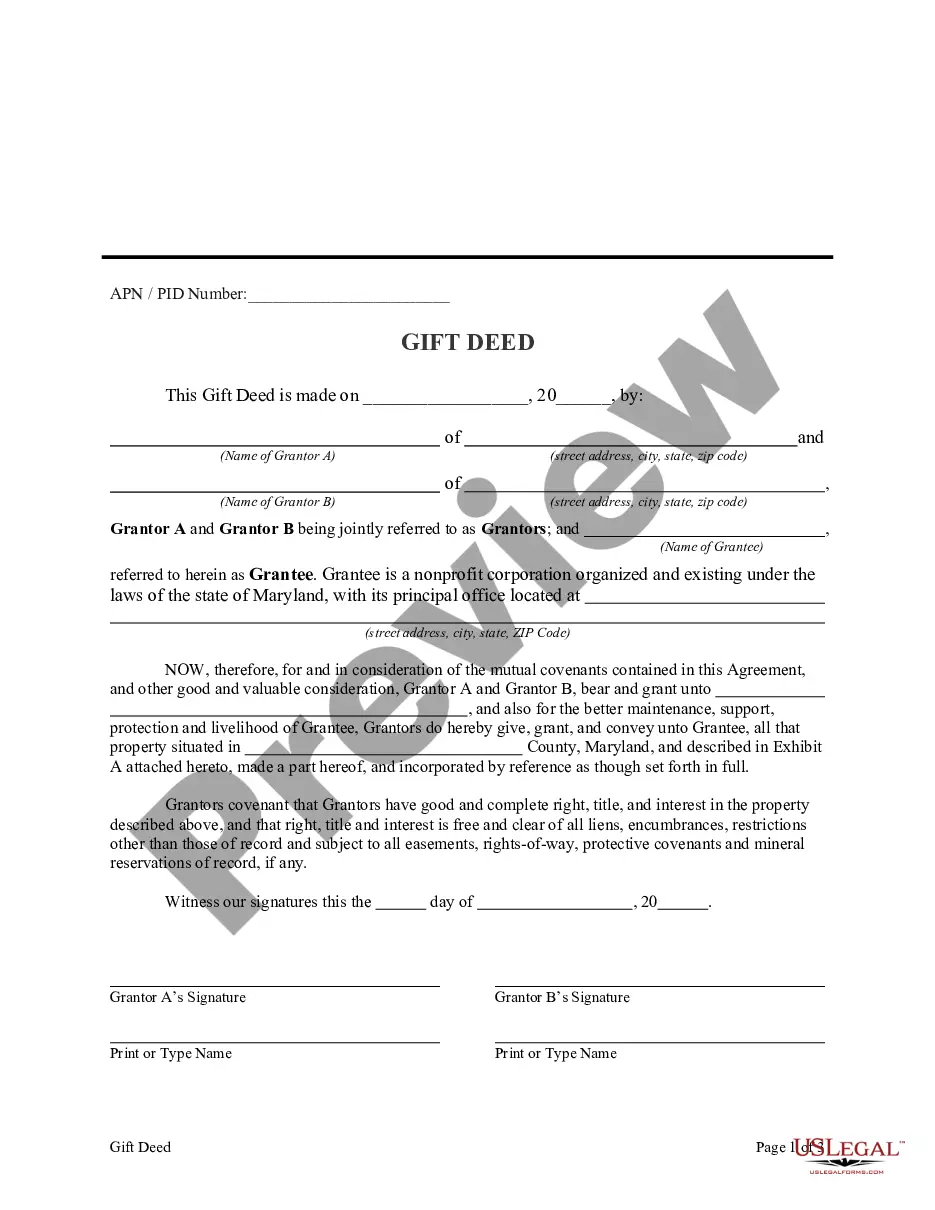

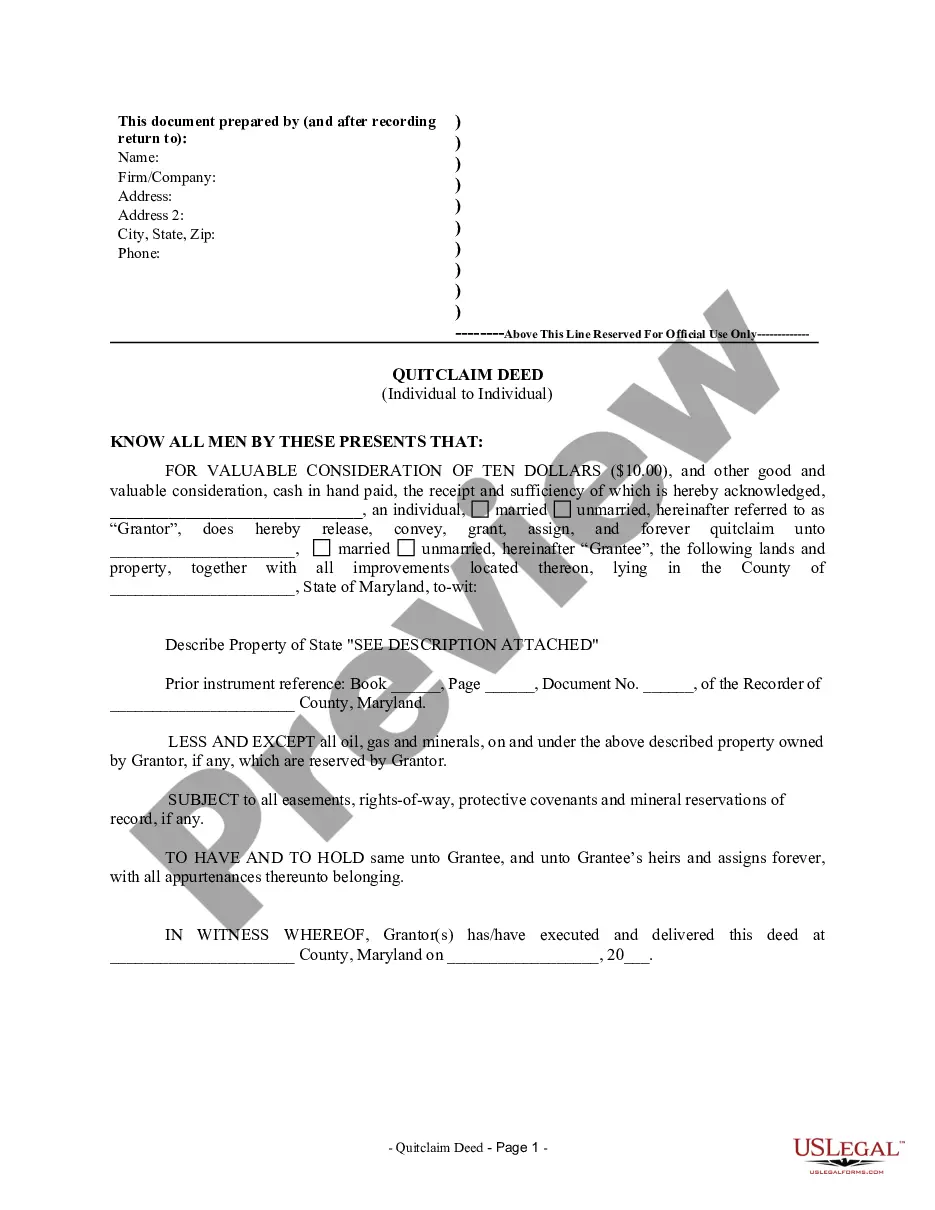

This form is a Gift Deed where the Grantors are two individuals and the Grantee is a non-profit corporation. Grantors convey the described property to the Grantee as a gift without monetary consideration. This deed complies with all state statutory laws.

Maryland Gift Deed from Two Grantors to a Non-Profit Corporation as Grantee.

Description

How to fill out Maryland Gift Deed From Two Grantors To A Non-Profit Corporation As Grantee.?

You are invited to the premier legal documents repository, US Legal Forms.

Here you can discover any template such as Maryland Gift Deed from Two Grantors to a Non-Profit Corporation as Grantee.

download them (as many as you desire/need). Prepare legal documents in a few hours, rather than days or even weeks, without incurring significant costs on a lawyer. Obtain your state-specific form in just a few clicks and be assured that it was created by our experienced attorneys.

