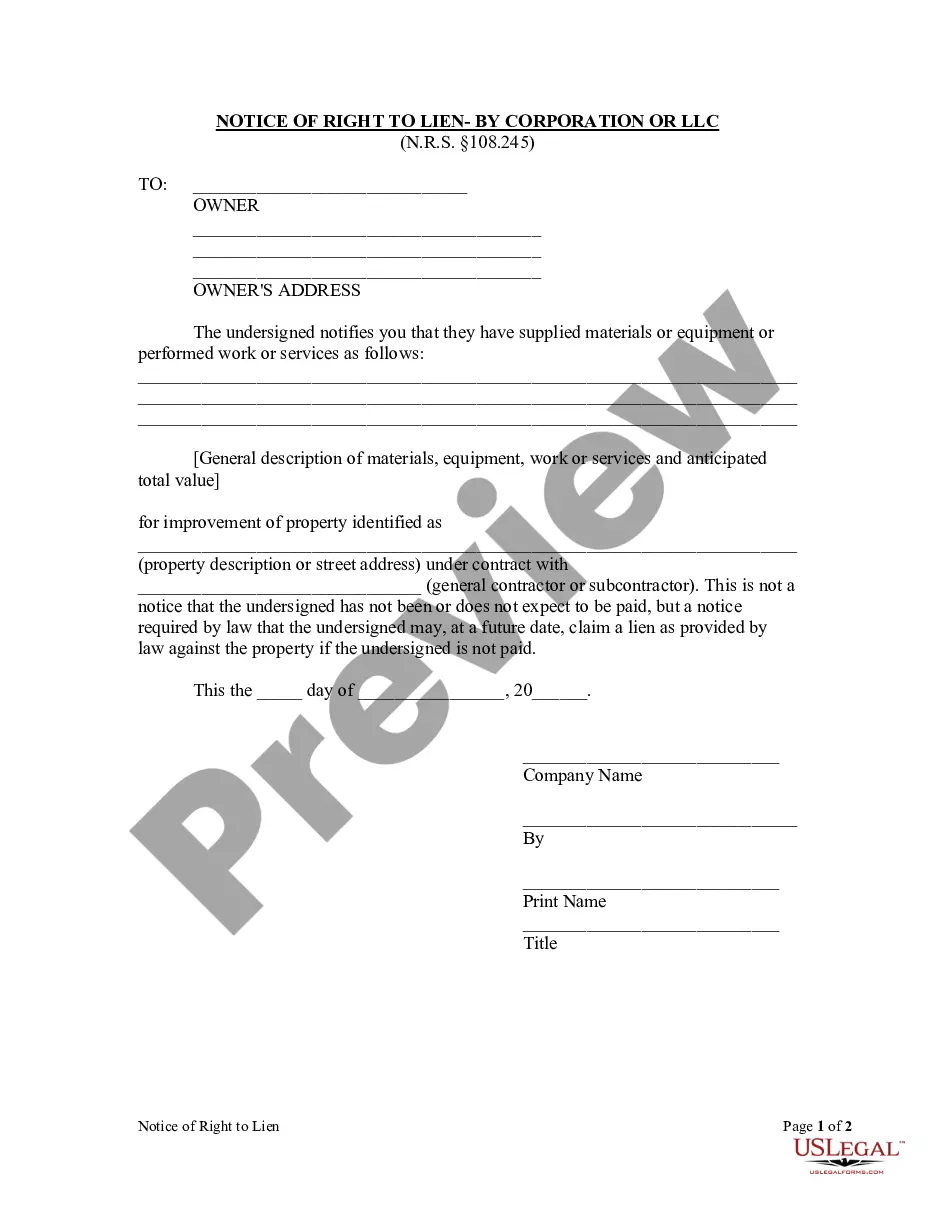

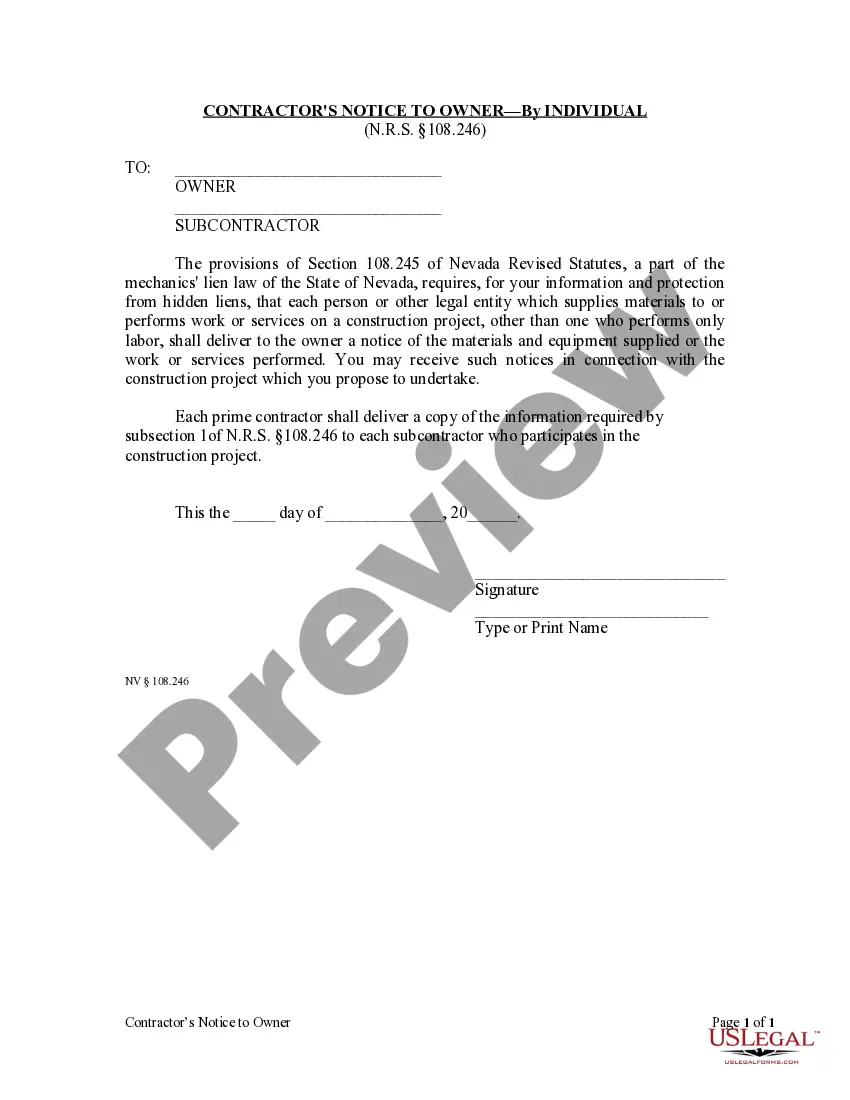

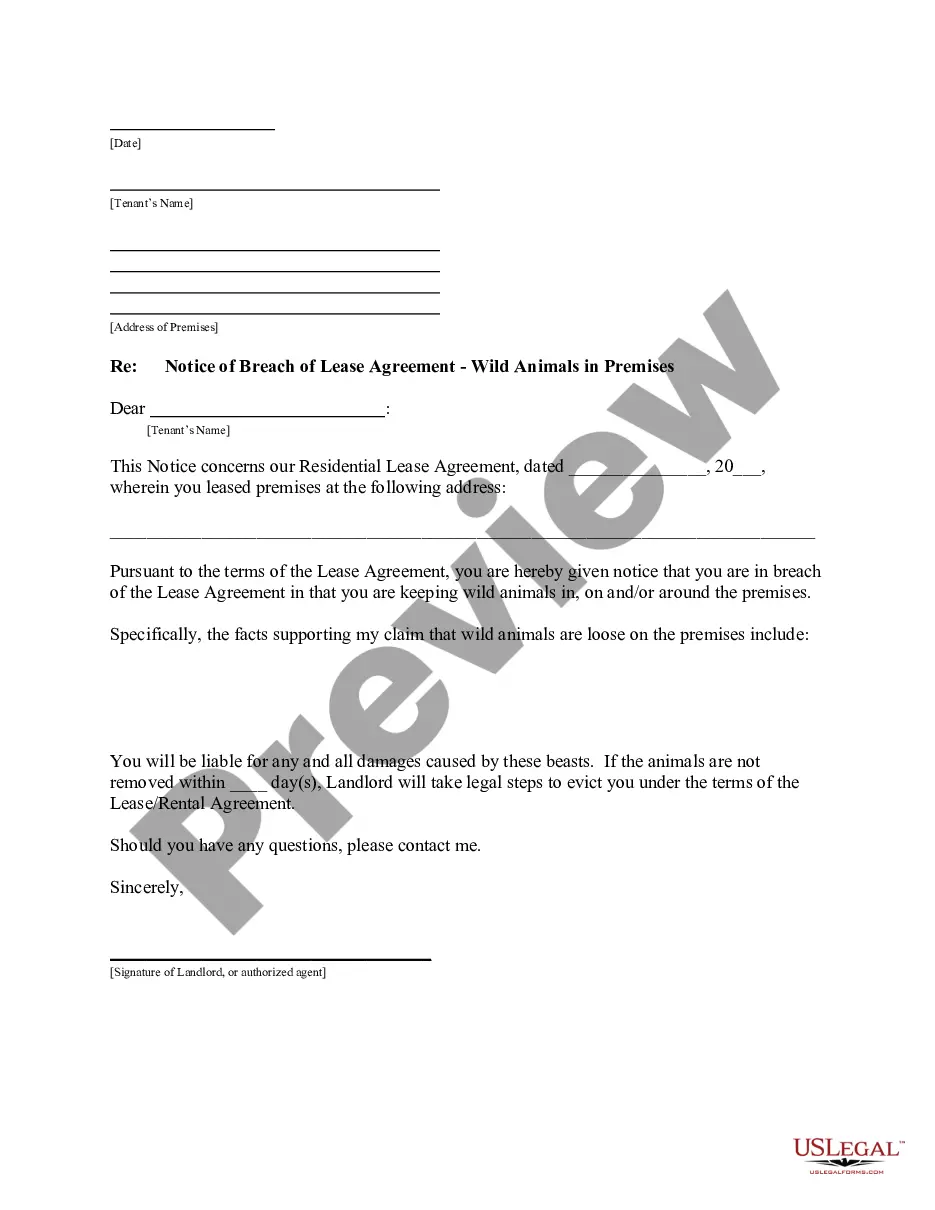

- See additional content with the Preview feature.

- If the template fulfills all your criteria, click Buy Now.

- To establish your account, select a subscription plan.

- Utilize a credit card or PayPal account to register.

- Download the document in the format you choose (Word or PDF).

- Print the document and complete it with your or your business’s details.

Form popularity

FAQ

Yes, a judgment lien can be placed on jointly owned property in Maryland. This means that creditors can seek repayment from the value of the property shared by co-owners. If you find yourself facing a Maryland Partial Release Of Judgment Lien and are concerned about joint ownership, it's important to understand your legal rights. Consulting resources like USLegalForms can provide invaluable assistance.

Real Property Code 3-105 in Maryland pertains specifically to the right to redeem property after a foreclosure. This code outlines the timeframes and processes involved in reclaiming property owned by a debtor. When dealing with a Maryland Partial Release Of Judgment Lien, understanding your rights under this code is essential, especially if you face potential foreclosure. Resources available on USLegalForms can provide clarity on your options.

