Massachusetts Private placement of Common Stock

Description

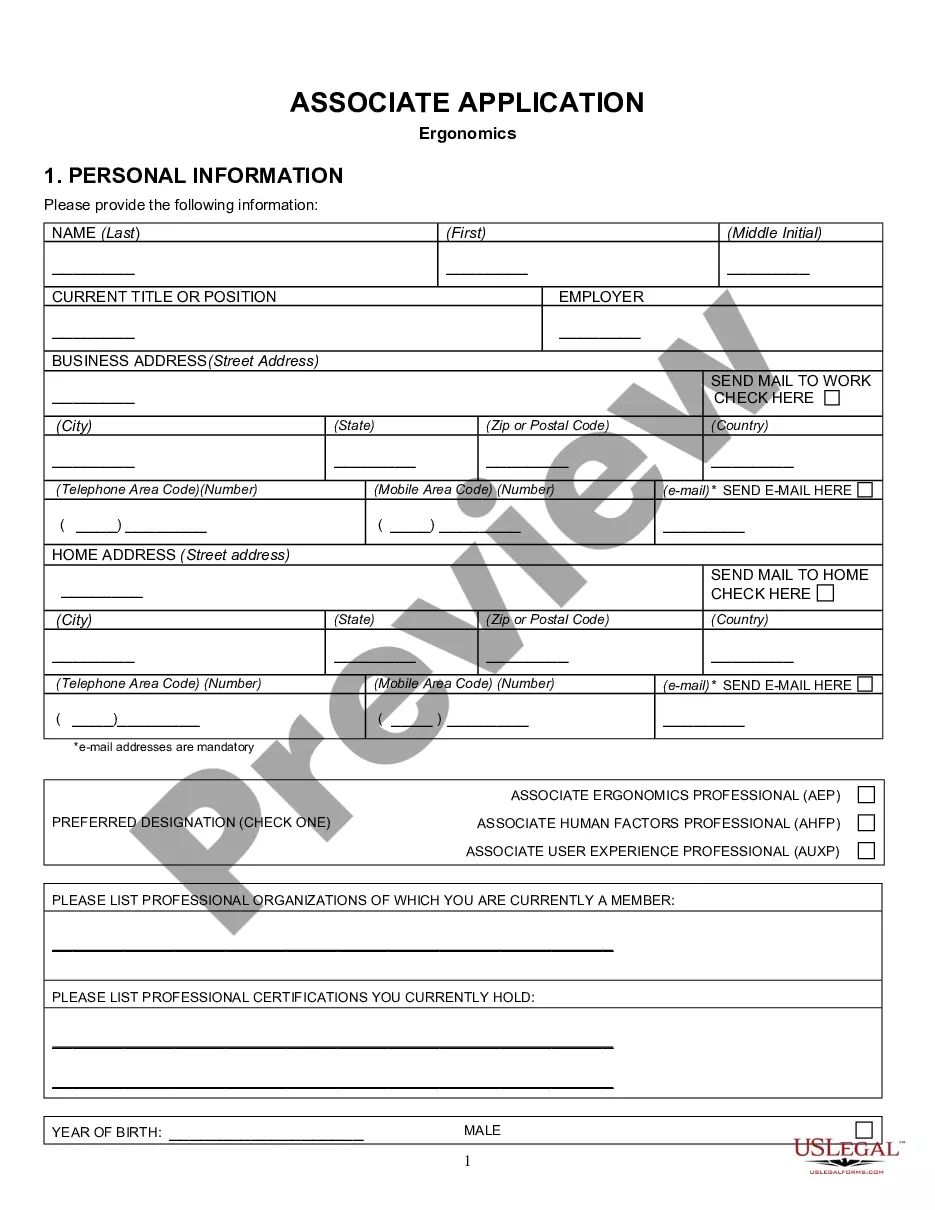

How to fill out Private Placement Of Common Stock?

Are you currently within a situation in which you need to have documents for sometimes company or specific uses virtually every day time? There are plenty of lawful papers templates available on the net, but finding kinds you can rely on isn`t straightforward. US Legal Forms offers a huge number of kind templates, just like the Massachusetts Private placement of Common Stock, which are written to satisfy federal and state demands.

In case you are already informed about US Legal Forms website and get a merchant account, basically log in. After that, you can download the Massachusetts Private placement of Common Stock template.

If you do not offer an account and would like to start using US Legal Forms, abide by these steps:

- Obtain the kind you want and make sure it is for that correct town/state.

- Make use of the Preview option to check the shape.

- See the outline to ensure that you have selected the appropriate kind.

- In case the kind isn`t what you are seeking, make use of the Search field to get the kind that meets your requirements and demands.

- When you discover the correct kind, simply click Purchase now.

- Pick the pricing program you need, submit the necessary details to generate your account, and pay for the order making use of your PayPal or credit card.

- Choose a hassle-free file formatting and download your version.

Discover each of the papers templates you might have purchased in the My Forms menu. You can obtain a more version of Massachusetts Private placement of Common Stock at any time, if needed. Just click on the necessary kind to download or printing the papers template.

Use US Legal Forms, probably the most substantial assortment of lawful forms, to save lots of time and steer clear of errors. The service offers expertly made lawful papers templates that you can use for an array of uses. Make a merchant account on US Legal Forms and initiate making your way of life easier.

Form popularity

FAQ

Rule 505 of Regulation D is an exemption for limited offers and sales of securities not exceeding $5,000,000. Company can raise up to $5 million in a 12-month period. Security sales can be made to an unlimited number of accredited investor plus 35 additional investors.

There are two kinds of private placement?preferential allotment and qualified institutional placement. A listed company can issue securities to a select group of entities, such as institutions or promoters, at a particular price. This scenario is known as a preferential allotment.

Under the Securities Act of 1933, any offer to sell securities must either be registered with the SEC or meet an exemption. Issuers and broker-dealers most commonly conduct private placements under Regulation D of the Securities Act of 1933, which provides three exemptions from registration.

Disadvantages of using private placements a reduced market for the bonds or shares in your business, which may have a long-term effect on the value of the business as a whole. a limited number of potential investors, who may not want to invest substantial amounts individually.

Regulation D is a provision that exempts some companies from the registration requirements associated with a public offering. It gives smaller companies access to investment capital by letting them offer specific types of private placements.

A private placement is an offering of unregistered securities to a limited pool of investors. In a private placement, a company sells shares of stock in the company or other interest in the company, such as warrants or bonds, in exchange for cash.

Consent of Shareholders, if general meeting called at shorter notice. Copy of Board Resolution for allotment of securities. Copy of Valuation Report. List of allottees. a complete record of private placement offers and acceptances in Form PAS-5 is required.

Rule 504 is not a common method of privately placing securities because the $5,000,000 cap is unattractive to many large issuers. Rule 506, which restricts who can purchase securities in a private placement but does not cap the offering amount, is the more common method of private placement under Regulation D.