Massachusetts Stock Appreciation Rights Plan of The Todd-AO Corporation

Description

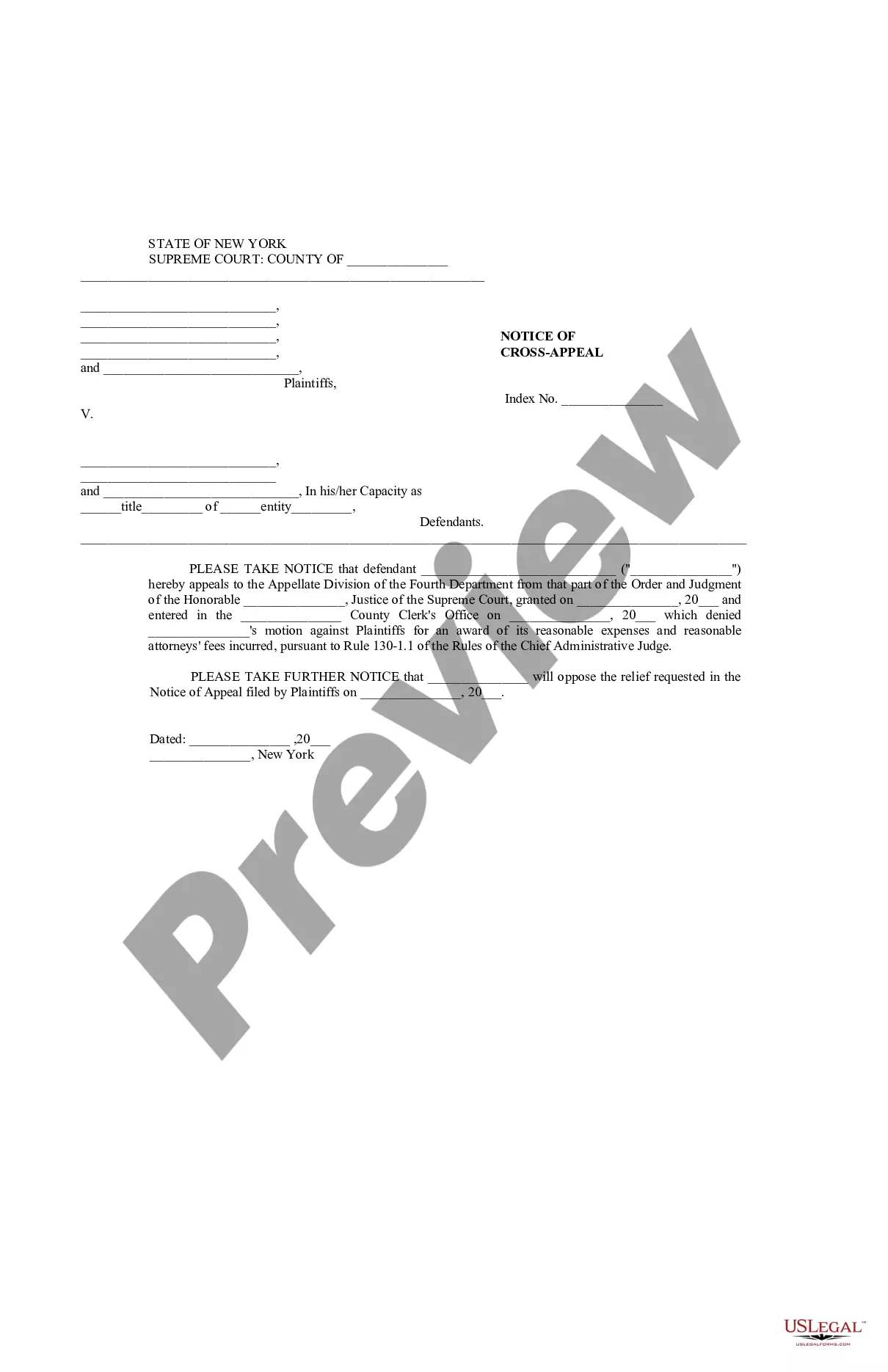

How to fill out Stock Appreciation Rights Plan Of The Todd-AO Corporation?

If you need to complete, download, or print out authorized record themes, use US Legal Forms, the most important assortment of authorized varieties, which can be found on the web. Use the site`s simple and hassle-free research to find the paperwork you want. Various themes for organization and specific functions are sorted by types and claims, or search phrases. Use US Legal Forms to find the Massachusetts Stock Appreciation Rights Plan of The Todd-AO Corporation in a couple of clicks.

If you are already a US Legal Forms client, log in to your account and click on the Download switch to get the Massachusetts Stock Appreciation Rights Plan of The Todd-AO Corporation. Also you can entry varieties you earlier downloaded from the My Forms tab of your respective account.

If you are using US Legal Forms the very first time, refer to the instructions below:

- Step 1. Ensure you have selected the form to the correct metropolis/land.

- Step 2. Make use of the Review solution to examine the form`s information. Do not forget to read through the information.

- Step 3. If you are unhappy with all the kind, take advantage of the Lookup industry towards the top of the display to find other variations of your authorized kind format.

- Step 4. Once you have discovered the form you want, select the Purchase now switch. Pick the costs plan you prefer and put your references to sign up for an account.

- Step 5. Approach the transaction. You can utilize your charge card or PayPal account to accomplish the transaction.

- Step 6. Pick the structure of your authorized kind and download it in your gadget.

- Step 7. Total, revise and print out or indication the Massachusetts Stock Appreciation Rights Plan of The Todd-AO Corporation.

Every single authorized record format you get is your own eternally. You may have acces to every kind you downloaded in your acccount. Click on the My Forms segment and choose a kind to print out or download yet again.

Remain competitive and download, and print out the Massachusetts Stock Appreciation Rights Plan of The Todd-AO Corporation with US Legal Forms. There are thousands of expert and state-specific varieties you can use for your organization or specific requirements.

Form popularity

FAQ

Stock Appreciation Right (SAR) entitles an employee, who is a shareholder in a company, to a cash payment proportionate to the appreciation of stock traded on a public exchange market. SAR programs provide companies with the flexibility to structure the compensation scheme in a way that suits their beneficiaries.

Stock Appreciation Rights Are Not Securities.

Stock Appreciation Rights plans do not result in equity dilution because actual shares are not being transferred to the employee. Participants do not become owners. Instead, they are potential cash beneficiaries in the appreciation of the underlying company value.

A stock appreciation right is a contract between an employer and an employee that grants the employee the right to receive a payment tied to any increase in the value of the employer's stock. When granting a stock appreciation right, the employer does not grant the employee any shares of the employer's stock.

For purposes of financial disclosure, you may value a stock appreciation right based on the difference between the current market value and the grant price. This formula is: (current market value ? grant price) x number of shares = value.

?SARs? means stock appreciation rights entitling the holder thereof to receive a cash payment in an amount equal to the appreciation in the Common Shares over a specified period, as set forth in this Plan and in the applicable Grant Agreement.

Stock appreciation rights are similar to stock options in that they are granted at a set price, and they generally have a vesting period and an expiration date. Once a stock appreciation right vests, an employee can exercise it at any time prior to its expiration.

Stock Appreciation Rights (SARs) SARs differ from ESOPs in that they do not grant direct ownership to employees, but rather give them the right to receive a cash payout equal to the value of the stock appreciation.