Massachusetts Self-Employed Industrial Laundry Services Contract

Description

How to fill out Self-Employed Industrial Laundry Services Contract?

If you wish to be thorough, download, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms that are accessible online.

Employ the site’s simple and user-friendly search to find the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to obtain the Massachusetts Self-Employed Industrial Laundry Services Contract with just a few clicks of your mouse.

Every legal document template you purchase is your property for a long time. You have access to all forms you acquired within your account. Click on the My documents section and select a form to print or download again.

Be proactive and download, and print the Massachusetts Self-Employed Industrial Laundry Services Contract with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to retrieve the Massachusetts Self-Employed Industrial Laundry Services Contract.

- You can also access forms you previously acquired in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

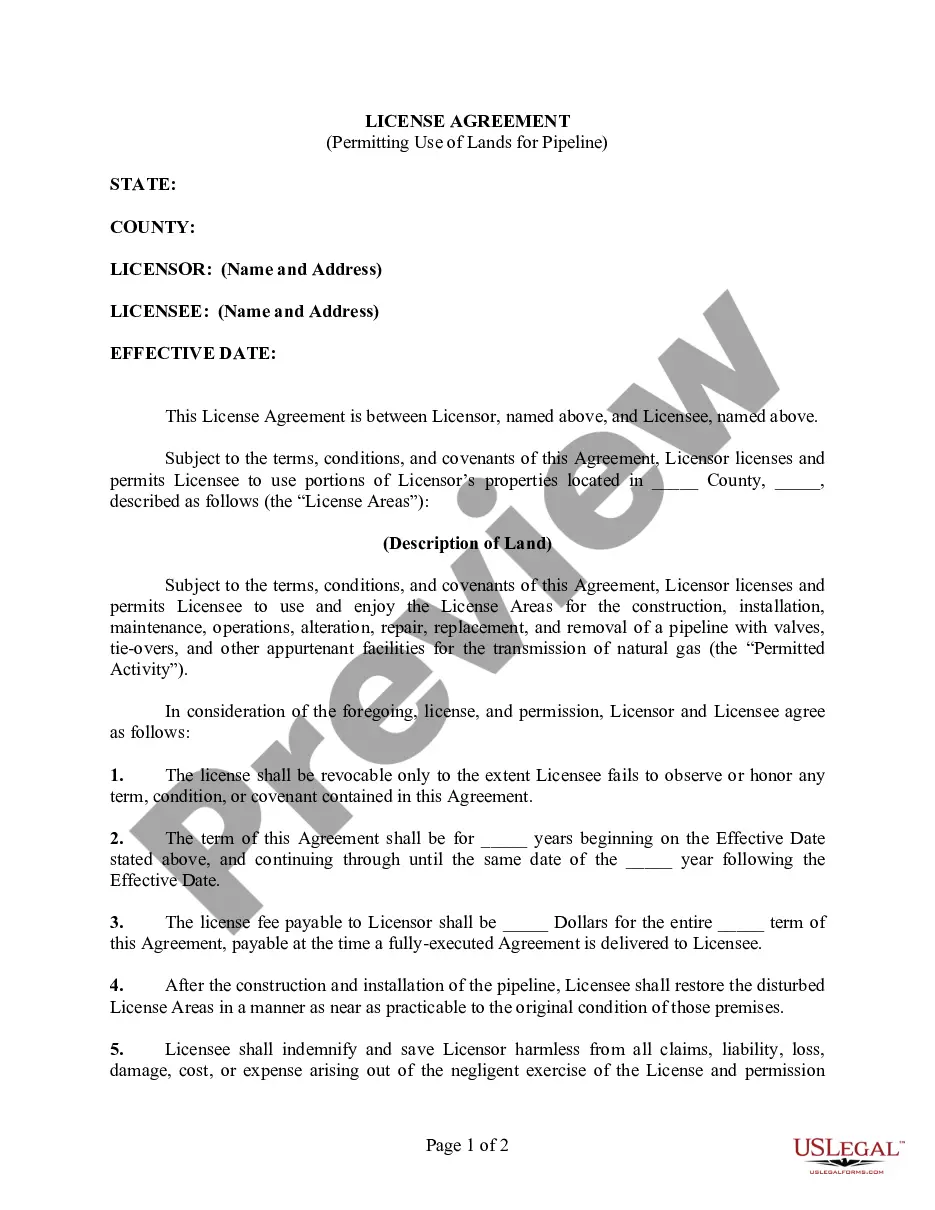

- Step 2. Utilize the Preview option to review the form’s content. Don’t forget to read the summary.

- Step 3. If you are dissatisfied with the form, make use of the Search area at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you desire, click the Buy now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Massachusetts Self-Employed Industrial Laundry Services Contract.

Form popularity

FAQ

Yes, employment contracts are generally enforceable in Massachusetts, provided they meet certain legal criteria. These contracts outline the terms of employment, including duties, compensation, and termination conditions. When drafting your Massachusetts self-employed industrial laundry services contract, ensure that it complies with state laws and clearly specifies the rights and responsibilities of both parties.

An industrial laundry business provides laundering services primarily to commercial clients, such as hotels, restaurants, and hospitals. These services often include washing, drying, and folding large quantities of linens, uniforms, and other textiles. If you are considering starting a Massachusetts self-employed industrial laundry services contract, it is essential to understand the operational aspects and legal requirements involved in this industry.

Contract labor in Massachusetts is generally not subject to sales tax if it falls under non-taxable services. However, the specifics of your Massachusetts Self-Employed Industrial Laundry Services Contract can influence tax obligations. It's beneficial to review your contract details and consult a tax advisor to ensure compliance.

As a self-employed individual, you can write off numerous business-related expenses to reduce your taxable income. This includes expenses related to your Massachusetts Self-Employed Industrial Laundry Services Contract, such as supplies, equipment, and travel costs. Keep detailed records to substantiate your deductions and consult a tax professional for guidance.

Service labor in Massachusetts is generally not taxable unless it is part of a taxable service or product. Under a Massachusetts Self-Employed Industrial Laundry Services Contract, service labor should typically remain tax-exempt. However, always verify the nature of the labor provided to ensure compliance.

Personal service contracts in Massachusetts are usually exempt from sales tax. This includes services provided under a Massachusetts Self-Employed Industrial Laundry Services Contract. However, reviewing the specifics of the contract and consulting a tax expert can provide clarity.

Professional services in Massachusetts are typically not subject to sales tax. This includes services rendered under a Massachusetts Self-Employed Industrial Laundry Services Contract. However, ensure you are aware of any exceptions that may apply to your specific industry.

Cleaning services in Massachusetts are generally considered non-taxable, especially if they fall under personal services. However, specific circumstances can change tax liability, such as if the cleaning service is part of a larger taxable contract. Always clarify the terms of your Massachusetts Self-Employed Industrial Laundry Services Contract for precise tax obligations.

In Massachusetts, whether a service contract is taxable depends on the type of service provided. Most personal services are not taxable, but certain services may fall under taxable categories. To avoid confusion, review the specific details of your Massachusetts Self-Employed Industrial Laundry Services Contract and seek guidance from a tax advisor.

When you provide services under a Massachusetts Self-Employed Industrial Laundry Services Contract, you must consider whether sales tax applies. Generally, services are not taxable unless they are specifically categorized as taxable services by the state. It's wise to consult with a tax professional to ensure compliance with Massachusetts tax regulations.