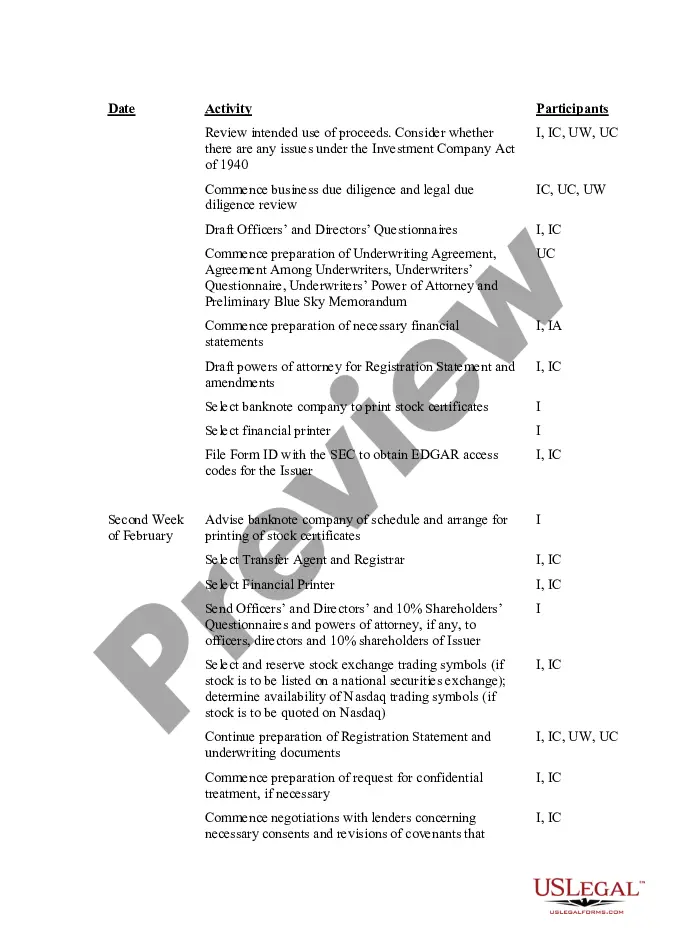

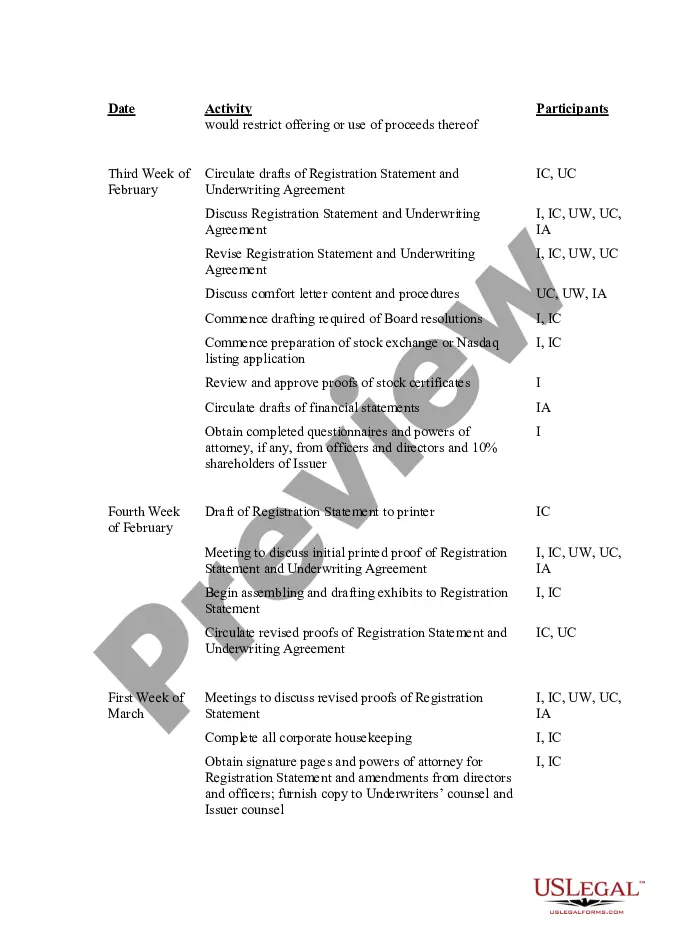

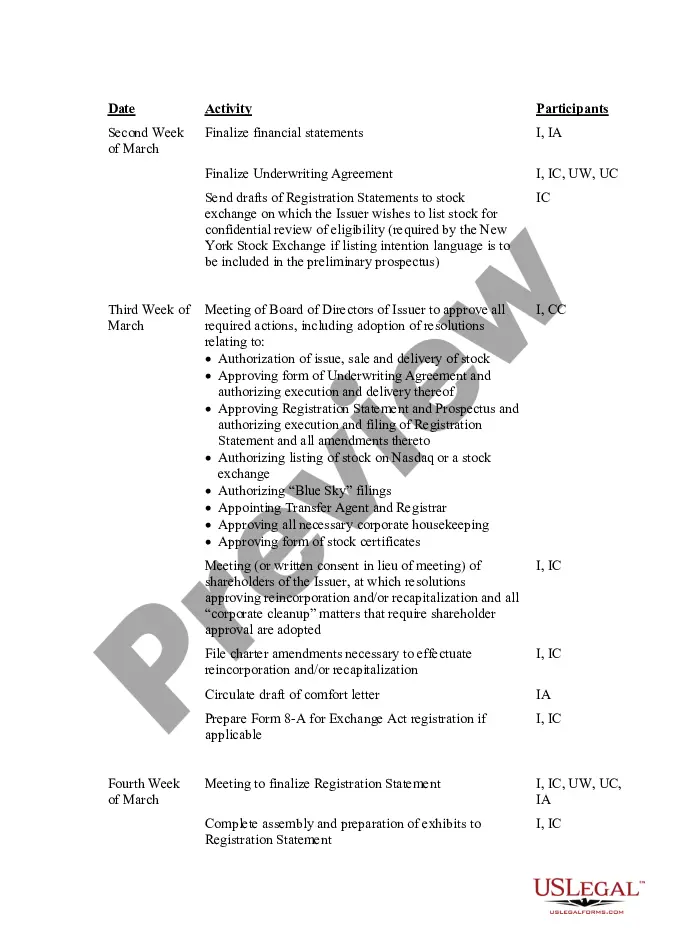

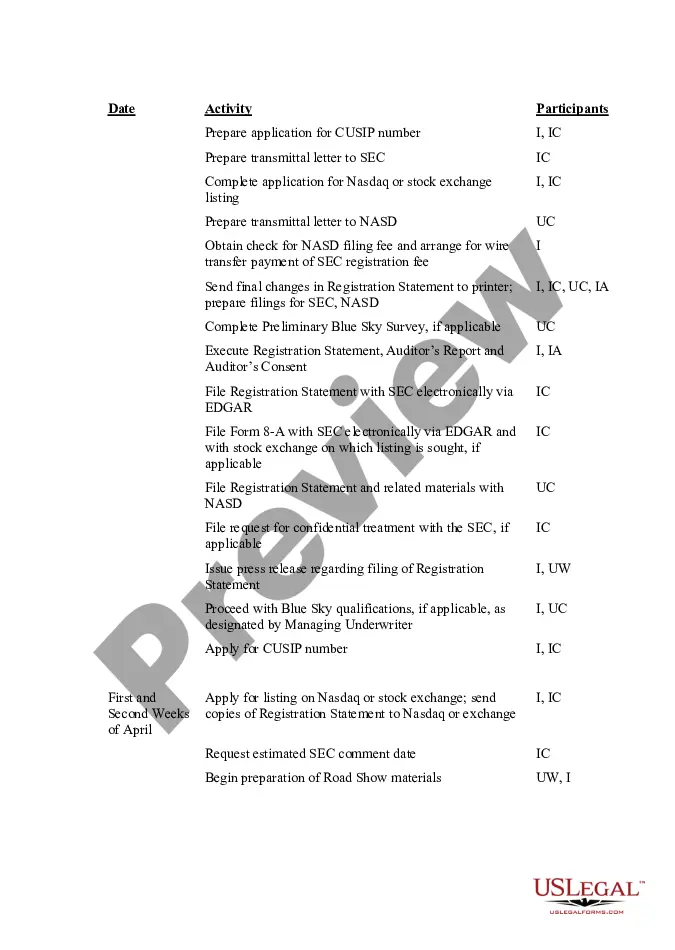

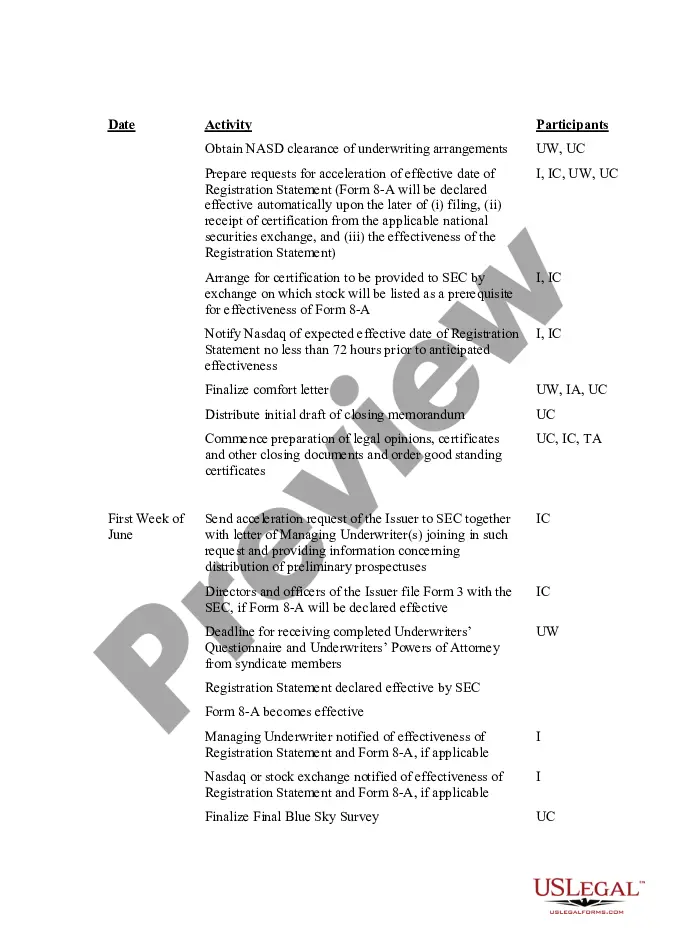

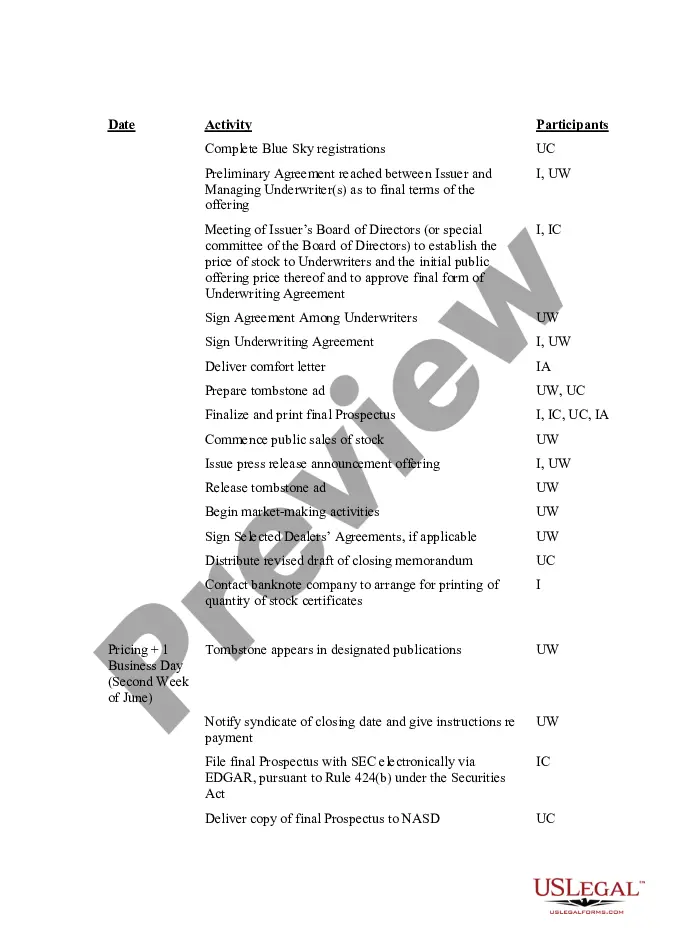

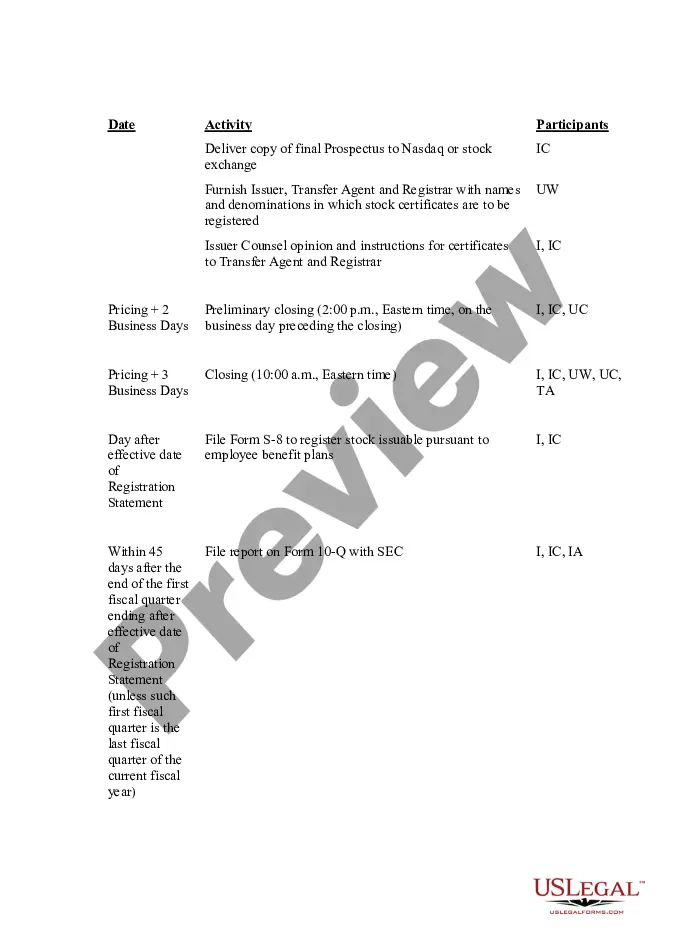

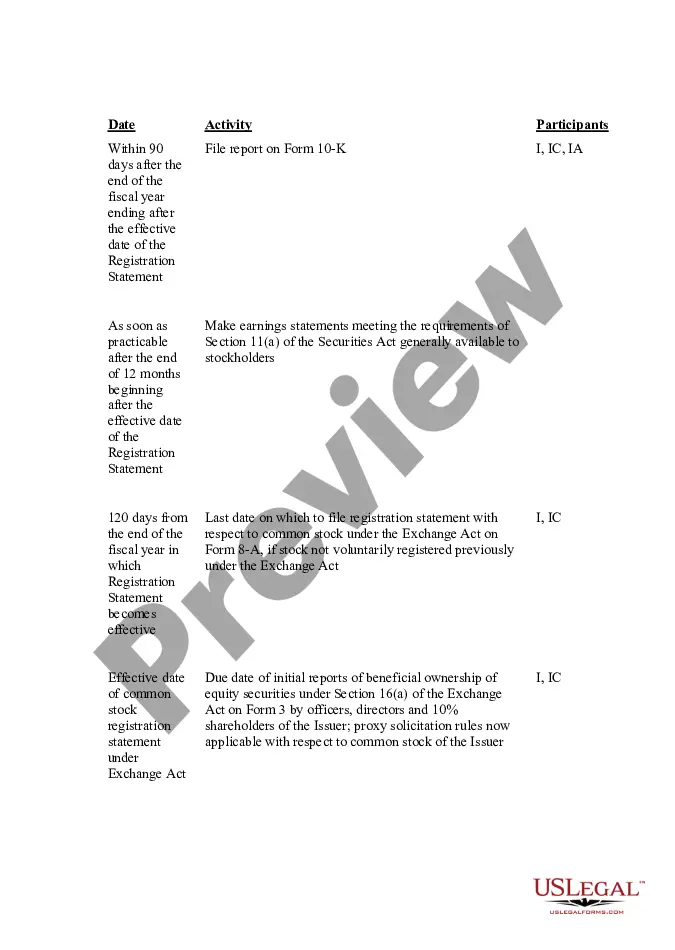

This IPO Time and Responsibility Schedule details, week by week, the tasks to be performed in the months leading up to the IPO. It lists the activities to be undertaken and the participants assigned to each task.

Massachusetts IPO Time and Responsibility Schedule

Description

How to fill out IPO Time And Responsibility Schedule?

If you want to comprehensive, download, or produce legitimate file layouts, use US Legal Forms, the biggest collection of legitimate forms, that can be found online. Make use of the site`s simple and easy practical search to discover the