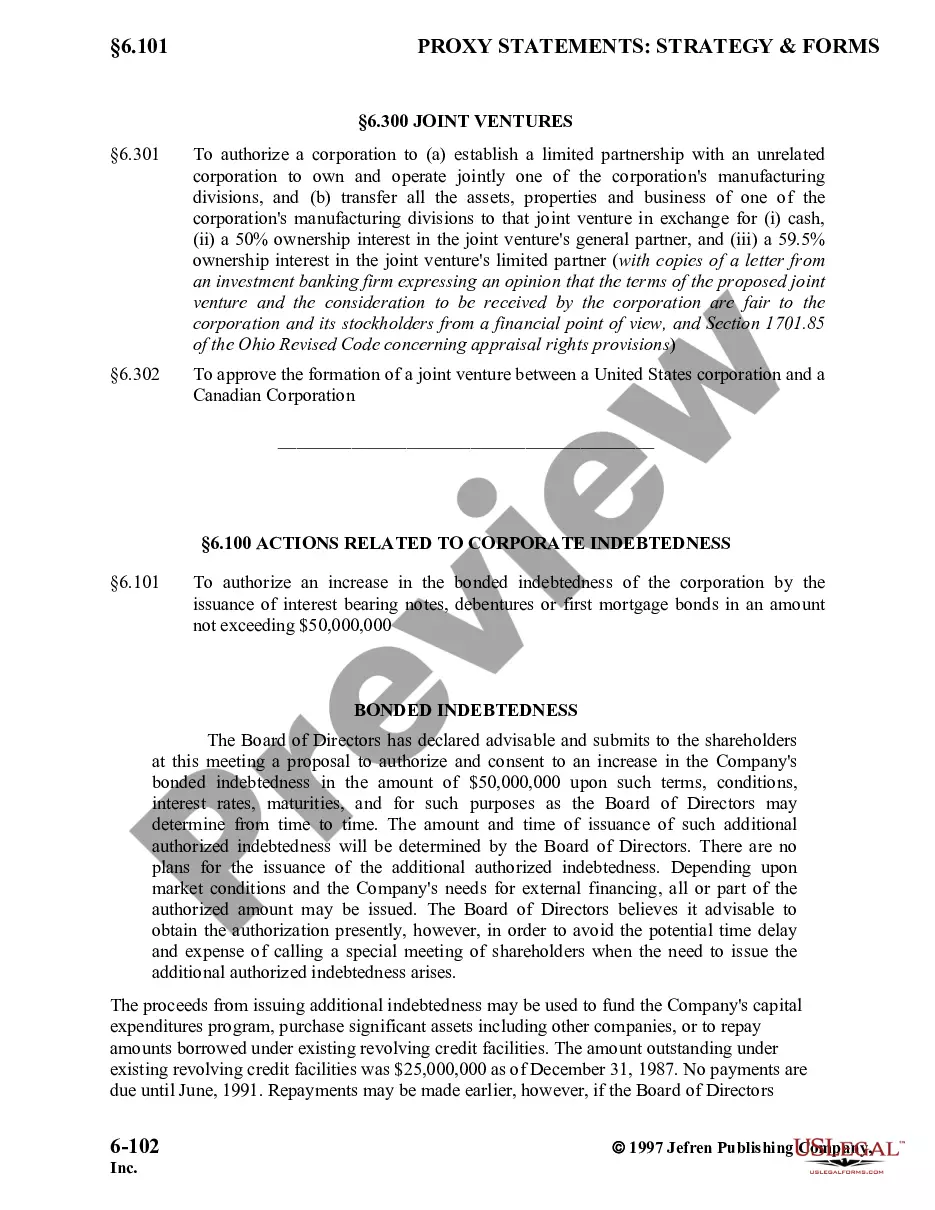

Massachusetts Authorization to increase bonded indebtedness

Description

How to fill out Authorization To Increase Bonded Indebtedness?

You are able to spend hrs on-line searching for the authorized record template that fits the federal and state demands you want. US Legal Forms provides a large number of authorized kinds which are reviewed by pros. It is possible to down load or print out the Massachusetts Authorization to increase bonded indebtedness from the support.

If you currently have a US Legal Forms account, it is possible to log in and click the Download key. Next, it is possible to comprehensive, change, print out, or sign the Massachusetts Authorization to increase bonded indebtedness. Each authorized record template you get is the one you have eternally. To acquire an additional copy of the acquired type, proceed to the My Forms tab and click the related key.

Should you use the US Legal Forms website for the first time, stick to the basic guidelines below:

- First, ensure that you have chosen the proper record template to the county/town that you pick. See the type information to make sure you have picked out the correct type. If available, make use of the Review key to look through the record template too.

- If you want to get an additional version of the type, make use of the Lookup discipline to discover the template that fits your needs and demands.

- After you have located the template you desire, just click Get now to continue.

- Pick the pricing prepare you desire, type your credentials, and register for your account on US Legal Forms.

- Comprehensive the purchase. You can use your bank card or PayPal account to cover the authorized type.

- Pick the file format of the record and down load it to your product.

- Make adjustments to your record if necessary. You are able to comprehensive, change and sign and print out Massachusetts Authorization to increase bonded indebtedness.

Download and print out a large number of record templates using the US Legal Forms website, which provides the greatest selection of authorized kinds. Use expert and state-certain templates to tackle your organization or personal requirements.

Form popularity

FAQ

The Attorney General's debt collection regulations prohibit: Calling you at home more than twice for each debt in any seven-day period, or more than twice for each debt in any 30-day period at some place other than your home, such as your place of work. Calling you at work if you have requested that they not call.

The Attorney General's debt collection regulations prohibit: Calling you at home more than twice for each debt in any seven-day period, or more than twice for each debt in any 30-day period at some place other than your home, such as your place of work. Calling you at work if you have requested that they not call.

Massachusetts laws The statute of limitations for consumer-related debt is six years.

Requesting validation of the debt is crucial. It serves two purposes: First, it requires the debt collector to provide proof that the debt is actually yours. This includes proof of the debt itself, and proof of assignment if the account is now owned by someone else.

Massachusetts laws The statute of limitations for consumer-related debt is six years. This period applies to credit card debt and oral and written contracts.

(1) It shall constitute an unfair or deceptive act or practice for a creditor to contact or threaten to contact persons in connection with a debt in any of the following ways: (a) Implying the fact of the debt to any such person; (b) Using language on envelopes or any other printed or written materials, except ...

Can debt collectors tell other people, like family, friends, or my employer, about my debt? No. Under federal law, a debt collector may contact other people but generally only to find out how to contact you. There are strict limits about what debt collectors can say or ask about you.