This office lease guaranty states that the guarantor's obligations under this guaranty shall be unaffected by any discharge or release of the tenant, its successors or assigns, or any of their debts, in connection with any bankruptcy, reorganization, or other insolvency proceeding or assignment for the benefit of creditors.

Massachusetts Guarantor Waiver Which Avoids Release of Guarantor by Reason of the Tenant Discharge Release or Bankruptcy

Description

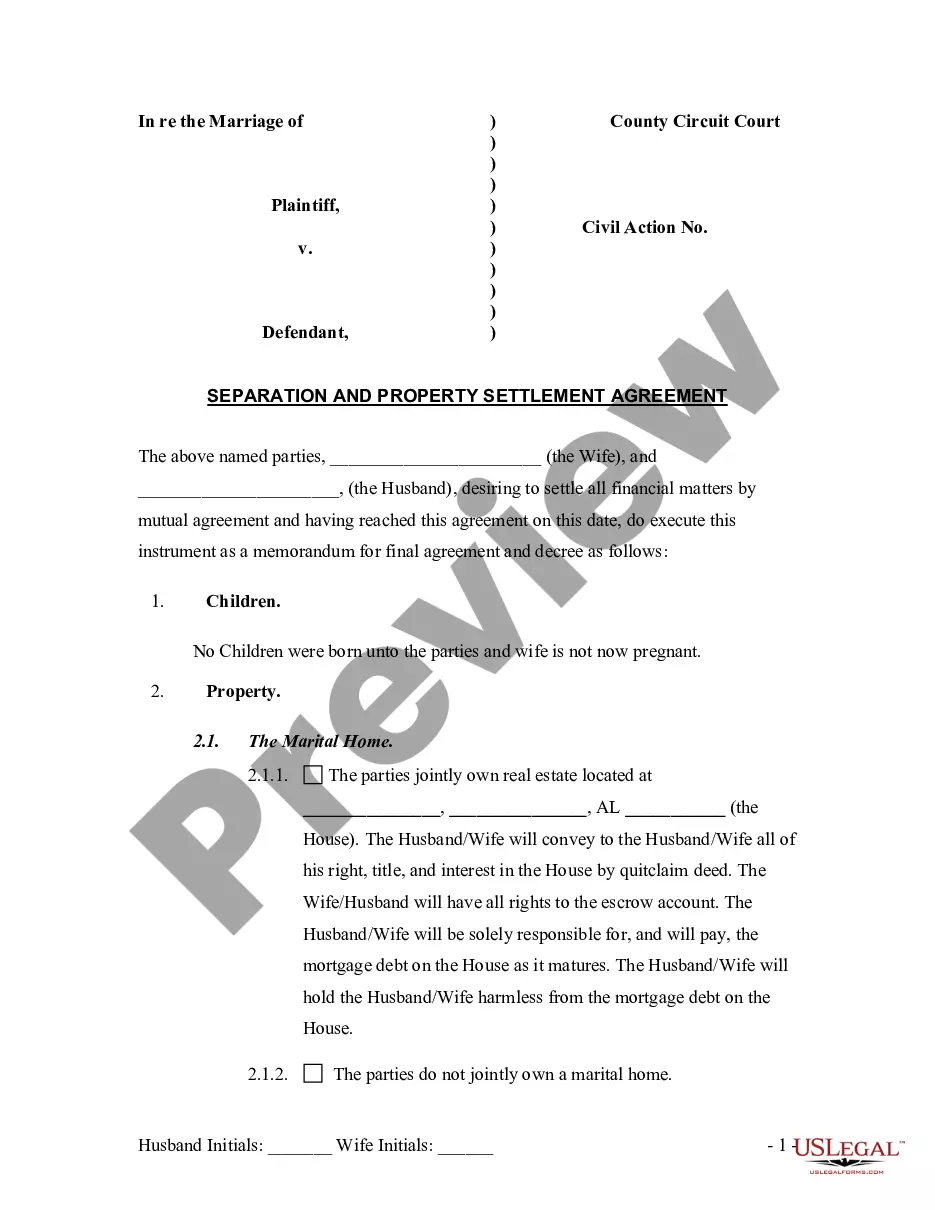

How to fill out Guarantor Waiver Which Avoids Release Of Guarantor By Reason Of The Tenant Discharge Release Or Bankruptcy?