files you require. Different layouts for organization and personal purposes are categorized by categories and claims, or keywords. Use US Legal Forms to discover the Massachusetts IPO Time and Responsibility Schedule in a number of clicks.

Should you be presently a US Legal Forms consumer, log in in your account and then click the Download key to get the Massachusetts IPO Time and Responsibility Schedule. You can even gain access to forms you in the past acquired in the My Forms tab of the account.

If you use US Legal Forms the very first time, refer to the instructions under:

- Step 1. Make sure you have selected the shape for the proper area/land.

- Step 2. Make use of the Review choice to look through the form`s content. Do not forget about to see the explanation.

- Step 3. Should you be unhappy using the form, utilize the Research discipline at the top of the display to get other versions of your legitimate form format.

- Step 4. After you have found the shape you require, go through the Buy now key. Opt for the rates prepare you choose and put your credentials to register for the account.

- Step 5. Procedure the transaction. You can utilize your charge card or PayPal account to accomplish the transaction.

- Step 6. Pick the structure of your legitimate form and download it on the system.

- Step 7. Total, modify and produce or sign the Massachusetts IPO Time and Responsibility Schedule.

Every single legitimate file format you purchase is the one you have forever. You possess acces to every form you acquired inside your acccount. Select the My Forms section and select a form to produce or download once more.

Compete and download, and produce the Massachusetts IPO Time and Responsibility Schedule with US Legal Forms. There are thousands of expert and condition-certain forms you may use for your personal organization or personal demands.

