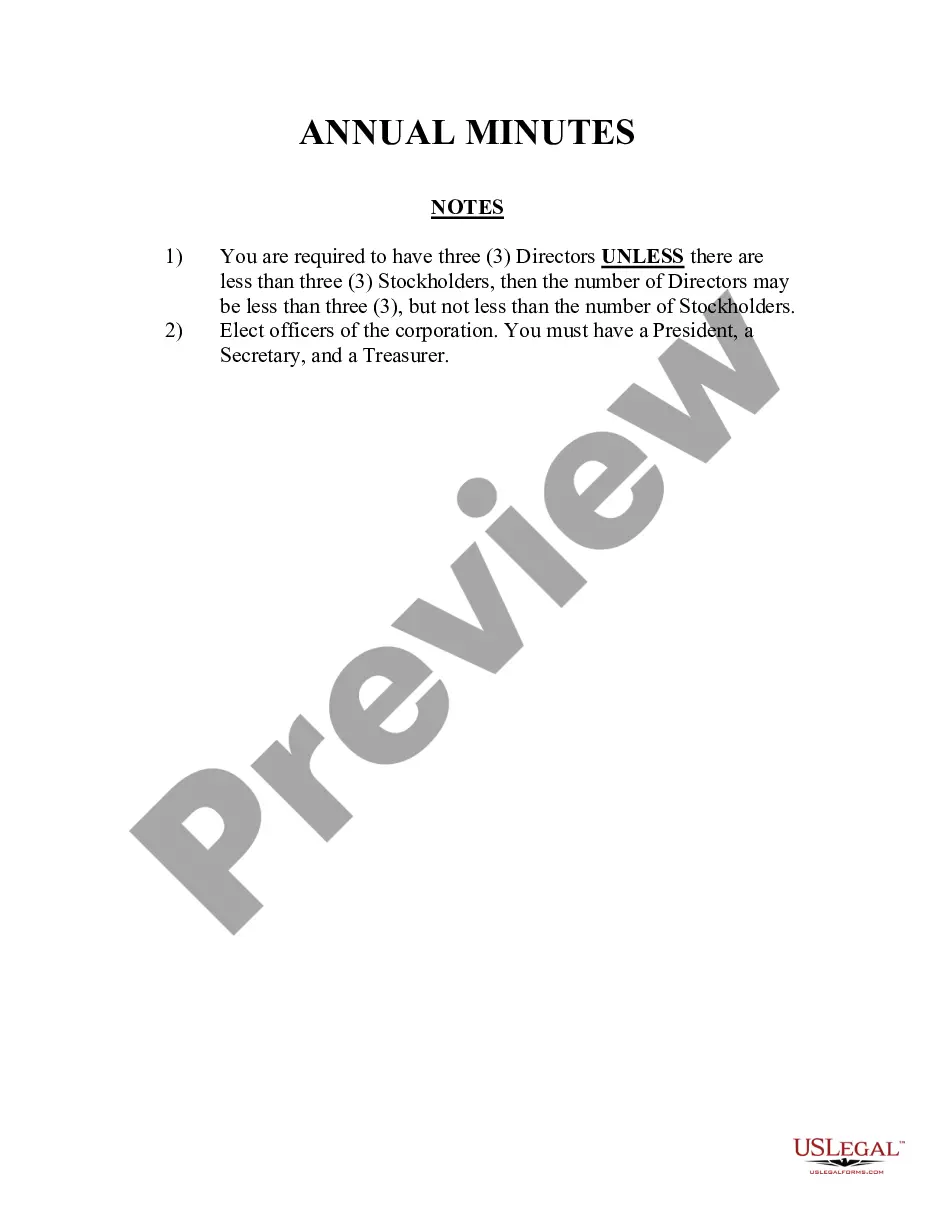

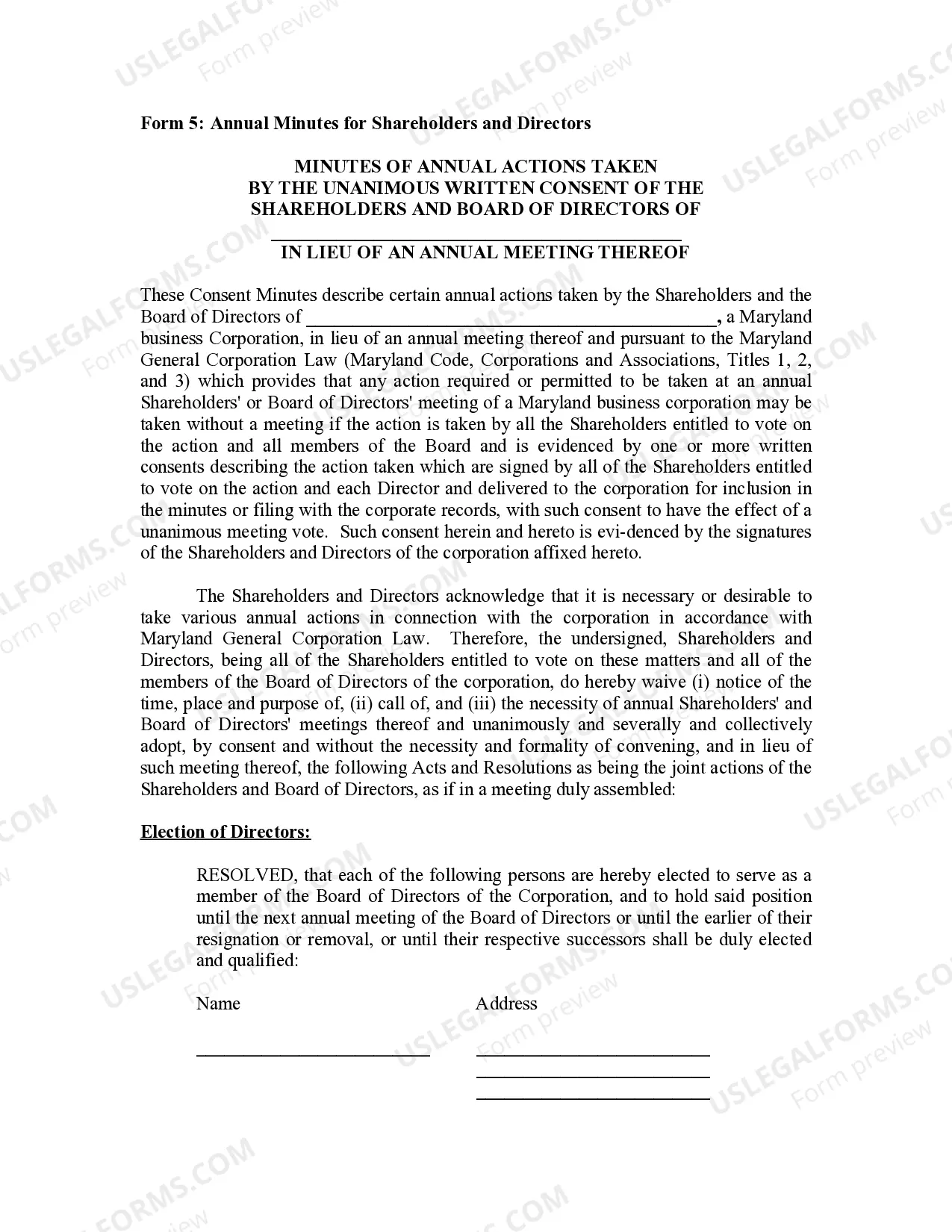

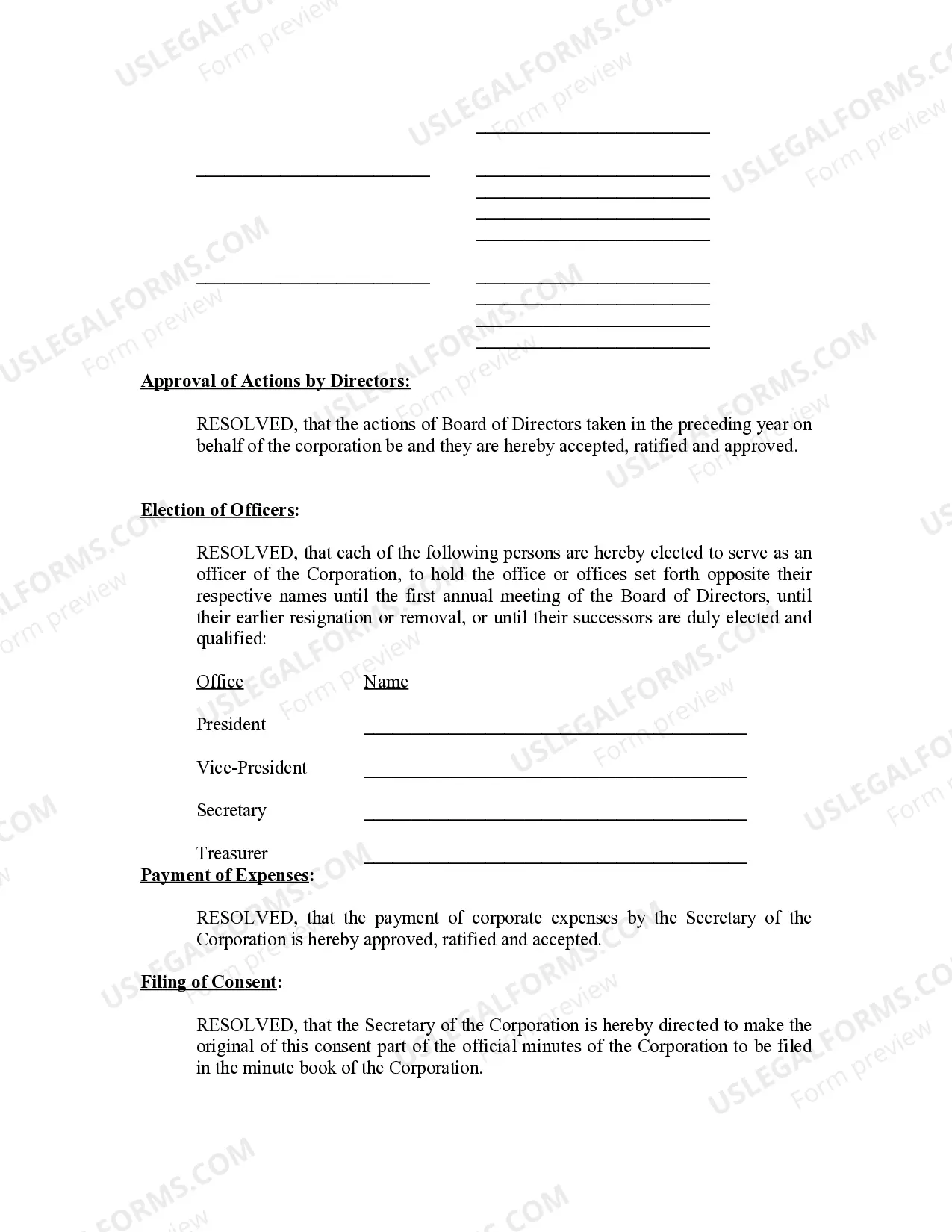

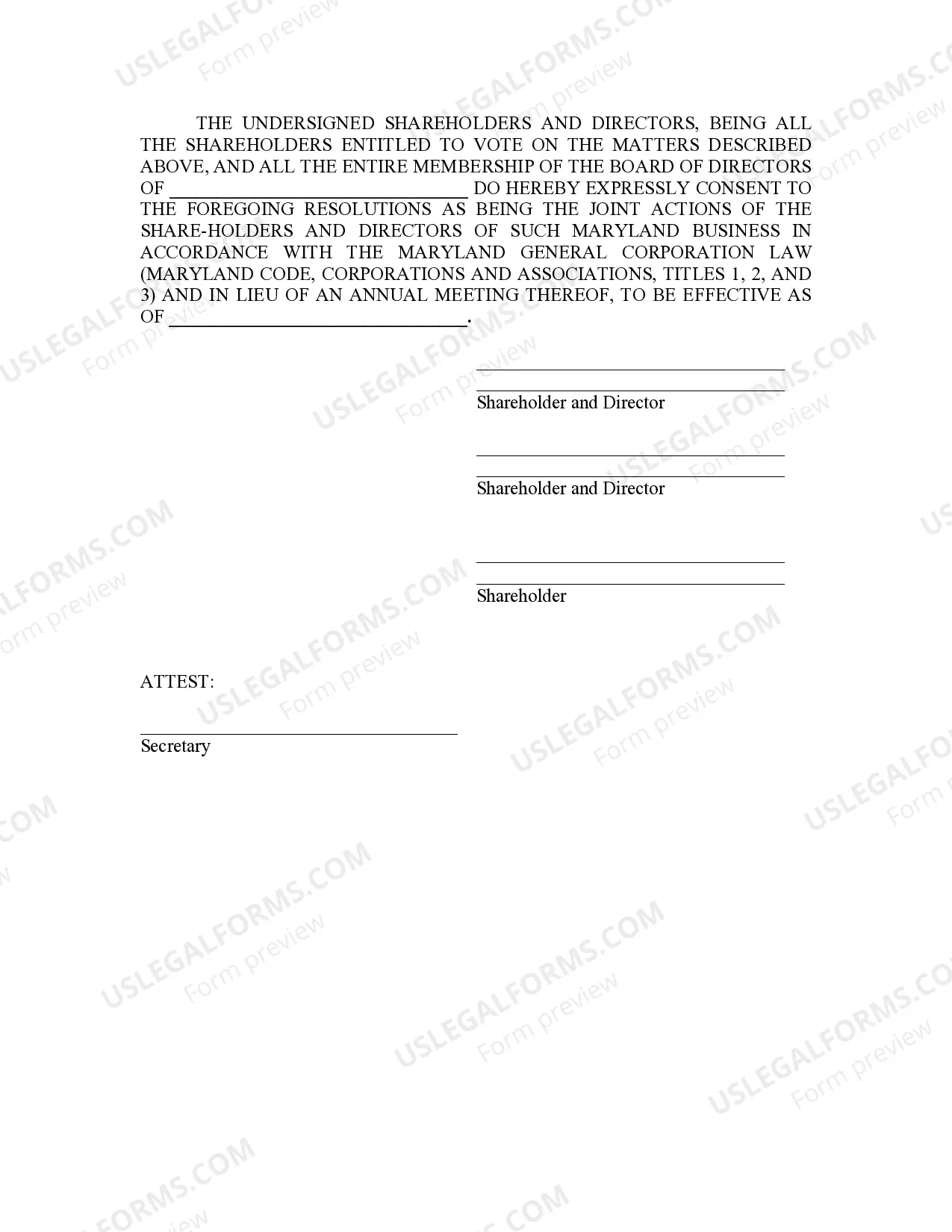

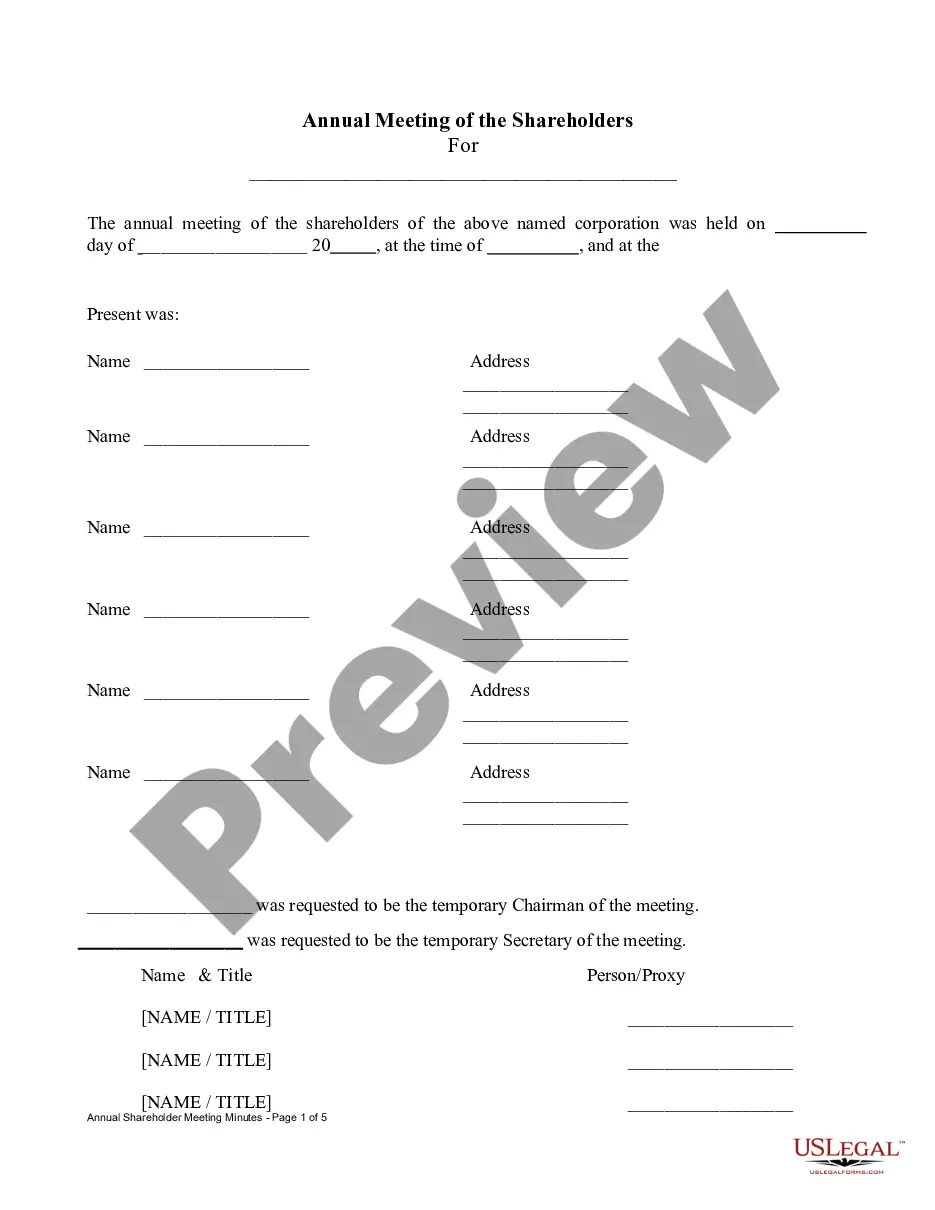

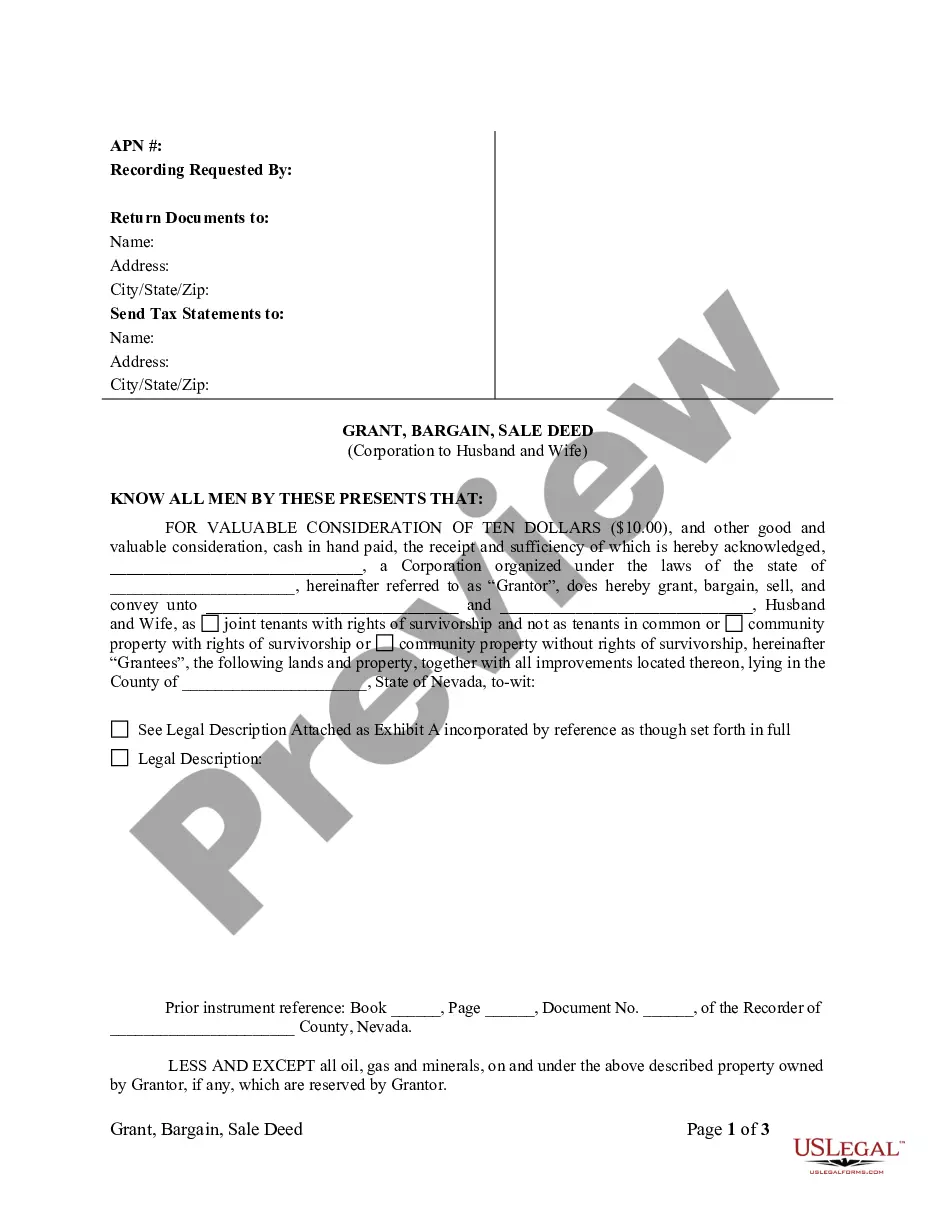

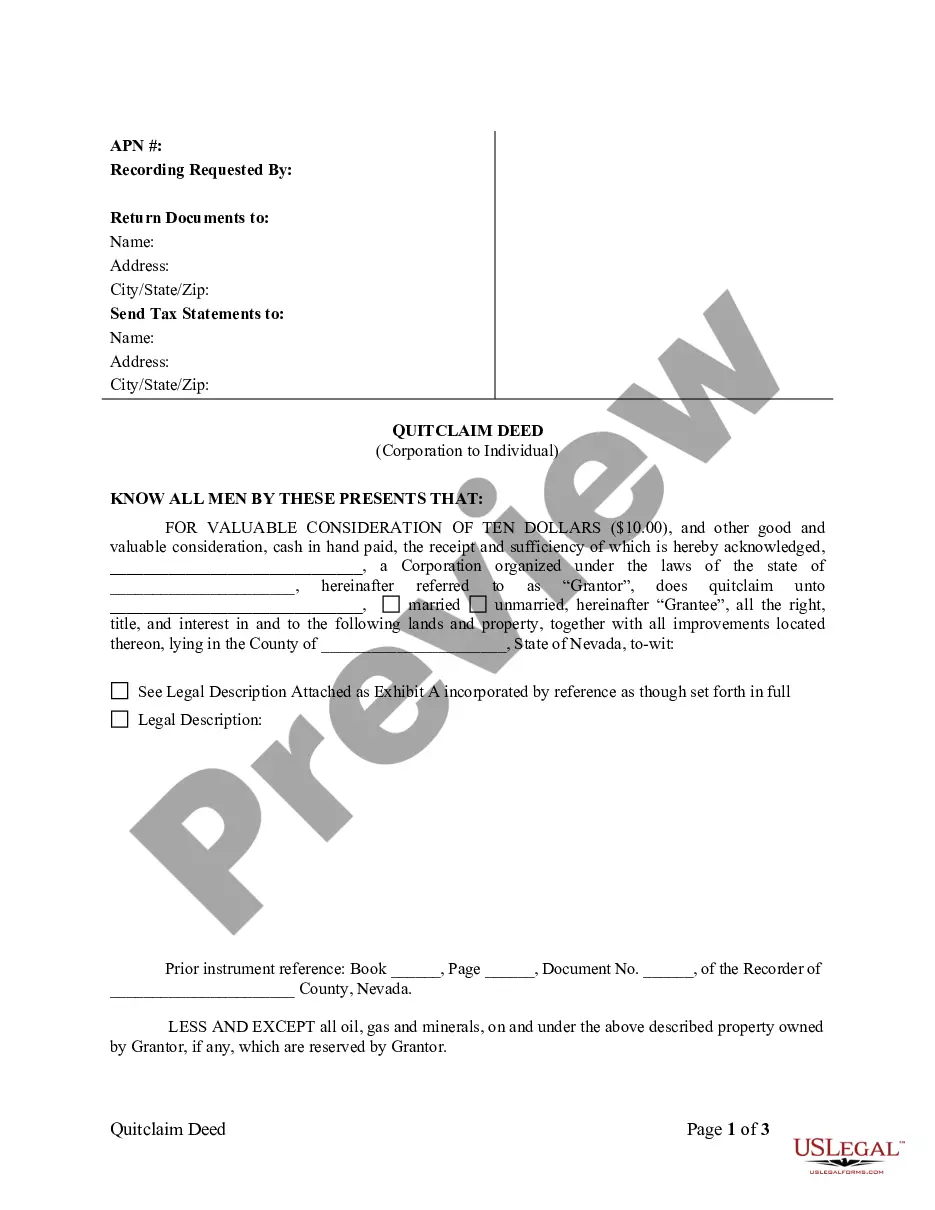

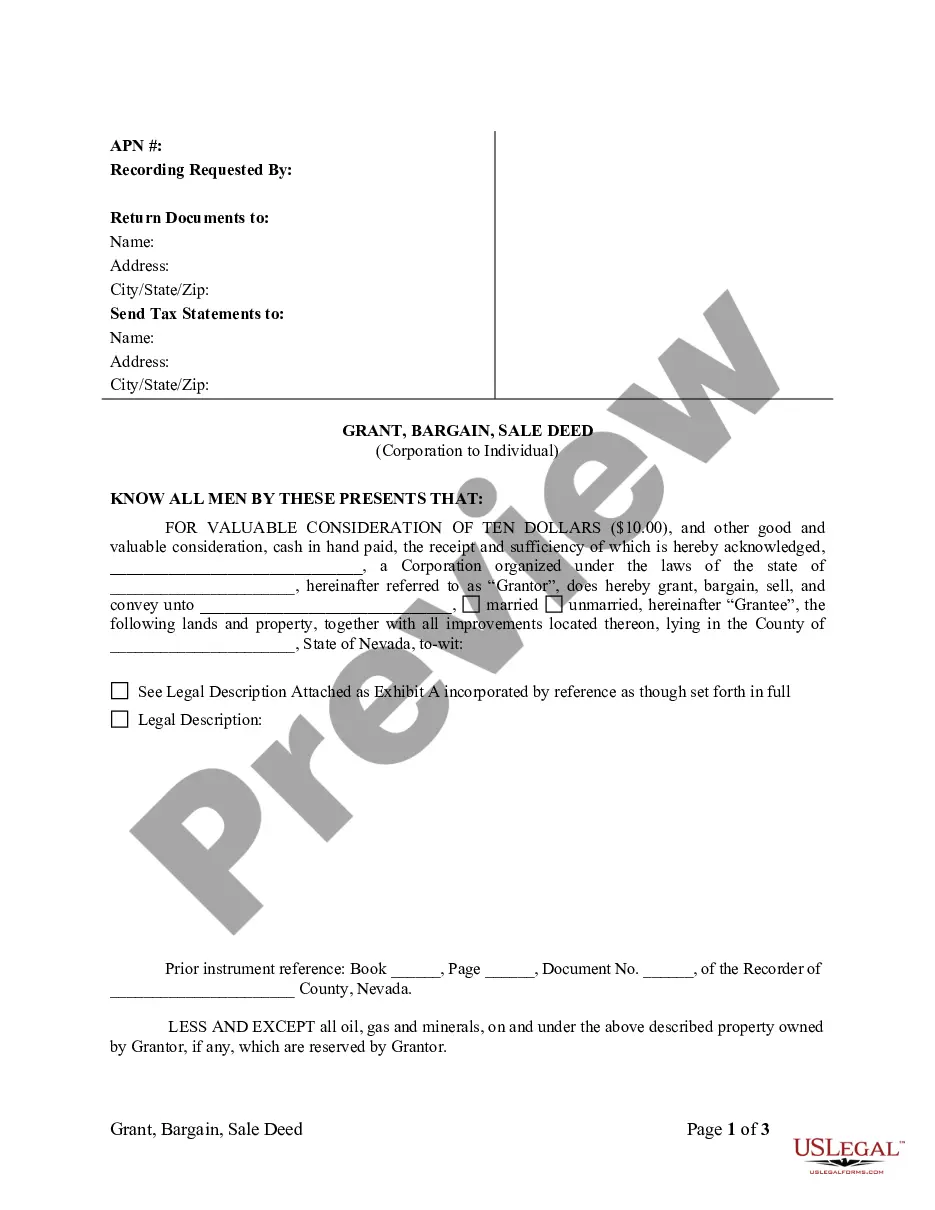

