Massachusetts Self-Employed Utility Services Contract

Description

How to fill out Self-Employed Utility Services Contract?

Are you presently in the situation where you require documents for various business or personal purposes almost every day? There are numerous legal document templates accessible online, but finding ones you can trust isn't simple.

US Legal Forms offers thousands of form templates, such as the Massachusetts Self-Employed Utility Services Contract, which are designed to meet state and federal requirements.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Massachusetts Self-Employed Utility Services Contract template.

Select a convenient document format and download your copy.

You can find all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Massachusetts Self-Employed Utility Services Contract at any time if needed. Just click the required form to download or print the document template. Use US Legal Forms, the most comprehensive collection of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your specific city/state.

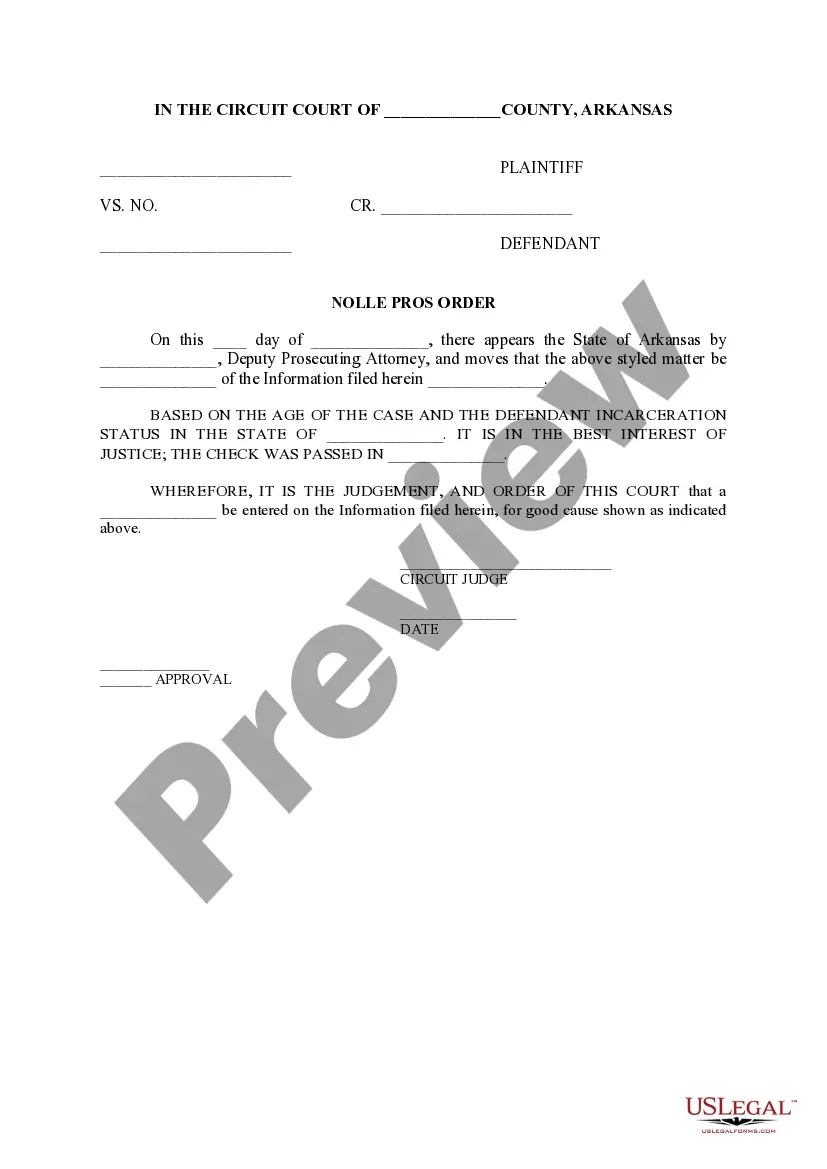

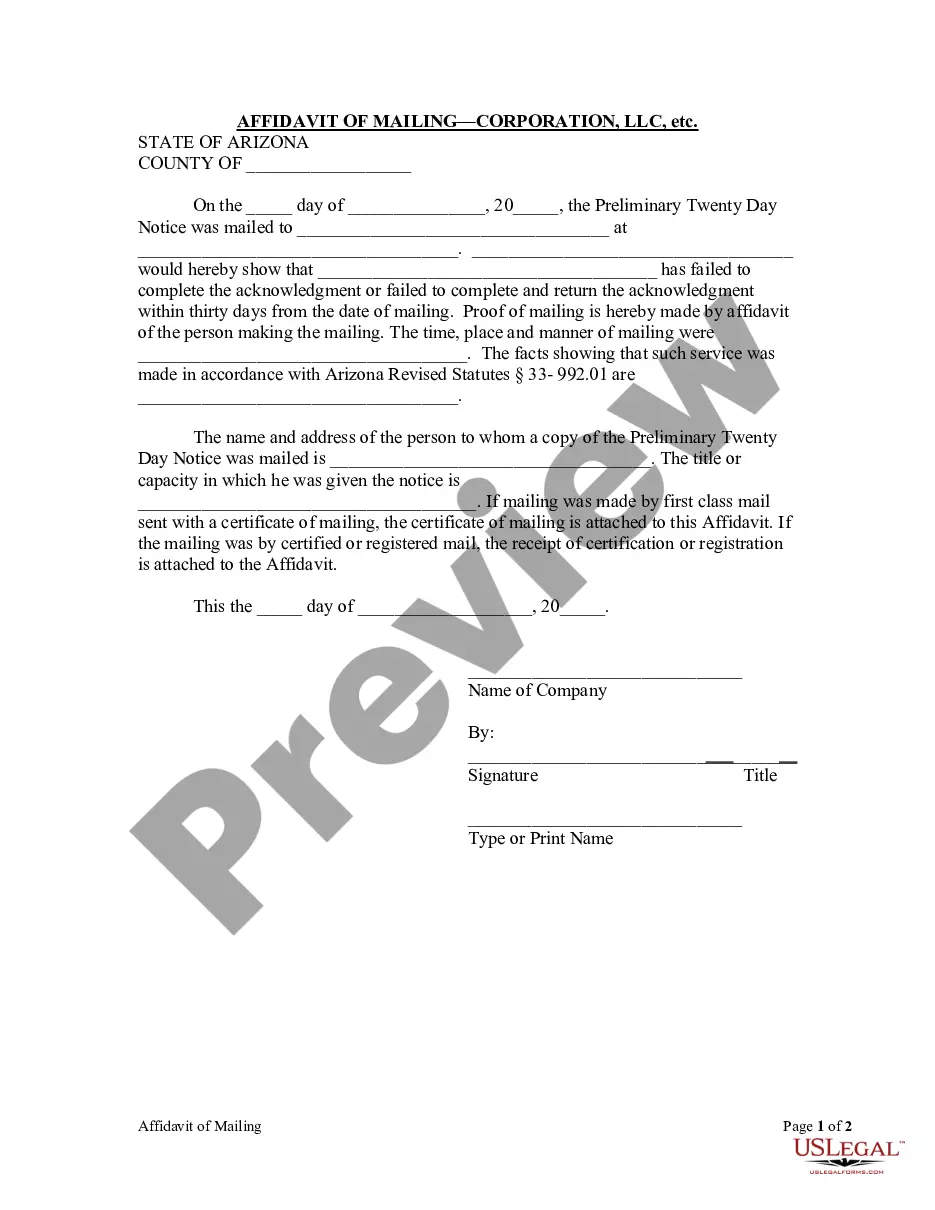

- Use the Preview button to view the form.

- Read the description to confirm you have selected the correct form.

- If the form isn't what you're looking for, use the Search area to find the form that meets your needs and criteria.

- Once you have the correct form, click Acquire now.

- Choose the pricing plan you prefer, fill in the necessary details to create your account, and complete the transaction using your PayPal or Visa or Mastercard.

Form popularity

FAQ

Writing a simple employment contract involves outlining key components such as job title, responsibilities, salary, and working hours. Include terms for termination and any benefits offered. Keep the language straightforward to ensure clarity. For those needing guidance, US Legal Forms provides comprehensive resources for creating a Massachusetts Self-Employed Utility Services Contract that meets your requirements.

To write a contract agreement for services, begin with a clear title and identify the parties involved. Describe the services in detail and include payment provisions, timelines, and any necessary warranties. It's crucial to make the agreement understandable to avoid disputes later. For a professional approach, consider using US Legal Forms to draft a Massachusetts Self-Employed Utility Services Contract.

You can write your own service agreement, but it must include essential details like the scope of services, payment terms, and duration of the agreement. Be precise in defining the responsibilities of each party. For added peace of mind, you can use templates from US Legal Forms that are specifically designed for Massachusetts Self-Employed Utility Services Contracts.

When writing a contract for a 1099 employee, specify the nature of the work, payment terms, and any deliverables. Clearly outline the independent status of the worker to prevent any misclassification issues. It’s advisable to include clauses related to termination and liability. Utilizing US Legal Forms can help you create a compliant Massachusetts Self-Employed Utility Services Contract tailored for your needs.

