Massachusetts Cease and Desist for Debt Collectors

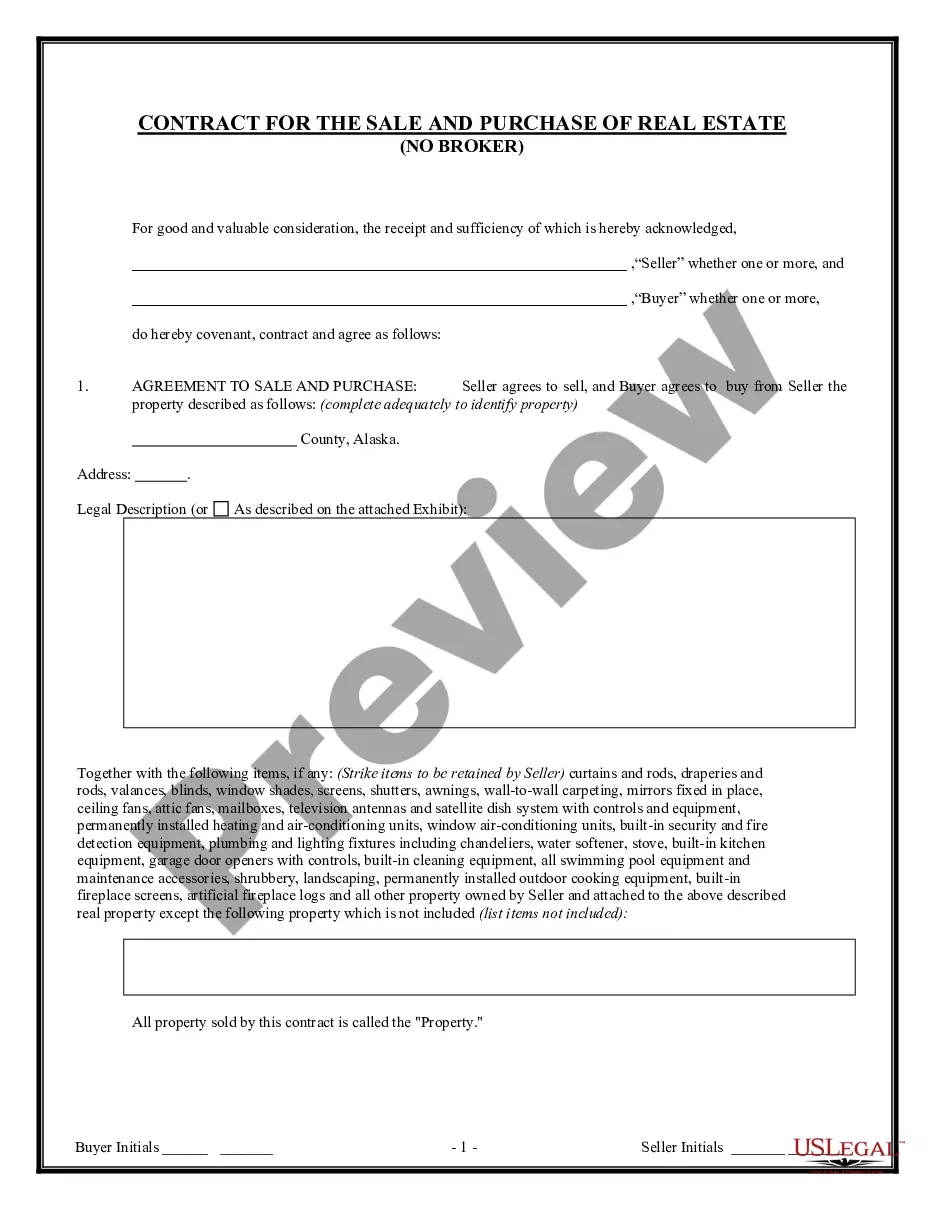

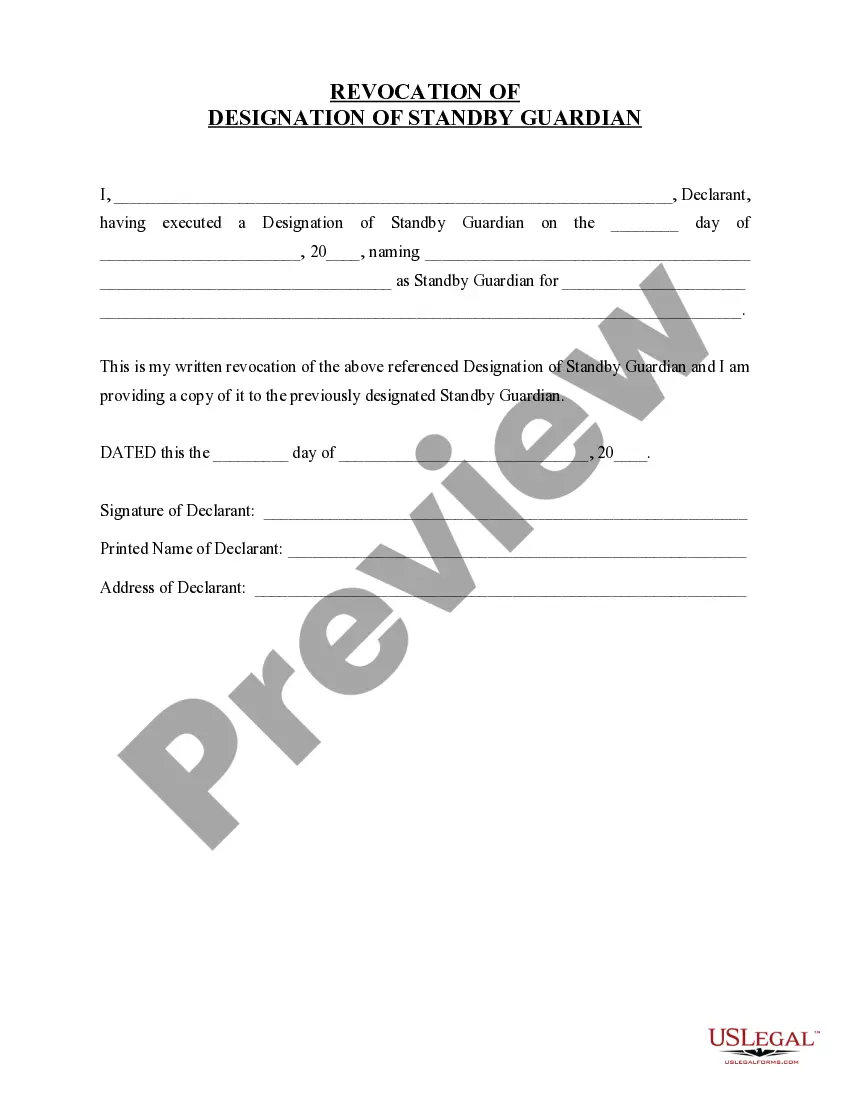

Description

How to fill out Cease And Desist For Debt Collectors?

US Legal Forms - one of the largest collections of authorized documents in America - offers a variety of legal document formats you can download or print.

Utilizing the website, you can discover thousands of templates for business and personal purposes, organized by categories, states, or keywords. You can acquire the latest documents like the Massachusetts Cease and Desist for Debt Collectors in just a few minutes.

If you already have a membership, Log In and access the Massachusetts Cease and Desist for Debt Collectors in the US Legal Forms collection. The Download button will appear on every document you view. You have access to all previously downloaded templates in the My documents tab of your account.

Retrieve the document format and download the form onto your device.