The Annual Minutes form is used to document any changes or other organizational activities of the Corporation during a given year.

Maryland Annual Minutes

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maryland Annual Minutes?

You are invited to the most extensive repository of legal documents, US Legal Forms.

Here you can obtain any template such as Annual Minutes - Maryland templates and retrieve them (as many as you desire).

Prepare official documents in several hours instead of days or weeks, without having to invest a fortune on an attorney.

If the template satisfies all of your conditions, simply click Buy Now. To create your account, choose a subscription plan. Utilize a credit card or PayPal account to register. Download the document in your preferred format (Word or PDF). Print the file and complete it with your or your business’s information. Once you’ve filled out the Annual Minutes - Maryland, send it to your attorney for validation. It’s an additional step but a crucial one to ensure you’re fully protected. Join US Legal Forms today and gain access to thousands of reusable templates.

- Acquire your state-specific template in clicks and feel confident knowing that it was created by our state-certified lawyers.

- If you’re already a subscribed user, just Log In to your account and then click Download next to the Annual Minutes - Maryland you wish.

- As US Legal Forms is online-based, you will typically have access to your saved documents, no matter the device you are on.

- Locate them within the My documents section.

- If you haven't created an account yet, what are you waiting for? Review our instructions below to begin.

- If this is a state-specific template, verify its relevance in your state.

- Examine the description (if available) to determine if it’s the correct template.

