Maryland Dissolution Package to Dissolve Limited Liability Company LLC

Description

How to fill out Maryland Dissolution Package To Dissolve Limited Liability Company LLC?

Greetings to the largest legal document repository, US Legal Forms. Here, you can obtain any template including Maryland Dissolution Package to Dissolve Limited Liability Company LLC forms and store them (as many as you wish/require). Prepare official documents within a few hours, instead of days or even weeks, without incurring significant costs for an attorney. Acquire your state-specific form in just a few clicks and feel assured knowing it was formulated by our experienced attorneys.

If you’re already an enrolled customer, simply Log In to your account and click Download next to the Maryland Dissolution Package to Dissolve Limited Liability Company LLC you need. Since US Legal Forms is an online service, you’ll consistently have access to your downloaded templates, regardless of the device you’re using. Locate them within the My documents section.

If you don't have an account yet, what are you waiting for? Review our instructions below to get started.

Once you’ve completed the Maryland Dissolution Package to Dissolve Limited Liability Company LLC, present it to your lawyer for approval. It’s an extra step but a crucial one for ensuring you’re entirely safeguarded. Sign up for US Legal Forms now and gain access to a vast array of reusable templates.

- If this is a state-specific document, verify its applicability in the state where you reside.

- Examine the description (if available) to determine if it’s the correct template.

- Access additional content with the Preview feature.

- If the sample aligns with your needs, click Buy Now.

- To create an account, select a pricing plan.

- Utilize a credit card or PayPal account to register.

- Download the template in the format you need (Word or PDF).

- Print the document and fill it out with your/your business’s details.

