Massachusetts Insulation Services Contract - Self-Employed

Description

How to fill out Insulation Services Contract - Self-Employed?

Are you in a location where you frequently require documents for either business or personal reasons? There are numerous legal document templates accessible online, but locating reliable forms can be challenging.

US Legal Forms offers thousands of document templates, such as the Massachusetts Insulation Services Contract - Self-Employed, designed to comply with federal and state regulations.

If you are already acquainted with the US Legal Forms website and possess an account, simply sign in. After that, you can download the Massachusetts Insulation Services Contract - Self-Employed template.

Select a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can download or print the Massachusetts Insulation Services Contract - Self-Employed template anytime you need it. Make use of US Legal Forms, one of the largest collections of legal forms, to save time and prevent errors. The service provides well-crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct city/area.

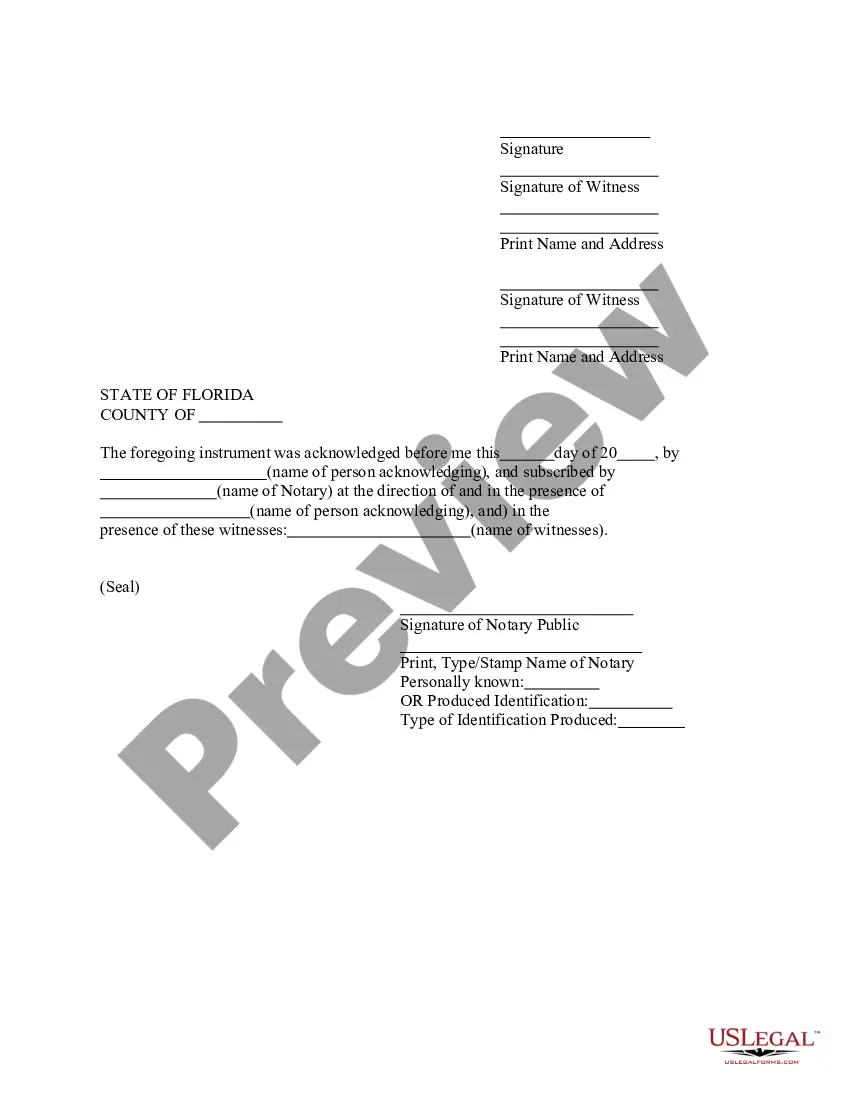

- Utilize the Preview button to examine the form.

- Read the description to confirm that you have selected the right form.

- If the form does not meet your needs, use the Search area to find a form that suits your requirements.

- Once you find the appropriate form, click Purchase now.

- Choose the pricing plan you want, provide the necessary information to create your account, and complete your purchase using PayPal or credit card.

Form popularity

FAQ

In Massachusetts, insulation requirements focus on energy efficiency and safety standards to enhance home performance. The Massachusetts Insulation Services Contract - Self-Employed often includes compliance with these local codes, which cover materials, installation techniques, and necessary certifications. Ensuring adherence to these regulations not only improves the insulation quality but also contributes to energy savings for homeowners. If you need guidance on these requirements, consider using our legal forms platform to streamline the process.

The independent contractor agreement in Massachusetts outlines the terms and conditions under which a self-employed worker operates. It specifies the responsibilities, payment structure, and duration of the project, ensuring clarity between the contractor and the client. For self-employed individuals in the insulation industry, this agreement is crucial to define your role under the Massachusetts Insulation Services Contract - Self-Employed. It protects both parties and helps avoid potential disputes.

Yes, you can be an independent contractor in Massachusetts, provided you meet specific legal criteria outlined by state laws. It's crucial to understand the factors that determine your status as an independent contractor versus an employee. Your Massachusetts Insulation Services Contract - Self-Employed should reflect this classification to ensure compliance and protect your rights. Always consult legal advice if you're unsure about your classification status.

To write a contract for a 1099 employee, begin by outlining the nature of the work, payment, and tax responsibilities. Specify that the worker is responsible for their own taxes under the 1099 classification. Your Massachusetts Insulation Services Contract - Self-Employed should outline the expectations and deliverables while ensuring compliance with IRS regulations. Utilize resources like uslegalforms for templates that meet state laws.

Yes, you can write your own legally binding contract in Massachusetts, as long as it contains all necessary elements, such as offer, acceptance, and consideration. It's important that the terms are clear and mutual obligations are specified. By using a well-structured Massachusetts Insulation Services Contract - Self-Employed, you minimize the potential for disputes. If you're unsure, consider seeking templates or advice from uslegalforms.

To create a self-employed contract, start with an introductory statement that identifies the parties involved. Then, list out the services to be provided, payment terms, and deadlines. Your Massachusetts Insulation Services Contract - Self-Employed must include clauses for confidentiality, dispute resolution, and termination conditions to provide clarity and protect both parties. Platforms like uslegalforms can help you with templates and guidance.

Writing a simple employment contract involves stating the job title, responsibilities, and payment rates. Clearly outline the duration of employment, work hours, and any necessary conditions. Your Massachusetts Insulation Services Contract - Self-Employed should also address how job performance will be evaluated. Simplicity ensures clarity, making it easier for both you and the worker.

To write a self-employment contract, start by clearly defining the scope of work and the terms of service. Include details like payment structure, timelines, and any specific obligations from both parties. Your Massachusetts Insulation Services Contract - Self-Employed should be detailed enough to protect your interests while remaining straightforward for all parties involved. If you need guidance, using platforms like uslegalforms can simplify this process.

An independent contractor exemption in Massachusetts allows certain workers to be classified as independent contractors rather than employees. This classification affects how taxes and benefits apply. It's crucial to understand the requirements for this exemption as you draft your Massachusetts Insulation Services Contract - Self-Employed, to ensure compliance and proper classification. Misclassification can lead to legal complications down the line.