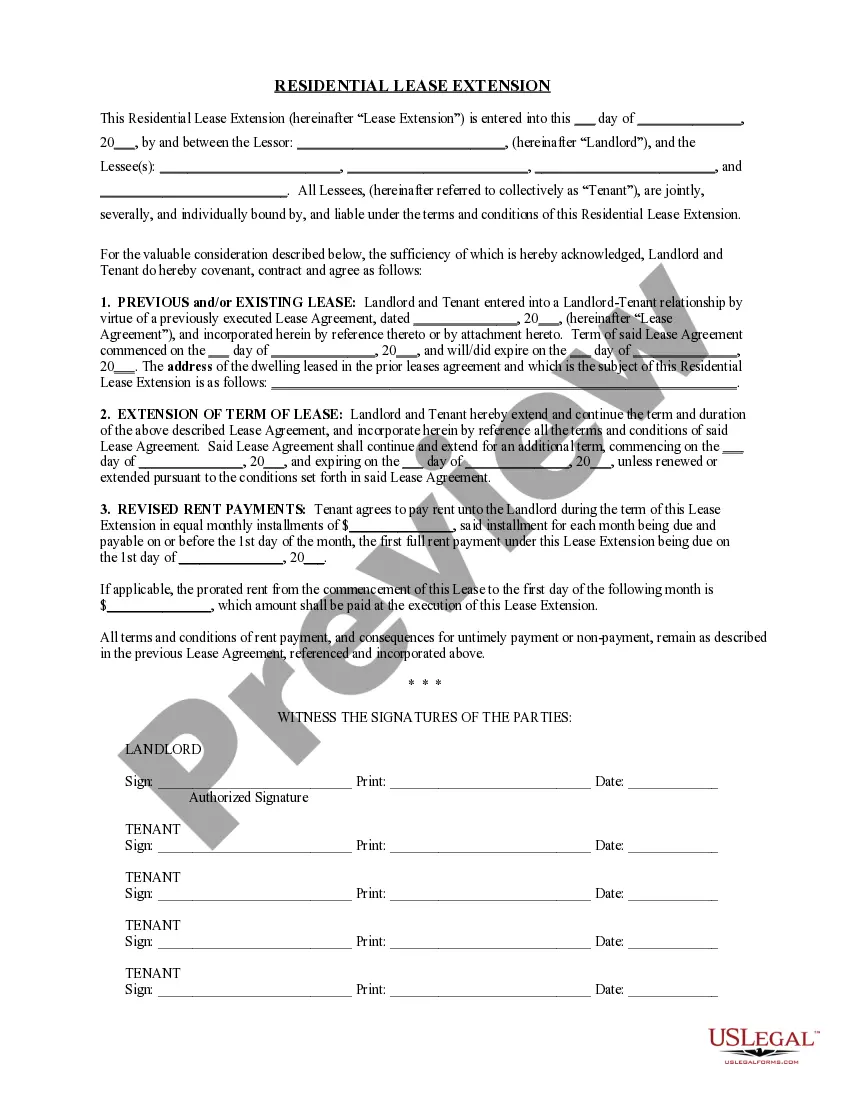

To create an account, select a pricing plan. Use a credit card or PayPal to subscribe. Save the template in your desired format (Word or PDF). Print the document and fill it with your or your business’s information. Once you’ve completed the Maryland Gift Deed from Two Grantors to a Non-Profit Corporation as Grantee, send it to your attorney for verification. It’s an additional step but essential for ensuring you’re fully protected. Join US Legal Forms today and gain access to thousands of reusable templates.

- If you’re already a registered user, simply Log In to your account and click Download next to the Maryland Gift Deed from Two Grantors to a Non-Profit Corporation as Grantee you require.

- Since US Legal Forms is a web-based service, you’ll always have access to your downloaded templates, regardless of the device you are using.

- Find them in the My documents section.

- If you haven't created an account yet, what are you waiting for? Follow our instructions below to begin.

- If this is a state-specific form, verify its validity in your state.

- Check the description (if available) to ensure that it’s the correct template.

- View additional details with the Preview option.

- If the document meets your requirements, click Buy Now.

Form popularity

FAQ

You can gift a self-acquired property to anyone, as long as you are competent to contract, as per the provisions of the Indian Contract Act.An immovable property can be gifted, by executing a gift deed. You need to pay stamp duty on the market value of the property, as on the date of execution of the gift deed.

Details of the donor and donee (name, date of birth, residence, relationship to each other, father's name, etc.) The amount of money being gifted, Reason for gifting, if any.

To change the names on a real estate deed, you will need to file a new deed with the Division of Land Records in the Circuit Court for the county where the property is located. The clerk will record the new deed.

The law provides that any gift that is made and accepted by the donee, is final and cannot be revoked later on. So, if all the conditions of a valid gift are present, the same cannot be annulled by the donor later on, except on the ground that the consent of the donor was obtained by fraud, undue influence or coercion.