Form popularity

FAQ

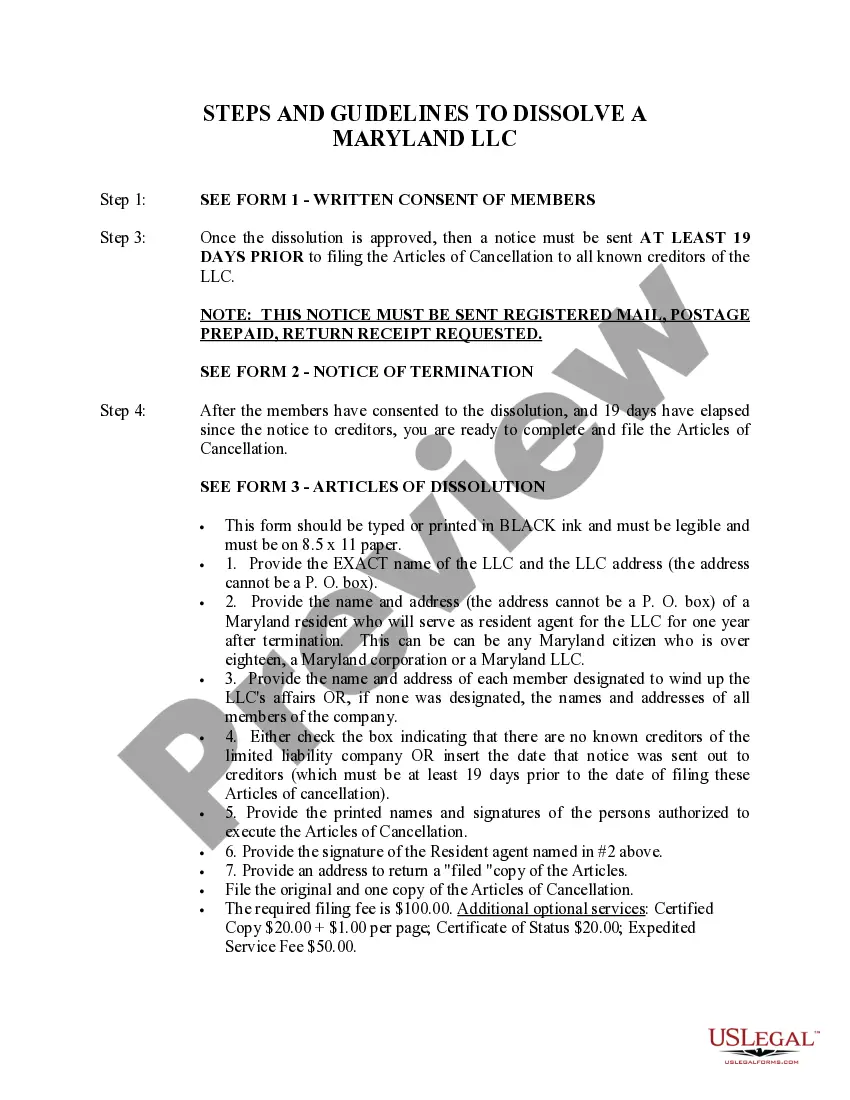

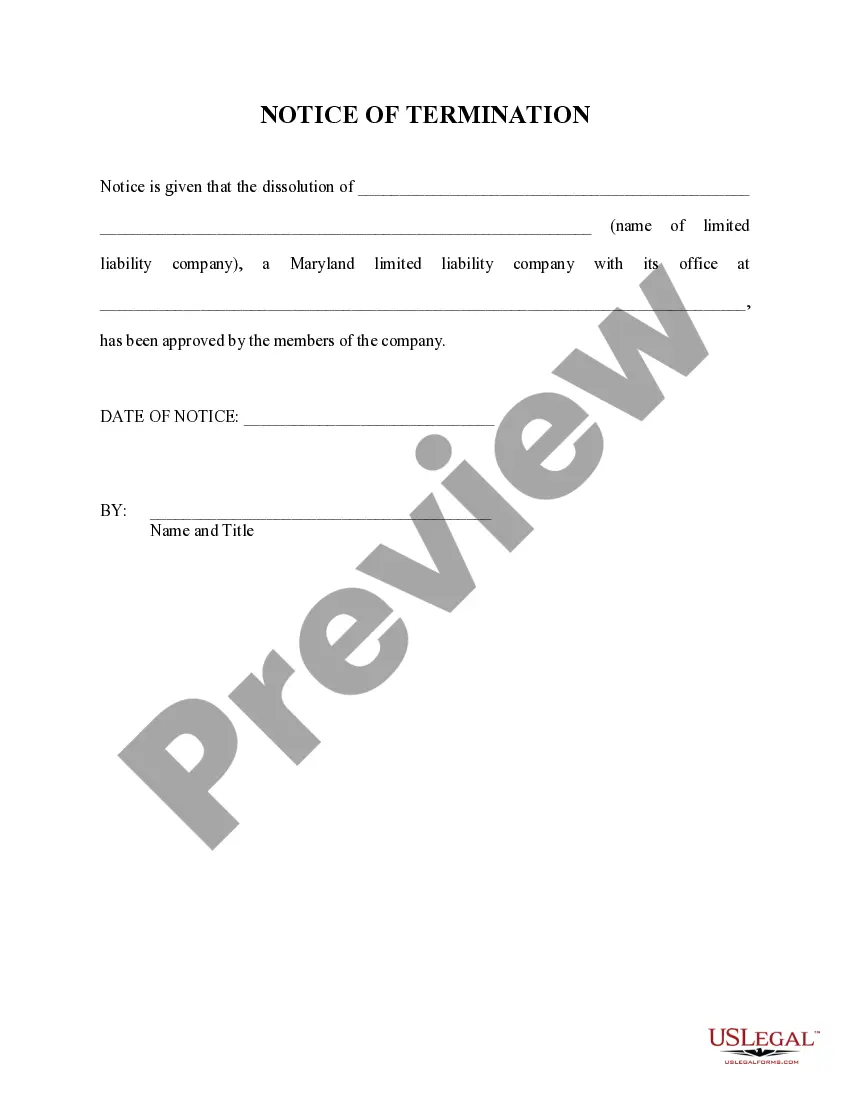

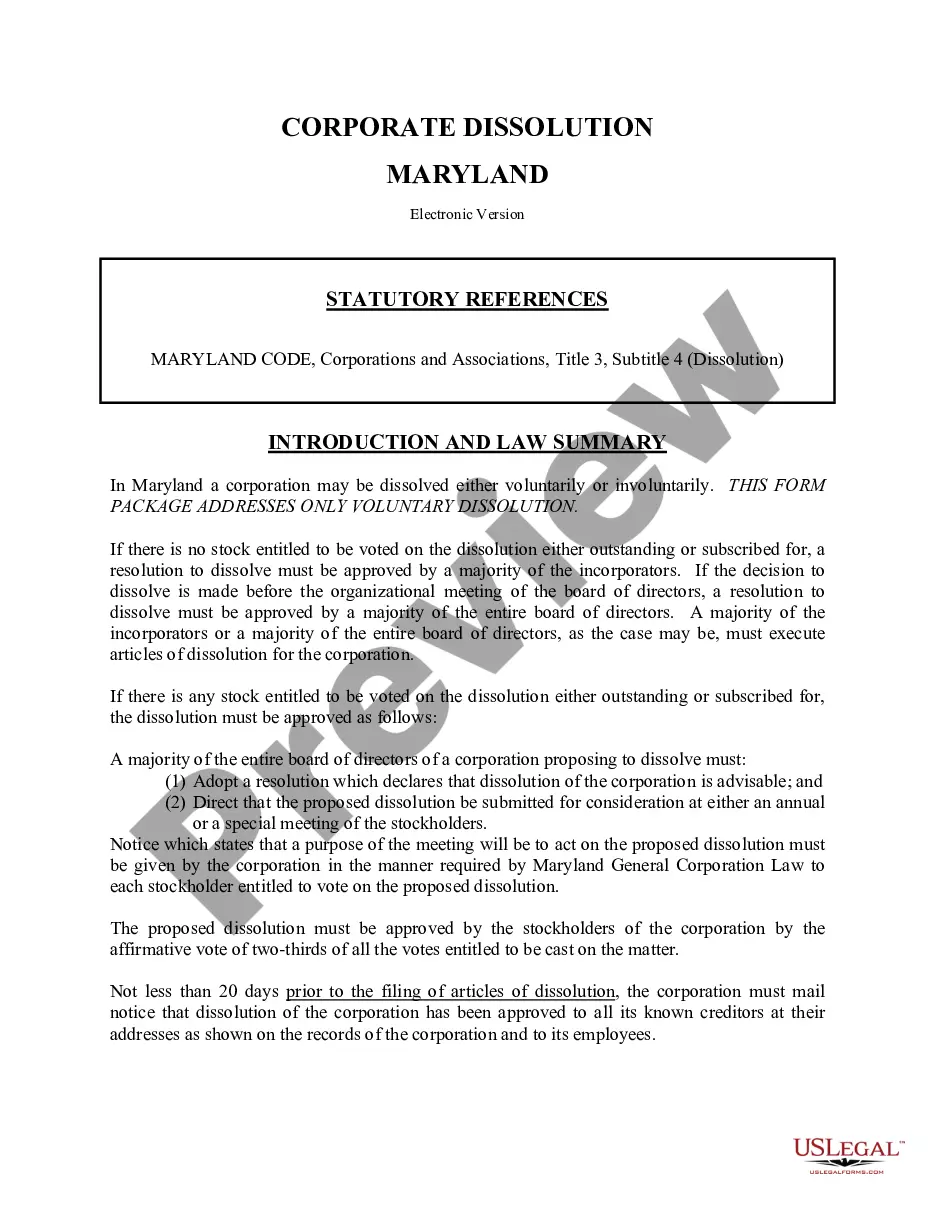

In Maryland, you can dissolve a domestic LLC by filing the Articles of Cancellation with the Maryland State Department of Assessments & Taxation. If you prefer to draft your own Articles of Cancellation, rather than using the standard form provided by the state, you may do so.