Form popularity

FAQ

A company goes through a three-part IPO transformation process: a pre-IPO transformation phase, an IPO transaction phase, and a post-IPO transaction phase.

An IPO lock-up is period of days, typically 90 to 180 days, after an IPO during which time shares cannot be sold by company insiders.

An IPO lock-up is period of days, typically 90 to 180 days, after an IPO during which time shares cannot be sold by company insiders. Lock-up periods typically apply to insiders such as a company's founders, owners, managers, and employees but may also include early investors such as venture capitalists.

What Time Do IPOs Start Trading? IPOs don't start trading at a specific time in the United States. The IPO is held before the market opens, and then shares generally start trading when the market opens at a.m. Eastern. However, the average retail investor often can't purchase them right away.

To prevent securities fraud, the Securities Act and SEC Rules regulate the IPO Process. Section 5 of the Securities Act prevents the sale of any security unless the issuer files a registration statement and regulates the issuers' ability to offer any security for sale before filing a registration statement.

The IPO subscription data shows the number of shares applied for by all investors during the IPO subscription period. This data is tracked across all investor categories and is available in real time. The IPO subscription period is 3-10 business days, depending on the type of IPO.

What is the typical IPO timeline? While an IPO timeline can stretch across years, many professionals recommend you operate as a public company for one to two years before actually going public. There are about six key months during the IPO process.