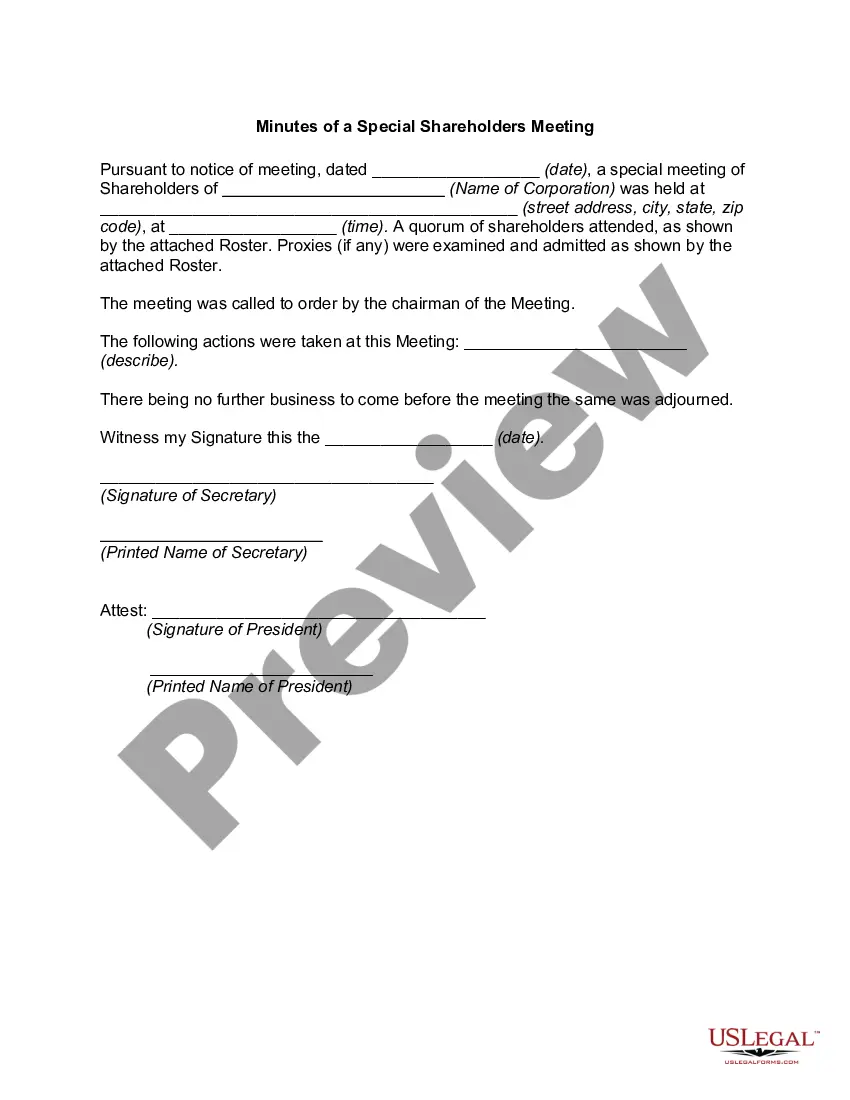

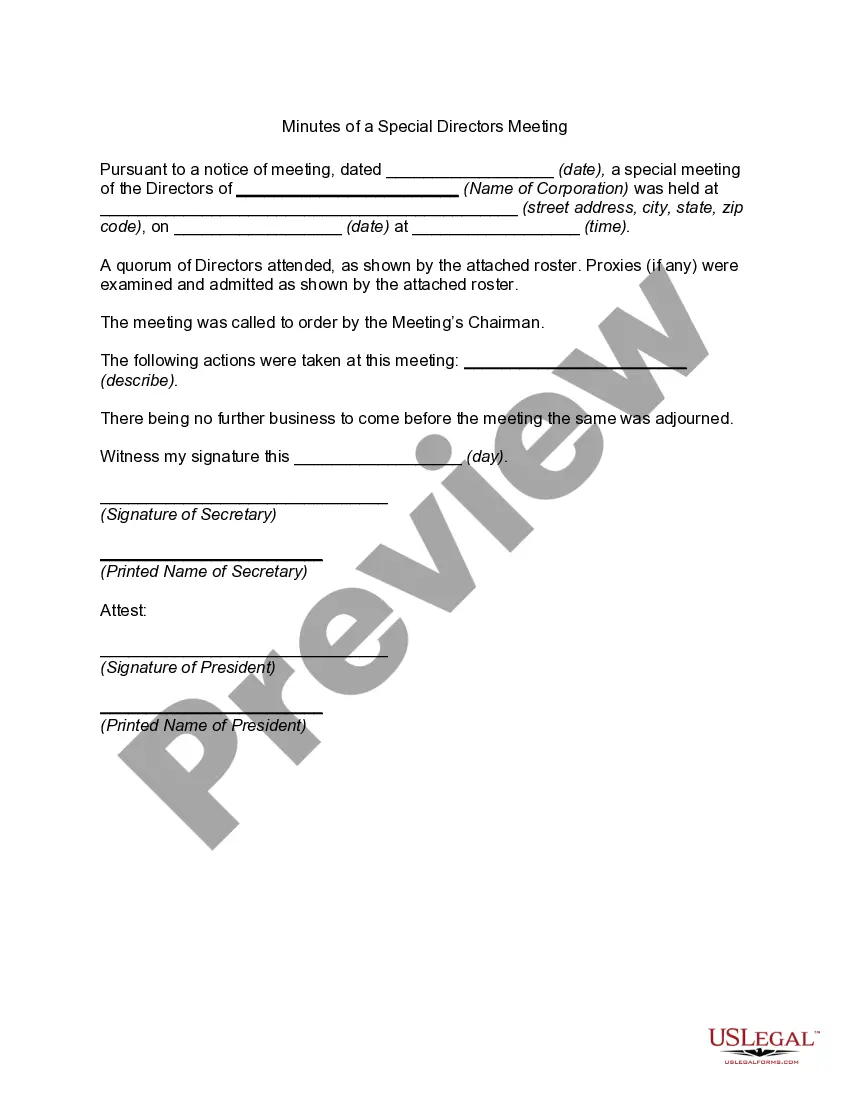

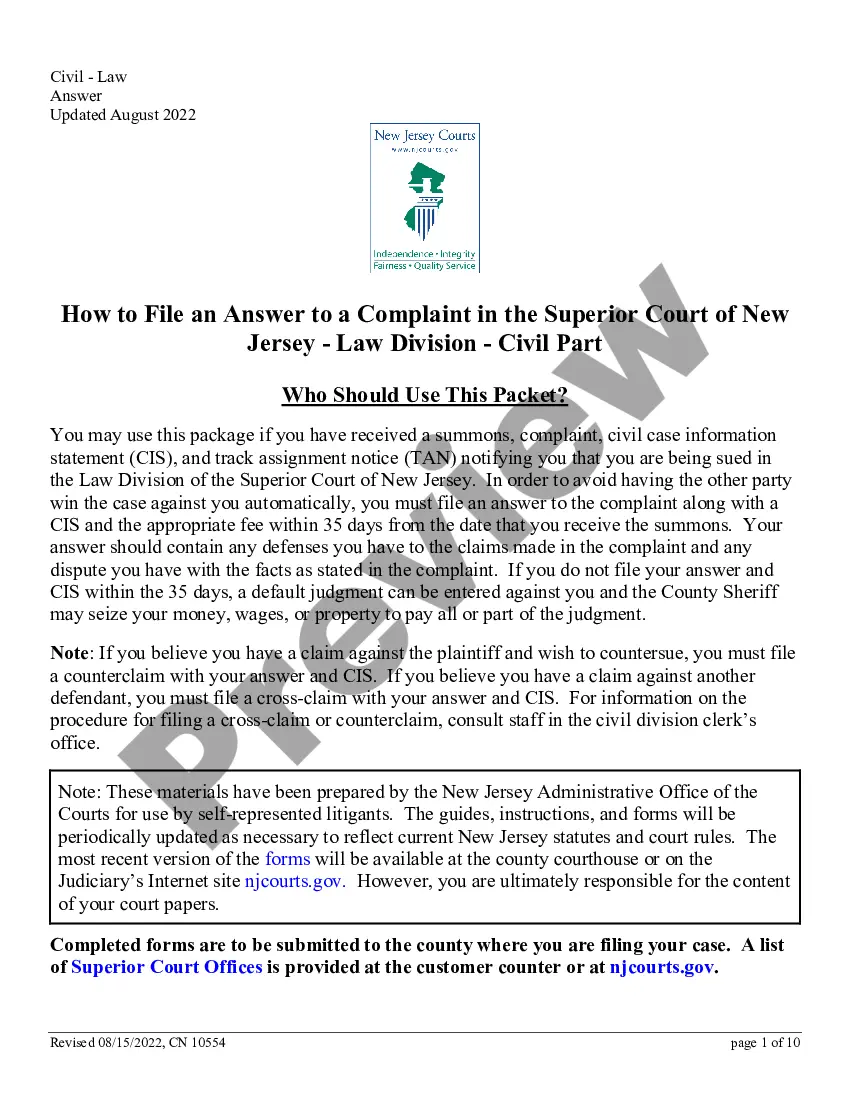

- Explore additional content with the Preview feature.

Form popularity

FAQ

To file, you must download and print the Annual Personal Property Return form from the Secretary of State website. Then, complete it mail in to the Maryland State Department of Assessments and Taxation along with the filing form.

If you're looking to incorporate in Maryland, you're in the right place. This guide will help you file formation documents, get tax identification numbers, and set up your company records. Incorporation: $120 filing fee + optional $5 returned mail fee + optional $50 expedited service fee.

You must file the Articles of Incorporation with the California Secretary of State, along with a filing fee of $100. Note that your corporation will also be responsible for an annual tax of $800 to the California Franchise Tax Board.

The great state of Maryland requires all corporations to draft and complete a corporate bylaws- a document that, in general, will delineate the financial and organizational structure of the corporation in question for the benefit of both the government and the relevant partners in the corporation.

Form 2553 S Corporation Election. Form 1120S S Corporation Tax Return. Schedule B Other Return Information. Schedule K Summary of Shareholder Information. Schedule K-1 Individual Shareholder Information.

For many businesses, filing annual reports is among them. If you operate your business as an LLC or corporation (depending on the state in which your company is registered), you may need to publish an annual report to keep in good standing with the state.

Choose a corporate name. File your Articles of Incorporation. Appoint a registered agent. Start a corporate records book. Prepare corporate bylaws. Appoint initial directors. Hold first Board of Directors meeting. Issue stock to shareholders.

To file, you must download and print the Annual Personal Property Return form from the Secretary of State website. Then, complete it mail in to the Maryland State Department of Assessments and Taxation along with the filing form.

Converting your LLC to an S-Corp when filing your tax return for tax purposes can be a complicated process, but it is possible. You can submit the documents necessary to convert your LLC to an S-Corp for tax purposes along with your tax return.