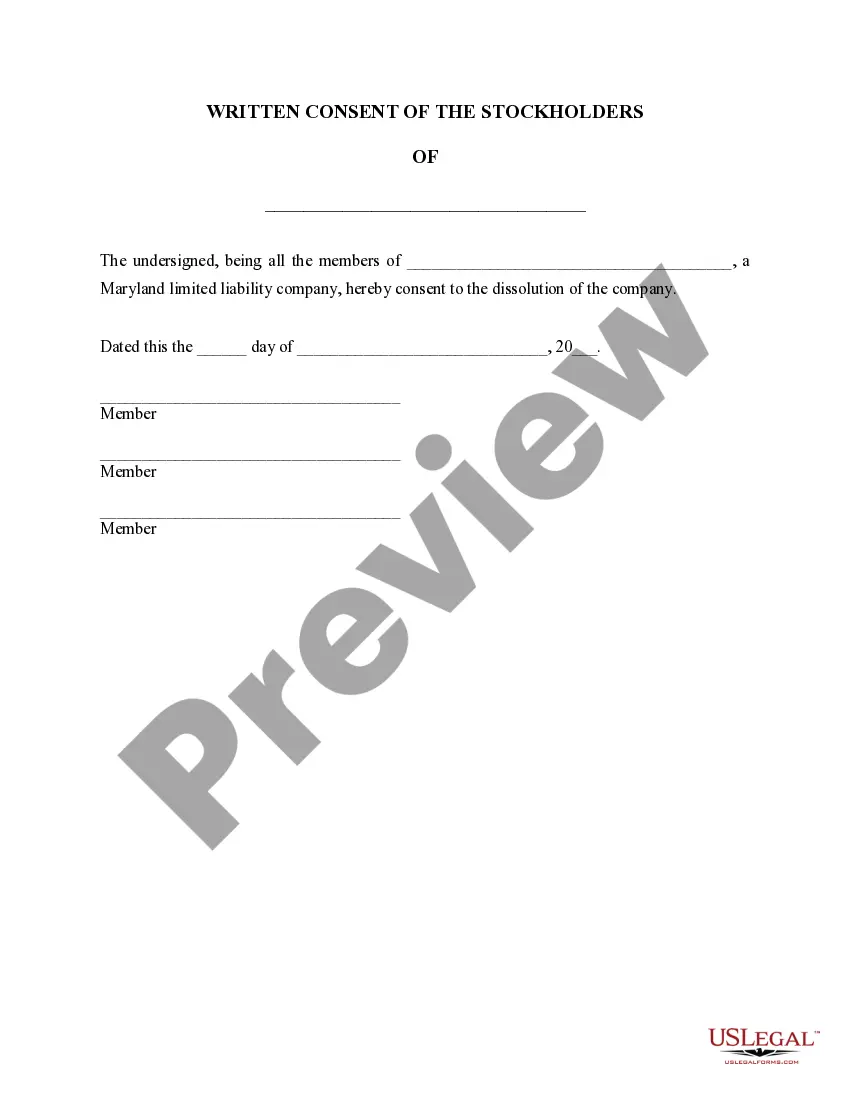

Method 1: You can voluntarily dissolve your LLC. This requires a majority vote from all members or a certain percentage of votes as required per your operating agreement. With the required votes, you can move forward with the dissolution.

The Effect of Dissolution After you close your LLC in California, that LLC shall be canceled, and its powers, rights, and privileges shall end upon the filing of the Certificate of Cancellation. This means you can no longer conduct business using that LLC.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office. It can take the SOS many weeks to process a certificate. However, expedited service is available for an additional fee.

If you choose to close down a Maryland nonprofit corporation, you'll need to go through a process called dissolution. Dissolution requires a vote or other formal authorization, the filing of key documents with government agencies, and a group of other tasks collectively known as winding up the corporation.

Holding a vote with LLC members to dissolve the LLC. Recording the dissolution vote in the LLC's meeting minutes. Determining the formal date of dissolution. Distribution of LLC assets. Notifying creditors and settling any business debts.

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office.