Make modifications. Complete, edit, print, and sign the downloaded Massachusetts Cease and Desist for Debt Collectors. Each template you add to your account has no expiration date and is yours indefinitely. Therefore, to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Massachusetts Cease and Desist for Debt Collectors with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the correct form for your city/state. Review the Preview button to verify the document's contents.

- Examine the form summary to confirm that you have chosen the right document.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find the one that does.

- If you are satisfied with the document, validate your choice by clicking the Buy now button.

- Then, select the pricing plan you prefer and provide your details to register for an account.

- Complete the purchase. Use your credit card or PayPal account to finalize the transaction.

Form popularity

FAQ

In Massachusetts, debt collection laws are designed to protect consumers from abusive practices. Collectors must follow specific rules, including respecting cease and desist requests, which you can send using a Massachusetts Cease and Desist for Debt Collectors letter. Familiarizing yourself with these laws can empower you to manage your debts more effectively. Platforms like US Legal Forms provide essential resources to help you understand and utilize these legal protections.

The 777 rule refers to a specific guideline regarding debt collection practices, where a collector must cease contact if a consumer requests it. This rule is part of the broader regulations governing how debt collectors should behave, particularly in Massachusetts. By understanding the 777 rule, you can better navigate your rights and obligations. Using a Massachusetts Cease and Desist for Debt Collectors can help you enforce this rule effectively.

Absolutely, you can send a cease and desist letter to a debt collector. This letter is your way of asserting your rights and requesting that they stop all communications regarding the debt. When you use a Massachusetts Cease and Desist for Debt Collectors template from US Legal Forms, you ensure that your letter meets all legal requirements. This approach can provide you with peace of mind and reduce unwanted stress.

Yes, you can tell a debt collector to cease and desist their communication with you. By sending a Massachusetts Cease and Desist for Debt Collectors letter, you inform them that you do not wish to be contacted about the debt anymore. This letter serves as a formal request, and once they receive it, they are legally obligated to stop contacting you. Utilizing a platform like US Legal Forms can help you create this letter effectively.

In Massachusetts, the statute of limitations for collecting most debts is typically six years. This means creditors have that time frame to file a lawsuit to collect the debt. After this period, you can assert a Massachusetts Cease and Desist for Debt Collectors to halt any further collection efforts. It's important to know your rights and seek help if you are facing persistent debt collection.

To support your cease and desist request, you should document any prior communications from the debt collector. Keep records of phone calls, letters, or messages that demonstrate unwanted contact. When you send a Massachusetts Cease and Desist for Debt Collectors, include copies of these communications to strengthen your case. This documentation can provide essential evidence if you need to take further action against the collector.

The 11-word phrase that can stop debt collectors is: 'I do not want to be contacted by you again.' This phrase can be included in your Massachusetts Cease and Desist for Debt Collectors to clearly communicate your wishes. When debt collectors receive this message, they are legally obligated to cease communication, allowing you to focus on resolving your financial issues. Remember, clarity is key in your communication.

Writing a cease and desist letter to a debt collector involves a few key steps. First, clearly state your intention to stop all communication from the collector in your Massachusetts Cease and Desist for Debt Collectors. Include your personal information, the debt collector's details, and a request for confirmation of receipt. You can use templates available on platforms like US Legal Forms to make this process easier and ensure you include all necessary information.

A 609 letter is a request for validation of a debt, named after Section 609 of the Fair Credit Reporting Act. When you send a Massachusetts Cease and Desist for Debt Collectors along with a 609 letter, you ask the collector to provide proof that you owe the debt. This process can help you verify the legitimacy of the debt and ensure that you are not being pursued for incorrect or outdated information. Using both letters can strengthen your position.

Yes, cease and desist letters can be effective tools for dealing with debt collectors. When you send a Massachusetts Cease and Desist for Debt Collectors, it formally requests that the collector stop contacting you. If they ignore your request, they may violate the Fair Debt Collection Practices Act, which provides you with legal grounds to take further action. Ultimately, this can help you regain control over your situation.