Vacating a judgment in Maryland involves filing a motion in the court that issued the original judgment. You must provide valid reasons for vacating the judgment, such as a lack of proper notice or newly discovered evidence. Successfully vacating a judgment can lead to a Maryland Partial Release Of Judgment Lien, allowing you to reset your financial obligations.

To file a judgment lien in Maryland, you must first obtain a court judgment. After securing the judgment, you will need to complete the necessary forms and file them with the appropriate circuit court. Once filed, the judgment lien will attach to the debtor's real property, establishing a claim that can later lead to a Maryland Partial Release Of Judgment Lien when certain conditions are met.

Rule 2 621 in Maryland outlines the process for seeking a partial release of a judgment lien. This rule allows individuals to request a reduction of the lien amount based on payments made or other considerations. By utilizing Maryland Partial Release Of Judgment Lien provisions, you can effectively manage lien impacts on your property. Engaging with platforms like USLegalForms can streamline the process and provide you with necessary documentation.

Then the creditor has 10 days after they receive a stamp filed copy back to issue it to the judgment debtor. So that whole process could usually take about 30 days.

You must have the Acknowledgment of Satisfaction of Judgment (EJ-100) served on the judgment debtor by someone over 18 who is not a party to the case. Be sure the judgment debtor receives all the original, notarized copies he or she will need to release all of the liens you placed on his or her property.

If the Judgment Debtor, the party who lost during the trial, does not pay you voluntarily, you may contact an enforcement officer.An execution is a court order that allows the enforcement officer to take money or property from the Judgment Debtor in order to have your Judgment paid.

Judgments are no longer factored into credit scores, though they are still public record and can still impact your ability to qualify for credit or loans.You should pay legitimate judgments and dispute inaccurate judgments to ensure these do not affect your finances unduly.

The defendant should ask for a letter confirming that the entire amount of the judgment has been paid. He or she may do so by sending a demand letter to the plaintiff. The release and satisfaction form is filed with the court clerk and entered into the case record.