Yes, you can write your own legally binding contract as long as it includes all necessary elements such as offer, acceptance, and consideration. Ensure that the language used is clear and unambiguous. To enhance the reliability of your contract, you may want to consult templates or resources from US Legal Forms, especially for a Massachusetts Self-Employed Utility Services Contract.

To write a self-employment contract, start by clearly stating the names of the parties involved and the services to be provided. Include terms regarding payment, deadlines, and any specific responsibilities. It is also essential to address confidentiality and dispute resolution. Consider using a template from US Legal Forms for a streamlined process that adheres to Massachusetts Self-Employed Utility Services Contract standards.

An independent contractor agreement in Massachusetts is a legal document that outlines the relationship between a contractor and a client. This agreement specifies the terms of work, payment, and responsibilities, making it essential for those operating under a Massachusetts Self-Employed Utility Services Contract. By clearly defining expectations, this agreement helps protect both parties and promotes a successful working relationship. To create a solid agreement, explore the resources available on uslegalforms for tailored templates.

The 3 hour rule in Massachusetts refers to a guideline that dictates how long a self-employed individual can work without requiring certain benefits. This rule is particularly relevant for workers who operate under a Massachusetts Self-Employed Utility Services Contract. Understanding this rule helps ensure that you comply with state regulations while maximizing your work hours effectively. For personalized guidance, consider using platforms like uslegalforms to navigate the specifics of your contract.

Writing a self-employed contract involves outlining the scope of work, payment terms, and responsibilities for both parties. Start by clearly defining the services you will provide under a Massachusetts Self-Employed Utility Services Contract, including timelines and deliverables. It is crucial to include clauses about confidentiality, liability, and dispute resolution to protect your interests. For an effective contract template, you can explore uslegalforms, which offers user-friendly resources tailored to self-employed professionals.

The tax rate for 1099 income in Massachusetts aligns with the state's income tax brackets, which range from 5% to 9%. If you earn income as a contractor under a Massachusetts Self-Employed Utility Services Contract, you will report this income on your state tax return. It is important to calculate your earnings accurately and set aside enough for taxes to avoid any surprises during tax season. Consider using uslegalforms to help draft your contracts and clarify your tax responsibilities.