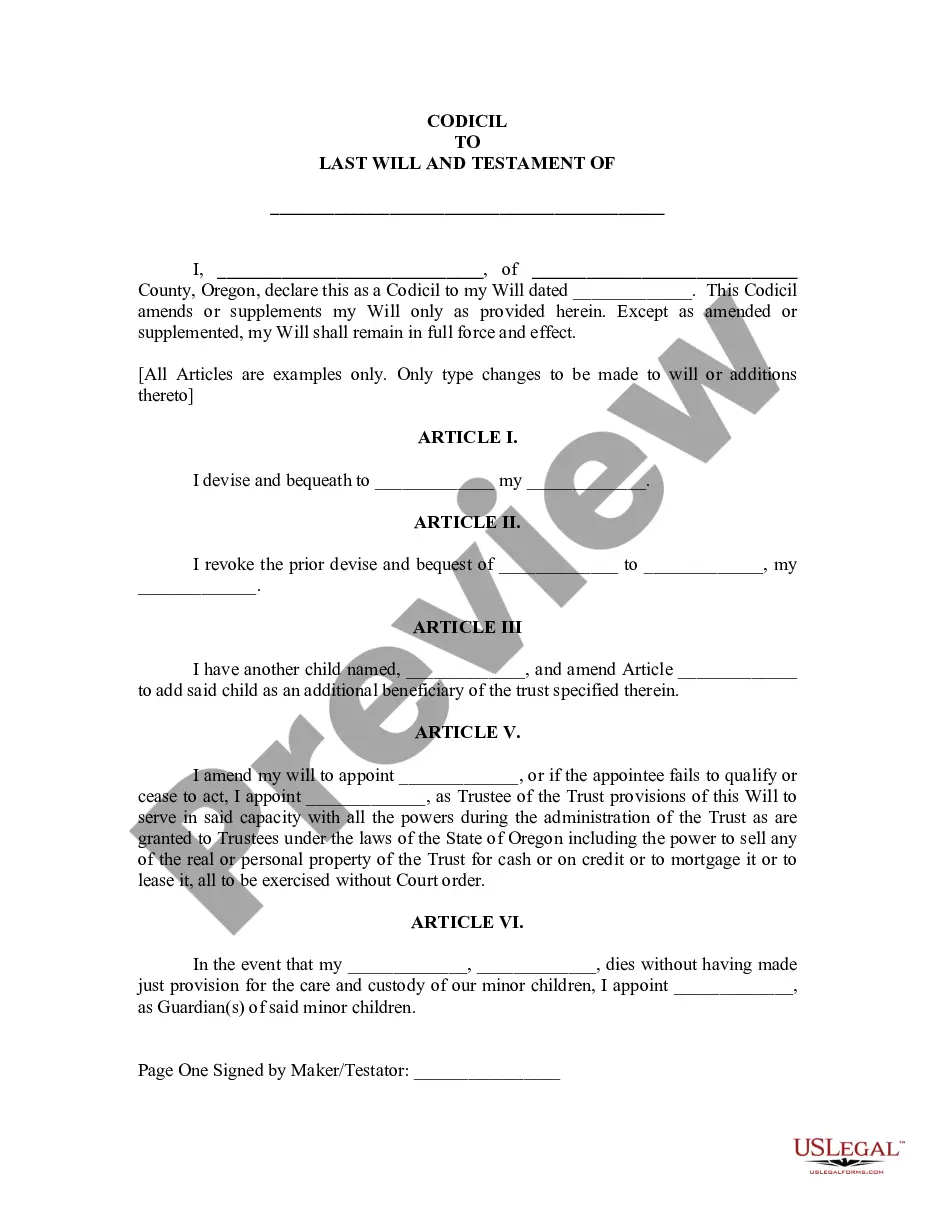

This NOTICE OF HARRASSMENT & VALIDATION OF DEBT is to be used when creditors call you repeatedly and mail you letters too. This form includes a cease and desist and a validation of debt, 2 letters in one.

Massachusetts Notice of Harassment and Validation of Debt

Description

How to fill out Notice Of Harassment And Validation Of Debt?

Are you in a situation where you require documents for either business or personal purposes regularly.

