The non-employee director stock option prospectus explains the stock option plan to the non-employee directors. It addresses the director's right to exercise the option of buying common stock in the company, along with explaining the obligations of the non-employee director where taxes and capital gains are concerned.

Massachusetts Nonemployee Director Stock Option Prospectus

Description

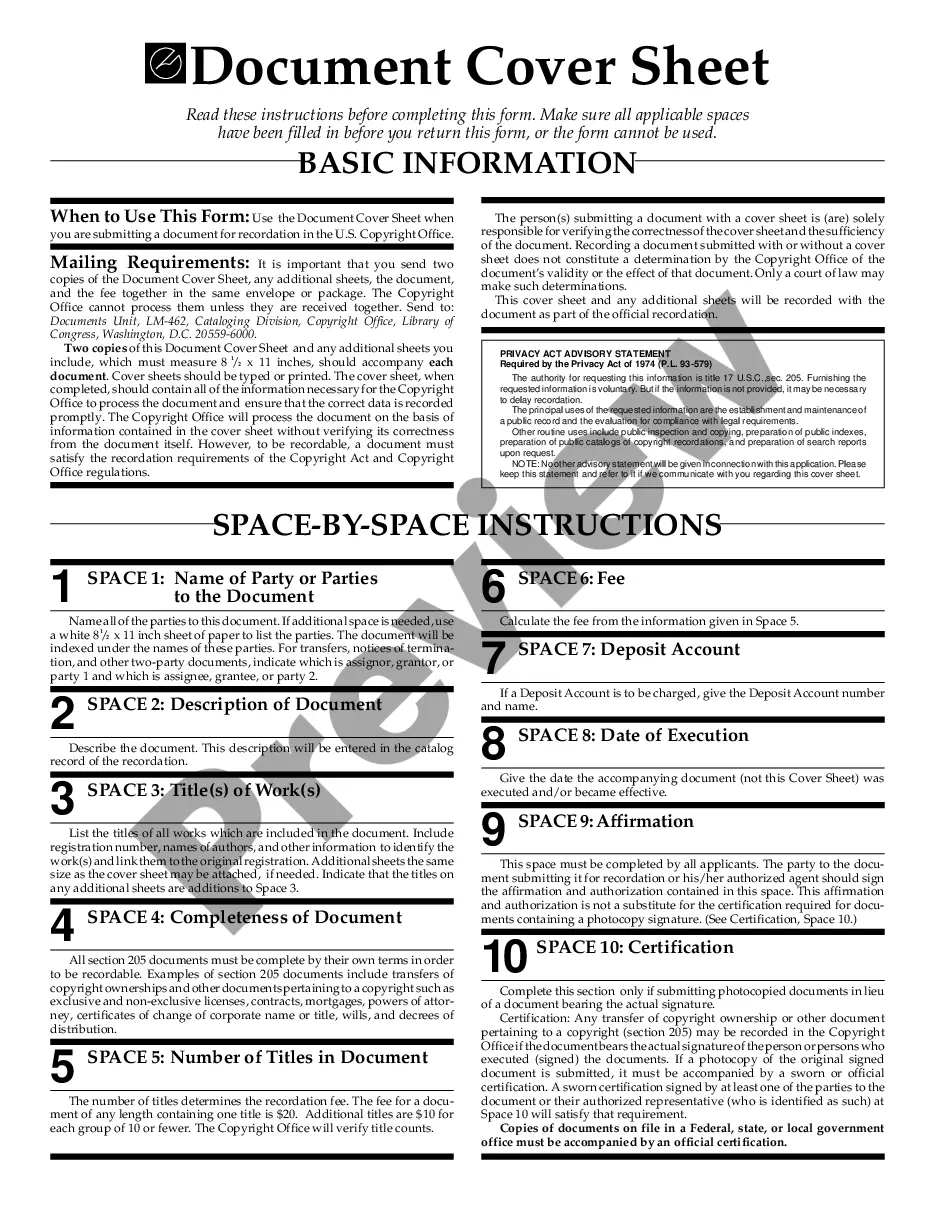

How to fill out Nonemployee Director Stock Option Prospectus?

You are able to spend time on-line looking for the legitimate record format that fits the state and federal needs you require. US Legal Forms supplies a huge number of legitimate varieties which are reviewed by professionals. It is simple to download or print the Massachusetts Nonemployee Director Stock Option Prospectus from my service.

If you currently have a US Legal Forms profile, you are able to log in and click the Down load key. Following that, you are able to total, revise, print, or sign the Massachusetts Nonemployee Director Stock Option Prospectus. Every legitimate record format you purchase is the one you have permanently. To have another backup of any purchased kind, visit the My Forms tab and click the related key.

If you work with the US Legal Forms web site the first time, follow the easy directions beneath:

- Initially, be sure that you have selected the right record format to the region/city that you pick. Look at the kind description to make sure you have selected the appropriate kind. If offered, utilize the Preview key to appear from the record format also.

- If you wish to find another model in the kind, utilize the Lookup industry to get the format that meets your needs and needs.

- Once you have discovered the format you want, click Buy now to continue.

- Pick the pricing plan you want, key in your qualifications, and sign up for your account on US Legal Forms.

- Comprehensive the financial transaction. You should use your Visa or Mastercard or PayPal profile to cover the legitimate kind.

- Pick the file format in the record and download it for your product.

- Make adjustments for your record if necessary. You are able to total, revise and sign and print Massachusetts Nonemployee Director Stock Option Prospectus.

Down load and print a huge number of record layouts making use of the US Legal Forms website, that provides the biggest variety of legitimate varieties. Use professional and condition-distinct layouts to handle your company or individual demands.

Form popularity

FAQ

qualified stock option (NQSO) is a type of stock option that does not qualify for special favorable tax treatment under the US Internal Revenue Code. Thus the word nonqualified applies to the tax treatment (not to eligibility or any other consideration).

In the case of both private and public companies, stock options are used instead of simply "giving" shares to employees. This is done for tax reasons. The only time when shares can be "given" without adverse tax consequences is when a company is founded, i.e. when the shares have a zero value.

NSOs are typically used by more mature companies for higher-paid employees. These stock options are also given to contractors, consultants and other non-employees if companies want to give them more than $100,000 worth of stock annually.

Many startups, private companies, and corporations will include them as part of a compensation plan for prospective employees. Companies often offer stock options as part of your compensation package so you can share in the company's success.

Non-qualified stock options offer workers, whether independent contractors or regular employees, the right to obtain a certain amount of the company shares for a set price. Employers tend to offer NSOs as an alternative type of compensation, to make sure they remain loyal and work for the company's best interests.

A share option is a contract issued to an employee (or another stakeholder) giving them the right to purchase shares in a company at a later date for a predetermined strike price. Share options grant you the ability to buy those shares and become a shareholder in the future.

What are non-qualified stock options? Non-qualified stock options (NSOs or NQSOs) are a type of stock option that does not qualify for tax-advantaged treatment for the employee like ISOs do. NSOs can also be issued to other non-employee service providers like consultants, advisors, and independent board members.