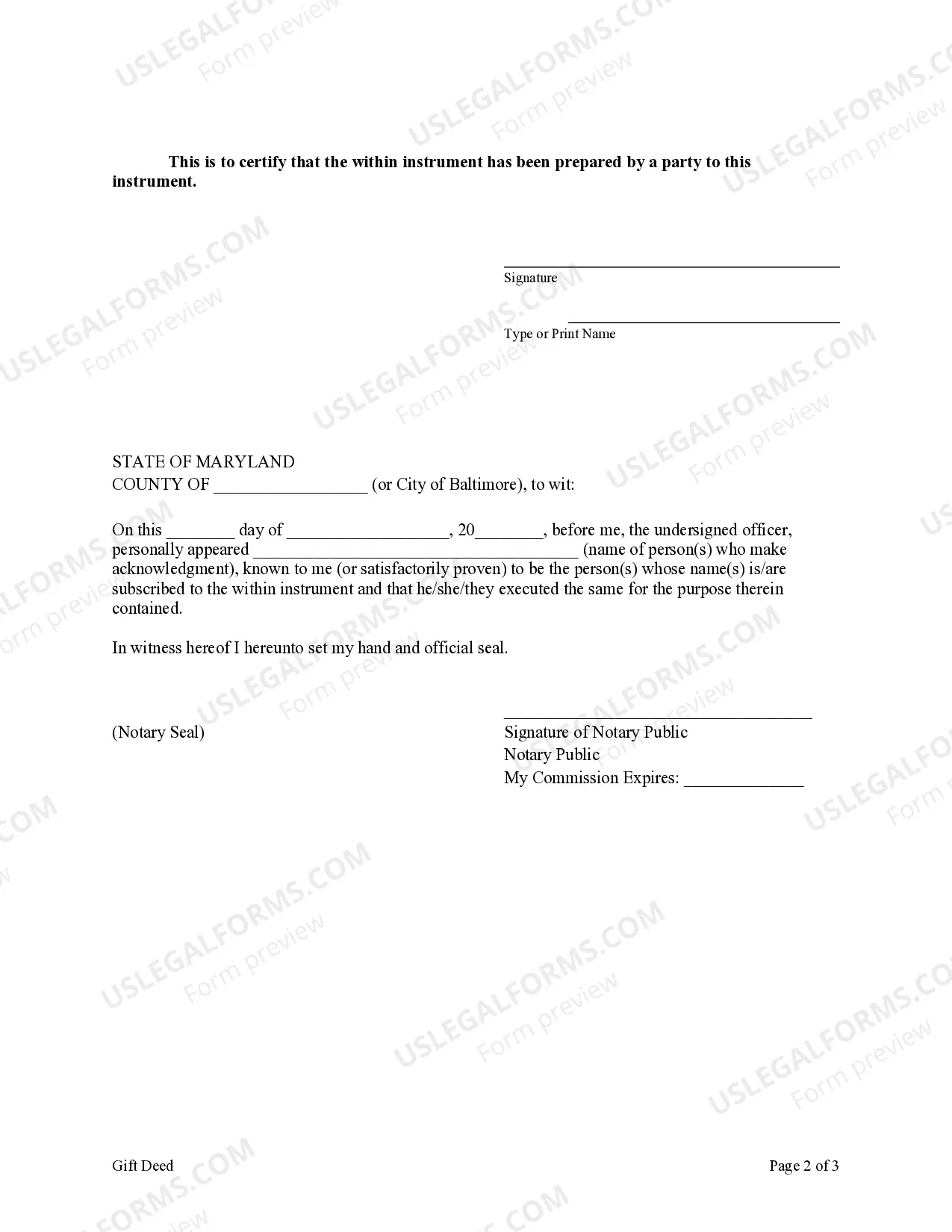

Typically, the only cost is between $25 and $55 to record the new deed and obtain a certificate from the city/county to show that all taxes are current. The deed should be notarized and must be prepared by one of the parties or under the supervision of a Maryland attorney.

To do this, you will need to fill out Transfer Form 01T on the Land and Property Information website (NSW only). If you are transferring the property as a gift, then you will fill out and sign a gift deed, which allows you to gift your assets or transfer ownership without any exchange of money.

In case the transfer is in the name of other relatives such as the father, the mother, the son, the sister, the daughter-in-law, the grandson or the daughter, 2.5 per cent of the property value has to be paid as stamp duty.

The steps to follow in order to register a gift deed are: An approved valuation expert will evaluate the property to be gifted. The Donor and the Donee will sign the gift deed in the presence of 2 witnesses. Submit the signed document at the office of the Sub-Registrar nearest to the gifted property.

Any valid owner of an existing property can gift property. A minor is incompetent to gift a property though a guardian can accept such a gift on his behalf. WHAT is the law that governs gifts by one person to another? Transfer of Property Act, 1882.