US Legal Forms - one of the most significant libraries of legitimate kinds in the States - provides a wide range of legitimate papers templates you are able to obtain or print. While using web site, you will get a large number of kinds for company and specific functions, sorted by classes, says, or keywords and phrases.You can find the newest variations of kinds much like the Massachusetts Guarantor Waiver Which Avoids Release of Guarantor by Reason of the Tenant Discharge Release or Bankruptcy in seconds.

If you currently have a registration, log in and obtain Massachusetts Guarantor Waiver Which Avoids Release of Guarantor by Reason of the Tenant Discharge Release or Bankruptcy in the US Legal Forms library. The Acquire key will appear on each and every form you see. You have accessibility to all in the past delivered electronically kinds inside the My Forms tab of the bank account.

If you would like use US Legal Forms initially, here are easy directions to help you started out:

- Be sure you have selected the proper form for your personal area/area. Select the Preview key to examine the form`s information. Browse the form outline to ensure that you have selected the right form.

- When the form does not fit your demands, take advantage of the Research discipline near the top of the display screen to discover the one that does.

- In case you are content with the form, verify your option by clicking the Purchase now key. Then, select the pricing program you favor and give your qualifications to register for an bank account.

- Method the transaction. Utilize your Visa or Mastercard or PayPal bank account to accomplish the transaction.

- Select the file format and obtain the form on your own product.

- Make changes. Fill up, revise and print and signal the delivered electronically Massachusetts Guarantor Waiver Which Avoids Release of Guarantor by Reason of the Tenant Discharge Release or Bankruptcy.

Each and every template you added to your bank account does not have an expiration day and is your own property forever. So, in order to obtain or print another version, just check out the My Forms section and click on about the form you require.

Get access to the Massachusetts Guarantor Waiver Which Avoids Release of Guarantor by Reason of the Tenant Discharge Release or Bankruptcy with US Legal Forms, the most substantial library of legitimate papers templates. Use a large number of expert and condition-certain templates that meet your organization or specific requires and demands.

Form popularity

FAQ

Reimbursement: the right to pursue the borrower to recover any money they paid. Subrogation: If the guarantor pays back the lender in full, they then become the lender and have all the same rights as the lender to collect the debt from the initial borrower.

The guarantor waives all rights and defenses that the guarantor may have because the debtor's debt is secured by real property. This means, among other things: (1) The creditor may collect from the guarantor without first foreclosing on any real or personal property collateral pledged by the debtor.

Guarantees are a contractual arrangement where one party (the guarantor) agrees to answer for the liability of another party (the principal) to another party (the guaranteed party). Guarantors have various rights usually conferred in equity against the principal, the guaranteed party and any co-guarantors.

Guaranties are commonly used by creditors to limit their risk by shifting the risk of loss in a transaction to a third party (the guarantor) who will agree to pay the obligations owed by the person or entity primarily liable for the debt (the principal obligor) if the principal obligor defaults on its obligations.

A guarantor can't withdraw the guarantee unless entire debt has been fully repaid. As a tool for mitigating credit risk, lenders often require individuals to sign up as guarantors for: business loans being availed by the business entity of the individual; or loans being availed by friends and family of such individuals ...

Can I stop being a guarantor for a loan? Once you've signed a loan agreement and the loan has been paid out, you can't get out of being a guarantor. The lender won't remove you from the agreement because your credit history, employment status and other influences all had an impact on the approval of the loan.

The Rights of the Guarantor If the John does default, and Sandra is pursued to repay the outstanding debt, she has a few rights. Reimbursement: if Sandra paid any part of John's debt, she can pursue him to recover the money she paid or any out-of-pocket expense incurred in paying the debt.

A guarantor guarantees to pay a borrower's debt if the borrower defaults on a loan obligation. The guarantor guarantees a loan by pledging their assets as collateral. A guarantor alternatively describes someone who verifies the identity of an individual attempting to land a job or secure a passport.