The New York Foreclosure Conference Notes Form is a legal document used to document court proceedings related to foreclosure actions in the state of New York. It is used by court personnel to take notes during court proceedings and to ensure the accuracy of the proceedings. The form contains information such as the court's jurisdiction, the case number, the court date, the names of the parties involved, the court's decision, and the court's order. There are two types of New York Foreclosure Conference Notes Form: the Short Form and the Long Form. The Short Form is used for proceedings that are relatively simple and do not require a lengthy explanation. The Long Form is used for more complicated proceedings and requires more detailed notes. The form is filled out and then filed with the court.

New York Foreclosure Conference Notes Form

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out New York Foreclosure Conference Notes Form?

If you’re searching for a way to properly prepare the New York Foreclosure Conference Notes Form without hiring a lawyer, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every individual and business scenario. Every piece of documentation you find on our web service is created in accordance with nationwide and state laws, so you can be sure that your documents are in order.

Follow these straightforward instructions on how to get the ready-to-use New York Foreclosure Conference Notes Form:

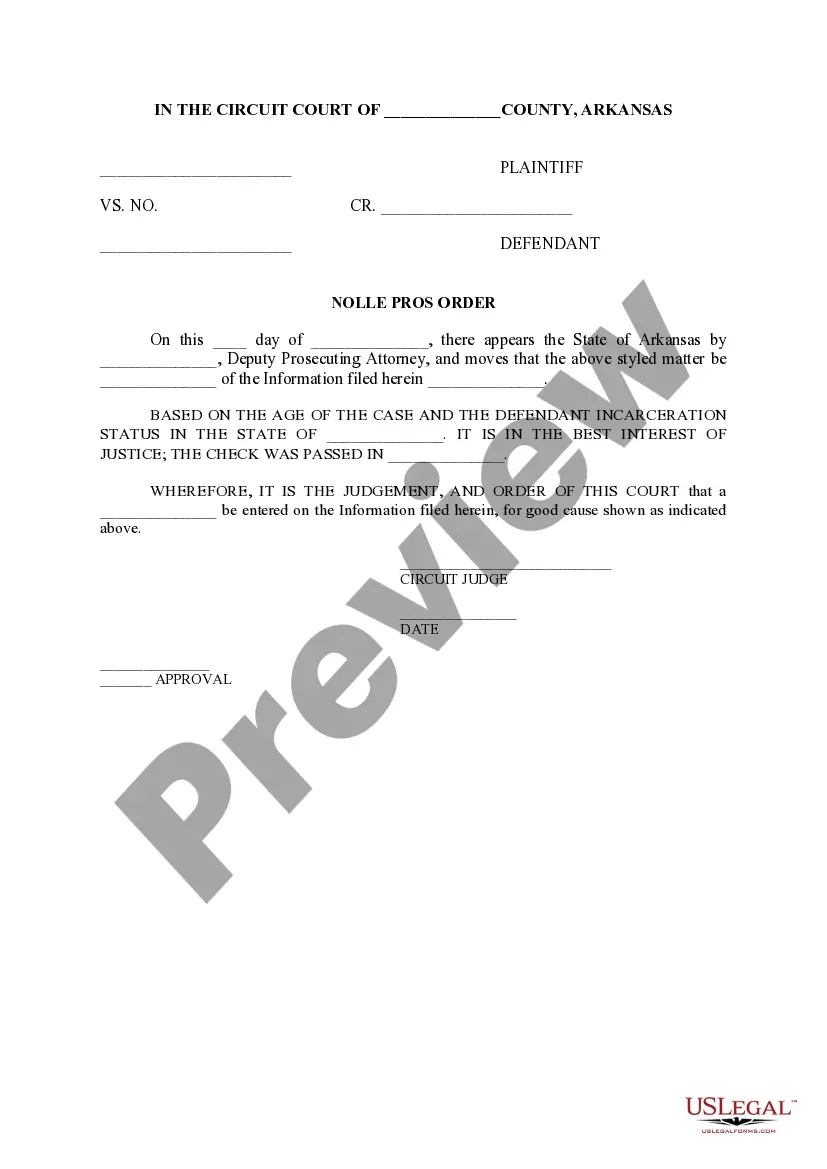

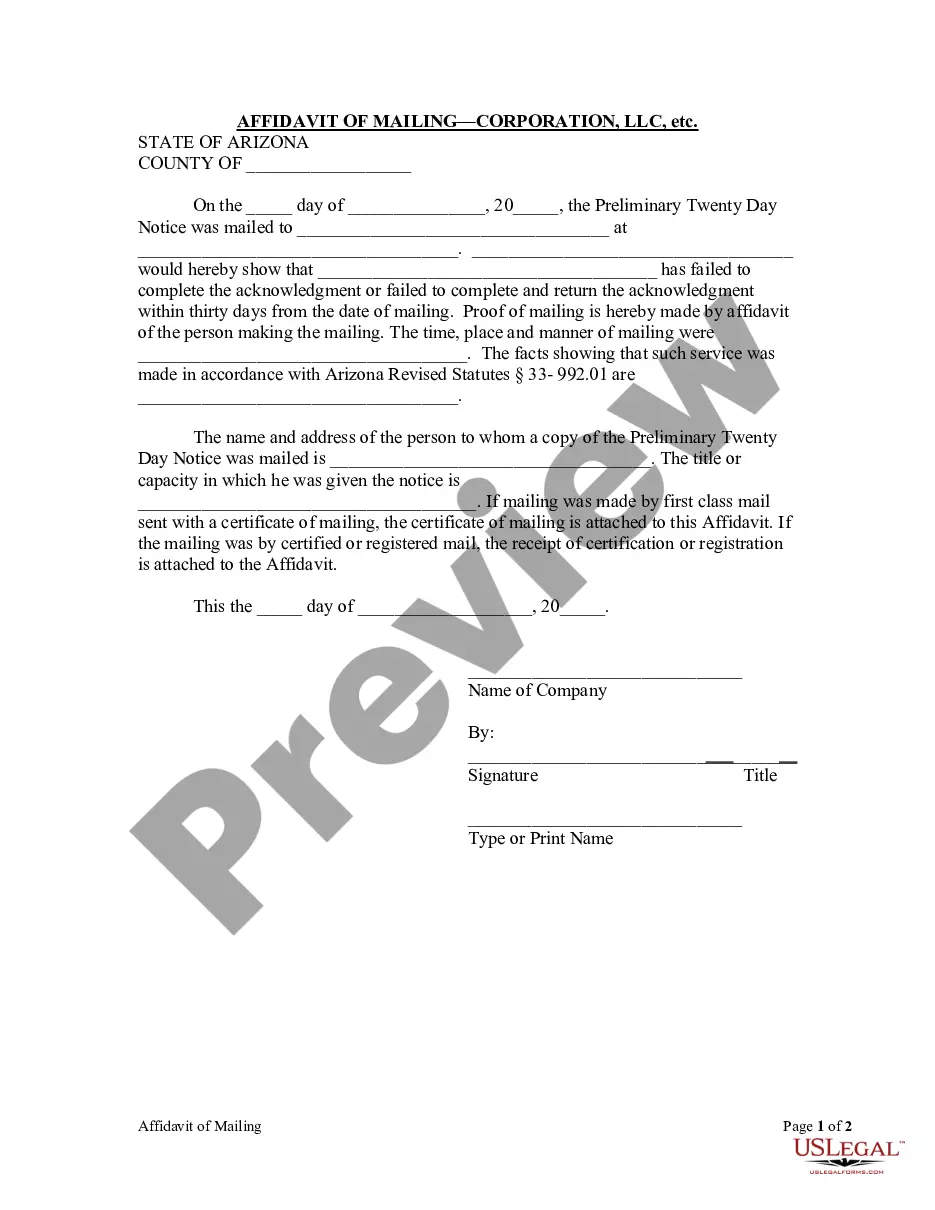

- Make sure the document you see on the page meets your legal situation and state laws by checking its text description or looking through the Preview mode.

- Type in the document title in the Search tab on the top of the page and select your state from the dropdown to locate another template if there are any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Register for the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The blank will be available to download right after.

- Decide in what format you want to save your New York Foreclosure Conference Notes Form and download it by clicking the appropriate button.