There are numerous legal document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms offers a vast array of form templates, such as the Massachusetts Notice of Harassment and Validation of Debt, designed to meet state and federal regulations.

Avoid altering or removing any HTML tags.

Only synonymize plain text outside of the HTML tags.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Massachusetts Notice of Harassment and Validation of Debt template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the form you require and ensure it's for your correct state/region.

- Utilize the Preview button to examine the form.

- Review the details to ensure you have selected the correct form.

- If the form is not what you need, use the Search field to find the form that suits your needs and requirements.

- Once you find the appropriate form, click on Purchase now.

- Choose the payment plan you prefer, enter the necessary information to set up your account, and pay for your order with your PayPal or credit card.

- Select a suitable file format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Massachusetts Notice of Harassment and Validation of Debt anytime, if needed. Just select the desired form to download or print the document template.

- Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors.

- The service offers professionally crafted legal document templates that can be used for various purposes.

- Create your account on US Legal Forms and start making your life a bit easier.

Form popularity

FAQ

Harassment from debt collectors includes aggressive communication tactics, threats of violence, or using obscene language. It also encompasses contacting you at unreasonable hours or repeatedly calling you. Understanding what constitutes harassment can help you take appropriate action. If you encounter such behavior, the Massachusetts Notice of Harassment and Validation of Debt can serve as an essential tool in asserting your rights.

You can report harassment from debt collectors to several authorities, including the Consumer Financial Protection Bureau and your local attorney general's office. These organizations take such complaints seriously and can help investigate the matter. Additionally, consider using the Massachusetts Notice of Harassment and Validation of Debt as part of your documentation. This approach can strengthen your case against unlawful practices.

The 777 rule refers to a guideline that debt collectors must follow, which includes a seven-day waiting period before contacting you again after a dispute. This rule aims to protect consumers from excessive communication. Understanding the 777 rule can empower you when dealing with debt collectors. Utilize the Massachusetts Notice of Harassment and Validation of Debt to ensure that you are treated fairly under this guideline.

If you believe that a debt collector is harassing you, document all interactions you have with them. You can file a complaint with the Consumer Financial Protection Bureau or your state's attorney general's office. Additionally, consider using the Massachusetts Notice of Harassment and Validation of Debt to formally address the harassment. This document can help assert your rights and seek resolution.

To file a debt validation claim, start by sending a written request to the debt collector, asking for proof of the debt. This request should include your details and the specific information you seek. Once you receive the information, review it carefully to ensure its accuracy. If the debt is not validated, consider using the Massachusetts Notice of Harassment and Validation of Debt to protect your rights.

To obtain a debt validation letter, you should first request it from the creditor or debt collector. Under the Fair Debt Collection Practices Act, you have the right to ask for this letter within 30 days of receiving a notice about the debt. This letter must include important details about the debt, such as the amount and the original creditor. Additionally, you can visit USLegalForms, where you can find templates and resources to assist you in crafting a formal request for validation, ensuring you protect your rights under the Massachusetts Notice of Harassment and Validation of Debt.

The 11-word phrase to stop debt collectors is, 'I do not owe this debt, please cease contact.' This statement asserts your position and invokes your rights under the Massachusetts Notice of Harassment and Validation of Debt. Using such phrases can be effective when dealing with aggressive collectors, helping you regain control over your financial situation.

Filling out a debt validation letter involves entering your personal details, the collector's information, and the amount owed. Clearly state your request for validation, referencing the Massachusetts Notice of Harassment and Validation of Debt for clarity. Follow the template provided by uslegalforms to ensure you include all necessary information and maintain a professional tone.

The best sample for a debt validation letter includes essential elements such as your contact information, a clear request for validation, and specific details about the debt. You can find reliable samples on uslegalforms, which can help you customize your letter according to the Massachusetts Notice of Harassment and Validation of Debt. This ensures your letter is effective and aligns with legal standards.

Responding to a summons for debt collection in Massachusetts requires careful attention. First, read the summons thoroughly to understand the claims against you. Then, prepare a written response that addresses each point, citing the Massachusetts Notice of Harassment and Validation of Debt if applicable. It's wise to consult with a legal expert or use platforms like uslegalforms to guide you through this process.