- Add your template to an online editor to fill out and sign it quickly or print it out to prepare your paper copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you acquired - you can find any of your downloaded blanks in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

Ing to the New York State Department of Financial Services, an average foreclosure case takes about 445 days to be concluded in New York, with some taking much longer depending on the court in which the case was filed.

Lender asks court for a judgment on default and to appoint a Referee to decide the amount you owe and write a report. Lender asks court to accept the Referee's findings. Judge orders sale of your home. Lender and Referee choose date for auction at the courthouse.

It's due in 20 days if you were served in person; 30 days if served by mail. Lender asks court for a judgment without trial and to appoint a Referee to decide the amount you owe and write a report. Both sides come to court to see if they can find a way for you to keep your home and avoid foreclosure.

To avoid foreclosure, you agree to turn over the deed to your home to the lender. In exchange, the lender agrees that you no longer owe any additional debt. The agreement should say that the deed in lieu of foreclosure is in full satisfaction of your debt.

You can sell your home until the foreclosure auction date, and you will lose all property rights once the sale is final. Homeowners who are selling their homes should communicate their plans to their lenders. Most lenders would prefer a total sale price to a loss at auction.

New York is a judicial foreclosure state, which means that the lender has to sue the borrower in order to enforce their rights under the mortgage and note. If the lender wins the lawsuit, it obtains a judgment from the court, which allows the lender to sell the property at an auction.

If you cannot afford a private attorney, resources for free or low-cost legal assistance include: New York's Homeowner Protection Program (HOPP), which connects with housing counselors and legal services at no cost. Call the HOPP hotline at (855) 466-3456 or visit homeownerhelpny.com.